Bitcoin Paves The Way For A New Era Of Free Market Banking

Authored by Nick Giambruno via InternationalMan.com,

Hal Finney was a pioneering computer scientist, cryptographer, and prominent Cypherpunk who played a crucial role in the early development of Bitcoin.

He was one of the first supporters, contributors, and adopters of Bitcoin.

In short, Finney was a visionary who understood Bitcoin’s potential before almost everyone else.

In December 2010, Finney wrote:

“There is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins.

Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the blockchain.

There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases.

Bitcoin backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.

I believe this will be the ultimate fate of Bitcoin, to be the ‘high-powered money’ that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers.

Bitcoin transactions by private individuals will be as rare as… well, as Bitcoin based purchases are today.”

Bitcoin banking takes the “free banking” concept and makes enormous improvements.

The free banking era in the US lasted from the 1830s to the early 1860s. Minimal regulations and the absence of a central bank characterized it.

Banks were permitted to issue their own currency, known as banknotes, that circulated as money. These banknotes were supposed to be redeemable on demand for the gold or silver reserves they represented.

The value of these banknotes fluctuated based on the perceived solvency of the issuing bank and the distance from the bank itself, as people were less willing to accept notes from distant or unknown banks.

Similarly, Bitcoin banks hold BTC as a reserve asset and issue digital eCash notes redeemable for Bitcoin (either onchain or on the Lightning Network) anytime on demand. These eCash notes are like digital versions of the gold-backed banknotes during the free banking era, but with several significant improvements.

The best way to think of Bitcoin banking is as a massive upgrade to the existing custodial banking models.

Below are a few benefits.

-

Private transactions

-

Fungibility between different eCash notes

-

Low barrier to entry

-

Minimizing trust

-

Low switching costs

-

Convenient and easy to use

-

Redeemable at any time

-

Backup and recovery of funds

First, we have to understand the basic structure of how a Bitcoin bank could work.

Bitcoin banks are likely to take the form of a federation.

This model reduces trust by distributing control over a group of people or entities. This federated group issues, verifies, transfers, and administers the digital eCash notes—but only if there is consensus among the federation members to take these actions.

The main idea of a federation is that you are reducing the amount of trust needed to run a system by distributing control.

The federation holds its Bitcoin reserves in a multisig wallet, a special type of wallet that requires multiple people’s authorization to spend the funds. Think of it as a safe that requires multiple keys to open.

There will likely be a wide variety of Bitcoin banking federations. Some will be small and focused on local communities, while others will be large and geared towards providing commercial-scale operations.

Naturally, there are risks with any system that depends on trust or third parties.

Bitcoin banks have risks, too, but the main point is that they significantly reduce these risks compared to centralized systems. Specifically, you have to trust that the members of the federation will not form a majority quorum to steal the Bitcoin held in the multisig wallet that backs customer deposits or debase their eCash notes. I’ll discuss these and other risks later.

Here’s how it works.

Someone who wants to obtain eCash notes will first download the software to interact with the federated Bitcoin bank. Then, you will send Bitcoin (onchain or Lightning) to the federated Bitcoin bank and receive eCash notes in return.

With a federated Bitcoin bank, you can also sell something and receive eCash notes in your wallet. You could also earn eCash notes from your employer as they deposit your salary into your wallet, just like they do with your traditional bank account today.

Bitcoin banking federations are meant to be interoperable with the Lightning Network—an open, peer-to-peer network built on Bitcoin that allows for nearly instantaneous transactions and almost zero fees. You can use eCash notes anywhere that Lightning is accepted.

With Bitcoin banking federations, you can withdraw to another federation or your own Bitcoin wallet (onchain or Lightning) anytime on demand.

Unlike self-custody wallets, Bitcoin banking federations can help users recover their funds if they lose access to their wallets.

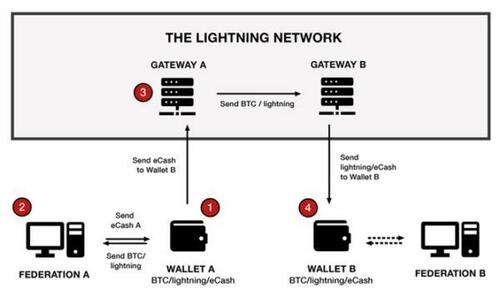

Suppose you want to spend your eCash with a merchant with a different Bitcoin banking federation. This is where the Lightning Gateways come in. They are market makers who provide liquidity between Bitcoin (onchain and Lightning) and various eCash notes issued by different banking federations for a small fee.

