Bad Is Good

Everyone thinks of inflation as being purely a financial phenomenon. However, it is much more than that. It is also a social phenomenon. As the inflation accelerates, an opportunist class rises to the top of society, and the productive class is impoverished. Inflation re-orients all economic activities, encouraging speculation at the expense of work, and forever changing the people who experience it. This societal aspect is rarely discussed.

Fortunately, my buddy, Erik Renander, recently wrote a blog post on the topic. As he did a better job of it than I would ever hope to, with his permission, I’ve re-posted his entry in its entirety.

For disclosure, I’m a paid-up subscriber to YWR. If you enjoyed this blog post, I recommend you also check out his recent podcast with my friends at the Market Huddle.

The following was originally published on YWR on March 23rd, 2024…

Disclosure: These are personal views only and not investment recommendations. For investment advice seek professional help.

We’ve learned a lot from Project Zimbabwe.

We’ve learned that as inflation takes hold, the prices of everything rise unimaginably. Daily goods, stock prices, real estate, everything.

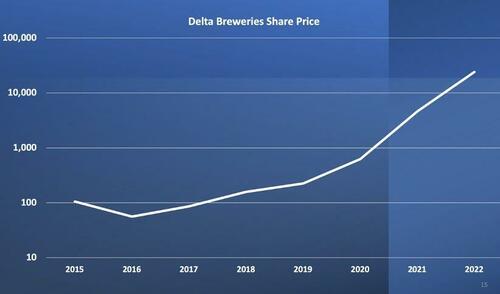

We reviewed the example of Delta Breweries, a beer company where volumes were unchanged over a 7 year period, and yet the share price rose 1000x.

Source: Project Zimbabwe presentation and company filings.

We learned that in high periods of inflation, inflation becomes the dominant factor. It becomes less about what you own (value vs growth or tech vs banks) and more that you own something.

We learned that in times of high inflation the risk is not so much to the left (20% stock market correction), but to the right.

It’s the risk that prices rise unimaginably and you are left behind.

We learned from from Zimbabwe that paradoxically, Bad is Good when it comes to the stock market.

There can be power outages, crop failures, people walking around with no money and yet the market goes to the moon.

Stocks, property, precious metals; everything goes up as people scramble to escape cash.

But that’s Zimbabwe. It’s Africa.

We study it because it’s a useful exaggeration. It’s a way for us to understand how markets dynamics change as inflation rises.

But that type of a market environment is rare in this day and age. We have to study obscure countries in Africa, or Latin America to understand what happens.

Thankfully, that would never happen here. Right?

We don’t have to worry about high inflation. The Fed has raised rates, inflation is moderating and things are under control.

Still, it might be useful to be able recognize the signs if things were shifting towards a hyper inflationary environment. And what would those signs be?

Of course there would be monthly economic statistics to show us CPI was running structurally higher, but maybe if inflation numbers were bouncing around a lot it might be hard to tell the trend, especially in the beginning.

But maybe there would be other signs along the way, which would warn us inflation was going to get a lot worse. Maybe there would be cultural signs that things were going to spiral out of control.

The best account I’ve come across of the cultural signs leading to inflation is ‘Fiat Money Inflation in France’ by Andrew Dickson White, a history professor and founder of Cornell. It was written back in 1896 as a historical review of the Assignats and France’s slide into inflation in 1789.

As with Zimbabwe, we learn that the worse things seem to get, the more the market rises.

It’s another example of the Bad is Good theme.

So what were some of the signs along the way from France’s slide?

It always starts the same way. Business is slow and the government is looking for a shortcut.

EARLY in the year 1789 the French nation found itself in deep financial embarrassment: there was a heavy debt and a serious deficit.

There was a general want of confidence in business circles; capi- tal had shown its proverbial timidity by retiring out of sight as far as possible; throughout the land was stagnation.

Statesmanlike measures, careful watching and wise management would, doubtless, have ere long led to a return of confidence, a reappearance of money and a resumption of business; but these involved patience and self-denial, and, thus far in human history, these are the rarest products of political wisdom. Few nations have ever been able to exercise these virtues; and France was not then one of these few.

There was a general search for some short road to prosperity: ere long the idea was set afloat that the great want of the country was more of the circulating medium; and this this was speedily followed by calls for an issue of paper money.

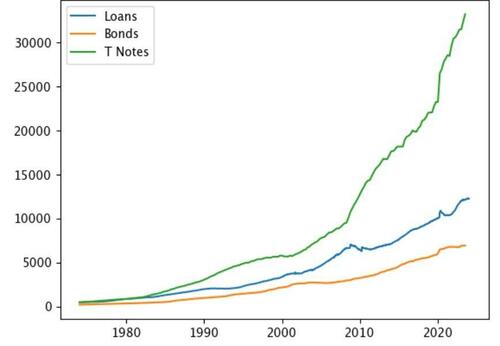

In the beginning there is resistance to large issuances of debt. It is seen as being financial imprudent. But, gradually the politicians and the people learn to crave it, and the debt increases exponentially. There is no more resistance.

