Futures Gain Boosted By Apple’s Blowout Buyback, Dollar Drops Ahead Of Payrolls

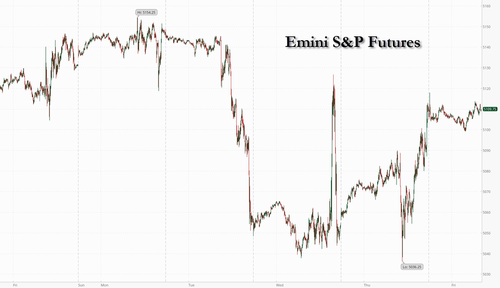

US stock futures pointed to further strength on Wall Street ahead of the April jobs report after solid earnings and a record buyback announcement from Apple As of 8:00am, S&P futures rise 0.3% while Nasdaq 100 contracts add 0.6% thanks to a 6% surge in Apple in premarket trading. The dollar weakened for a third day, while Treasuries were steady. The US 10-year yield is down about 9 basis points this week at 4.57%, its first weekly drop since March, after Powell struck a less hawkish tone than feared. Traders have also pulled forward expectations for the Fed’s first full interest-rate cut by a month to November.

In premarket trading Apple jumped .2% after the company posted stronger-than-expected sales last quarter and predicted a return to growth in the current period, sparking optimism that a slowdown is easing. Amgen soared 14% after its CEO said he was “very encouraged” by early results from a study of the company’s experimental obesity drug, MariTide. Here are some other notable premarket movers:

- Alignment Healthcare gains 9% after the company forecast revenue for the 2Q that beat the average analyst estimate.

- Ardelyx (ARDX) soars 18% after the pharma company’s Xphozah and Ibsrela drugs drove a strong 1Q revenue beat, which Jefferies expects will boost confidence in the company’s management.

- BigBear.ai (BBAI) falls 14% the AI software company reported a wider-than-expected first-quarter loss.

- Block (SQ) rises 7.2% after Jack Dorsey’s payments technology company forecast adjusted Ebitda for the full year above analysts’ estimates.

- Cloudflare (NET) sinks 13% after the cloud security firm provided a 2Q revenue forecast that fell slightly short of estimates.

- Fortinet (FTNT) falls 8% as the cybersecurity company reported a miss in first-quarter billings due to weakness in Europe.

- FuboTV (FUBO) rises 8.4% after the internet television service provider reported revenue for the first quarter that beat the average analyst estimate.

- ImmunityBio (IBRX) gains 8% on a deal with the Serum Institute of India for Bacillus Calmette-Guerin supply.

- Live Nation Entertainment (LYV) rises 3% after the operator of Ticketmaster reported first-quarter results that beat expectations.

- OneSpan (OSPN) rises 15% after the software services company reported first-quarter results that are seen as strong.

- Open Text (OTEX) slips 13% after the application software company gave an outlook that is seen as weak, prompting a downgrade.

- WideOpenWest (WOW) climbs 17% after shareholder Crestview says it and DigitalBridge submitted a joint, preliminary non-binding proposal to buy the cable service provider for $4.80 per Class A share.

Traders will be watching this morning’s jobs report for clues about renewed slowing in the economy (full preview here). Non-farm payrolls data is the next big trigger for markets after Federal Reserve chief Jerome Powell effectively laid concerns about a potential rate hike to rest. The forecast gain of 240,000 jobs would be the weakest since November.

“NFP gains have likely slowed, but to a level that has remained strong,” wrote Credit Agricole CIB strategists led by Sébastien Barbé. “The ‘higher for longer’ narrative should remain well in place, but is largely priced in by the market at this stage.”

If the Labor Department’s report shows fewer than 125,000 jobs were added in April, and the average hourly earnings rose more than 0.4% from the previous month, that would be a “stagflation risk-off print,” according to Bank of America Corp. strategist Michael Hartnett. On the other hand, if payrolls were to rise by more than 225,000 and average hourly earnings by less than 0.2%, it would be interpreted as “Goldilocks back on and risk back on,” he wrote.