When you send an eCash payment to a merchant at a different banking federation, you will send the eCash to a Lightning Gateway, which will then send the correct eCash to the merchant. Or suppose the Lightning Gateway doesn’t have liquidity in the merchant’s eCash notes. In that case, it will find another Lightning Gateway that does, send that Lightning Gateway a Lightning payment, and then the second Lightning Gateway will forward the payment to the merchant in its eCash note.

In short, Lightning Gateways will provide liquidity that increases the fungibility between numerous eCash notes issued by different Bitcoin banking federations.

It’s like seamlessly sending a payment from PayPal to a user on Cash App, Venmo, or another platform.

If this seems complicated, don’t worry. This just explains how a Bitcoin banking application on your phone would work under the hood. It does all of this in the background without your input. For the user, it will be a seamless experience of simply scanning a QR code and authorizing a payment on a phone application.

Most internet users do not know how TCP/IP or SSL works, but they use it daily in the background as they browse the web. I expect a similar dynamic with Bitcoin, the Lightning Network, federated Bitcoin banks, and various Bitcoin-backed eCash notes.

The graphic below does an excellent job illustrating how transactions with different eCash notes from different federated Bitcoin banks would work. It’s from Eric Yakes, author of The 7th Property: Bitcoin and the Monetary Revolution, which I consider the best resource for understanding the mind-bending potential of Bitcoin banking.

Source: Eric Yakes

Bitcoin Banking and Privacy

Financial privacy is one of the biggest benefits federated Bitcoin banks will offer over traditional custodians.

Chaumian eCash is what will enable it.

The name is a nod to cryptographer and Cypherpunk David Chaum, who created a way to provide secure and anonymous online transactions, much like using cash in the physical world.

With Chaumian eCash, users can spend money online without revealing their identity or transaction details to anyone, including the recipient or the federated Bitcoin banks and Lightning Gateways involved in the transaction.

One of the key features of Chaumian eCash is its use of blind signatures, a cryptographic technique that allows a federated Bitcoin bank to sign and validate eCash notes without actually seeing the transaction details.

In other words, a federated Bitcoin bank knows a valid eCash note has been issued and spent, but it doesn’t know who spent it or on what. Further, they will not be able to know individual account balances nor the identity of those who redeem an eCash note for Bitcoin.

Those running a federated Bitcoin bank will only be able to know the total amount of BTC held in reserves in the federation’s multisig wallet and the total amount of eCash notes outstanding for redemption.

This is a revolutionary improvement in financial privacy over existing custodial solutions, which offer no privacy whatsoever.

The strong privacy protections that Chaumian eCash offers enable another critical benefit: censorship resistance.

With PayPal, Venmo, traditional bank accounts, and other traditional custodial financial services, they can block a payment or cancel your account whenever they want under any pretext they find convenient.

With federated Bitcoin banks, they are unable to censor or block transactions. Thanks to the strong privacy protections from Chaumian eCash, they can’t know the details of each transaction, so they can’t block or prevent them.

In short, with federated Bitcoin banks and Chaumian eCash, we have, for the first time, a convenient custodial solution that is resistant to censorship.

Fedimint

Perhaps the most promising implementation of federated Bitcoin banks is Fedimint.

Fedimint is an open-source protocol that allows anyone to create a federated Bitcoin bank with a few clicks.

Using Fedimint to set up a federated Bitcoin bank costs nothing. No licenses or permission is needed.

In short, Fedimint could do to the banking cartels what Uber did to the taxi cartels.

Rug Pull Risk

Like all Layer 2 solutions, federated Bitcoin banks are a trade-off. They are less secure than self-custody but offer more convenience, ease of use, and privacy, among other benefits.

Specifically, you have to trust that the members of the federation will not collude to form a majority quorum to steal the Bitcoin held in the multisig wallet that backs customer deposits.

The size of that quorum will vary between different federations. The larger the quorum, the more distributed the risk.

It could be as small as a 2-of-3 setup, meaning there are three authorized users, and two are needed to spend the Bitcoin reserves in the federation’s multisig wallet, or as large as a 99-of-100 and anything in between.

Rug pull risk will naturally vary between different banking federations.

Local Bitcoin banking federations could mitigate this risk because known community members would operate them. They would likely suffer serious legal, reputational, and physical consequences for stealing their neighbors’ money.

