Now that Powell telegraphed a rate cut at the July 30/31 FOMC meeting is virtually certain, the question is whether the Fed will cut once or twice. And while many still believe that the Fed’s “insurance” cut will be just 25bps, or 1 rate cut, as Bloomberg’s Elena Shulyatyeba writes, “we do not see support for a 50-bp cut given limited interest-rate ammunition compared with previous economic cycles”, noting that the current level of the fed funds rate gives policy makers the capacity for 9 rate cuts compared to 20 at the start of the last recession and 25 ahead of the 2001 downturn, others disagree.

Case in point, Morgan Stanley’s Chief Economist Chetan Ahya, who is bucking the trend and writes this morning that “a strong policy response is necessary to guard against risks of a further, sharper loss of economic momentum.” Specifically, the “weak incoming data” – which is an odd statement for an economy which just added so many jobs it surpassed even the most optimistic forecast – “lingering trade tensions, and preventing both financial conditions from tightening and a non-linear adverse impact on growth are key reasons for a front-loaded adjustment.”

Echoing what Powell lamented in his prepared remarks, MS writes that “corporate confidence and the capex cycle have remained weak”, even if that means that the stock buyback cycle has never been stronger. Furthermore, “uncertainty over trade tensions – the key overhang on the macro outlook – lingers. Against this backdrop and in the context of preventing the downside risks and attendant non-linear impact from materializing” Morgan Stanley argues that a strong policy response is necessary to arrest the recent sharp decline in economic momentum.

A response in the form of 50bps of rate cuts in just three weeks.

To justify its uber dovish outlook, Morgan Stanley lays out the following four arguments why a strong policy response is needed:

