US equity futures dropped, and European markets were mixed on the last day of the month amid concerns the Fed may stick to its hawkish messaging at its meeting on Wednesday. As of 7:40am, S&P 500 and Nasdaq futures were down 0.1% while Europe’s Stoxx 600 index retreated 0.4%, while Asian stocks gained on Japan’s return from holiday. The Bloomberg Dollar Spot Index climbed and 10-year Treasury yields were steady at 4.62%. The yen resumed its decline even as a Bloomberg analysis found that Japan almost certainly conducted its first currency intervention since 2022 to prop up the yen on Monday. Commodities were mixed with metals down and oil rebounding from its biggest drop in almost two weeks amid discussions on a possible cease-fire in the Middle East. Macro data today includes Q1 employment cost index, Case Shiller home prices, April MNI Chicago PMI, consumer confidence and Dallas Fed services activity. Bitcoin tumbled after activity on Hong Kong’s new crypto ETFs came in far below expectations.

In premarket trading, HSBC Holdings climbed more than 3% after solid earnings and the surprise departure of CEO Noel Quinn, which some analysts said could pave the way for the next stage in the bank’s growth plans. Chegg shares fell 13% after the online educational platform company forecast total net revenue for the second quarter that missed the average estimate. Here are some other notable premarket movers:

- Blend Labs shares jump 20% after it reported a $150 million investment by Haveli Investments in the form of convertible preferred stock with a zero percent coupon.

- Coursera’s shares drop 14%, putting them on track for a one-year low, after the online educational firm cut full-year revenue and adjusted-Ebitda forecasts, prompting analysts to lower their price targets on the stock.

- NXP Semiconductors shares rose 3.6% after the chipmaker reported better-than-expected 1Q adjusted earnings per share and forecast 2Q adjusted EPS and revenue largely above average analyst expectations.

- Paramount Global analysts note that investors are more focused on the Skydance deal rather than results this quarter. The media company replaced CEO Bob Bakish as the board negotiates a possible change in control of the company. Shares in the company fell about 0.4% in premarket trading.

US stocks are on the edge of closing out the first monthly retreat of 2024, with the S&P 500 down 2.6% in April. Amazon.com, McDonald’s and Coca-Cola are due to report later today, but all eyes are on Fed Chair Powell who will likely bolster expectations interest rates will stay higher for longer after Wednesday’s rates announcement.

“Sentiment is positive but reserved,” said Peter Rosenstreich, head of investment products at Swissquote. “There has been plenty of hype around rates, earnings and the macro environment — now markets want to see the results.”

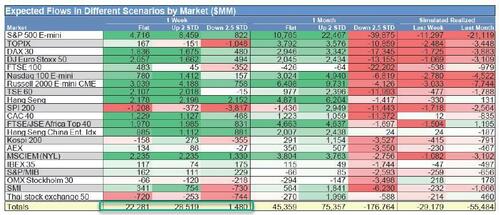

Meanwhile, as we reported first last night, Goldman’s desk calculated that momentum traders are modeled to buy equities over the next week, regardless of market direction. Commodity trading advisers — funds that use systematic strategies to trade futures contracts — are exposed to about $106 billion in long positions after the drawdown in April, Cullen Morgan, an equity derivatives and flows specialist at the bank, wrote in a note. That’s set to support a bounce in global equities after a rough month.

European stocks also fall, led by declines in autos as Volkswagen and Mercedes Benz shares fall post-earnings which offset better-than-expected European economic data. Here are the biggest movers Tuesday:

- Logitech shares soar as much as 10%, the most in six months, after the Swiss maker of computer accessories reported better-than-expected FY25 sales guidance

- Cargotec jumps as much as 17% to a fresh high after the Finnish crane and cargo-handling equipment firm reports “record” first-quarter earnings boosted by its Marine division

- HSBC shares advanced as much as 3.6% after the lender announced a larger buyback than expected and reported earnings that analysts saw as solid

- OMV shares jump as much as 5.3%, largest intraday rise since November, after Austrian refiner reported 1Q clean CCS operating profit beat

- Clariant shares gain as much as 4.8%, to the highest level in more than six months after the Swiss specialty chemicals firm’s margins beat consensus despite some challenges

- Rotork shares rise 3.9% after the valve manufacturer reported a solid start to the year. Sales and orders both grew, while its book-to-bill ratio also improved

