Fed Rate-Cut Pricing Will Soon Need A Recession To Be Justified

Authored by Simon White, Bloomberg macro strategist,

The depth of expected rate cuts from the Federal Reserve is close to being consistent with a recession.

If a contraction is on the cards (unlikely in the near term), stocks and credit are mispriced. Otherwise short-term rates now look too low for a soft-landing scenario.

Markets love pushing things to their limits. Soft-landing expectations combined with Fed speak that for the first time countenanced rate cuts drove an increase in Fed rate-cut expectations for next year.

But we are at the point where it would be almost unprecedented for the expected amount of cuts to be delivered unless a recession is imminent.

The chart below shows the annual change in the fed funds rate in basis points. The black dashed line shows the current ~125 bps of cuts expected over the next year (based on OIS).

As the chart shows, there has only been one occasion, in the mid 1980s, when the Fed has cut rates by more than this amount at a non-recessionary time (i.e. not immediately before, during or after a recession).

I don’t view an NBER recession as imminent, and the downturn is likely delayed until mid next year at the earliest. But if the rates market is correct, and a recession is on its way, then stocks and credit markets have not got the message, with the S&P only ~5% off its all-time high, and credit spreads having been on a tightening track for most of this year.

Not only do the amount of rate cuts look overdone, they may not happen at all as the Fed may respond to loosening financial conditions with another hike.

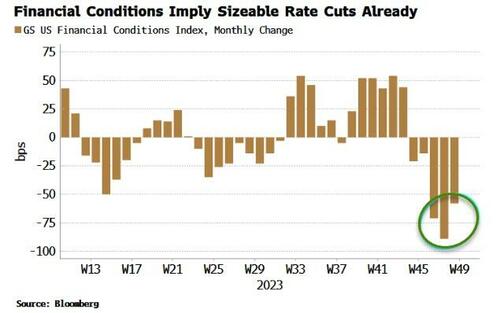

Goldman Sachs’ Financial Conditions Index has been designed to translate in to an equivalent move in the Fed’s policy rate (h/t Jim Bianco of Bianco Research).

The index infers that the loosening in financial conditions is equivalent to up to 90 bps of Fed cuts over the last month.

Favorable liquidity conditions are poised to continue to provide a tailwind for risk assets, implicitly lowering rates through a further easing in financial conditions.

There is thus an increasing chance the Fed will feel compelled to hike rates again to prevent a re-acceleration in inflation.

Tyler Durden

Tue, 12/05/2023 – 14:05

via ZeroHedge News https://ift.tt/3IhUgt8 Tyler Durden