Bottom Watch: US NatGas Prices Snap Longest Losing Streak Since 2020

US natural gas prices broke their longest monthly losing streak since 2020. This comes after an El Niño winter swept across the Lower 48, causing demand to dwindle and storage levels to surge, sending prices spiraling lower in recent months. However, now there are signs a bottom is forming in NatGas markets.

April printed the first monthly gain since October, up nearly 13%, breaking the longest losing streak in more than four years.

Between mid-February and late April, prices were floored around $1.50/MMBtu with resistance around the $2 mark. Since last week, prices have surged above $2.

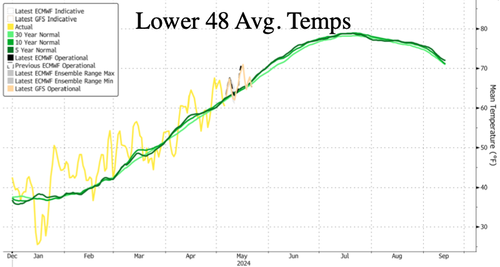

One reason for the bullish price action is that the market expects warmer weather across the Lower 48. Peak summer is mid-July, and this is the point when households and businesses crank up air conditioning, which ignites power demand from NatGas-fired power plants.

FXStreet noted the prices are also rising today due to a higher war risk premium as “Israel is starting offensive in Rafah.”

Warmer weather will help draw down on the record NatGas storage in the US. The end of the withdrawal season was:

- 2019: 1.107 trillion cubic feet (tcf)

- 2020: 1.986 tcf

- 2021: 1.750 tcf

- 2022: 1.386 tcf

- 2023: 1.830 tcf

- 2024: 2.259 tcf

The 2.259 tcf figure is the highest inventories in years for the US, specifically due to mild winter weather.

On Monday, Goldman’s Samantha Dart gave clients a snapshot of NatGas fundamentals in the US. The big takeaway is elevated storage but declining production due to ongoing maintenance.

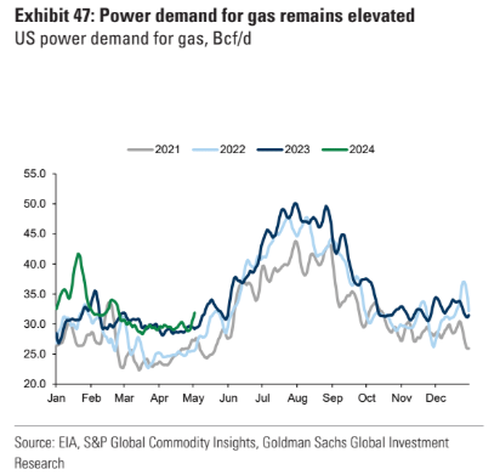

Dart notes that the power demand for NatGas remains elevated.

In a separate note last week, Dart said increasing power demand for data centers “might not change much for US gas prices.”

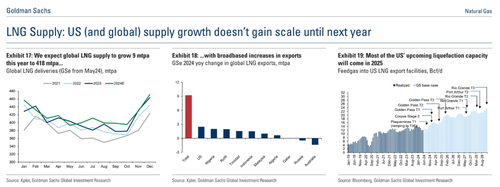

The good news for US NatGas prices is that LNG exporting capacity is expected to ramp up next year.

NatGas prices have likely bottomed.

Tyler Durden

Tue, 05/07/2024 – 05:45

via ZeroHedge News https://ift.tt/2C30yTt Tyler Durden