With 34 Pending Filings, China Sends A Message: No More US IPOs

In the aftermath of the Didi IPO fiasco, the window for Chinese companies hoping to list in the US is shut, perhaps for good.

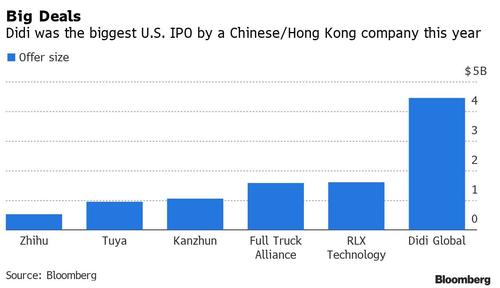

And that’s a problem, because according to Bloomberg, there are as many as 34 pending filings for US listings by firms based in China or Hong Kong announced this year. The IPO euphoria has been running at a record pace this year, with more than $15 billion priced in New York IPOs so far this year, although much of this has been on the back of the SPAC bubble which burst in the first quarter and has yet to recover.

“The Didi situation reinforces the fact that China is annoyed by the flood of U.S. IPOs by Chinese tech companies, and is attempting to slow the reception of these IPOs in the West,” said Hans Albrecht, portfolio manager at Horizons ETFs Management Canada Inc. “While Chinese names look like better value, they will suffer from this overhang for some time.”

In addition to the crackdown on Didi, whose app was pulled from mainland store sending its shares crashing on Tuesday, China is also probing Kanzhun Ltd., the owner of an online recruitment platform, and Full Truck Alliance Co., an Uber-like trucking startup. Both companies listed in the U.S. recently. Their shares also dropped in U.S. premarket trading Tuesday.

“The Chinese government could have stopped the IPOs from happening, like how they did with Ant,” said Sharif Farha, a Dubai-based portfolio manager at Safehouse Global Consumer Fund. “Instead, they allowed global investors to take pain, and consequently have broken trust with a lot of foreign investors. While we did not participate in any of these listings, we would imagine that several funds would consider exiting.”

One company poised to test sentiment soon is Hong Kong’s on-demand logistics and delivery firm Lalamove. It filed confidentially for a U.S. initial public offering last month, according to people with knowledge of the matter, and is seeking to raise at least $1 billion.

The latest crackdown is “very bad news for these Chinese companies’ image abroad,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Group Holdings SA. “It’s a terrible hit to foreign investor appetite.”

Which, incidentally, may be just what Beijing wants: as Bloomberg Ye Xie writes, by punishing Didi Global just days after its mega listing, Beijing is sending an unequivocal message to leading Chinese tech companies: Seeking initial public offerings in the U.S. is not something to be encouraged. The ride-hailing firm lost about $19 billion in market value after regulators barred new users from Didi’s app, citing security risks. The shares sank below the IPO price, three days after the company debuted as the largest Chinese listing in U.S. history after Alibaba’s IPO in 2014.

According to Xie, Beijing’s aggressive intervention shows Beijing is increasingly worried about two things.

- First, private tech companies’ sprawling data collection is a threat to national security.

- Secondly, by listing in the U.S., these companies subject themselves to America’s regulatory requirements, leaving their huge trove of national and personal data reachable to foreign hands.

The crackdown happens at a time when the U.S.-China relationship has deteriorated to the worst in decades. The U.S. has increased scrutiny over listed Chinese companies, delisted companies including China Telecom and China Mobile, and put a number of firms on its blacklist. It also occurred as China is working hard to develop its home-grown technology and build Shanghai, Shenzhen and Hong Kong as its answer to Nasdaq. Dozens of U.S.-listed companies, from Alibaba, JD.com to Baidu, have turned to Hong Kong for secondary listings.

As Xie adds, Didi’s IPO looks particularly ill-timed. Bloomberg reported that Chinese regulators asked Didi as early as three months ago to delay its U.S. IPO because of national security concerns involving its collection of data. Didi defied the warning and raised $4.4 billion in the U.S. listing on June 30, one day before the Communist Party’s 100th birthday.

In a way, Didi’s decision to rush the IPO is similar to the tactics adopted by Ant Finance. The Alibaba fintech affiliate was fast-tracking its overseas listing in November, just as the authorities were tightening regulations on the industry. The difference is that Beijing called off Ant’s IPO at the last minute, helping potential investors avoid losses. Didi’s investors aren’t so lucky.

Beijing chose to crack down on Didi after Chinese firms raised $7.9 billion in U.S. IPOs in June, the most since Alibaba’s debut 2014. It is now telling China Inc. to forget about New York for a listing. Think about Shanghai, Shenzhen and Hong Kong instead.

Tyler Durden

Tue, 07/06/2021 – 14:40

via ZeroHedge News https://ift.tt/3xlC52F Tyler Durden