European stocks have tracked a tech-driven rally in Asia after Apple forecast a return to sales growth and announced the largest stock buyback plan in US history. The Stoxx 600 is up 0.4% as it looks to snap a three-day losing streak. While tech stocks led gains, pharmaceuticals lagged with Novo Nordisk A/S retreating more than 5% on competition concerns. Here are the most notable European movers:

- Henkel jumps as much as 6.6%, the biggest gainer on the Stoxx 600 benchmark, after the German chemicals firm boosted its organic sales and adjusted Ebit margin forecasts for the full year

- Credit Agricole shares rise as much as 4.2% to a fresh six-year high after the French bank delivered a big net income beat in the first quarter, according to analysts

- Novonesis shares rise as much as 5.7%, the most since Oct. 26, after the Danish company reaffirmed its organic revenue forecast for the full year, rebounding from a recent slump

- JCDecaux shares jump as much as 13% to the highest in more than a year after the outdoor advertising firm set a second-quarter revenue growth target that were ahead of expectations

- Trainline gains as much as 9% after the online ticket retailer posted an earnings beat and upgraded its 2025 Ebitda forecast. It also announced a new £75 million share buyback program

- Siemens Energy gains as much as 3.3% after Deutsche Bank raised the recommendation on the German renewable energy company to buy from hold, citing its newly-listed peer GE Vernova

- Hensoldt, Renk and Rheinmetall gain as Hauck & Aufhaeuser initiates coverage of the defense contractors at buy, seeing quality in the sector and noting their resilient business model

- Novo Nordisk falls as much as 4.9% after Amgen’s CEO said he was “very encouraged” by early results from a study of the US company’s experimental obesity drug, MariTide

- Danske Bank falls as much as 5.7%, the most since March, after the Danish lender’s NII for the first quarter was weaker than expected, which also weighed on overall revenues in the period

- Aurubis drops as much as 12%, the most since September, as UBS cuts its recommendation on the copper smelting firm to sell from buy, saying material market tightness is likely to persist

- Daimler Truck declines as much as 7.3%, the most since July 2022, after the German truckmaker warned that it was seeing an increasingly difficult environment in its key European market

- Bpost falls as much as 9%, the most since January, after the courier service released results that missed expectations on Ebit as M&A costs weighed, according to Jefferies

Earlier in the session, Asian stocks gained with the Hang Seng Index surging 1.5% to cap a ninth straight session of gains, the longest winning streak since 2018. Chinese technology giants Alibaba Group Holding Ltd. and Tencent Holdings Ltd. were among the top contributors to the advance.

In FX, the dollar declined 0.2% against all its Group-of-10 peers, with the Bloomberg dollar index heading for a 0.9% loss this week as traders pulled forward expectations for the first Fed rate cut to November ahead of today’s jobs report. its worst since early March. The yen strengthened as traders mulled news that authorities had likely spent about $23 billion in their second suspected currency intervention this week; Japan markets were shut for a local holiday. The Norwegian krone climbed after the nation’s central bank said tight policy may be needed somewhat longer, as it held the key interest rate steady at 4.5%, in line with expectations.

Treasuries are narrowly mixed with the yield curve flatter ahead of the April jobs report, holding most of the past two days’ steepening rally. 7- to 30-year yields are lower by ~1bp with shorter tenors little changed; 2s10s spread flattens ~2bp, unwinding less than half of Thursday’s steepening move. 5s30s spread remains near top of Thursday’s range at ~15bp. 10-year yield 4.57%, slightly outperforming bunds and gilts in the sector.

Oil prices are flat, with WTI trading near $79 a barrel. Spot gold falls 0.2% to around $2,300/oz.

