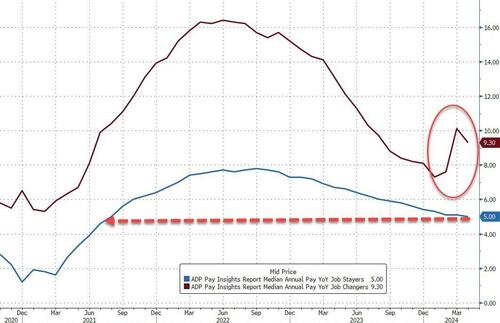

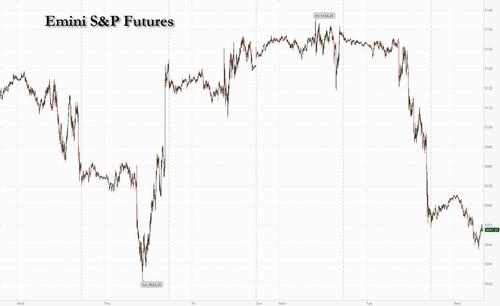

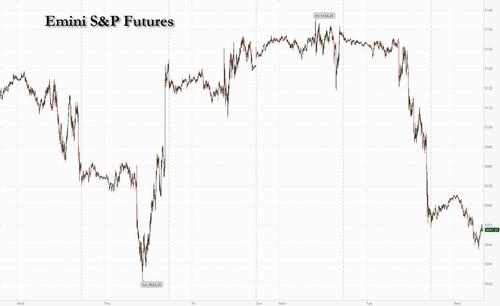

US equities were set for a second day of losses, as investors weighed disappointing tech earnings and braced for today’s Quarterly Refunding Announcement and Fed rate decision and Powell press conference where the Fed chair is expected to signal a delay to rate cuts. S&P 500 futures slid 0.4%, while Nasdaq 100 contracts dropped 0.8% as of 7:40 a.m. in New York, extending losses from Tuesday with markets digesting the surge the employment cost index, a measure of wages and benefits, driven by soaring union and government wages as well as the drop in US consumer confidence to its lowest since level 2022. Europe’s Stoxx 600 gauge edged lower in holiday-thinned trading. The Bloomberg dollar index was little changed, while the two-year Treasury yield held near a six-month high. Gold rebounded from yesterday’s rout but bitcoin did not and instead tumbled deeper below $60,000 driven by European selling. It’s a busy calendar and besides the FOMC, we also get the April ADP employment change (8:15am), April US manufacturing PMI (9:45am), March construction spending and JOLTS job openings and April ISM manufacturing (10am).

In premarket trading, AMD shares slipped after the chipmaker issued a disappointing forecast for artificial intelligence processors as it attempts to make inroads into the lucrative market dominated by Nvidia. Super Micro Computer also dropped despite beating forecasts. Starbucks slumped after quarterly sales fell for the first time since 2020. In contrast, Amazon.com shares rose in premarket trading after the e-commerce and cloud computing company reported first-quarter results that beat expectations. Pinterest jumped after the social media company’s better-than-expected results and outlook prompted analysts to raise their price targets on the stock. Here are the biggest premarket movers:

- Advanced Micro Devices shares slip 6.8% after the chipmaker issued a disappointing forecast for artificial intelligence processors as it attempts to make inroads into the lucrative market dominated by Nvidia.

- Amazon shares are up 2.2% after the e-commerce and cloud computing company reported first-quarter results that beat expectations.

- Cryptocurrency-linked stocks fall as the prospect of higher-for-longer interest rates is weighing on the sector and Bitcoin extends losses for a third consecutive session. Coinbase Global (COIN US) -3.9%, Marathon Digital (MARA US) -4.7%, Riot Platforms (RIOT US) -4.1%, Hut 8 Mining (HUT US) -6.9%, Cleanspark (CLSK US) -4.5%, MicroStrategy (MSTR US) -4.2%, Cipher Mining (CIFR US) -5.9%, Bitdeer Technologies (BTDR US) -2%

- Inari Medical shares rise 12% in premarket trading after the medical device firm reported a firm sales beat and boosted its year sales view.

- Leggett & Platt shares drop 13% after the furniture component maker slashed its dividend after over 50 years of reliable growth.

- Lemonade shares gain 8.1% after the company, which offers renters and homeowners insurance, raised its revenue forecast for the full year.

- Nio ADRs rise 2.1% after the Chinese EV maker reported a 32% jump in vehicle deliveries in April compared with the previous month.

- Pinterest shares gain 17% after the social media company’s better-than-expected results and outlook prompted analysts to raise their price targets on the stock.

- Polestar ADRs fall 7.9% after the electric vehicle maker postponed its fourth-quarter and full-year earnings report and identified accounting errors made in previous years.