France was now fully committed to a policy of inflation; and, if there had been any question of this before, all doubts were removed now by various acts very significant as showing the exceeding difficulty of stopping a nation once in the full tide of a depreciating currency.

The first inflation bills were passed with great difficulty, after very sturdy resistance and by a majority of a few score out of nearly a thousand votes; but we observe now that new inflation measures were passed more and more easily and we shall have occasion to see the working of this same law in a more striking degree as this history develops itself.

US Treasury Debt, corporate bonds and bank loans outstanding. Source: FRED

The economy rebounds after every stimulus, but the rebounds get shorter and shorter.

The great majority of Frenchmen now became desperate optimists, declaring that inflation is prosperity. Throughout France there came temporary good feeling. The nation was becoming inebriated with paper money. The good feeling was that of a drunkard just after his draught; and it is to be noted as a simple historical fact, corresponding to a physiological fact, that, as draughts of paper money came faster the successive periods of good feeling grew shorter.

Inflation starts to change the culture. There becomes an obsession with luxury and speculation.

But these evils, though great, were small compared to those far more deep-seated signs of disease which now showed themselves throughout the country. One of these was the obliteration of thrift from the minds of the French people. The French are naturally thrifty; but, with such masses of money and with such uncertainty as to its future value, the ordinary motives for saving and care diminished, and a loose luxury spread throughout the country.

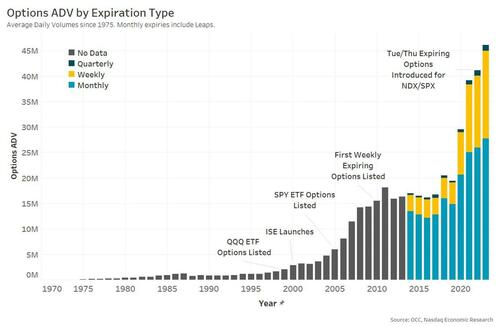

There is an obsession with trading and speculation.

A still worse outgrowth was the increase of speculation and gambling. With the plethora of paper currency in 1791 appeared the first evidences of that cancerous disease which always follows large issues of irredeemable currency,—a disease more permanently injurious to a nation than war, pestilence or famine.

For at the great metropolitan centers grew a luxurious, speculative, stock-gambling body, which, like a malignant tumor, absorbed into itself the strength of the nation and sent out its cancerous fibres to the remotest hamlets. At these city centers abundant wealth seemed to be piled up: in the country at large there grew a dislike of steady labor and a contempt for moderate gains and simple living.

Now began to be seen more plainly some of the many ways in which an inflation policy robs the working class. As these knots of plotting schemers at the city centers were becoming bloated with sudden wealth, the producing classes of the country, though having in their possession more and more currency, grew lean. In the schemes and speculations put forth by stock-jobbers and stimulated by the printing of more currency, multitudes of small fortunes were absorbed and lost while a few swollen fortunes were rapidly aggregated in the larger cities.

Speculation and inflation lead to corruption.

Nor was this reckless and corrupt spirit confined to business men; it began to break out in official circles, and public men who, a few years before, had been thought above all possibility of taint, became luxurious, reckless, cynical and finally corrupt. Mirabeau himself, who, not many months previous, had risked imprisonment and even death to establish constitutional government, was now at this very time—secretly receiving heavy bribes. When, at the downfall of the monarchy a few years later, the famous iron chest of the Tuileries was opened, there were found evidences that, in this carnival of inflation and corruption, he had been a regularly paid servant of the Royal court.

The artful plundering of the people at large was bad enough, but worse still was this growing corruption in official and legislative circles. Out of the speculating and gambling of the inflation period grew luxury, and, out of this, corruption.

Trust in politicians and the media declines.

The artful plundering of the people at large was bad enough, but worse still was this growing corruption in official and legislative circles. Out of the speculating and gambling of the inflation period grew luxury, and, out of this, corruption. It grew as naturally as a fungus on a muck heap. It was first felt in business operations, but soon began to be seen in the legislative body and in journalism.

Like in Zimbabwe the Speculators realize they should borrow to buy assets.

As manufacturers had closed, wages had fallen, until all that kept them up seemed to be the fact that so many laborers were drafted off into the army. From this state of things came grievous wrong and gross fraud. Men who had foreseen these results and had gone into debt were of course jubilant. He who in 1790 had borrowed 10,000 francs could pay his debts in 1796 for about 35 francs.

The rise of the Debtor Class

There appeared, as another outgrowth of this disease, what has always been seen under similar circumstances. It is a result of previous, and a cause of future evils. This outgrowth was a vast debtor class in the nation, directly interested in the depreciation of the currency in which they were to pay their debts. This body of debtors soon saw, of course, that their interest was to depreciate the currency in which their debts were to be paid; and these were speedily joined by a far more influential class; by that class whose speculative tendencies had been stimulated by the abundance of paper money, and who had gone largely into debt, looking for a rise in nominal values.

The Debtor Class become celebrities and mix with the politicians.

Soon demagogues of the viler sort in the political clubs began to pander to it; a little later important persons in this debtor class were to be found intriguing in the Assembly—first in its seats and later in more conspicuous places of public trust.

