US Domestic Bank Deposits Drop For Second Straight Week

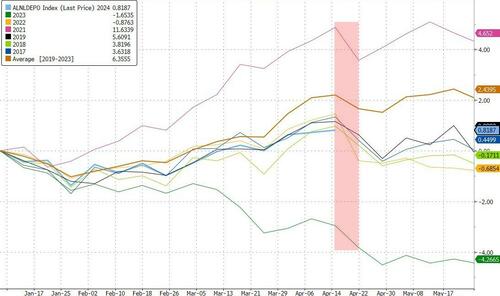

On the heels of a major deposit outflow the week before, and a huge (record) money-market fund outflow last week, all eyes are back on the banks again on Friday evening to see if this ‘flight’ continues as Tax-Day drags cash away from its comfy-5%-earnings-spots.

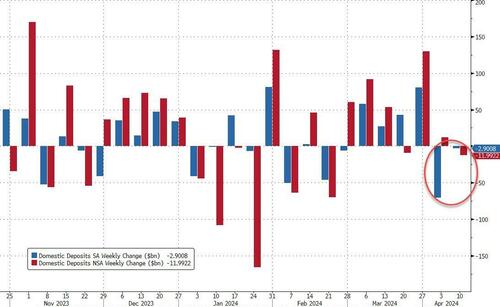

On a seasonally-adjusted basis, total US bank deposits declined for the second straight week (though only $2.4BN) after reaching back to pre-SVB levels…

Source: Bloomberg

And once again – like last week, and rather oddly giving the tax-day’ timing – non-seasonally-adjusted bank deposits rose $16BN, now well above pre-SVB levels…

Source: Bloomberg

Is some of the money-market cash being moved (temporarily) into bank deposits before heading out to tax man?

Source: Bloomberg

Historically, it appears NEXT week is when we see the Tax-Day decline in the NSA data…

Source: Bloomberg

Excluding foreign deposits, domestic bank deposits did fall on both an SA (-$2.9BN – large banks -$14.8BN, small banks +11.9BN) and NSA (-$12bn – large banks -$24BN, small banks +12BN) basis.

Source: Bloomberg

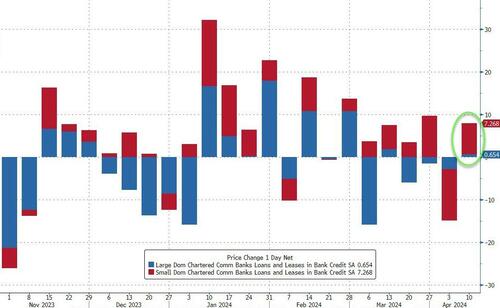

But, unlike last week when deposits dropped, we saw bank loan volumes rise (not fall) in the week ending 4/10 with large bank voilumes rising 0.65BN and small bank volumes rising $7.3BN…

Source: Bloomberg

Finally, as we detailed earlier, it appears the reality of bank reserves at The Fed is slowly (but surely) catching up with US equity market cap…

Source: Bloomberg

That’s going to get awkward in an election year…

Tyler Durden

Fri, 04/19/2024 – 16:44

via ZeroHedge News https://ift.tt/lutWcbm Tyler Durden