- Root shares 28% after the car insurance company reported first-quarter total revenue that beat the average analyst estimate.

- Sirius XM shares rise 1.7% after Goldman Sachs lifts its rating on the satellite radio company to neutral from sell, citing a period of underperformance by the stock.

- Skyworks Solutions shares slump 14% after the semiconductor device company issued weaker-than-expected forecasts for revenue and profit in the current quarter, spurring analysts to cut their ratings and price targets on the stock.

- Starbucks shares slide 12% as a fall in the coffee chain’s second-quarter comparable sales bucked consensus estimates for a 1.5% increase. William Blair downgraded their recommendation on the stock.

- Super Micro Computer shares fall 9.9% after estimate-topping forecasts for adjusted EPS and net sales in the fourth quarter weren’t enough to impress investors. JPMorgan flags concern over capital needs.

- TransMedics shares gain 14% after sales beat expectations thanks to greater usage of organ transportation technologies, and the company boosted its 2024 revenue guidance.

Here are the biggest large cap (>$20BN) movers this morning:

- Pinterest (PINS US) +18.1%

- Amazon (AMZN US) +2.4%

- 3M Co (MMM US) +1.4%

- GE Healthcare (GEHC US) +1.2%

- Datadog (DDOG US) +1.2%

- Tesla (TSLA US) -2.5%

- Coinbase (COIN US) -3.0%

- AMD (AMD US) -6.2%

- Super Micro Computer (SMCI US) -9.2%

- Starbucks (SBUX US) -12.2%

“The main catalyst for the selloff yesterday came from the Employment Cost Index for the first quarter, which is an important one since the Fed view it as a high-quality indicator,” said Deutsche Bank AG strategist Jim Reid. “Moreover, it adds to the collection of readings which suggest that inflation is remaining stubbornly above target, and if anything might even be re-accelerating.”

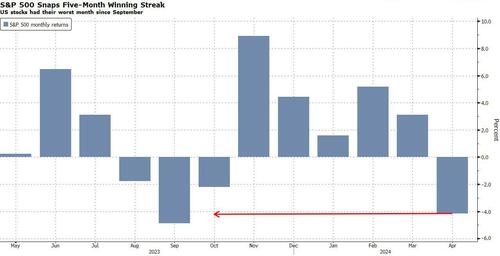

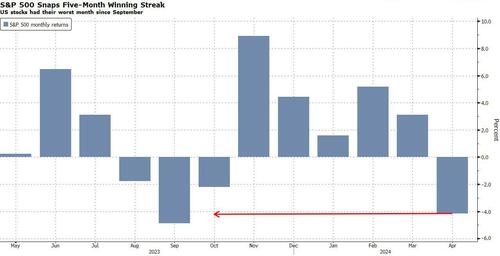

US stocks had their first negative month since October, as volatility rose amid a more hawkish tone from Fed officials, pushing back against the timing for rate cuts. Bond markets are currently expecting just one rate cut by the end of the year, compared with almost seven in January.

Traders are bracing for big market moves and bonds are turning more bearish ahead of what many expect will be a hawkish tilt from Powell. After positioning at the start of the year for multiple reductions in 2024, investors are now pricing in just one full quarter-point cut.

With all eyes on the Fed today and Powell’s presser, a hawkish pivot is all but priced in and any dovish signalling could send stocks soaring (more in our preview here). The last time Powell spoke, he pointed to the lack of progress in bringing inflation down. The most recent signals on prices and the economy. along with expectations for a robust employment report on Friday, mean the chances of a a change in tune are low. Some are even pricing in higher odds of a rate hike than a rate cut in the immediate future, but not Goldman: this is what the bank wrote in its FOMC preview:

We continue to think that rate hikes are quite unlikely because there are no signs of genuine reheating at the moment, and the funds rate is already quite elevated. It would probably take either a serious global supply shock or very inflationary policy shocks for rate hikes to become realistic again. And even then, the FOMC might prefer to hold the funds rate steady at a high level unless the shocks seemed likely to spark a broader and more persistent inflation problem

Still, WSJ’s Timiraos wrote on X that “It’s another wait-and-see meeting for the Fed, but this time, the questions are likely to be tilted in the direction of filling out the Fed’s reaction function for upside risks on inflation and wages rather than downside risks or benign inflation.”

Others expect nothing major to be unveiled today: “We are unlikely to hear anything dovish from the Fed today,” said Lilian Chovin, head of asset allocation at Coutts. “The higher-for-longer narrative is not easy for markets to navigate.”

