Russia Hikes Rates To 12% In Emergency Move To Halt Rouble’s Collapse

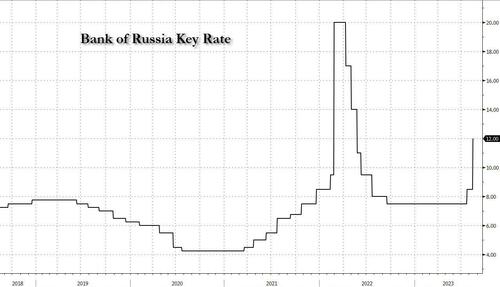

Russia’s central bank unexpectedly hiked its key interest rate by 350 basis points to 12% on Tuesday, an emergency move to try and halt the rouble’s recent plunge after a public call from the Kremlin for tighter monetary policy.

This was the second straight increase and the sharpest since the start of the of Ukraine war almost 18 months ago. The emergency meeting came after the rouble tumbled past the 100 threshold against the dollar on Monday, dragged down by the impact of Western sanctions on Russia’s balance of trade and as military spending soars.

The rouble pared gains after the decision to stand 0.5% weaker at 98.16, but still significantly above lows near 102 on Monday which had not been hit since the early weeks after Russia invaded Ukraine.

On Monday, president Vladimir Putin’s economic adviser Maxim Oreshkin rebuked the central bank, blaming what he called its soft monetary policy for weakening the rouble. Hours after Oreshkin’s words, the bank announced the emergency meeting, throwing the currency a lifeline.

The accompanying Bank of Russia statement was considerably shorter than previous ones. Unlike in the press release after the last meeting, the Bank refrained from including the usual hawkish phrase that “the Bank of Russia holds open the prospect of a further increase at its next meeting”, suggesting that today’s outsized hike is at least partially front-loading the hiking cycle that we and consensus had expected, and leading some analysts to speculate that interest rates had peaked.

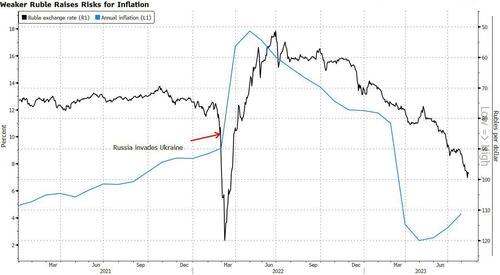

“Inflationary pressure is building up,” the bank said in the statement adding that “the pass-through of the rouble’s depreciation to prices is gaining momentum and inflation expectations are on the rise.”

But a little after the decision, the bank issued an additional statement: “In the case of strengthening pro-inflationary risks, an additional increase in the key rate is possible.”

The Bank continues to see inflationary pressure building and puts inflation momentum and core inflation momentum in the 3 months to 7 August at 7.6% and 7.1% respectively, well above the 4% target. Similar to the previous statement, the Bank attributes the price pressure to “steady domestic demand surpassing the capacity to expand output” and, unlike in the previous statement, it explicitly links strong domestic demand to the recent depreciation of the Ruble through its positive impact on import growth.

Commenting on the decision, Goldman analyst Clemens Grafe writes that “the Bank’s economic assessment remains close to ours. Final domestic demand was, in our view, close to 4% above the pre-Ukraine invasion level in an economy that we estimate saw its potential output contract by a slightly smaller margin over the same period. Hence, stabilizing prices will require a meaningful slowdown in the economy. The strong expansion of domestic demand has also reduced the current account rapidly through higher imports, which in USD terms have risen back to slightly above the level in Q4-2021. Consequently, the current account surplus has fallen to our estimate of 1% of GDP in Q2 from close to 10% in 2022.”

He adds that “given the sanctions imposed on Russia, we doubt Russia would be able to fund a current account deficit, nor do we think the CBR would be willing to fund it from its reserves. Thus, we consider a balanced current account as a binding constraint on the economy, and hitting that constraint would lead to sizeable Ruble volatility. While the recent rise in oil prices will likely alleviate that risk somewhat, we interpret the front-loading of the hiking cycle partially as the Bank wanting to ensure it keeps the economy away from that BoP constraint.”

As Bloomberg notes, the precipitous decline in the Russian currency has thrust the central bank onto center stage in an increasingly fraught debate over how to steer an economy battered by shrinking export revenues and isolated from international financial markets. And even with rates now at their highest in over a year, the market remains unimpressed as capital seeps out.