Before long, the debtor class became a powerful body extending through all ranks of society. From the stock-gambler who sat in the Assembly to the small land speculator in the rural districts; from the sleek inventor of canards on the Paris Exchange to the lying stock-jobber in the market town, all pressed vigorously for new issues of paper; all were apparently able to demonstrate to the people that in new issues of paper lay the only chance for national prosperity.

J0H10R Washington, DC, USA. 12th Apr, 2017. Laurence “Larry” Fink, Chairman and Chief Executive Officer of BlackRock, Inc., speaks during an Economic Club of Washington event in Washington, DC, on April 12, 2017. Credit: Kristoffer Tripplaar/Alamy Live News

This great debtor class, relying on the multitude who could be approached by superficial arguments, soon gained control. Strange as it might seem to those who have not watched the same causes at work at a previous period in France and at various times in other countries, while every issue of paper money really made matters worse, a superstition gained ground among the people at large that, if only enough paper money were issued and were more cunningly handled the poor would be made rich. Henceforth all opposition was futile.

As the wealth disparity increases there are calls to expropriate wealth from the rich.

But now another source of wealth was opened to the nation. There came a confiscation of the large estates of landed proprietors who had fled the country. An estimate in 1793 made the value of these estates three billions of francs.

and on June 22, 1793, the Convention determined that there should be a Forced Loan, secured on the confiscated lands of the emigrants and levied upon all married men with incomes of ten thousand francs, and upon all un- married men with incomes of six thousand francs. It was calculated that these would bring into the treasury a thousand millions of francs.

As daily goods get too expensive, people start to loot the stores.

Marat declared loudly that the people, by hanging shopkeepers and plundering stores, could easily remove the trouble. The result was that on the 28th of February, 1793, at eight o’clock in the evening, a mob of men and women in disguise began plundering the stores and shops of Paris. At first they demanded only bread; soon they insisted on coffee and rice and sugar; at last they seized everything on which they could lay their hands—cloth, clothing, groceries and luxuries of every kind. Two hundred such places were plundered. This was endured for six hours and finally order was restored only by a grant of seven million francs to buy off the mob.

Politicians and financiers start to think they can solve everything by issuing more debt. It’s not necessary to balance budgets or pay for spending through taxes (which would be unpopular).

And now was seen, taking possession of the nation, that idea which developed so easily out of the fiat money system the idea that the ordinary needs of government may be legitimately met wholly by the means of paper currency; that taxes may be dispensed with. As a result, it was found that the assignat printing press was the one resource left to the government, and the increase in the volume of paper money became every day more appalling.

It’s natural to think the financiers in 1789 France must not have known what they were doing or been uneducated, but they were actually some of the brightest in Europe.

All this vast chapter in financial folly is sometimes referred to as if it resulted from the direct action of men utterly unskilled in finance. This is a grave error. That wild schemers and dreamers took a leading part in setting the fiat money system going is true; that speculation and interested financiers made it worse is also true: but the men who had charge of French finance during the Reign of Terror and who made these experiments, which seem to us so monstrous, in order to rescue themselves and their country from the flood which was sweeping everything to financial ruin were universally recognized as among the most skillful and honest financiers in Europe.

Smart speculators buy up the personal property of the working class.

The hopes of many were revived by the fact that in spite of the decline of paper there was an exceedingly brisk trade in all kinds of permanent property. Whatever articles of permanent value certain needy people were willing to sell certain cunning people were willing to buy and to pay good prices for in assignats.

At this, hope revived for a time in certain quarters. But ere long it was discovered that this was one of the most distressing results of a natural law which is sure to come into play under such circumstances. It was simply a feverish activity caused by the intense desire of a large number of the shrewder class to convert their paper money into anything and everything which they could hold and hoard until the collapse which they foresaw should take place. This very activity in business simply indicated the disease. It was simply legal robbery of the more enthusiastic and trusting by the more cold-hearted and keen. It was the “unloading” of the assignats upon the mass of the people.

An enormous wealth disparity develops between those who saw what was happening and levered up to purchase more assets, and those who didn’t.

The question will naturally be asked, On whom did this vast depreciation mainly fall at last? When this currency had sunk to about one three-hundredth part of its nominal value and, after that, to nothing, in whose hands was the bulk of it? The answer is simple.

Financiers and men of large means were shrewd enough to put as much of their property as possible into objects of permanent value. The working classes had no such foresight or skill or means. On them finally came the great crushing weight of the loss. After the first collapse came up the cries of the starving.

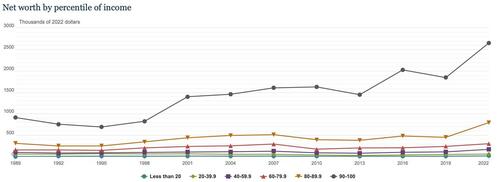

Federal Reserve Survey of Consumer Finances 2022.

Those are some of the key warning signs from Fiat Money Inflation in France, and I recommend reading the whole story, but as I said… it’s not something we need to worry about.

Have a good weekend.

Tyler Durden

Thu, 03/28/2024 – 07:20

via ZeroHedge News https://ift.tt/KLTuqsz Tyler Durden