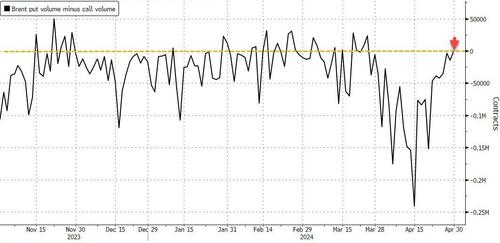

Still, the market isn’t taking any chances, and the options market is flagging a bigger move in the S&P 500 Index than at any point in the past 11 months. Meanwhile, data for the week leading up to April 23 showed hedge funds building short positions in bond futures. Commodity trading advisors, or CTAs, are now sitting at near “max short duration,” according to Bank of America strategists.

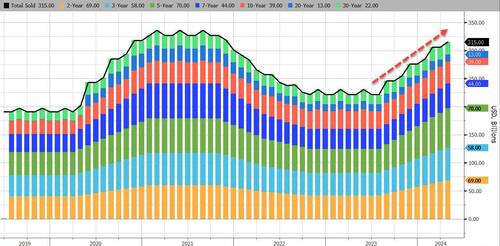

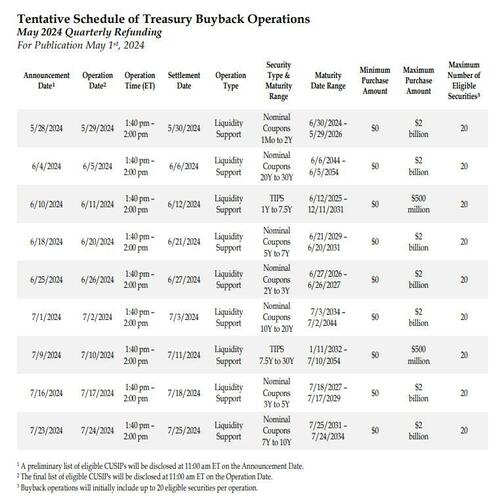

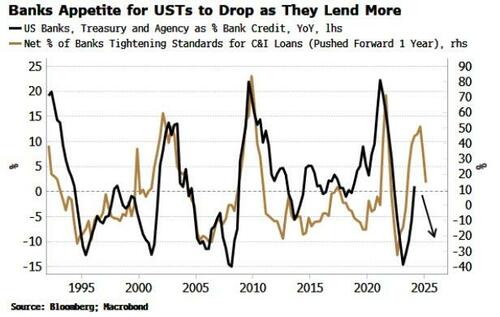

Ahead of the Fed meeting, traders face a slew of US economic releases including job openings and manufacturing data. They will also be on the watch for the Treasury’s quarterly plan of long-term debt sales, which are expected to remain steady, and the exact date for a Treasury program to buy back existing debt.

Elsewhere, global investors are unwinding bets on local-currency bonds in emerging markets as some central banks come under pressure to raise interest rates. A Bloomberg gauge of the asset class fell 1.3% in April, the the biggest monthly decline since September.

Most markets are closed in Europe and in Asia for the May day holiday. UK stocks held steady, with health care, banks and miners on the rise. The FTSE 100 rises 0.1%.

In FX, the Bloomberg Dollar Spot Index is little changed amid thin volumes, with some markets closed due to a public holiday

Spot volumes run at 60%-70% of recent averages in the euro and the pound, a Europe-based trader says; DTCC data show options flows at 75% of average Options traders have added topside bets in the dollar versus its major peers; one-month risk reversals in BBDXY at 48 basis points, versus 34 basis points on April 24. USDJPY was hovering just below 158 as the market faded much of Japan’s intervention gains.

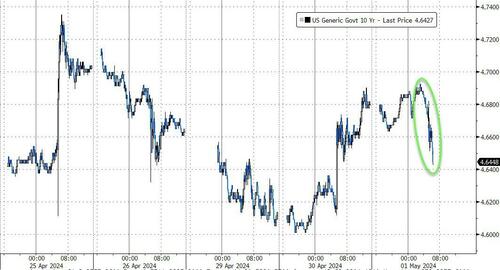

In rates, treasuries edged lower ahead of the Fed decision later on Wednesday. Treasuries were narrowly mixed with yields less than 1bp from Tuesday’s closing levels. Most US yields slightly higher on the day with 10-year around 4.68%; gilts lag by 3bp in the sector. European rates see wider losses, with gilts lagging after 10-year bond sale. Data-heavy US session includes April ADP employment change and manufacturing gauges and March JOLTS job openings before attention turns to Fed policy announcement.

The Fed rate decision expected at 2pm New York time, Chair Powell’s news conference thirty minutes later. Bond market positioning appears to lean short ahead of the meeting, anticipating a hawkish pivot

In commodities, oil prices decline, with WTI falling 1.8% to trade near $80.50. Bitcoin drops 4% to around $57,000.

Bitcoin (-4.3%) sank briefly below $57k after hefty selling pressure; currently holds just above the aforementioned level.

