Worst Week For Stocks Since Banking Crisis; Bonds, Bitcoin, & Bullion Battered

Aggressive interventions by Chinese authorities were a notable theme on the week (strong-arming funds not to sell stocks, tapping banks on the shoulder to buy yuan against the dollar, and making firms an offer they can’t refuse with regard share buybacks). However, Chinese stocks closed lower…

Source: Bloomberg

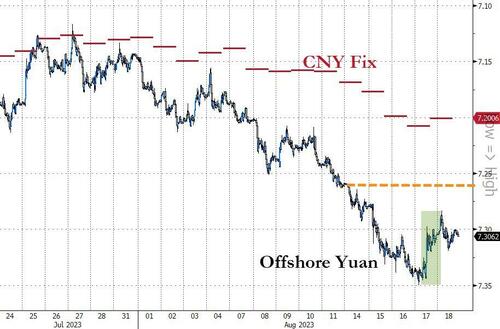

..and so did the offshore yuan…

Source: Bloomberg

So Mission Unaccomplished Beijing.

Interestingly, Goldman traders suggest that:

“to this point in the sequence, I’d argue the slowdown in China had been a net positive for US equities… with specific regard to the disinflationary impulse and the flow of capital...

…that said, coming out of a week that featured another disappointing set of data… and another dose of CNH weakness…

…it now feels like China growth fears can provoke a more global risk-off dynamic“

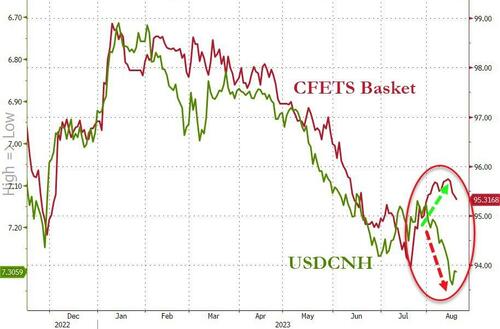

But, bear in mind that while the yuan has been spanked like a monkey against the dollar, it has actually rallied against the rest of its trading partners’ currencies…

Source: Bloomberg

And while Chinese data was a shitshow, US macro (hard and soft) surprised to the upside this week…

Source: Bloomberg

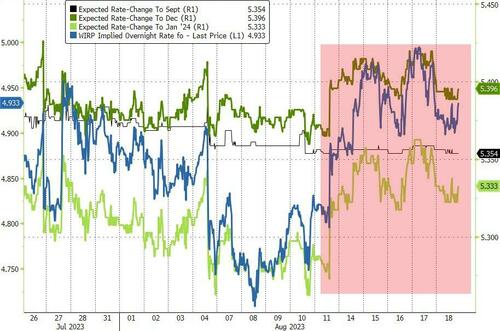

Which, combined with relatively hawkish Fed Minutes pushed rate expectations higher on the week (reducing expectation for cuts next year also)…

Source: Bloomberg

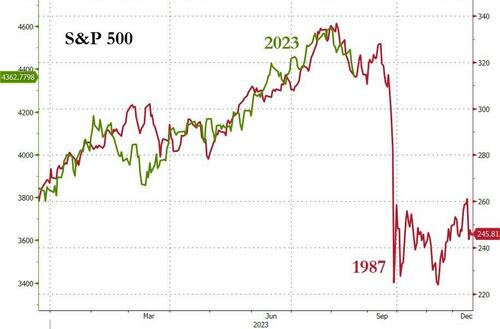

This prompted ‘risk-off’ as the S&P fell for the 3rd straight week, its longest weekly losing streak since Feb, and suffered its biggest weekly loss since the collapse of SVB in March. Small Caps were the ugliest horse in the glue factory…

All of the US Majors closed below their 50DMAs (note in upper right that Small Caps dropped to 100DMA and bounced)…

The S&P 500 closed down 0.01% today (lol!!!) as the algos ran the stop but couldn’t keep it green…

Regional bank stocks fell for the 3rd straight week…

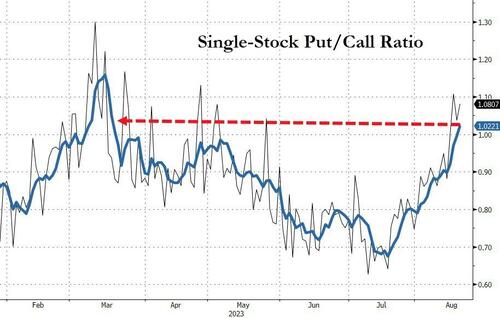

The put/call ratio surged up to the highest since the SVB collapse…

Source: Bloomberg

Most notably it appears the $2.2 trillion OpEx was put-monetization day for all options players (including 0-DTEs)…

