Money-Market Fund Assets Top $6 Trillion Again, Fed’s Bank Bailout Facility Still At $113BN

Money market funds saw inflows for the third straight week (up $31.1BN) pushing the total assets to $6.03TN – the highest level in a month…

Source: Bloomberg

In a breakdown for the week to May 8, government funds – which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.88 trillion, a $20 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $1.03 trillion, an $8.6 billion increase.

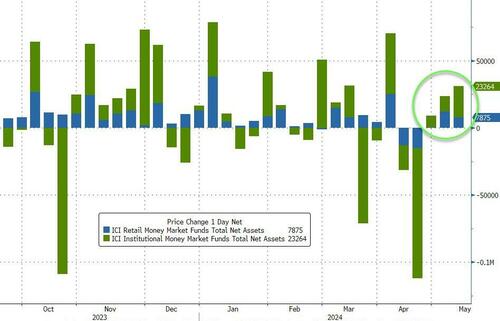

Both Retail and Institutional funds saw inflows (+7.8BN and +23.3BN respectively)…

Source: Bloomberg

Amid all the chatter about tapering QT, The Fed balance sheet continued to contract (though only $9.1BN)…

Source: Bloomberg

Additionally, The Fed’s (now expired) bank bailout scheme continues to decline (as the 12-month term loans run off), dropping by a sizable $11.5BN last week – erasing all the arb-driven usage. However, the facility still has a whopping $112.8BN left outstanding filling holes in bank balance sheets somewhere…

Source: Bloomberg

Finally, bank reserves at The Fed continues to contract, while US equity market cap remains dramatically decoupled…

Source: Bloomberg

Which makes us wonder, is Powell’s acquiescence to a bigger, sooner ‘QT taper’ (in the face of not-under-control inflation) to soften the blow when this crocodile mouth snaps shut.

Tyler Durden

Thu, 05/09/2024 – 16:40

via ZeroHedge News https://ift.tt/7hjOyNk Tyler Durden