“The recent acceleration of ruble weakness might indicate that some cracks in the capital control might have emerged and therefore capital might be able to flee Russia at an increasing speed,” said Ulrich Leuchtmann, head of currency strategy at Commerzbank AG. “The rate hike will hardly convince those who might have a choice to keep their capital inside Russia.”

The central bank last made an emergency rate hike in late February 2022 with a rate raise to 20% in the immediate fallout of Russia’s despatching troops to Ukraine. The bank then steadily lowered the cost of borrowing to 7.5% as strong inflation pressure eased in the second half of 2022.

Since its last cut in September 2022, the bank had held rates but steadily increased its hawkish rhetoric, eventually hiking by 100 basis points to 8.5% at its last scheduled meeting in July. The next rate decision is due on Sept. 15.

Central Bank Governor Elvira Nabiullina has won plaudits for her handling of the economy since Russia began what it calls a “special military operation” in Ukraine, but the plunging rouble and high inflation have put her on the back foot, especially among pro-war nationalists. The Kremlin’s public criticism of her monetary policy adds further pressure as Russia heads towards a presidential election in March 2024, with consumers battling rising prices for basic goods.

“While such a depreciation risks boosting inflation, it is also the signal it sends out to the Russian public about the costs of the invasion of Ukraine,” said Stuart Cole, chief macro economist at Equiti Capital in London.

“As such, today’s decision will likely have had an element of politics behind it as well as economics.”

Quoted by Reuters, Andrei Melaschenko, economist at Renaissance Capital in Moscow, said the bank was right to react to inflation risks, but that the meeting, being announced so soon after Kremlin criticism, raised questions about the bank’s independence.

“(Nabiullina) has built quite a strong team around her and the central bank has been a strong regulator and I think and the market, both the domestic and international market, sees it that way.”

Russia saw double-digit inflation in 2022 and after a deceleration in the spring of 2023 due to that high base effect, annual inflation is now above the central bank’s 4% target once more and quickening. In annualized terms on a seasonally adjusted basis, current price growth over the last three months amounted to 7.6% on average, the bank said.

Promsvyazbank analysts said an additional hike may be required if the rouble does not stabilize and that measures to reduce the rouble liquidity surplus were also needed.

Russia’s widening budget deficit and stark labor shortage have contributed to rising inflationary pressure this year, but the rouble’s rapid slide from around 70 against the dollar at the start of the year to more than 100 on Monday pushed the central bank to act.

The bank, which blames the rouble’s slide on Russia’s shrinking current account surplus – down 85% year-on-year in January-July – has already tried to limit the rouble’s decline.

Last week, it halted the finance ministry’s FX purchases to try to reduce volatility, a step that effectively saw Russia abandon its budget rule. Analysts widely agreed that those measures alone were too minimal in scope to significantly support the currency.

Looking ahead, Goldman writes that in its view “the Ruble will continue to weaken unless oil prices rise” and notes that in July, the real effective exchange rate was still about 10% stronger than in Q4-2021 on the Bank of Russia’s index, and hence Goldman does not view the Ruble as undervalued.

The transmission of rates to the Ruble is likely to be slow. Given the sanctions, the financial channel is weaker than it used to be and the main transmission of interest rates to the currency would instead be through lower domestic demand and weaker imports, which will take time. Whether today’s rate hike will ultimately suffice remains, in our view, primarily a function of fiscal policy and oil prices. Fiscal policy was very loose in H1-2023, with real expenditures of the consolidated budget up 12%yoy. The Ministry of Finance continues to say that spending was considerably front-loaded and that the deficit would be contained at 2% of GDP in 2023 and largely unchanged from last year. While real expenditure growth had indeed fallen to 5%yoy in June, the deficit target would require a sustained tightening of fiscal policy in H2-2023, a correction that seems unusual in a time of military conflict.

Hence, we think it seems more likely that higher oil prices could support the Ruble in the short run, in line with the view of our commodity strategists, who see Brent prices in the mid-US$80s till year-end.

Others agreed: “Today’s rate hike will only temporarily slow the bleeding,” said Liam Peach, senior emerging markets economist at Capital Economics in London.

“Russia will struggle to attract capital inflows because of sanctions,” he said. “And there’s little ammunition for FX intervention – the central bank has some unfrozen renminbi assets and gold reserves, but the bar for using these is likely to be high.”

Tyler Durden

Tue, 08/15/2023 – 07:38

via ZeroHedge News https://ift.tt/ZkyHB1t Tyler Durden