The Pennsylvania County That Just Might Be 2024’s ‘Ground Zero’

Authored by Salena Zito via RealClearPolitics,

ERIE, Pennsylvania — Despite 40,000 people leaving this city since 1970 (10,000 of them between 2000 and 2016) and having the unfortunate distinction of being the home of the poorest zip code in the state – “ride or die” Erie residents, especially young people who have left for better opportunities only to come back to raise their families here, are a real thing.

They are reshaping the way the city moves and shakes as well as its politics, in what is perhaps not just the most important county in Pennsylvania in determining who will be the next president – but arguably the most important county in the country.

It is a city and county in economic flux, situated halfway between New York City and Chicago along one of the Great Lakes. It has two major interstates, a massive port, and access to robust freight and passenger railroad service. Once a powerhouse of heavy industry, Erie is in the process of remaking itself as the center of “Eds and Meds” (universities and world-renowned hospitals), light manufacturing, and tourism.

Yet the collective memory of what they used to do here is a palpable undercurrent – especially among union workers who, for generations, called Erie’s sprawling 340-acre General Electric locomotive plant their second home. The slow erosion of the good-paying jobs that employed 25,000 in the 60s and dwindled to the current 3,000 has taken its toll emotionally as well as politically.

Still, the people here have been in Erie for generations – often living in close proximity to parents and grandparents, aunts and uncles, cousins, and childhood friends who they believe make their lives richer because of that multi-generational influence.

Erie, which will surprise everyone who has never been here, is the home of one of the most beautiful beaches in the country, located along the shores of popular Presque Isle State Park. The city is lined with 13 miles of bike trails and seven miles of sandy beaches and boasts the state’s only seashore.

For blue-collar residents of western Pennsylvania, eastern Ohio, and the panhandle of West Virginia, Erie is their “Jersey Shore,” complete with the same amenities of camping, seashore cabins, an amusement park along the beaches, and of course, dozens of diners.

The voters here are important. Very important, as Sen. John Fetterman told me in an interview. Every statewide election in Pennsylvania comes down to what Erie voters decide to do.

Once a solid county for Democrats in statewide gubernatorial elections as well as federal elections for president, U.S. Senate, and Congress, Erie shocked the world when the county went from supporting President Obama by a whopping 16 percentage points in 2012 to supporting Donald Trump in 2016 by 40,000 votes.

Four years later, Biden would win the county by roughly the same amount; in between, Democrats Josh Shapiro and John Fetterman would also win the county for governor and U.S. Senate, and a Republican won the county executive’s race for the first time in decades.

In short – win Erie, you win the state. The question is, going into the presidential election, who is winning the hearts and minds of Erie’s swing voters? Because where they go and what is on their minds heading into the election will tell us not just how Pennsylvania is doing, but also how states like Michigan, Wisconsin, Nevada, and Arizona might go, states that are a little less Democratic than the Keystone State.

At Gordon’s butcher shop, owner Kyle Bohrer is sitting with several swing voters who have voted for Trump, Biden, and third-party candidates, and who, with the exception of one voter – his own father – are all fatigued with both Biden and Trump.

Bohrer, 43, is a diamond in the rough – and the kind of outside-the-box thinker that cities like Erie need by the thousands. A fourth-generation Erie resident, he has owned one of Unishippers franchises, a logistics company that, as he says, keeps the family’s lights on.

In 2019, he decided to purchase a meat market called Gordon’s Butcher and Market, a 2,000-square-foot iconic local store that had been in business for 50 years, but was in decline. He bought it, he says, purely on sentiment.

Bohrer went all in, and today the business rivals the top-of-the-line meat markets seen across the country. There is also a spectacular restaurant called Firestone, a bar, a six-pack section stacked with craft beer, and an upscale wine store – all located in one high-end building.

A true homer, Bohrer never left Erie despite the city’s decay, instead throwing his energy into creating a cultural touchstone. The father of three loves bringing people together at his restaurant, even those who hold wildly different political viewpoints.

“I think it is important to be able to have discussions like this, and I think perhaps places like New York or D.C. or Los Angeles think we cannot because they cannot, but look at us here, we all come at this from different political views and we can discuss it, laugh at it and move on,” he said.

Bohrer is center-right; his worldview is moderate and pragmatic, but because he owns a business, he declines to voice whom he supports. Scott Carnes, seated to his left – physically and politically – is more than happy to.

The civil engineer, also 43, is married and the father of two young daughters ages 2 and 5; Carnes grew up in Erie, left for western New York for 10 years, then lived in Pittsburgh for 12 years until he and his wife and family moved back here last year.

“My wife got a job at Erie Insurance and I was able to work remote, which gave us the ability to move, so we came back,” explained Carnes. He says he has voted Democrat all of his life, “The most important issue to me is the economy, an issue ironically that puts me more in line with the Republicans,” he said. But the Biden-Trump debate took its toll.

“I am hoping Biden drops out. I think he’s absolutely going to lose if he stays in. He’s clearly too old to be running the country in my opinion,” he said. Yet if Biden stays in, he would still vote for him: “That is how much I despise Trump.”

Jacqueline Williams is a CPA and small business owner, born and raised in Erie. Williams left here to attend college and then moved to Pittsburgh to start her career before returning with her husband Adam, who is sitting beside her, to raise their family.

The striking mother of a teenager and a 7-year-old said she and her husband run a tax strategy business. “We try to help small business owners save as much as possible on their taxes, legally. And so, the way that the future government goes about changing what was enacted is important to me,” she explained.

One of her biggest concerns heading into the election is Biden’s insistence that he will end the Trump tax breaks for family incomes above $400,000. “So that is definitely going to have an impact on small business owners. The tax brackets are shrinking. They were wider before. Right now, we’re in lower marginal tax brackets, so we’re going to be going into higher ones more quickly, with that change,” she told me.

