Meta Craters 13% After Revenue Forecast Disappoints

After yesterday’s eruption by the first Mag7 member Tesla, which missed across the board but gave an extremely cheerful outlook where Musk vowed he would release a lower-priced EV as soon as this year, moments ago the second, and far bigger, Mag7 member – and who really cares about Mag7 any more, it’s all about the Fabulous Four these days – Meta reported results which were a mirror image: while the company beat across the board, its guidance was a mess, with revenue disappointing while projected CapEx surging by 10%, and the stock is plunging 13% after hours.

Here is what META just reported for Q1:

- Revenue $36.46B, beating est. $36.12B

- Q1 EPS $4.71, beating est $4.30

And while the historical numbers were solid, it was the guidance that spooked the market:

- Meta sees Q2 Revenue of $36.5B to $39B, with the mid-range below the est. $38.24B

Yet while revenue guidance was disappointing, the company expects to spend even more to get there, and its capex forecast increased dramatically with attention finally turning to how much money this AI dream will actually cost…

- Full-year capital expenditures expected to be $35-$40 billion, from prior range of $30-$37 billion

In other words, Zuckerberg is still betting the metaphorical house – and investing in it – on AI. Parsing the company’s language on capex, the color from CFO Li on next year’s increase in spending says the company will “invest aggressively” to support “ambitious” AI research and product development.

Still, the market is not impressed – it vividly recalls how much money the company burned on the catastrophic metaverse dead end – and as Bloomberg notes, ever since Meta’s rollout for its expensive metaverse/virtual reality plans, investors have been laser-focused on expenses and how quickly those will pay off. With AI, the company appears to have a longer grace period since it’s an industrywide bet, but even that will soon come under scrutiny for Meta, seeing as its expected capex is ticking up now for the year.

And sure enough, the advertising-funded social network could not wait to turn the attention to AI, with CEO Mark Zuckerberg’s quote in the earnings release, citing its new large language model (Llama 3) just released:

“The new version of Meta AI with Llama 3 is another step towards building the world’s leading AI. We’re seeing healthy growth across our apps and we continue making steady progress building the metaverse as well.”

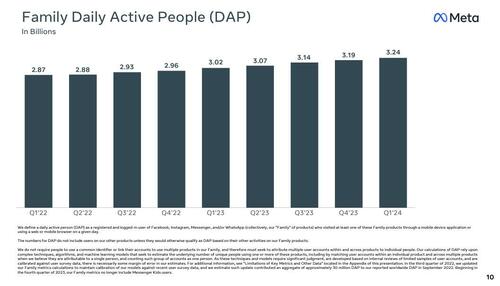

Turning to the company’s actual metrics, the total number of people using Meta’s apps (Facebook, Instagram, WhatsApp and Threads) rose 7% year-over-year to 3.24 billion.

That’s the only user metric we’re getting from Meta, which said last quarter it would stop consistent reporting of MAUs and app-level metrics.

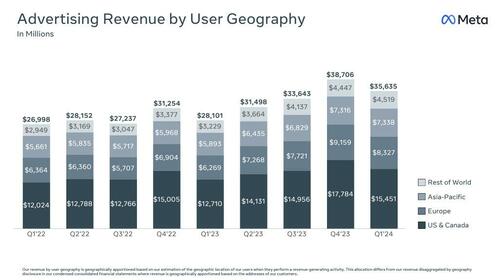

Turning to revenue, ad revenue dropped sequentially as it always does in Q1 but rose YoY…

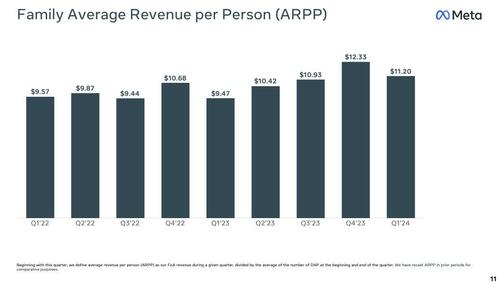

… with Average Revenue per User dropping but higher than a year ago.

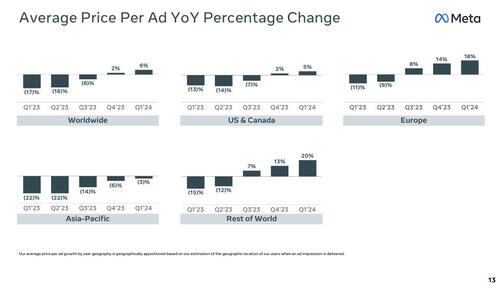

… as the average price per ad rose significantly in Q1.

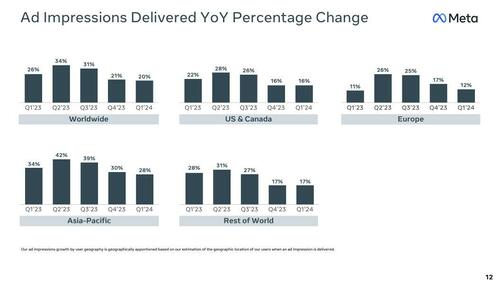

… although the growth in ads delivered declined.

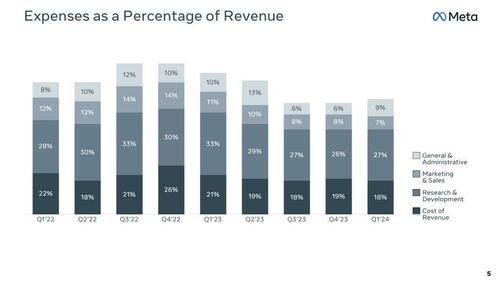

Meanwhile, even as ad revenue dipped, expenses as a % of revenues are once again rising.

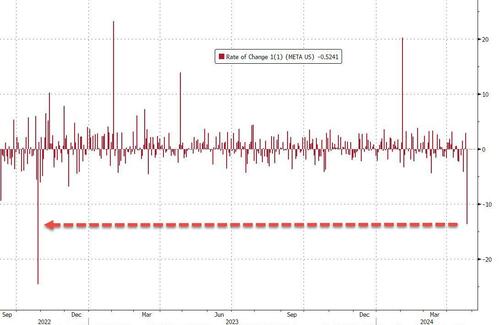

Putting it all together, and taking a quick look at the stock price, we can conclude that the market is not impressed, as META shares are tumbling 13%, wiping out some $135BN in market cap…

… on pace for their worst drop since Oct 2022 and vaporizing all gains since the last earnings report.

… as we officially enter the “show me the monAI” phase and as focus among investors right now is on spending “and the fact that they’re raising capex guidance by 10%” according to Bloomberg tech analyst Mandeep Singh, who adds that “investors are fearful. Whenever this company talks about spending more, the alarm bells start ringing.”

The plunge in META stock is weighing on the Nasdaq and other social media stocks post-market. Shares of Snap are down 3.3%, while Pinterest has shed nearly 4%. Reddit is down 1.3%.

The company’s earnings presentation is below (pdf link)

And now we await the earnings call to see if Zuck can save this catastrophic earnings report.

Tyler Durden

Wed, 04/24/2024 – 16:33

via ZeroHedge News https://ift.tt/JenchuE Tyler Durden