Looking at the day ahead, at 8:30am Treasury quarterly refunding announcement of next week’s auction sizes and projections for the May-to-July period is expected to deliver on January guidance of no further increases to nominals. US economic data slate includes April ADP employment change (8:15am), April final S&P Global US manufacturing PMI (9:45am), March construction spending and JOLTS job openings and April ISM manufacturing (10am). Finally, today’s earnings releases include Mastercard, Pfizer, and Qualcomm.

Market Snapshot

- S&P 500 futures down 0.3% to 5,053.75

- STOXX Europe 600 little changed at 504.61

- MXAP down 0.5% to 173.42

- MXAPJ down 0.3% to 537.53

- Nikkei down 0.3% to 38,274.05

- Topix down 0.5% to 2,729.40

- Hang Seng Index little changed at 17,763.03

- Shanghai Composite down 0.3% to 3,104.82

- Sensex down 0.3% to 74,482.78

- Australia S&P/ASX 200 down 1.2% to 7,569.95

- Kospi up 0.2% to 2,692.06

- German 10Y yield little changed at 2.58%

- Euro little changed at $1.0669

- Brent Futures down 1.1% to $85.42/bbl

- Gold spot up 0.0% to $2,286.31

- US Dollar Index little changed at 106.32

Earnings

- Amazon (AMZN) Q1 EPS 0.98 (exp. 0.83), Q1 revenue USD 143.31bln (exp. 142.5bln); North America net sales USD 86.34bln (exp. 85.55bln), International net sales USD 31.94bln (exp. 32.47bln); Q1 AWS net sales ex-FX +17% (exp. +14.5%); Q1 operating margin 10.7% (exp. 7.63%); Q1 North American retail operating margin 5.8% (exp. 5%). Sees Q2 net sales between USD 144-149bln (exp. 150.13bln), sees Q2 operating income of USD 12bln (exp. 12.7bln). Shares +2.4% pre-market

- Starbucks (SBUX) Q2 adj. EPS 0.68 (exp. 0.79), Q2 revenue USD 8.56bln (exp. 9.13bln); Q2 comp. sales -4% (exp. +1.46%), North America comps -3% (exp. +2.05%), US comps -3% (exp. +2.31%), International comps -6% (exp. +1.36%), China comps -11% (exp. -1.62%) Shares -12.1% pre-market

- Super Micro (SMCI) Q3 adj. EPS of 6.65 (exp. 5.78), Q3 revenue of USD 3.85bln (exp. 3.95bln); Q3 gross margin 15.6% (exp. 15.34%) Shares -9% pre-market

- Advanced Micro Devices (AMD) Q1 adj. EPS 0.62 (exp. 0.61), Q1 revenue USD 5.47bln (exp. 5.46bln). Sees Q2 revenue between USD 5.4-6bln (exp. 5.72bln), sees Q2 adj. gross margin of about 53% (exp. 53%), and sees AI chips sales of about USD 4bln (prev. saw USD 3.5bln). Shares -6.3% pre-market

- GSK (GSK LN) Q1 (GBP): Revenue 7.363bln (exp. 7.067bln). EPS 0.431 (exp. 0.360). Adj. Operating Profit 2.443bln (exp 2.096bln). Sees FY adj. EPS +8-10% (prev. +6-9%) and sees Adj. FY operating profit +9-11% (prev. +7-10%). Shares +1.6% in European trade

Top Overnight News

- Beijing is preparing for a second Trump term and bracing for the turmoil that would bring in US-China relations (China thinks a second Trump term would be a net negative for it). WSJ

- Starbucks missed a very low bar, with a significant miss on EPS (68c vs. the Street 80c) and sales (comps -4% vs. the Street +1.5%). Comps were weighed down by soft transactions (-6%, a huge swing from +3% in the prior quarter) and a China pressure (comps in China slumped 11%). Op. margins contracted 150bp to 12.8%, a large miss vs. the consensus. RTRS

- Aston Martin shares lower after the company reported a shortfall on Q1 revenue (-10% to GBP267.7MM vs. the Street GBP290MM) and EBITDA (-34% to GBP19.9MM vs. the Street GBP29.4MM). RTRS

- AMD reported Q1 inline and the Q2 guide was largely consistent w/expectations, but the new AI accelerator chip sales guidance of ~$4B for ’24 didn’t get increased by as much as hoped. RTRS

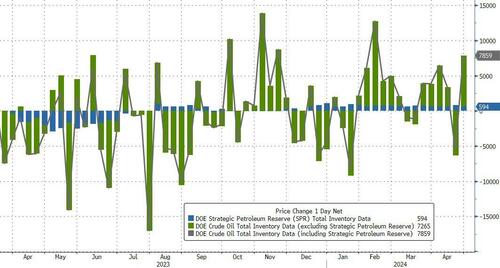

- US crude stockpiles increased 4.9 million barrels last week, the API is said to have reported. That would be the fifth expansion in six weeks if confirmed by the EIA today. Supplies at Cushing jumped, while those of gasoline and distillate dipped. BBG