Williams says if the Trump tax breaks end, then bonus depreciation, which she said is already declining, goes away.

“Which is an incentive to invest in your business,” injects Adam, an attorney.

William says we’re working through a time where we want small business owners to create more opportunities, “And when you take away the tax breaks, that’s harder for them to do,” she explains, adding that it can lead to a snowball effect with small businesses either closing, not investing in their businesses, laying workers off, or not hiring at all.

“It becomes an overall negative, not just for our clients but for my entire community,” she said.

Williams, 40, has always been a Republican. She voted for Trump in 2016 and voted third party in 2020, and even though she thinks both Trump and Biden are too old, because of the tax implications, she says she will vote for Trump.

Her husband says he will not.

Like Kyle Bohrer, Adam says he and his wife came home to make a difference. “We wanted to have an impact. My belief was, you would be able to look back on the timeline of Erie, and see what we’ve done, and say, ‘We are in the position that we’re in, partially because of the work that those people did.’”

He added, laughing, “So, yeah, that’s a little meta.”

Adam explains that what he loves best about Erie depends on the day. “The name of our law firm is Rust Belt Business Law. We changed the name a few years ago. And the whole idea is, if I wanted my life to be easy, I would go and start a business law firm in Miami, or Silicon Valley, or New York, or Chicago, or you name it,” he said, naming big cities with people with more money to spend.

“The thought was, there are values that this region holds that aren’t held in other places. And you talked about it with understanding. But I think it’s work ethic … I think it’s culture. And our clients are business owners that reflect the values and culture of where they were raised, and how they were raised and we really buy into those values … We believe that all else being equal, hard work will prevail over waiting for something to happen,” he said.

As for this election, he’s leaning toward one of the independent candidates. “Because I am not inspired,” he said. “I’m voting for what I believe in. So many people treat politics like sports, and they’ve got to be part of the winning team. Well, for me, it’s more about what really matters to me. And I believe I would be out of integrity with myself if I voted for either of the two front runners.”

Joe Bohrer is Kyle’s father. A tool and die maker born and raised in Erie, he’s never left to live elsewhere. Joe started his political awareness as a Democrat and began moving away from the party with each election.

“By the time Reagan came along, I was a full Republican,” he said.

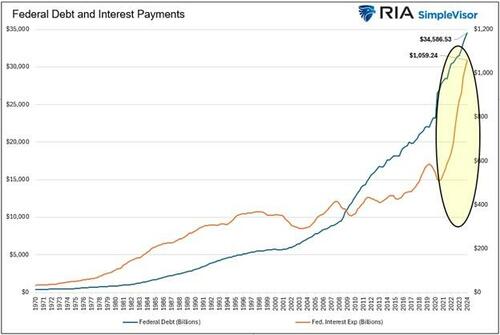

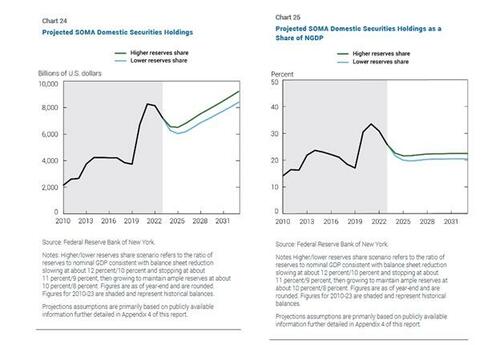

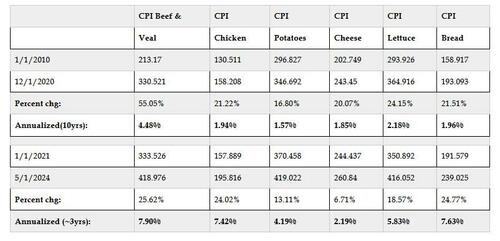

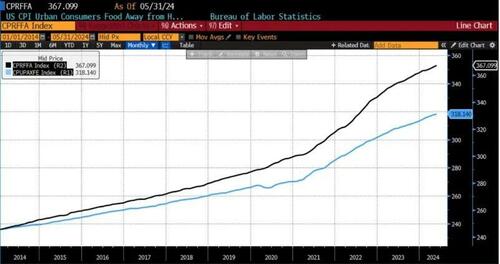

Joe is all-in for Trump. He longs for a time when the dignity of work mattered, not just locally, but in the national conversation about hard work. Inflation is his top concern – he says high prices are hurting him.

“I can kind of blame Republicans and Democrats with their spending. So, the more money you spend that you don’t have, it has to diminish buying power. Because there’s not any more goods, but you have more money to spend on goods that aren’t being produced. Especially coming off of COVID,” he said.

He does not understand why Biden doesn’t embrace talking directly to the middle class about inflation. He doesn’t understand his shouting, either.

“It used to be Democrats, I felt, were anti-establishment,” he said. “Now I feel like it’s the opposite. They are establishment.”

For more than two hours, they all discussed their love of their community and how they could better impact it, all within the framework of having very different political worldviews.

Kyle Bohrer says he understands Erie is going to be ground zero for the election – not just for the state but for the entire country. “That is a lot of pressure for voters. I think the candidate who shows they understand the concerns here will translate to other cities and towns like ours and resonate.”

Until then, Bohrer says, “Buckle your seatbelts, Erie, it’s going to be a bumpy ride.”

Salena Zito is a reporter for the Washington Examiner, Wall Street Journal contributor, and co-author of “The Great Revolt: Inside the Populist Coalition Reshaping American Politics.”

Tyler Durden

Wed, 07/10/2024 – 15:05

via ZeroHedge News https://ift.tt/usW1UFq Tyler Durden