US Treasury’s Funding Mix Will Be Pivotal For Fed’s Next Moves

Authored by Simon White, Bloomberg macro strategist,

How the Treasury intends to meet its borrowing requirements – the mix between shorter-term bills and longer-term coupons – will strongly influence liquidity and thus the performance of risk assets.

Quantitative tightening is thus on borrowed time, and the Federal Reserve’s next move this year is still likely to be an interest rate cut, despite the re-emergence of inflation.

On Wednesday the Treasury will announce how it intends to borrow $243 billion in Q2 and $847 billion in Q3, the amounts it announced on Monday that it wanted to raise. Q2’s figure was above the previous estimate, while Q3’s number was toward the upper end of expectations. The consensus is leaning toward the increase being made up for by issuing bills rather than coupons.

The distinction is important.

Treasury has increased its issuance of bills over the last 18 months. This enabled money market funds (MMFs) to lend to the government using liquidity parked at the Fed’s reverse repo facility (RRP).

Bills are now over the 20% ratio to total debt outstanding, which the Treasury has generally preferred to keep it under.

Even if the Treasury does not announce it will reduce bill issuance and increase coupon issuance this week, it’s likely it will at some point. Having too high a proportion of short-term, more money-like liabilities interferes with the Fed’s monetary independence (and arguably already is).

But increasing coupons is likely to have a detrimental impact on liquidity. MMFs can’t buy coupons. Instead it’s banks, other financials, households and foreigners. The issue is when any of these entities buy bonds, they have to use reserves.

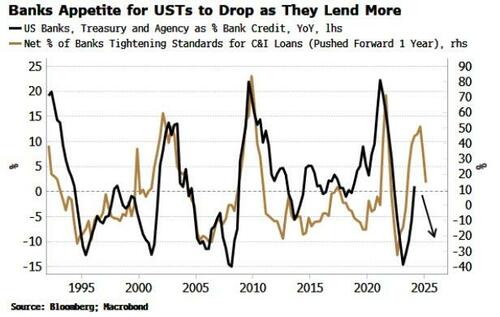

Only banks can in effect create bank deposits to buy Treasuries, mitigating the effect on reserves, and they have on net been divesting themselves of them since the Fed started hiking.

And looking at leading indicators, they are likely to continue to do so as they expand their commercial lending.

Yet, even before we get to the point of more coupon issuance, the advantage from heavy bill issuance is thinning out.

The domestic RRP is down to $500 billion, and it may not even need to get to zero for MMFs to stop tapping it to buy bills (they may wish to keep some ready cash-on-hand for customer withdrawals). At that point, MMFs’ bill buying will start to eat reserves and thus impact liquidity.

Either way, therefore, Treasury’s borrowing is soon likely to make its presence more felt in markets as pressure on reserves grows, increasing the likelihood the Fed loosens policy this year.

Tyler Durden

Wed, 05/01/2024 – 07:20

via ZeroHedge News https://ift.tt/UG3bM4a Tyler Durden