April Payrolls Unexpectedly Plunge, Biggest Miss Since 2021 As Unemployment Rate Rises

Ahead of today’s payrolls report, in our preview we said that while we knew we would get a slowdown, the question was how big it would be (and before that we also asked if Yellen had leaked the weaker number to Japan ahead of their multiple interventions this week to prevent them from wasting tens of billions in intervention dry capital for nothing).

So the question is: did Yellen leak to the BOJ what the next NFP and CPI prints will be? https://t.co/ugDVXhDvOq

— zerohedge (@zerohedge) May 1, 2024

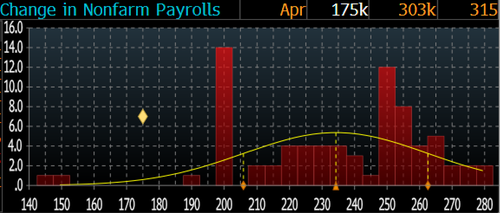

We got the answer moments ago when the BLS reported that in April the US added just 175K jobs, a nearly 50% drop from the upward revised 315K (was 303K), the lowest print since October 2023…

… and two-sigma miss to estimates of 240K.

In fact, as shown below, this was the biggest miss since Dec 2021

As usual, prior data was net revised lower, with the change in total nonfarm payroll employment for February revised down by 34,000, from +270,000 to +236,000, and the change for March was revised up by 12,000, from +303,000 to +315,000. With these revisions, employment in February and March combined is 22,000 lower than previously reported.

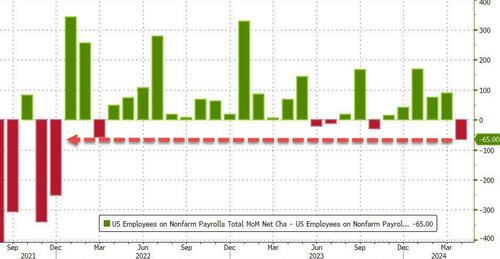

It wasn’t just the Establishment survey: the Household survey showed that in April, the US added just 25K jobs, a huge drop from the 498K in March…

… which means that the already record divergence between the number of people employed and those who have jobs expanded by another 150K.

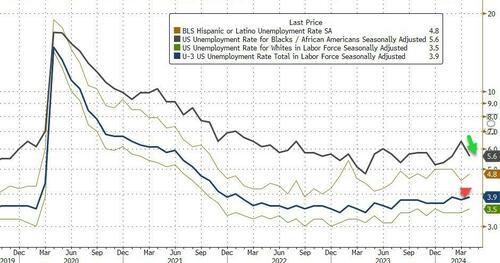

The weakness was pervasive, and while payrolls were a huge miss, the unemployment rate also rose more than expected, from 3.8% to 3.9%, – the highest since January 2022 – versus estimates of an unchanged print.

The unemployment rate for Blacks (5.6 percent) decreased, offsetting an increase in the prior month. The jobless rates for adult women (3.5 percent), teenagers (11.7 percent), Whites (3.5 percent), Asians (2.8 percent), and Hispanics (4.8 percent) showed little change over the month

Despite the increase in unemployment, the participation rate was unchanged at 62.7%

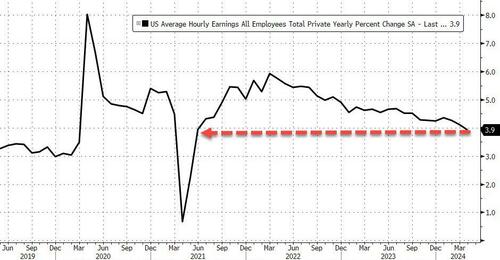

Wages also eased back with average hourly earnings rising 0.2% MoM, below the expected 0.3% increase and down from last month’s 0.3% print. On an annual basis, earnings rose 3.9%, down from 4.1% last month and below the 4.0% estimate.

Developing

Tyler Durden

Fri, 05/03/2024 – 08:46

via ZeroHedge News https://ift.tt/45akKyb Tyler Durden