- European automakers shares fall as 1Q numbers from Stellantis, Volkswagen and Mercedes disappointed the market, making the SXAP auto index the worst performing subsector

- Straumann shares drop as much as 10%, the most since Oct. 26, after a soft performance in North America overshadowed the Swiss dental equipment company’s 1Q revenue beat

- SES depositary receipts drop as much as 12% after the satellite firm agreed to buy Intelsat for $3.1 billion, in a deal to be funded by cash on hand and new debt

- Air France-KLM falls as much as 4.7% after carrier reports a wider operating loss than expected in the first quarter. Bernstein says one-off costs weighed on profitability

- Santander shares drop as much as 2.9% after forecast-beating net interest income and fees in the first quarter were offset by a cost surge at the Spanish lender

- Adidas shares fell as much as 1.6% as 1Q results broadly confirmed a recent pre-release, and the sportswear maker’s guidance was seen by some as conservative

Earlier in the session, Asian stocks advanced for a third day, led by a rally in Japanese shares as the yen stabilized following wild swings in the previous session. The MSCI Asia Pacific Index rose as much as 1.1%, led by industrial shares such as Hitachi and Toyota Motor. Japan’s Topix Index jumped more than 2% as the market reopened from a holiday. Traders remain on alert for sharp yen moves after the currency’s rebound from a 34-year low sparked speculation of intervention.

“While we remain constructive on the Japan equity market over the medium term, we also believe that near-term FX movement is likely to see some profit taking from investors in the broad Japanese equity market,” said Ricky Tang, head of client portfolio management at Value Partners Group.

In FX, the dollar gained against all its major peers on expectation of a hawkish message from the Federal Reserve on Wednesday. The euro outperformed and the region’s government bonds fell after data showed the largest economies of the bloc were stronger than expected in the first quarter. The yen weakens towards 157 against the dollar. The Aussie underperforms, falling 0.5% after retail sales missed estimates.

In rates, treasuries are slightly cheaper across the curve, paring a portion of Monday’s gains, amid steeper declines for bunds after first estimate of 1Q euro-zone growth rate topped estimates. US yields cheaper by 0.5bp to 1.5bp across the curve with losses led by intermediates, steepening 2s10s spread by 1bp on the day; 10-year yields around 4.63% with bunds underperforming by 1.5bp in the sector. Also during London morning, an array of regional inflation readings lifted intermediate German yields by ~3bp. Bunds are in the red, with German 10-year yields rising 2bps to 2.55%. S&P 500 futures are down 0.1%.

In commodities, oil prices advanced, with WTI rising 0.2% to trade near $82.80. Spot gold falls 0.8%.

Looking at today’s calendar, we have the 1Q employment cost index (8:30am), February FHFA house price index, S&P CoreLogic home prices (9am), April MNI Chicago PMI (9:45am, 3 minutes earlier for subscribers), consumer confidence (10am) and Dallas Fed services activity (10:30am). Fed members are in self-imposed quiet period ahead of May 1 policy announcement.

Market Snapshot

- S&P 500 futures down 0.1% to 5,139.50

- STOXX Europe 600 down 0.2% to 507.25

- MXAP up 0.7% to 174.73

- MXAPJ little changed at 540.41

- Nikkei up 1.2% to 38,405.66

- Topix up 2.1% to 2,743.17

- Hang Seng Index little changed at 17,763.03

- Shanghai Composite down 0.3% to 3,104.82

- Sensex up 0.5% to 75,063.11

- Australia S&P/ASX 200 up 0.3% to 7,664.08

- Kospi up 0.2% to 2,692.06

- German 10Y yield little changed at 2.54%

- Euro down 0.2% to $1.0700

- Brent Futures little changed at $88.47/bbl

- Gold spot down 0.9% to $2,314.21

- US Dollar Index up 0.31% to 105.90

Top Overnight News

- China’s NBS PMIs for April are mixed, with manufacturing about inline at 50.4 (vs. the Street 50.3 and down from 50.8 in Mar) while non-manufacturing fell short at 51.2 (vs. the Street 52.3 and down from 53 in Mar). China’s Caixin manufacturing PMI came in at 51.4, slightly ahead of the Street’s 51 forecast. WSJ