- Amazon gained premarket after its AWS unit posted strong sales growth, making up for the company’s lower-than-expected current-quarter sales forecast. Its livestreaming site Twitch launched a short-form video platform that may rival TikTok. BBG

- We continue to think that rate hikes are quite unlikely because there are no signs of genuine reheating at the moment, and the funds rate is already quite elevated. It would probably take either a serious global supply shock or very inflationary policy shocks for rate hikes to become realistic again. And even then, the FOMC might prefer to hold the funds rate steady at a high level unless the shocks seemed likely to spark a broader and more persistent inflation problem. GIR

- New York City police stormed Columbia University’s campus on Tuesday night, arresting dozens of pro-Palestinian protesters in an attempt to quash unrest that has spread to campuses across the nation and inflamed US divisions over the war in Gaza. FT

- Pfizer is developing an online platform for patients to order medicine including anti-Covid drug Paxlovid and a migraine nasal spray, according to people familiar with the matter, in the latest push by drugmakers to cut out industry middlemen and sell straight to consumers. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took their cues from the losses on Wall St amid a hawkish impulse owing to the firmer-than-expected Employment Cost data heading into today’s FOMC and with trade mired by mass holiday closures. ASX 200 was pressured as gold miners led the declines after the precious metal slid beneath the USD 2,300/oz level, with underperformance also seen in rate-sensitive sectors. Nikkei 225 slipped at the open but held on to 38,000 status and briefly clawed back all of its losses with the downside cushioned by a weaker currency and as participants digested another batch of earnings releases, while it was also reported that Japan could provide tax breaks for companies repatriating foreign profits into the JPY.

Top Asian News

- NDRC said China will promote the development and growth of leading companies in the NEV industry, as well as accelerate the exit of lagging enterprises and capacities. Furthermore, China will lift foreign investment access restrictions in the manufacturing industry and it welcomes global automotive companies to deeply integrate into China’s market and industrial chain system.

- Japan may introduce measures to provide tax breaks for companies repatriating foreign profits into the JPY and include it in the government’s annual mid-year policy blueprint, according to Sankei.

- RBNZ Financial Stability Report stated New Zealand’s financial system remains strong and rising nominal incomes are helping many households navigate the transition onto higher interest rates, while it added some are doing it tough and reducing their spending or extending their repayment timelines. RBNZ also stated that although non-performing loans to businesses have increased, they remain low by historical standards and there remains a risk that new or persistent inflation pressures could mean global interest rates remain restrictive for longer.

- RBNZ Deputy Governor Hawkesby said New Zealand’s employment data is confirmation of the trend they were expecting to see and higher interest rates will involve a cooling of the labour market.

- Japan’s Government is considering laws and regulations for AI development and obligatory reporting to large-scale business, via Nikkei

European bourses are closed for Labour Day, with the exception of the UK’s FTSE 100 and Denmark’s Nasdaq Copenhagen. The FTSE 100 (+0.1%) is incrementally firmer, though has come under slight selling pressure in recent trade. GSK (+1.9%) gains post-earnings after beating on top/bottom lines, and raising guidance. US Equity Futures (ES -0.3%, NQ -0.6%, RTY -0.3%) are entirely in the red, with clear underperformance in the NQ, hampered by chip-led weakness. Amazon (+2.3%) firmer pre-market on its results, whilst dire Starbucks (-12.1%) earnings have led to pre-market pressure.

Top European News

- UK House Prices Fall Again After Mortgage Rates Creep Higher

- Bitcoin Hits Two-Month Low After Worst Stretch Since FTX Crash

- It’s the Weather, Stupid!: The London Rush

- GSK Expects Higher Profits Boosted By Vaccines, Asthma Drugs

- Ireland’s Listed Companies Now Have Zero Female CEOs

- Aston Martin Slumps; First Quarter a ‘Big Miss,’ Jefferies Says

- UAE Snubs London’s Lord Mayor as Row Over Sudan Role Deepens

FX

- USD is steady vs. peers after yesterday’s buying momentum followed through into the early stages of today’s trading with the index topping out just shy of the YTD peak at 106.51. A slew of US data and the FOMC thereafter will decide direction.

- EUR is flat vs. the USD with European markets closed for Labour Day. EUR/USD did drift as low as 1.0650 before staging a marginal pick up.

- JPY is trivially softer vs. the USD (compared to recent moves) with the pair briefly eclipsing the 158 mark. Focus is on today’s busy US data/FOMC docket and whether a hawkish outturn could see a revisit to 160.

