The Bitcoin-Halving Crash-Course – What Is It & Why It Matters

Authored by Mark Jeftovic via BombThrower.com,

The Honey Badger’s fourth halving is special for several reasons.

The Bitcoin blockchain is secured by “Proof-of-Work” (PoW) – which is known as “mining”. In simple terms, it uses specialized computers (ASICs) which are optimized to solve a cryptographic math problem – a big one.

The number of computations per second is measured in TerraHashes (TH/s). One TerraHash is a trillion computations. The current hashrate across the entire Bitcoin blockchain is 75K TH/s (75 thousand trillion computations per second).

-

For each block there is a particular puzzle that needs to be solved – they’re all the same, but the value of the solution is different each time.

-

Each block contains the metadata for all the transactions that occurred on chain during that block period,

-

When a miner solves a block, it “wins” the right to append the next block to the blockchain.

-

That miner receives “the block reward” for that block (often sharing it with all the other miners in it’s mining pool)

-

The new block is appended, cryptographically signed, and the rest of the miners confirm it

-

The search begins for a new block

-

This happens roughly every ten minutes.

That’s how the Bitcoin blockchain is built and maintained – we can park for now the weeping and wailing from those bemoaning how much electricity that uses (which is a lot) because the net benefit to humanity for having an immutable, decentralized, non-state hard money system is worth it (especially when you compare it to the energy used to enforce the fiat standard, globally).

The Significance of The Halving

Is that every 210,000 blocks, that block reward is cut in half (hence, the “halving” or “halvening”). 210,000 blocks pencils out to about four years.

It is this halving mechanism that creates the 21,000,000 BTC hard cap for Bitcoin.

This halving – which will happen on Friday – is the fourth bitcoin halving – and it will take the block reward down from 6.25 BTC now, to 3.175 afterwards (it started at 50, then 25 in 2012, 12.5 in 2016, 6.25 in 2020, and so on).

In previous cycles this has set up a “supply shock” for the price of Bitcoin – driving prices higher. Sometimes mind-bogglingly so.

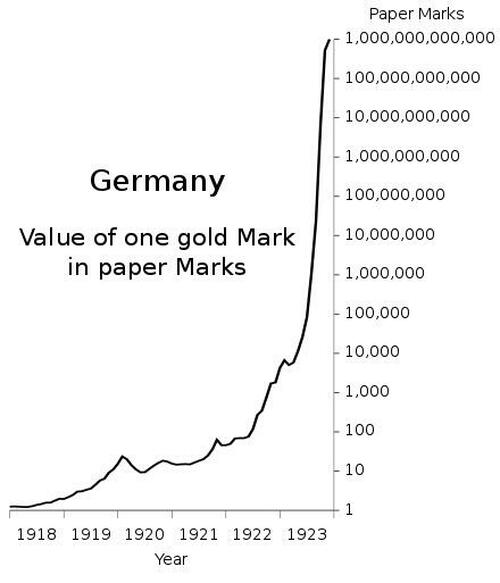

This chart via (@ChartsBTC) shows it to us in logarithmic scale (because linear graphs can’t even fit into the window)

#bitcoin price history pic.twitter.com/yPs3HEDQpk

— ChartsBTC (@ChartsBtc) January 21, 2023

As I remarked in this month’s Bitcoin Capitalist Portfolio Update:

Bitcoin seems to “add a digit” by the time it goes into each successive halving. At first glance this may seem to be superficial pattern, but it’s based on what happens when you measure something in a logarithmic scale.

There’s another famous chart that shows the “progression of digits” that belies a logarithmic progression, and from an earlier chapter in monetary history, a rather famous one:

It becomes more plausible to suspect this progression will continue if we realize two things:

First: we are not looking at Bitcoin’s price action as chart patterns that purportedly foretell the gyrations of some asset or a “meme stock” that can only go so high.

Second: What we’re really witnessing is a rather large, tectonic wealth transfer out of one monetary system and into another – shaped by the dynamics of the four year halving cycle.

In other words, the price trajectory of Bitcoin is mapping out the hyperinflationary spiral of all global fiat currencies. So the answer to the question “how high can it go?” is “How much wealth exists to denominate?” Whatever you came up with for an answer, divide that by 21 million.

That happens to be the base case for The Bitcoin Capitalist – we call it “the monetary regime change” (which was the thesis of the original Crypto Capitalist Manifesto – which you can get free here).

Some other notes about this particular halving:

-

After this halving, Bitcoin’s natural inflation rate will be below that of gold’s (which is 2% per year)

-

In two more halvings the block reward will drop below 1 BTC per block.

-

By 2060, the total block rewards will be less than 1 BTC per day

What the above means, is this:

If you’re a “whole-coiner” (somebody who owns an entire Bitcoin), then by 2032 you’ll own more Bitcoin than the entire mining network earns in subsidies for securing a single block.

By 2060, you (or your children), will own more than the entire Bitcoin network earns in a day (in block subsidies).

Also worth noting that there are more millionaires in the world now (approx. 60 million) than there will ever be Bitcoin. Which means, if every millionaire decided they wanted to own a single Bitcoin, there wouldn’t be enough to go around.

The last thing I’ll say about this halving that makes it different from the prior cycles, is this:

Bitcoin has never put in a new all-time high before the halving. That always came a few months after.

This time it’s put in three. The most recently at $73K/BTC almost exactly a month ago.

* * *

We gated memberships to our premium letter The Bitcoin Capitalist – but to commemorate the halving we’re allowing new members until it happens. Check out the halving deal here ».

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops (and The Crypto Capitalist Manifesto while you wait), sign up today. Follow me on Nostr, or Twitter.

Tyler Durden

Wed, 04/17/2024 – 09:05

via ZeroHedge News https://ift.tt/OQ34GuN Tyler Durden