Big Government’s Crackdown On Hedge Fund Home-Buying Looms

“I strongly support free markets,” but this “corporate large-scale buying of residential homes seems to be distorting the market and making it harder for the average Texan to purchase a home,” Republican Texas Gov. Greg Abbott wrote on X in March. He added, “This must be added to the legislative agenda to protect Texas families.”

I strongly support free markets.

But this corporate large-scale buying of residential homes seems to be distorting the market and making it harder for the average Texan to purchase a home.

This must be added to the legislative agenda to protect Texas families. https://t.co/VBs6Rluh3K

— Greg Abbott (@GregAbbott_TX) March 15, 2024

Institutional ownership of single-family homes has surged in recent years, with many firms turning the bulk of these homes into rentals. This has triggered a massive uproar with some lawmakers who want to end Wall Street’s home-buying mania.

The Wall Street Journal reports that several lawmakers in Nebraska, California, New York, Minnesota, and North Carolina have sponsored bills requiring large single-family hedge fund owners to dispose of their portfolios or risk hefty fines.

The bill mentioned the most in the corporate press, called the End Hedge Fund Control of American Homes Act, was introduced in the Senate by Oregon Sen. Jeff Merkley with companion legislation introduced in the House by Rep. Adam Smith.

The Merkley/Smith bill could force hedge funds to divest their single-family home portfolios over the course of ten years.

Lawmakers argue that “investors that have scooped up hundreds of thousands of houses to rent out are contributing to the dearth of homes for sale and driving up home prices,” according to WSJ, noting that limited housing supply has made housing unaffordable for the vast majority of Americans.

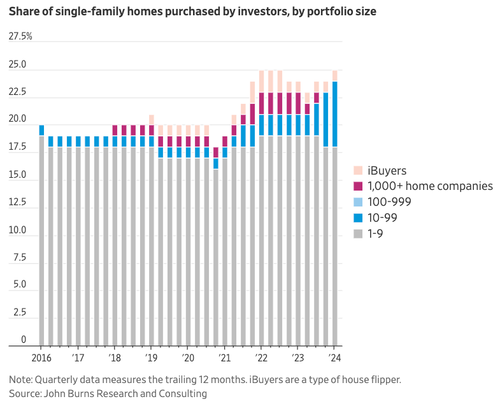

Data from John Burns Research and Consulting shows that the share of institutional buying of single-family homes topped 25% in the first quarter—near a record high. The data goes back to 1Q16.

Calls to block hedge funds from buying single-family homes predominantly come from Democrats, but some conservatives, such as Texas Gov. Abbott, also show support.

In an election year, blocking hedge funds from buying single-family homes might be popular with middle-class and working-poor voters battered by the era of high inflation under failed Bidenomics. Many have been financially paralyzed in today’s economy, unable to afford a home, and stuck in a doom loop of renting and no savings with maxed-out credit cards.

However, institutional investors have a different view of the bills being proposed by lawmakers. They’re overwhelmingly frustrated with signs that the government could step into a free market and break something.

During a recent interview on Fox Business, Kevin O’Leary shared his stance on the proposed legislation.

“Very bad idea. Very bad policy when you try to manipulate markets or sources of capital,” O’Leary said, adding, “I don’t care if they’re Democrats or Republicans, whoever they are, stay out of the markets. Let the markets be the markets.”

The real problem isn’t the hedge funds but the Federal Reserve, which has distorted markets with record-low rates over the years. Great job, Yellen/Powell.

Tyler Durden

Tue, 04/30/2024 – 06:55

via ZeroHedge News https://ift.tt/XLkPt0r Tyler Durden