Looking at today’s calendar, US economic data slate includes April jobs report (8:30am), S&P Global US services PMI (9:45am) and ISM services (10am). Fed members’ scheduled speeches include Chicago’s Goolsbee (10:30am and 7:45pm) and New York’s Williams (7:45pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,106.00

- STOXX Europe 600 up 0.2% to 504.33

- MXAP up 0.7% to 177.18

- MXAPJ up 0.8% to 546.84

- Nikkei little changed at 38,236.07

- Topix little changed at 2,728.53

- Hang Seng Index up 1.5% to 18,475.92

- Shanghai Composite down 0.3% to 3,104.82

- Sensex down 1.4% to 73,569.19

- Australia S&P/ASX 200 up 0.6% to 7,628.97

- Kospi down 0.3% to 2,676.63

- German 10Y yield little changed at 2.54%

- Euro up 0.1% to $1.0741

- Brent Futures up 0.2% to $83.80/bbl

- Gold spot down 0.2% to $2,298.75

- US Dollar Index little changed at 105.22

Top Overnight News

- Four Chinese generative artificial intelligence start-ups have been valued at between $1.2bn and $2.5bn in the past three months, leading a pack of more than 260 companies vying to emulate the success of US rivals such as OpenAI and Anthropic. The newly minted unicorns — Zhipu AI, Moonshot AI, MiniMax and 01.ai — have gained significant backing from a largely domestic pool of investors and are fighting to hire the best talent to develop the most popular AI products. FT

- Across China and among the global scientific community, Friday’s launch of a Chinese mission to collect samples from the moon’s far side has been hailed for its potential for a scientific breakthrough. But in the U.S., lawmakers and the National Aeronautics and Space Administration are closely watching the expedition with trepidation: as a milestone in a rival’s campaign to build a base on the moon’s most strategic location. WSJ

- Norway’s central bank leaves rates unchanged (as expected) and says “the policy rate will likely be kept at today’s level for some time ahead”. RTRS

- Britain’s Conservative Party suffered striking early setbacks on Friday in local elections that are viewed as a barometer for how the party will perform in a coming general election and a key test for the embattled prime minister, Rishi Sunak. NYT

- The OPEC+ group of countries could extend their production cuts beyond June if demand fails to improve, creating upside risks for oil prices. RTRS

- The NBA is targeting $76 billion in TV rights over 11 years, three times its current deal, people familiar said. Disney and Amazon have agreed to the framework, while Warner Bros. is racing Comcast for a third package. BBG

- Dated Brent has seen record trading volumes in both physical and derivative markets since WTI Midland was added to the grades that determine its price. It’s eliminated decades-long concerns over the benchmark’s viability amid shrinking North Sea production. BBG

- AAPL +6% beat … “guided up LSD. Upside on Services, China revs, iPhone revs .. $110bn BUYBACK .. Revenues $90.33bn vs cons $90.3b (-4.8% y/y). iPhone revenues $45.96bn vs cons $45.76bn (-11% y/y). Services revenues $23.87bn vs cons $23.28bn (+11.4% y/y. China revenues $16.37 (-8% y/y) vs cons $15.9bn. Inventories $6.232bn (vs $6.5bn last qtr). EPS $1.53 vs cons $1.50. GS Trading

Earnings

- Apple Inc (AAPL) Q2 2024 (USD): EPS 1.53 (exp. 1.50), Revenue 90.75bln (exp. 90.01bln); to buy back additional 110bln of shares and boosts quarterly dividend 4% to 0.25/shr, Revenue breakdown: Products 66.89bln (exp. 66.95bln), iPhone 45.96bln (exp. 45.76bln), Mac 7.45bln (exp. 6.79bln), iPad 5.56bln (exp. 5.91bln), Wearables, home and accessories 7.91bln (exp. 8.29bln), Service 23.87bln (exp. 23.28bln), Greater China revenue 16.37bln (exp. 15.87bln). Shares +5.9% in pre-market trade