- China’s ruling Communist Party vowed to explore new measures to tackle a protracted housing crisis, which remains the biggest drag on the nation’s economy, and hinted at possible rate cuts ahead. BBG

- HSBC’s chief executive Noel Quinn is to retire unexpectedly after five years, setting off a hunt for a successor at the UK-based bank. Quinn, 62, has overhauled the lender since taking charge in 2019, selling off parts of its global operations to increase its focus on Asia, where it makes the lion’s share of its profits. FT

- BOJ accounts suggest Japan probably intervened in the FX market yesterday, buying around 5.5 trillion yen. Officials have declined to say whether they stepped in. BBG

- The chief executive of Ericsson said a focus on regulation was “driving Europe to irrelevance” as he warned that the region’s competitiveness was being undermined and called for changes to antitrust policy. FT

- EU’s Apr CPI was inline with the Street on a headline basis at +2.4% (unchanged vs. Mar) and a bit firmer on core (+2.7% vs. the Street +2.6% and vs. +2.9% in Mar). BBG

- ECB’s Knot says it is “realistic” to anticipate a cut in June and expresses confidence in inflation coming back to 2%, although he doesn’t envision rates returning to their pandemic/pre-pandemic lows. Nikkei

- Tensions grow between Trump and Lake in Arizona race for Senate. The former president fears that GOP candidate Kari Lake might not win and will drag down his own prospects in the battleground state. WaPo

- Apple has poached dozens of artificial intelligence experts from Google and has created a secretive European laboratory in Zurich, as the tech giant builds a team to battle rivals in developing new AI models and products. FT

- Caterpillar Caterpillar announced a voluntary delisting from Euronext Paris and the Six Swiss Exchange; cites low trading volumes and high administrative costs. CAT will solely trade on NYSE thereafter. (Newswires)

- Tesla (TSLA) CEO Musk is reportedly planning more layoffs as two senior executives depart, while roughly 500 people will be laid off in supercharger group, according to The Information. (The Information)

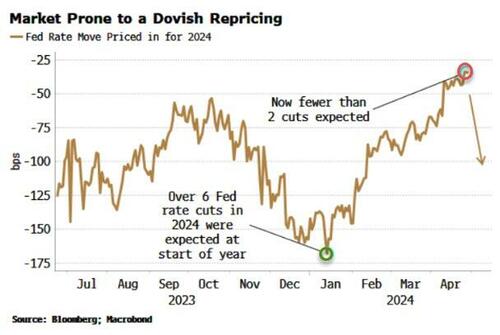

- WSJ’s Timiraos article “Fed to Signal It Has Stomach to Keep Rates High for Longer” & “Firmer price pressures could lead longer-term rates to rise as investors continue paring back expectations of cuts”

Earnings

- NXP Semiconductors NV (NXPI) Shares climb 3.4% pre-market on top- and bottom-line beats, and guidance. Q1 adj. EPS 3.24 (exp. 3.16), Q1 revenue USD 3.13bln (exp. 3.13bln). Q1 gross margin 58.2% (exp. 58%), Q1 operating margin 34.5% (exp. 34%). Auto revenue -1% Y/Y, Industrial/IoT +14%, Mobile +34%, Communications Infrastructure -25% Y/Y. Exec said early views into H2 underpin a cautious optimism. Sees Q2 revenue of 3.125bln (exp. 3.11bln), Q2 EPS of 3.20 (exp. 3.12).

- Paramount Global (PARA) Q1 Adj. EPS 0.62 (exp. 0.36), Q1 revenue USD 7.69bln (exp. 7.73bln); Q1 Paramount+ net additions +3.7mln (exp. +2.2mln); Q1 EBITDA USD 0.987bln (exp. 0.756bln), Q1 FCF USD 209mln (exp. -62mln). President and CEO Bob Bakish stepped down, as many press reports suggested he would do over the weekend. Establishes a management committee; George Cheeks, Chris McCarthy, and Brian Robbins will work with CFO Naveen Chopra to accelerate growth, streamline operations, and optimise streaming strategy; Chair Shari Redstone (of National Amusements) has expressed confidence in their leadership.

- Adidas (ADS GY) Q1 (EUR): Revenue 5.45bln (exp. 5.46bln, prev. 5.27bln Y/Y). Currency-neutral sales +8% driven by growth in all regions except in North America, where revenue fell by 4% to 1.12bln. Europe: +14%.