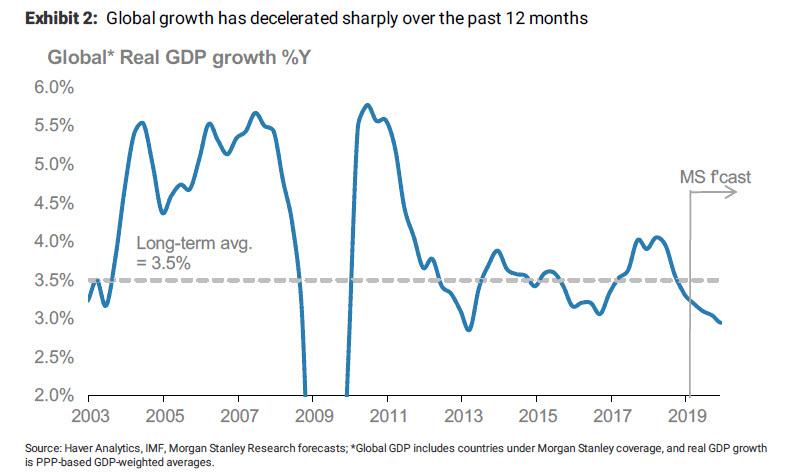

1. The global economy has lost significant momentum in the past 9 months

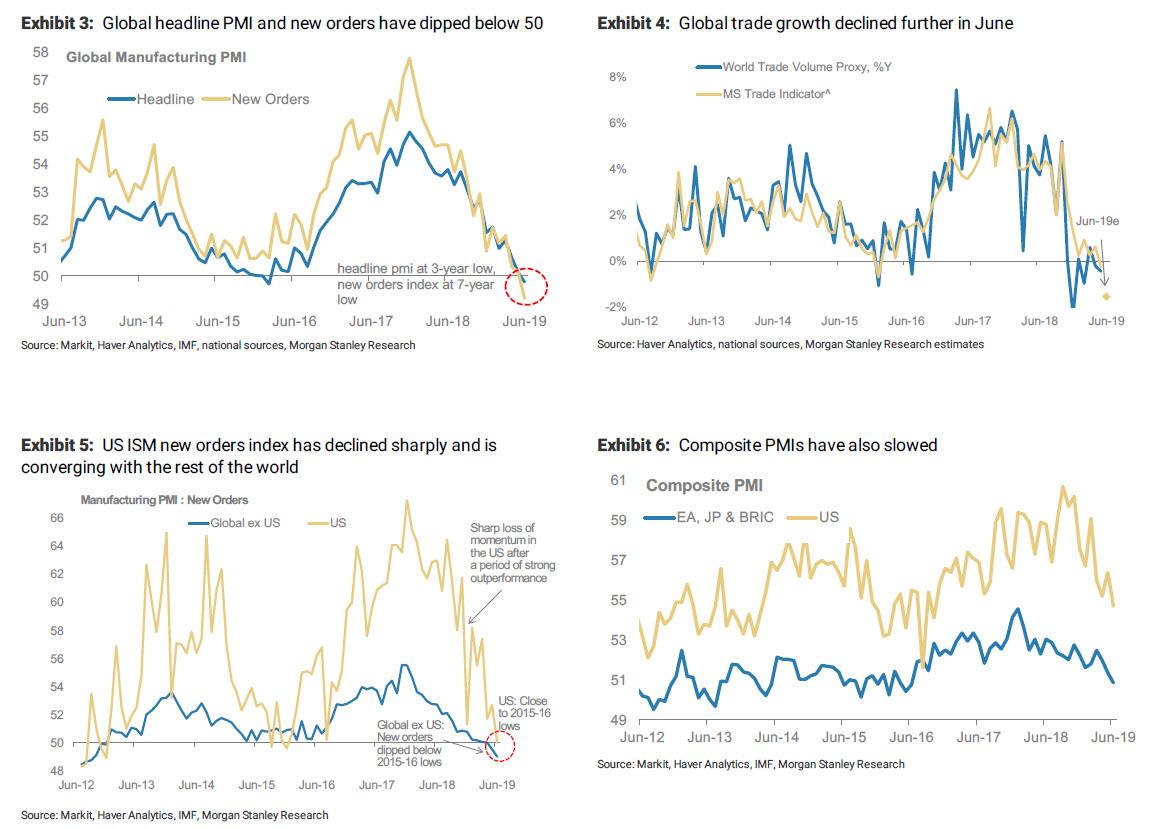

Global GDP growth has slipped quickly from a peak of 4.0%Y in 2Q18 to 3.1%Y in 2Q19. High-frequency indicators, for instance PMIs and trade, are currently close to or below the previous cycle (2015-16) lows. Of particular concern is the dip of the global new orders sub-index (the more forward-looking component) within the manufacturing PMIs to well below 2015-16 lows, suggesting that the outlook for aggregate demand remains anemic.

The slowdown is also broad-based across regions. While the rest of the world began to slow from the middle of 2018, the US economy appeared to have weathered the headwinds as the tailwinds from fiscal stimulus were still supporting growth then. However, as the global slowdown has deepened and the impact from fiscal stimulus is fading, growth momentum in the US is also beginning to slow. As a case in point, the US manufacturing ISM index has weakened sharply over the last eight months and is now converging rapidly in line with global aggregates after a period of outperformance. We expect US growth to slow further, to 1.6% in 2H19 on a sequential quarterly average rate from a pace of 2.8% in 2H18.

2. Lingering trade tensions remain an overhang on corporate confidence

One of the key factors behind the current global slowdown is trade tensions – their impact on corporate confidence and the capex cycle. Corporate sentiment has already weakened significantly and the capex cycle has ground to a halt. While the G20 meeting did not result in an immediate escalation in trade tensions, it did not provide a clear path toward a comprehensive deal either. This “uncertain pause” therefore does not remove the uncertainty created by trade tensions and it remains an overhang on corporate confidence and the macro outlook. As a result, the corporate sector is unlikely to get back to investing unless and until we see a complete resolution on US-China trade policy and that no other major trade disputes are being pursued (for instance with the EU or Mexico).

3. Inflation expectations are slipping again

Actual incoming inflation data, market-based measures of inflation expectations, and the bank’s outlook for inflation all suggest there is room for further policy accommodation. In the US, core PCE is currently at 1.6%Y, below the Fed’s 2% symmetric inflation goal. Market-based measures of inflation expectations have also softened, to close to a 3-year low. With wage growth softening again and overall growth set to slow to a pace below potential, MS is not expecting inflation pressures to build up in a significant way that would constrain easing today. Similarly, in the case of Europe, growth is set to remain sub-par, and headline inflation has been well-below the ECB’s target and has softened more recently. Additional stimulus by the ECB is thus warranted.

4. Protecting against the risk of a non-linear tightening in financial conditions

The economic backdrop is not encouraging and the risks to the outlook remain skewed to the downside. A sharper slowdown in growth will bring corporate credit risks to the fore, particularly in the US as leverage has picked up significantly in the corporate sector, especially among the riskier borrowers. If downside risks were to materialize, it could result in a non-linear tightening of financial conditions. We believe a strong policy response is therefore warranted to keep financial conditions easy and provide support to the cycle. As a reminder, in the last quarter of 2018, growth had slipped but the policy stance had not shifted pre-emptively. This created a situation where financial conditions tightened in a non-linear fashion.

Hence, in the context of managing the risks to the outlook, we think there is a case to be made that policymakers should proceed with a strong policy response. As Chair Powell said at the June FOMC press conference, “an ounce of prevention is worth a pound of cure”. In today’s context, this means it would be better to act more quickly and more aggressively up front, to prevent a sharper and prolonged weakening of the economy

Translation, the Fed must do everything to prevent the market from dropping in a “non-linear’ fashion.

In conclusion, Morgan Stanley expects “the policy-easing cycle to move into full swing and expect a stronger policy response from central banks than what markets and consensus currently expect.” As a result, the bank expects the Fed to cut rates by 50bps at its July meeting and assigns a higher probability to the ECB restarting QE than consensus.

In response, and following Powell’s prepared remarks, the odds of a 50bps hike jumped from 0 to 12.5%…

… and rising.

via ZeroHedge News https://ift.tt/2Jpic41 Tyler Durden