- Antipodeans are both relatively steady vs. the USD after yesterday’s pronounced selling. AUD/USD marginally extended on yesterday’s low with the session trough at 0.6466 before picking up a touch.

Fixed Income

- USTs are flat ahead of a packed US session, holding at 107-14 which is 10 ticks above the contract low from last week. Alongside this, Quarterly refunding is due after Monday’s estimates were above exp., though coupon sizes seen unch. Q/Q with the extra need to be filled by bills.

- Gilts are softer as the benchmark catches up to the continued late-doors downside in benchmarks on Tuesday. Catalysts light thus far given the mass-European market closure for Labour Day. Gilt auction was incrementally softer than the prior but still solid overall with a few fleeting downticks to a 95.44 base.

Commodities

- A downbeat session for the crude complex thus far amid the broader risk aversion in APAC hours coupled with the surprise large build in crude stockpiles and the “positive” atmosphere in efforts to reach an Israel-Hamas ceasefire. Brent July slipped from a USD 85.88/bbl high to a trough at USD 85.22/bbl.

- A flat session for spot gold but mixed for the overall complex with spot silver posting mild gains and spot palladium in the red. Price action in the yellow metal has been minimal thus far amid the aforementioned mass closures and upcoming risk events state-side; Spot gold is currently confined to a USD 2,281-2,293.oz.

- Base metals are lower across the board amid the negative APAC sone coupled with low demand amid mass market closures. On that note, Chinese markets will remain closed for the rest of the week.

- US Energy Inventory Data (bbls): Crude +4.9mln (exp. -1.1mln), Gasoline -1.5mln (exp. -1.1mln), Distillate -2.2mln (exp. -0.2mln), Cushing +1.5mln.

- US and Philippines reportedly eye a partnership to cut China’s nickel dominance, according to Bloomberg.

Geopolitics

- Walla’s Elster citing a senior Egyptian source who told local media that efforts to reach a truce agreement continue in a “positive atmosphere”

- Hamas official says the group still studying recent ceasefire offer

- Philippines Coast Guard official said China’s Coast Guard has elevated the tension and level of aggression, while the official added the Chinese Coast Guard’s use of a water cannon is still not an armed attack but is using higher water pressure, according to Reuters.