- Stellantis (STLAM IM/STLAP FP) Q1 (EUR): Revenue 41.7bln (exp. 43.92bln), -12% Y/Y due to “volume, mix and foreign exchange headwinds, partly offset by firm net pricing”.

- Volkswagen (VOW3 GY) Q1 (EUR): Operating Profit 4.59bln (exp. 4.51bln). Revenue 75.5bln (exp. 74.193bln). Operating Margin 6.1% (prev. 7.5% Y/Y); outlook confirmed.

- Mercedes-Benz Group (MBG GY) Q1 (EUR): Adj. EBIT 3.60bln (exp. 3.71bln). Sales 35.87bln (exp. 35.58bln). Cars Adj. EBIT 2.32bln (2.57bln); Outlook maintained.

- HSBC (5 HK/ HSBA LN) Q1 (USD): Revenue 20.75bln (exp. 21.03bln). Pretax profit 12.65bln (exp. 12.61bln). CET1 ratio 15.2% (exp. 15.4%). CEO Quinn is unexpectedly retiring.

A more detailed look at markets courtesy of Newsquawk

APAC stocks were mostly higher but with gains capped heading into month-end amid a slew of data and earnings. ASX 200 was led by strength in the mining sector but with upside limited after a surprise contraction in Retail Sales. Nikkei 225 outperformed on return from the long weekend and as participants digested a slew of earnings releases. Hang Seng and Shanghai Comp. were varied in which the former made another brief foray into bull market territory, while the mainland lagged ahead of the Labour Day holidays and as participants reflected on mixed Chinese PMI data in which the official NBS Manufacturing and Caixin Manufacturing PMIs topped forecasts but Non-Manufacturing PMI disappointed despite remaining in expansion territory.

Top Asian News

- PBoC injected CNY 440bln via 7-day reverse repos with the rate at 1.80%.

- PBoC reportedly wants to halt the bond-buying spree and not join in on it, with the central bank concerned about bond market bubbles and economic gloom, according to Bloomberg.

- Japan’s top currency diplomat Kanda said no comment on FX intervention and noted that a weak yen has positive and negative impacts, while he added the currency has a bigger impact on import prices now and that excessive FX moves could impact daily lives. Kanda said they need to take appropriate actions on FX and reiterated they are ready to take action 24 hours a day and will continue taking appropriate actions when needed.

- BoJ keep monthly bond purchases plan for May unchanged from April

- China’s Communist Party Central Committee is to hold a 3rd plenum during July, via State Media; Politburo undertook a meeting on Tuesday.

- Former Japanese top FX diplomat Furusawa says it is highly likely the Japanese government intervened on Monday to prop up the JPY

European bourses, Stoxx600 (-0.3%) are mixed, with a slight negative bias. Indices initially opened around flat, though tilted lower as the morning progressed, with little driving the shift in sentiment. European sectors hold little bias, with the breadth of the market fairly narrow, with the exception of Autos, dragged down by poor results from Mercedes (-3.4%), Stellantis (-2.4%) and Volkswagen (-2.1%). Real Estate tops the pile, propped up by post-earning gains in Vonovia (+5.5%). US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.3%) are modestly softer, in fitting with the broader price action seen in European trade. Earnings include: McDonald’s, AMD, Amazon and Starbucks.

Top European News

- ECB’s Knot said he is increasingly confident inflation is falling towards the 2% target but the ECB must be cautious beyond a June rate cut.

FX

- USD is attempting to claw back some of yesterday’s JPY-induced losses which sent the index down to a low of 105.46. For now, the DXY has topped out at 105.96 and unable to reclaim 106 status, 106.18 was the high from yesterday. Recent EUR strength in the wake of the EZ data has led the index back down to the unchanged mark.

- EUR is slightly firmer vs. the broadly flat USD in the wake of a slew of EZ data with EUR being propped up by firmer than expected growth metrics. Inflation data was in-line on a headline basis and mixed from a core perspective.

- JPY is softer vs. the USD after yesterday’s wild (touted intervention led) session which saw USD/JPY swing from a 160.20 peak to a 154.51 low; currently trades towards the top end of a 156.08-99 range.

- Antipodeans are giving back yesterday’s gains and then some as the USD regains some poise. AUD/USD had advanced to a peak of 0.6586 yesterday (highest since April 12th) before pulling back as low as 0.6514 with soft retail sales also acting as a drag.