- Amgen Inc (AMGN) Q1 2024 (USD): Adj. EPS 3.96 (exp. 3.87), Revenue 7.45bln (exp. 7.44bln); Still sees share buyback up to 500mln. Shares +14.9% in pre-market trade

- Booking Holdings Inc (BKNG) Q1 2024 (USD): EPS 20.39 (exp. 14.06), Revenue 4.40bln (exp. 4.25bln). Shares +1.9% in pre-market trade

A more detailed look at global market courtesy of Newsquawk

APAC stocks took impetus from Wall St where equities extended on post-FOMC gains and futures were also lifted by Apple’s earnings beat, but with upside capped in the region amid key market closures including in Japan and Mainland China. ASX 200 traded higher as real estate led the outperformance in the rate-sensitive sectors. Hang Seng extended its rally after having recently entered a bull market and following stronger GDP data.

Top Asian News

- China May Day railway travel reached a record high of around 20.7mln trips, according to Xinhua.

- US FCC said roughly 40% of US telecom companies cannot replace Huawei or ZTE equipment in US networks without additional government funding.

European bourses, Stoxx600 (+0.2%) are entirely in the green, and with price action fairly muted as participants await the US Employment report at 13:30 BST / 08:30 EDT. European sectors hold a strong positive tilt, with Media taking the top spot, lifted by post-earning gains in JCDecaux (+12.5%) and UMG (+2.5%). Healthcare is found at the foot of the pile, dragged lower by Novo Nordisk (-4.5%), after recent Amgen updates. US Equity Futures (ES +0.3, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the NQ lifted by pre-market gains in Apple (+5.7%) after its earnings.

Top European News

- Norges Bank maintains its Key Policy Rate at 4.50% as expected; the data so far could suggest that a tight monetary policy stance may be needed for somewhat longer than previously envisaged. Click here for more details. Norges Bank Chief Bache says Norges has not decided when to cut rates.

- UK opposition Labour party wins Blackpool South by-election, taking the seat from the Conservatives in a blow for PM Sunak, according to BBC. It was also reported that the Labour party gained Hartlepool from no overall control in the local elections and they also claimed a win for Thurrock Council which the Tories won last year but had moved to no overall control after defections. Thus far, only around 30 of the 107 councils have declared but the swing as it stands is to Labour at the expense of the Conservatives. As a reminder, there have been reports in recent days that a bad result at the local elections could see MPs put in a no-confidence vote in PM Sunak in the next week or so.

- ECB’s Lane said given the lags in transmission, the tightening effects from past interest rate hikes are still unfolding, while he noted expectations of future inflation normalising further and that leaving nominal rates unchanged implies a mechanical increase in real interest rates. Lane said moving from one meeting to the next meeting and from one projection round to the next projection round allows for the accumulation of further data that can help inform the rate decision. Furthermore, Lane said inflation has declined more quickly than expected and noted the more the data validates inflation coming back to the target, the more they will be able to remove restrictions this year and next year.

- ECB’s Stournaras said three ECB rate cuts are more likely this year and the latest euro-area GDP figures were a positive surprise, according to comments made to Liberal cited by Bloomberg.

- German Engineering Orders -17% Y/Y in March (Domestic -23%; Foreign Orders -15%), Jan-Mar orders -13% (Domestic -16%; Foreign -12%), according to VDMA

FX

- DXY is modestly lower on NFP day and within 105.16-37 confines after dipping under yesterday’s trough (105.29) in APAC hours as with the next downside level the 11th April low (105.03) before the round figure.

- Sideways trade for the EUR against the Dollar amid a lack of drivers, whilst dovish ECB commentary continues with ECB’s Lane yesterday. EUR/USD trades within a narrow 1.0725-45 parameter at the time of writing.

- Yen stands as one of the G10 outperformers despite a lack of fresh headlines following this week’s double suspected intervention. USD/JPY trades in a 152.76-153.75 intraday band with potential support at the 12th April low (152.59).