US Event Calendar

- 07:00: April MBA Mortgage Applications -2.3%, prior -2.7%

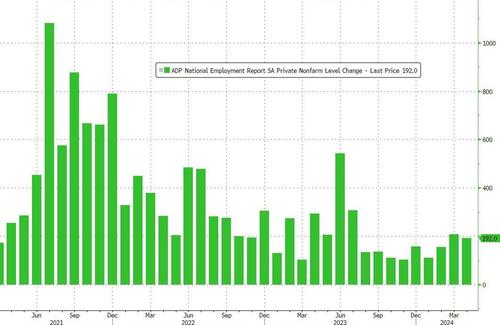

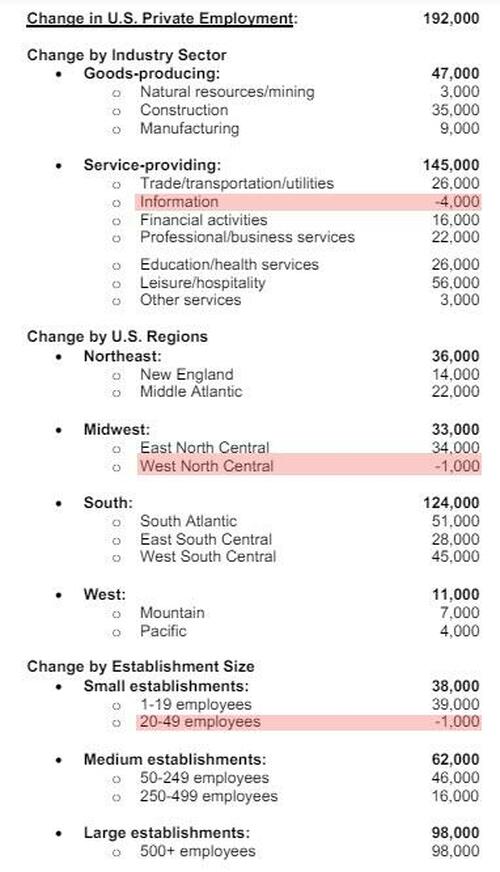

- 08:15: April ADP Employment Change, est. 180,000, prior 184,000

- 09:45: April S&P Global US Manufacturing PM, est. 49.9, prior 49.9

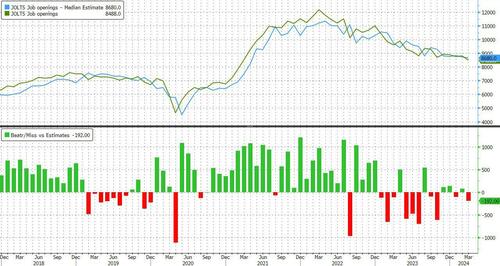

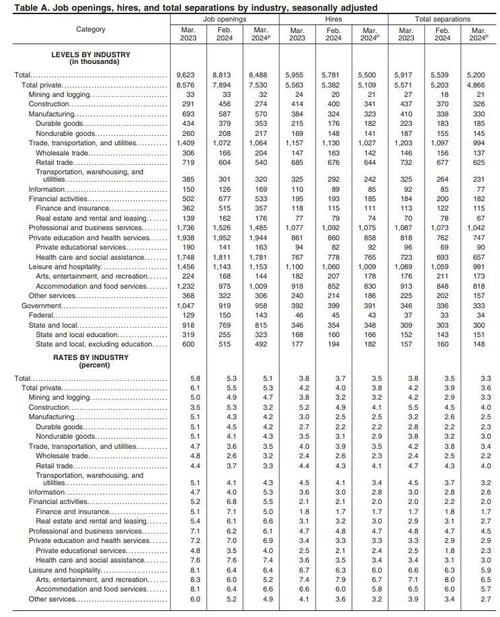

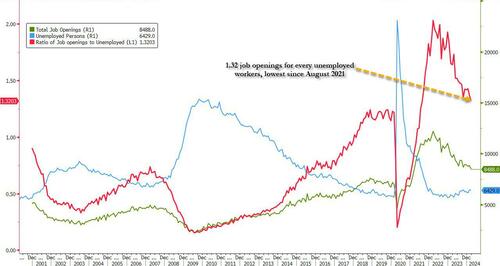

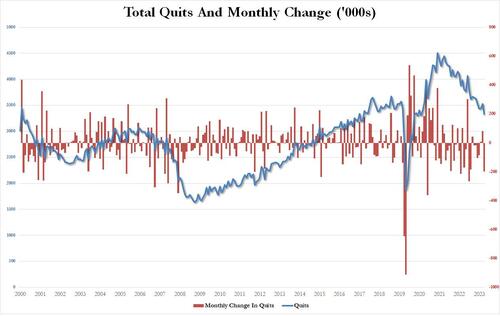

- 10:00: March JOLTs Job Openings, est. 8.69m, prior 8.76m

- 10:00: March Construction Spending MoM, est. 0.3%, prior -0.3%

- 10:00: April ISM Manufacturing, est. 50.0, prior 50.3

- 14:00: May FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

Since it’s the start of the month, Henry will shortly be releasing our usual performance review for the month just gone. Overall, April marked a change in tone from the positivity of Q1, as investors’ concern grew about sticky US inflation and geopolitical tensions in the Middle East. Although that helped haven assets like gold and the US Dollar, it also meant the S&P 500 fell back (-4.16%) after 5 consecutive monthly gains, whilst 10yr Treasury yields (up +48bps) saw their biggest increase since September 2022. See the full report in your inboxes shortly. May will start with a holiday today across much of Europe and some of Asia but it won’t be quiet later on with the latest FOMC set to be fascinating in terms of what Powell says about inflation and rates. A full preview follows below.

Those April themes we discussed above were very evident on the last day of the month yesterday, as US data pointed to stubborn inflation and weak consumer confidence, which meant bonds and equities both lost substantial ground. That’s certainly a big part of our “what keeps us awake at night” pack. The main catalyst for the selloff yesterday came from the Employment Cost Index for Q1, which is an important one since the Fed view it as a high-quality indicator. That rose by +1.2% in Q1 (vs. +1.0% expected), which is the strongest reading in a year. Moreover, it adds to the collection of readings which suggest that inflation is remaining stubbornly above target, and if anything might even be re-accelerating. 90 minutes later, any remaining positive sentiment took a further hit after the Conference Board’s consumer confidence indicator fell back to 97.0 in April (vs. 104.0 expected). Maybe falling equities, rising yields, and higher oil earlier in the month played a part. That was its lowest reading since July 2022, back when there were heightened fears of a recession after the Fed had begun hiking by 75bps and global energy prices were surging. Elsewhere the Chicago PMI saw a very surprising slump to 37.9 vs. 45.0 expected, only one tenth off being the worst print since the early months of the pandemic and lower than anything seen between the GFC and the pandemic. This was once a bellwether but has lost a lot of its lead indicator sheen in recent months.