Fixed Income

- Bunds began on the backfoot after hotter than expected French inflation and a sticky Services metric, with additional pressure coming from better-than-forecast GDP prints by France & Germany ahead of the EZ figures. EZ HICP headline Y/Y was in-line with the core metrics mixed against expected, which led to a hawkish reaction; Bunds currently sit at session lows around 130.40 given the strong GDP numbers and potentially mixed core.

- USTs are moving in tandem with EGBs which leaves the benchmark a touch softer but some way from Monday’s 107-18+ base. Specifics light thus far into Wednesday’s FOMC and Quarterly Refunding.

- Gilts are once again following EGB/UST impetus. A narrative that is unlikely to change significantly in the near-term given a sparse UK docket before next week’s BoE; though, we are attentive to anything from the EZ/US, particularly around the Fed, which provides insight into the Central Bank divergence narrative.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.21x, average yield 4.251%, tail 0.8bps.

Commodities

- Crude futures are choppy and now in modest positive territory after earlier subdued trade. Prices are on standby ahead of key macro risk events including the FOMC and US jobs data on Friday; Brent July similarly found an intraday base at USD 86.64/bbl.

- Softer trade across precious metals amid yesterday’s geopolitical unwind coupled with a rebound in the Dollar today. Spot silver sits as the laggard after yesterday’s outperformance; XAU fell under yesterday’s low (USD 2,319.84/oz) to a current base at USD 2,310.96/oz.

- Losses seen across base metals amid the aforementioned Dollar rebound coupled with a pullback in sentiment. 3M LME copper topped USD 10,200/t earlier to reach a USD 10,217.00/t intraday peak.

Geopolitics

- “IDF finalizes Rafah plans, invasion possible if no deal in 72 hours”, according to Times of Israel.

- “Israeli delegation will not head to Cairo until Hamas gives its response, according to Israeli official”, according to Walla’s Elster.

- Hamas is expected to respond to the exchange deal proposal “tomorrow evening”, Al Arabiya reports

- Hamas delegation left Cairo and will return with a written response to the ceasefire proposal, according to Egypt’s Al Qahera News.

- An Israeli delegation plans to travel to Cairo to resume ceasefire talks if Hamas agrees to attend, according to NYT.

- Israeli PM Netanyahu asked US President Biden to help prevent the ICC from issuing arrest warrants against Israeli officials, according to Axios.

- Yemen’s Houthis said they targeted the ‘Cyclades’ vessel and two US destroyers in the Red Sea, while it also targeted ‘Israeli ship MSC Orion’ in the Indian Ocean, according to Reuters. US CENTCOM later confirmed that Iranian-backed Houthis fired three anti-ship ballistic missiles and three UAVs from Yemen into the Red Sea towards MV Cyclades but added there were no injuries or damages reported by US, coalition or merchant vessels.

- Chinese Coast Guard expelled a Philippines Coast Guard ship and vessels from waters adjacent to the Scarborough Shoal.

- Shanghai Maritime Safety Administration said military activities will be carried out in a part of the East China Sea from 07:00 AM on May 1st to 09:00 AM on May 9th local time and vessels unrelated to the activity are prohibited from entering the area.

