Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Oil-rich nations are bedeviled by the Resource Curse.

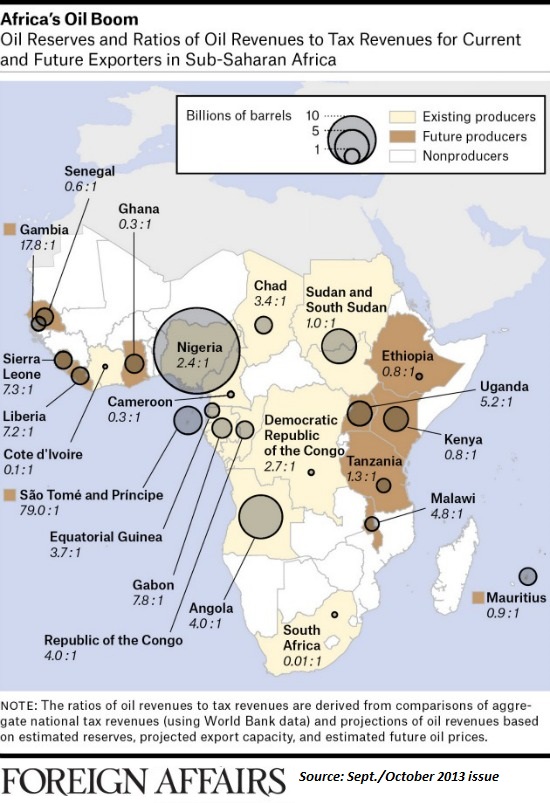

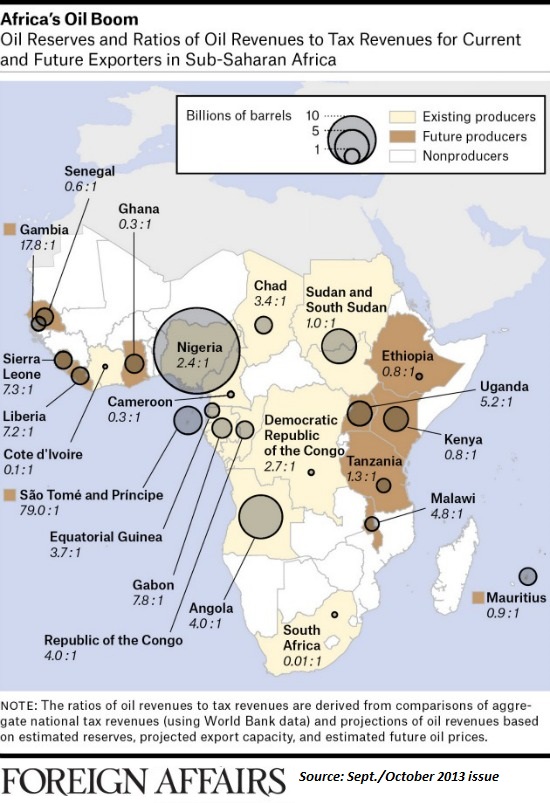

The global scramble for Africa's estimated 25 billion barrels of oil is on. Those scrambling to secure (and/or exploit) the continent's abundance of fossil fuels include each oil-rich nation's political and economic Elites, international oil corporations, regional powers, trading blocs and the four major (and energy-hungry) economic players: the E.U., the U.S., Japan and China.

Oil-rich nations are bedeviled by the Resource Curse. An abundance of natural resource wealth distorts the national economy and politics in a number of ways: private investment in other less exploitable/profitable sectors of the economy stagnates, leaving the government and economy highly dependent on resource revenues; local Elites quickly gain control of the income stream from the resource wealth and divert it to their own accounts and cronies, institutionalizing corruption, and this diversion of national income to Elites starves the nation of investment in infrastructure, education, transportation networks and all the other foundations of a vibrant, competitive economy.

In geopolitical terms, oil-rich nations become "areas of interest" to neighboring states and energy-hungry global powers, further complicating and distorting national development.

Though many hope that this flood of energy wealth can be used to fund much-needed infrastructure, education and public health projects throughout the continent, the key systems of governance, governmental transparency, an open media and a political process that enables public participation are problematic in many (if not all) of Africa's energy-rich nations.

Unfortunately, these systemic weaknesses render these nations even more vulnerable to the distortions of the Resource Curse.

No energy-importing power center can afford to be sidelined in the scramble for Africa's fossil fuel wealth. Sadly, that insures global and regional powers will continue jockeying for oil leases (vulnerable to cancellation when corrupt regimes change hands), development contracts and political influence within controlling Elites, a process that rewards the least savory aspects of corrupt regimes.

Global rivals who have lost out will be tempted to support armed rebellions that weaken their rival's influence, encouraging conflicts that are inherently destabilizing, not just to the oil-rich nations but to the region.

Arrayed against these powerful forces of corruption and destabilization are grassroots groups supporting democracy and national development and some non-governmental organizations (NGOs) funded by foundations.

In the abstract, almost everyone agrees that this energy wealth should benefit all residents of oil-rich nations. But as long as it is cheaper in terms of time and money to secure oil by making deals with kleptocrats and corrupt Elites, there will be few incentives for major powers to risk losing access to oil/natural gas by supporting policies that would spread the wealth and encourage democracy.

Sadly, few consumers of energy care where the energy they burn comes from, or what distortions were created by the extraction and processing of that energy.

As the Cliff Robertson character said at the end of the prescient 1975 film, Three Days of the Condor: "When the people are cold and their engines stop running, they're not going to ask us why; they'll just want us to go get it." It's difficult to refute that, whether the people are American, Chinese or European.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/FTUM7Jz1vaA/story01.htm Tyler Durden