Given we’ve got the Fed’s latest decision tonight and Chair Powell’s press conference, we should soon find out how they’re thinking about all this data. But in the meantime, the ECI data led investors to price out the chance of cuts this year, and they now see just 28bps of cuts by the December meeting, which is the fewest so far. If that profile is realised, it would also mean that the Fed funds rate stays above 5% for the entirety of 2024, so depending how you define “higher for longer”, this is clearly moving in that direction. In turn, that led to a fresh selloff for US Treasuries, and the 2yr yield (+5.8bps) closed at 5.04%, marking the first time since November that it’s closed above 5%. The 10yr yield was also up +6.6bps to 4.68%, although it remains beneath its peak levels from last week. They are a basis point lower in Asia this morning.

In terms of the Fed’s decision, it’s widely expected that they’ll leave rates unchanged today. But given the recent inflation data, our US economists think there’ll be a more hawkish-leaning message, echoing Chair Powell’s view that it will take longer to gain confidence about disinflation. One thing to look out for will be if we hear anything about a potential slowing of QT, although our economists believe this is likely to wait until June, as the FOMC will want to avoid a dovish misinterpretation that could ease financial conditions inadvertently. In the press conference, they think Chair Powell will emphasise that there’s no urgency to reduce rates given the resilient economy. See their full preview here for more details. One possible saving grace for bond investors going into the Fed is that yields have tended to decline around Fed meetings, an empirical observation that our US team took a deep dive into in a report here on Monday. We also have the latest QRA today with our preview here. Our US rates strategists see the main focus as likely to be on details of the Treasury’s new buyback program.

With investors pricing in higher rates for longer, equities had a challenging month end on both sides of the Atlantic. The S&P 500 fell -1.57% yesterday, its worst decline since January, with an already bad day made worse by a -0.5% slump in the final 10 minutes of month-end trading. That means that the index was down by -4.16% over April as a whole, ending a run of 5 consecutive monthly gains. And as it happens, it was actually the index’s second-worst monthly performance since December 2022, around the time the S&P had seen a peak-to-trough decline of -25%. Only September 2023 has been worst since. In terms of yesterday’s moves, the Magnificent 7 (-2.55%) helped to drive the declines, with Tesla (-5.55%) falling back after its surge on Monday. But equities also struggled more broadly, with the small-cap Russell 2000 (-2.09%), the NASDAQ (-2.04%) and the Dow Jones (-1.49%) all posting large declines. Meanwhile in Europe, the STOXX 600 (-0.68%) fell back more modestly, though Spain’s IBEX 35 (-2.22%) had its worst daily performance in over a year.

After the US close, we had results from Amazon. These beat Q1 revenue and earnings estimates thanks to stronger cloud computing growth, but the positive read through was limited by softer-than-expected sales guidance for Q2. Amazon shares were up slightly over +1% in after-hours trading after falling -3.29% yesterday. The negative sentiment from the US equity close has continued overnight, with S&P (-0.09%) and NASDAQ (-0.27%) futures trading slightly lower as I type.

Earlier in the day, the European data had actually come in pretty strongly, as Euro Area GDP growth came in at +0.3% in Q1 (vs. +0.1% expected). Moreover, the flash CPI release was in line with expectations at +2.4%, even if core CPI was a touch higher than expected at +2.7% (vs. +2.6% expected). Nevertheless, that was still the lowest core CPI in over two years, and the GDP growth was the strongest since Q3 2022. So it adds to the signals that Euro Area growth is turning higher, and it didn’t provide anything to really shift expectations for an ECB rate cut in June either, with market pricing still pointing to an 87% chance of a move. That said, the combination of solid European data and the reaction to the US ECI release saw the amount of ECB rate cuts priced by December fall -6.5bps to 66bps yesterday, its lowest so far this cycle. With this backdrop, yields on 10yr bunds (+5.1bps), OATs (+4.9bps) and BTPs (+6.1bps) all moved higher.

Asian equity markets are lower this morning in holiday thinned trading. The Nikkei (-0.56%) is seeing further losses after its worst month since December 2022 while the S&P/ASX 200 (-0.97%) is trading notably lower. Otherwise most Asian markets are closed due to the Labor day holiday.

In terms of yesterday’s other data, German unemployment was up by +10k in April (vs. +8k expected), and German GDP was up by +0.2% in Q1 (vs. +0.1% expected). Here in the UK, mortgage approvals were up to an 18-month high in March of 61.3k (vs. 61.5k expected). And in the US, the FHFA house price index for February was up +1.2% (vs. +0.2% expected).

To the day ahead now, and the Federal Reserve decision and Chair Powell’s subsequent press conference will be the main highlight. Otherwise, US data releases include the ISM manufacturing for April, the ADP’s report of private payrolls for April, and the JOLTS report for March. From central banks, we’ll also hear from the ECB’s De Cos. Finally, today’s earnings releases include Mastercard, Pfizer, and Qualcomm.