With larger commercial Bitcoin banking federations, depositors could mitigate this risk with private insurance, rating agencies, and other market solutions.

In any case, ongoing due diligence of federated Bitcoin banks will be important. Depositors will have to do this or find someone to do it.

Centralization Risk

Trusted third parties are centralized vulnerabilities. Governments can capture and coerce them.

This is precisely how governments used the gold standard to bootstrap the fiat currency system into existence.

First, people used physical gold as money. Then, to scale, they necessarily turned to third parties, like banks, that stored gold and issued gold IOUs to facilitate trade. Governments captured those third parties and then gradually removed the gold backing from the IOUs until they were nothing more than confetti. In short, that is how the fiat currency system was born.

Could something similar occur with Bitcoin?

Bitcoin has a great chance of avoiding this fate because of its extreme portability and decentralization.

In the past, government agents could simply show up at a bank and demand they hand over their physical gold reserves to a centralized depository.

Let’s presume government agents would even be able to identify someone running a federated Bitcoin bank.

What could they do?

If the federated Bitcoin bank had been set up with sufficient geographical and political diversification, there’s not much they could have done. They could, at most, detain the one person in their jurisdiction running the federated Bitcoin bank.

Let’s say there was a quorum of 7-of-10, and the other nine federation members were located in different political jurisdictions. The Bitcoin reserves would be safe because the one person the government agents detained could not reach a quorum to spend them. The other nine federation members could then take further defensive measures to ensure the safety of the federation’s BTC.

In short, it would be exponentially more challenging for governments to capture, coerce, and centralize federated Bitcoin banks than it was for them to do the same with banks under the gold standard.

Hal Finney noted that there will likely be a market for the various eCash notes, and their values will fluctuate depending on how the market evaluates their risk. I expect eCash notes with more exposure to riskier jurisdictions to trade a discount to their Bitcoin reserves to reflect this risk.

Remember, with the open-source Fedimint protocol, anyone can easily form a federated Bitcoin bank. This low barrier to entry also helps mitigate the centralization risk.

With the traditional banking system—and banking under the gold standard—the government needs to control a relatively small number of banks and entities. With federated Bitcoin banks, anyone could potentially operate one—permission from a centralized banking cartel is not required.

Here’s the bottom line.

If governments attempted to capture, centralize, and coerce federated Bitcoin banks, I believe it would be a fruitless game of whack-a-mole.

Debasement Risk

There is also a risk that the people running a federated Bitcoin bank could secretly collude to debase their eCash notes.

Consider the example of the bankrupt exchange FTX, which created many more claims to Bitcoin than the actual BTC held in reserve. FTX account holders who thought they owned Bitcoin and did not withdraw were left holding the bag.

I think several factors will mitigate this risk with federated Bitcoin banks.

First, the cost of switching to another federated Bitcoin bank or withdrawing is low and can occur anytime. The ease at which a potential bank run could occur should put fear in the hearts of those attempting any debasement scheme.

I expect other market-based incentives, such as memberships in exclusive clubs for Bitcoin banks with the best reputations and other reputation systems, will help minimize the debasement risk.

The low barrier to entry to creating a federated Bitcoin bank and low switching costs means there will likely be cut-throat competition. If the market suspects a Bitcoin bank is debasing its eCash notes, it will be an excellent opportunity for a competitor to grab market share.

Likewise, speculators could play an important role. They will be there to short the eCash notes of Bitcoin banks suspected of engaging in debasement.

Conclusion

Bitcoin is a revolutionary innovation for the base monetary layer and provides a foundation for a new financial system.

Consider the implications of the trustless Bitcoin base layer in combination with the Lightning Network, federated Bitcoin banks issuing Chaumian eCash, and other trust-minimized Layer 2 solutions for scaling and convenience.

The amount of value they could unlock is astonishing. It could usher in a new era of free banking worldwide.

While the Bitcoin megatrend is no longer in its infancy, it is still early, and you are not too late. Bitcoin has a long way to go before it emerges as the world’s dominant money and displaces the traditional financial system.

I have little doubt The Bitcoin Supremacy will be one of the biggest financial trends of the decade. I believe that patient investors will reap substantial gains.

That’s why I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

Tyler Durden

Wed, 05/15/2024 – 13:25

via ZeroHedge News https://ift.tt/cWuMzAp Tyler Durden