Treasury yields were all higher on the week with the long-end notably underperforming (30Y +12bps, 2Y +4bps)…

Source: Bloomberg

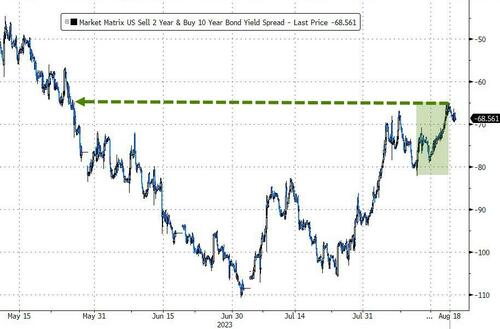

Which steepened (dis-inverted) the yield curve (2s10s) further (remember its the resteepening that is the real peril)…

Source: Bloomberg

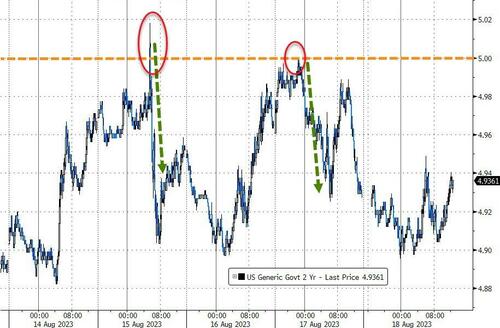

Also of note is that the 2Y Yield ripped up to 5.00% once again… and failed…

Source: Bloomberg

The dollar rallied for the 5th straight week to its highest since early June, breaking back above its 200DMA….

Source: Bloomberg

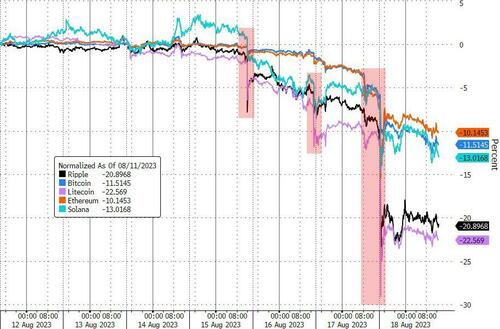

Crypto was clubbed like a baby seal this week with three big legs lower…

Source: Bloomberg

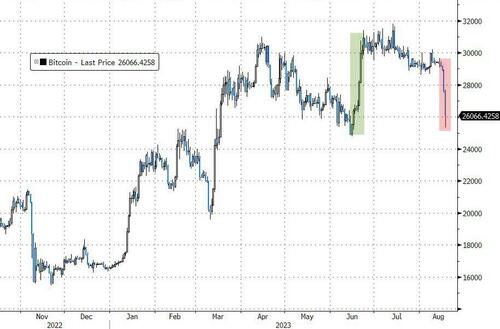

Bitcoin plunged back to pre-BlackRock ETF headlines…

Source: Bloomberg

The intraday pattern of overnight strength and post-London-Fix weakness continued every day this week in Gold. Spot Gold is back below $1900…

Source: Bloomberg

Oil prices fell on the week – the first weekly loss since June – with WTI finding some support at $80…

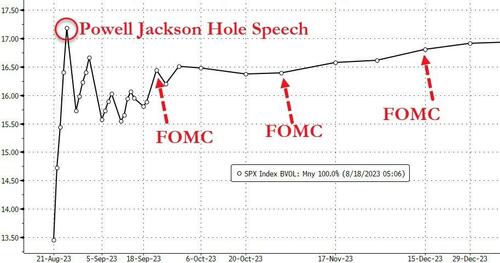

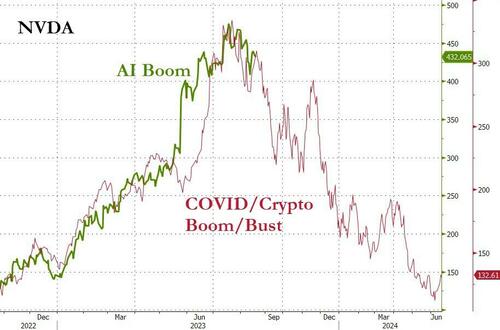

Finally, next week brings NVDA’s “guidance heard around the world” on Wednesday and Jay Powell’s Jackson Hole speech on Friday, both of which could catalyze major moves in the market.

The S&P volatility term structure is starting to fear it…

Source: Bloomberg

And NVDA bulls ‘smell the fear’…

Source: Bloomberg

But could Powell really push us off the cliff?

Source: Bloomberg

Of course not, we have Bidenomics (oh, talking of which, there’s always the chance that the govt shuts down in a week or two – that would slow the flow of money).

Tyler Durden

Fri, 08/18/2023 – 16:00

via ZeroHedge News https://ift.tt/tj96aOm Tyler Durden