- Antipodeans are modestly firmer and holding on to recent spoils and remained afloat amid the constructive mood but with price action quiet amid a lack of drivers. AUD/USD briefly topped its 100 DMA (0.6581).

- NOK came under some modest pressure as policy settings were maintained by Norges Bank but then appreciated slightly on the line that “the data so far could suggest that a tight monetary policy stance may be needed for somewhat longer than previously envisaged.”

Fixed Income

- USTs are flat/incrementally softer with the curve flattening on the margin as the post-FOMC steepening settles into NFP and Fed speak. Currently within a busy 114’25-155’04 range.

- Bunds are firmer but only modestly so with overnight action sparse on account of Japan’s holiday and EZ-specific drivers limited thus far; docket very much focused on US NFP & ISM Services alongside a handful of Fed speakers.

- Gilt price action has been in-fitting with EGBs after Thursday’s session of outperformance. UK specifics light before Monday’s bank holiday and then a packed week incl. the BoE on Thursday.

Commodities

- Crude is modestly firmer intraday but consolidating in the grander scheme after futures were relatively flat yesterday following a choppy session as participants await developments on the Israel-Hamas front after reports noted of “positive” spirit in talks. Brent July trades in a USD 83.77-84.15/bbl range.

- Precious metals are subdued but contained ahead of key US data and amid the absence of updates on the geopolitical front. XAU sits in a narrow USD 2,297.85-2,308.80/oz parameter.

- Base metals are mostly firmer across the board, but more so consolidation after yesterday’s weakness, with sentiment not helped by the absence of Chinese markets.

Geopolitics

- Israeli air strike hit a security building outside the Syrian capital of Damascus, according to a security source cited by Reuters, while Syrian state media later reported that 8 soldiers were injured in the Israeli airstrike on the outskirts of Damascus.

- Hezbollah announced it targeted the headquarters of Israel’s 91st Division in the Branet barracks with rocket-propelled grenades, according to Sky News Arabia.

- Islamic Resistance in Iraq launched attacks on targets in Israel with Arqab-type cruise missiles from Iraqi territory which was the first attack targeting Israel’s Tel Aviv by the Islamic Resistance in Iraq, according to a source in the group.

- Israel National Security Minister Gvir called on PM Netanyahu to remove Defence Minister Galant from office as he is not fit to continue his work as the defence minister.

- Israel’s Foreign Minister said Turkish President Erdogan is breaking agreements by blocking ports for Israeli imports and exports.

- Russian military personnel entered an air base in Niger that is hosting US troops which follows a decision by Niger’s Junta to expel US forces from the country, according to Reuters citing a US official. However, US Defense Secretary Austin later commented that Russians do not have access to US forces or equipment in Niger and they will continue to watch the presence of Russian forces in Niger.

US event calendar

- 08:30: April Labor Force Participation Rate, est. 62.7%, prior 62.7%

- 08:30: April Average Weekly Hours All Emplo, est. 34.4, prior 34.4

- 08:30: April Average Hourly Earnings YoY, est. 4.0%, prior 4.1%

- 08:30: April Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- 08:30: April Change in Manufact. Payrolls, est. 5,000, prior zero

- 08:30: April Change in Private Payrolls, est. 195,000, prior 232,000

- 08:30: April Unemployment Rate, est. 3.8%, prior 3.8%

- 08:30: April Change in Nonfarm Payrolls, est. 240,000, prior 303,000

- 09:45: April S&P Global US Composite PMI, est. 51.0, prior 50.9

- 09:45: April S&P Global US Services PMI, est. 51.0, prior 50.9

- 10:00: April ISM Services Index, est. 52.0, prior 51.4

DB’s Jim Reid concludes the overnight wrap

Tyler Durden

Fri, 05/03/2024 – 08:23

via ZeroHedge News https://ift.tt/ngd0TNX Tyler Durden