US Event Calendar

- 08:30: 1Q Employment Cost Index, est. 1.0%, prior 0.9%

- 09:00: Feb. FHFA House Price Index MoM, est. 0.2%, prior -0.1%

- 09:00: Feb. S&P CS Composite-20 YoY, est. 6.70%, prior 6.59%

- Feb. S&P/CS 20 City MoM SA, est. 0.10%, prior 0.14%

- Feb. S&P/Case-Shiller US HPI YoY, est. 6.38%, prior 6.03%

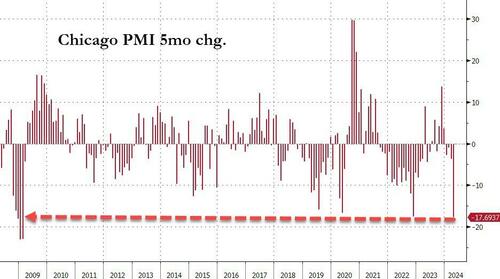

- 09:45: April MNI Chicago PMI, est. 45.0, prior 41.4

- 10:00: April Conf. Board Consumer Confidenc, est. 104.0, prior 104.7

- April Conf. Board Present Situation, prior 151.0

- April Conf. Board Expectations, prior 73.8

- 10:30: April Dallas Fed Services Activity, prior -5.5

DB’s Jim Reid concludes the overnight wrap

Markets got the week off to a decent start yesterday, with the S&P 500 (+0.32%) building on last week’s advance as we await the Fed’s decision tomorrow and an array of earnings releases. Several factors helped to boost sentiment, including a remarkable advance for Tesla (+15.31%) as outlets including Bloomberg and the Wall Street Journal reported that Chinese government officials had given the firm in-principle approval for its driver-assistance system. In addition, investors were reassured after there was nothing alarming in the flash CPI releases from several European countries, which cemented expectations that the ECB would deliver a rate cut in June. And alongside that, concern about a geopolitical escalation continued to ebb, with Brent crude oil prices down -1.23% to $88.40/bbl. So there were several positive catalysts helping to boost sentiment. The Yen’s range of around 160.25 – 154.5 was a constant side show all day, with heavy speculation that the government had intervened in very thin holiday trading. As we type this morning the Yen is trading down slightly at 156.75 from 156.35 as the US closed last night, which continues to leave it as the worst performing G10 currency year-to-date, down -10% against the US dollar. The intervention hasn’t been officially confirmed but top currency official Kanda has commented that the authorities are watching the Yen 24 hours a day and suggested they were looking more for the size of moves rather than specific levels.

Staying in Asia, China’s factory activity remained in expansion territory for the second consecutive month in April but the pace of expansion slowed slightly as the official manufacturing PMI came in at 50.4 (v/s 50.3 expected) as against a reading of 50.8 in March. Meanwhile, the decline in non-manufacturing activity was more pronounced as the official PMI moderated to 51.2 (v/s 52.3 expected) down from a reading of 53.0. At the same time, the Caixin manufacturing PMI advanced to 51.4 in April (v/s 51.0 expected), marking the fastest pace since February 2023 and compared to an expansion of 51.1 seen in March. Our Chinese economist reviews the details within today’s PMIs in a note just out here.

Going into more detail now on the main events of the last 24 hours. Those European inflation numbers were important from the market open, as they helped to allay fears about a European inflation rebound of the sort happening in the US. We’ll have to wait for the Euro Area-wide number today, but ahead of that, Spanish inflation came in at +3.4% on the EU-harmonised measure, in line with expectations. Then in Germany, harmonised inflation ticked up to +2.4% in April (vs. +2.3% expected), whilst in Ireland it fell a tenth to +1.6%, the lowest since June 2021. So given recent ECB commentary about a potential June cut, those numbers keep that on track, and market pricing raised the chance to a 91% probability by the close, up from 88% on Friday. Estonia’s Muller also backed up that sentiment, as he said that in June “we’ll probably have reached the point where it’s already possible to start lowering central-bank interest rates”.

The lack of any bad news on inflation supported government bonds on both sides of the Atlantic, with some added support from the fall in energy prices. For instance in Europe, yields on 10yr bunds (-4.3bps), OATs (-6.2bps) and BTPs (-6.6bps) all saw decent declines. And over in the US, yields on 10yr Treasuries were also down -5.0bps to 4.61% and are a further -1bps lower overnight at 4.60% as we go to print.

