Saudi Arabia’s Price Hike May Signal Oil Bottom

One of the recent positives for bonds and non-energy stocks could have run its course after Saudi Arabia raised the price of its flagship crude to Asia for a third consecutive month, according to Bloomberg markets live reporter Garfield Reynolds

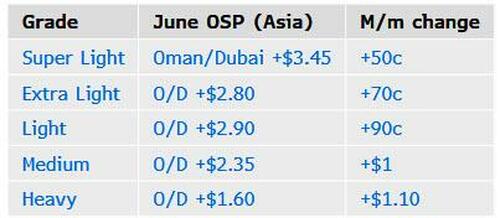

Over the weekend, state-owned Saudi Aramco raised the June official selling price of Arab Light crude for customers in Asia by 90 cents to $2.90 a barrel above the regional Oman-Dubai benchmark, Bloomberg reported. It compares with an increase of 60 cents forecast in a Bloomberg survey of six refiners. Prices for other lighter and heavier varieties were also increased from May.

The hike highlights Saudi Arabia’s efforts to keep the market tight amid fading war risk in the Middle East, which has helped drive oil prices in London lower. Most traders and analysts predict that the Organization of the Petroleum Exporting Countries and its allies will extend their output curbs, potentially to the end of the year.

Crude took a marked step lower last week thanks to a surge in US inventories and optimism that Middle East tensions can cool further, but there’s a decent chance it’s busy finding a new floor rather than settling in for sustained declines according to Reynolds who notes that if Israel and Hamas can agree on a truce — a substantial if with the status of talks unclear after the latest round in Cairo — that would likely set off a fresh, rapid drop in the short term for crude.

But even then it looks as though Saudi Arabia and the other producers would be likely to respond with further efforts to trim supply to prop up prices.

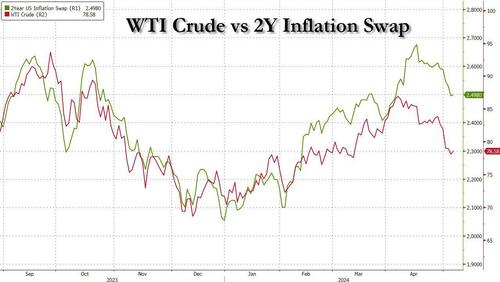

With two-year US inflation swaps sitting at ~2.5% that shows bonds remain vulnerable to sticky oil prices even with WTI under $80/barrel.

Tyler Durden

Mon, 05/06/2024 – 11:25

via ZeroHedge News https://ift.tt/nCYR2w8 Tyler Durden