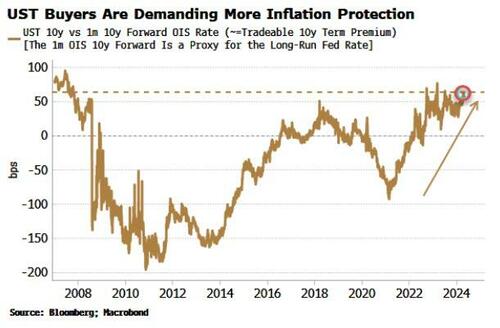

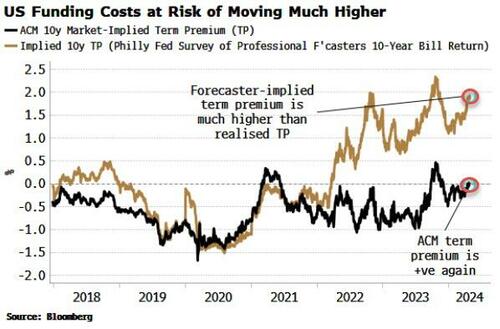

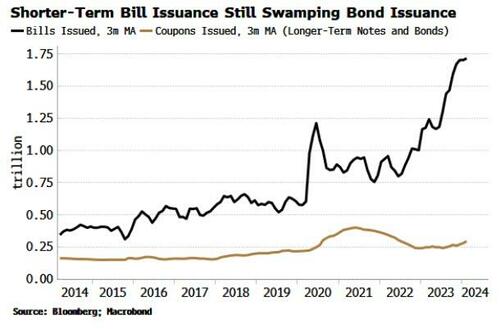

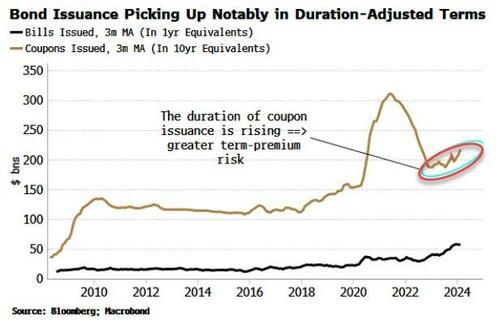

US Treasuries had sold off by a couple of basis points later in the US session following the latest borrowing estimates from the US Treasury. These saw the expected Q2 issuance rise from $202bn to $243bn, “largely due to lower cash receipts”. This was slightly puzzling given what have been fairly strong tax receipts in the recent April tax period. Still, while the Q2 estimate was revised slightly higher, the Q3 number (excluding TGA movement) was in line with expectations, so our rates strategists don’t see meaningful alteration to the fiscal outlook. Indeed, the negative reaction in Treasuries did not persist with yields closing not far above their intra-day lows.

For equities, it was also a solid day, with the S&P 500 (+0.32%) up to its highest level in a couple of weeks, and Europe’s STOXX 600 (+0.07%) inching up to a 3-week high. The advance was a broad-based one, with the small-cap Russell 2000 (+0.70%) and the equal-weighted S&P 500 (+0.70%) posting larger gains. But there was some weakness in continental Europe, where the CAC 40 (-0.29%), the DAX (-0.24%) and the IBEX 35 (-0.48%) all lost ground.

Asian equity markets are mostly higher again this morning with the Nikkei leading gains (+1.38%) after returning from a public holiday with the KOSPI (+0.70%) also notably higher after index heavyweight Samsung Electronics topped earnings estimates for the Jan-March quarter after its semiconductor division returned to profitability. Meanwhile, the Hang Seng (+0.25%) and the S&P/ASX 200 (+0.24%) are also moving higher. Elsewhere, mainland Chinese stocks are trading slightly lower with both the CSI (-0.18%) and the Shanghai Composite (-0.12%) seeing minor losses following the batch of mixed PMI readings for April. S&P 500 (-0.11%) and NASDAQ 100 (+0.0%) futures are quiet.

Retail sales in Australia unexpectedly slumped -0.4% m/m in March (v/s +0.2% expected) as against a revised +0.2% increase the previous month thus dampening expectations that the next move in interest rates might be up. This was a very low number relative to the last several decades of data so it does put into doubt the RBA’s view that the consumer is holding up.

In the political sphere, Spanish Prime Minister Sánchez confirmed that he would remain as PM, which follows his decision to cancel engagements last week following allegations against his wife. Separately in the UK though, the Scottish First Minister Humza Yousaf announced his resignation. That comes after last week’s collapse of an agreement between his Scottish National Party and the Greens, meaning that the SNP no longer had a majority in the Scottish Parliament. We’ve got lots more UK political events this week, as local elections are taking place on Thursday, which are the final electoral test for the political parties before the next general election, which has to be held by January at the latest.

To the day ahead now, and data releases include the Euro Area flash CPI release for April, along with Q1 GDP. In the US, we’ll also get the Employment Cost Index for Q1, the FHFA house price index for February, the Conference Board’s consumer confidence for April, and the MNI Chicago PMI for April. Meanwhile in the UK, there are mortgage approvals for March. Finally, today’s earnings releases include Amazon, Eli Lilly, Coca-Cola, McDonald’s and Starbucks.