States Work To Make Gold And Silver Alternative Currencies To US Dollar

Authored by Kevin Stocklin via The Epoch Times (emphasis ours),

Those who seethe as their dollars lose value to inflation may be pleased to know that many states are now working to pass laws that would allow gold and silver to be used—not only for savings and investment but as everyday currency for purchases and payments as well.

The state of Utah took a major step last week toward the use of gold and silver as transactional currencies, allowing their use for state payments to vendors. A bill, sponsored by state Rep. Ken Ivory, passed the Utah state legislature on March 18 and is now awaiting the signature of Gov. Spencer Cox.

If signed, this bill would make Utah the first state in America to pass a “transactional gold” bill.

“This is about making sure that people have choices,” Ivory told The Epoch Times. “It’s important that we give people a choice in how they store and transact their earnings and their savings.”

For Utah residents, the bill also addressed issues of local autonomy and preservation of savings, he said.

“We express our liberty and our work and our property in something called money, but where the dollar used to be money, now it’s just currency,” he said. “I think people want to see their earnings and property be reflected in real money again.”

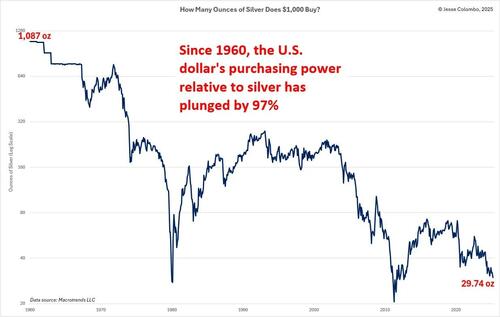

Money functions as a medium of exchange, a unit of account, and a store of value. But the dollar has struggled to hold its value since it was delinked from gold.

“One of the key elements of precious metals is the ability to hopefully retain purchasing power of your money, and so if the dollar is being eroded by inflation, precious metals have typically been able to preserve purchasing power better than the fiat currency,” Utah state treasurer Marlo Oaks told The Epoch Times.

A Growing Movement to Use Gold as Money

State lawmakers believe they are on firm legal footing in establishing an alternative legal tender. While the U.S. Constitution gives the federal government the exclusive right to “coin money,” it also permits states to make “gold and silver coin a tender in payment of debts.”

“That’s one of the key elements of why this is even possible … because it’s called out in the Constitution,” Oaks said.

Utah is far from alone in this effort. Many other states are also working to accept gold as currency.

According to Kevin Freeman, author of “Pirate Money” and a longstanding advocate for using gold as legal tender, the movement by states to legislate transactional gold has gained significant traction over the past several years.

“Now, 25 states have looked at this, and we’re getting even some traditionally blue states that are demonstrating interest,” Freeman told The Epoch Times. “We’ve picked up bipartisan support, and so my optimism is quite high.”

In February, legislators in Mississippi introduced a bill, HB 1064, to make gold and silver legal tender in the state. If the bill passes, it would allow citizens to use gold or silver coins to settle debts and for private transactions.

In December 2024, Missouri introduced the “Constitutional Money Act,” which among other things would recognize gold and silver as legal tender.

Other states working to introduce or pass similar legislation include Alabama, Alaska, Arizona, Arkansas, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Louisiana, Montana, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Texas, Utah, West Virginia and Wyoming, according to an organization called Constitutional Currency, which is affiliated with Freeman’s work.

History on Their Side

Historically, gold functioned as money throughout the United States until the federal government intervened to force the transition to what ultimately became a “fiat” currency. The word “fiat” in Latin means “let it be done” in respect of decrees; regarding currencies it has come to mean that they are worth what the issuing government says they are worth, to the extent that people have confidence in the government that issues it.

According to a 2024 Federal Reserve report by Maria Hasenstab, until the 1930s, American banks had to keep gold reserves in their vaults equal to a designated percentage of the money they issued.

When the Great Depression hit in 1929, “people hoarded gold instead of depositing it in banks, which created an international gold shortage,” Hasenstab writes. “Countries around the world basically ran out of supply and were forced off the gold standard.”

A shortage of money caused prices to decline in the 1930s, causing the crisis to escalate. Farmers, for example, could no longer earn enough for their crops to repay bank loans, leading to defaults and the failure of many local banks.

At the time, the Federal Reserve maintained a tight money supply, restricting credit and causing the U.S. economy to contract further.

One of the first major efforts to transition Americans away from the use of gold as money occurred in 1933, when President Franklin Delano Roosevelt issued an executive order to seize privately-held gold, forcing Americans to hand over their gold coins, bullion, and gold certificates. Those who refused faced up to ten years in prison or a fine of $10,000, or both.

This ended the use of gold for domestic transactions in the United States.

Thereafter, the value of U.S. paper currency was linked to gold and could theoretically be exchanged into gold for international transactions until 1971, when President Richard Nixon ended this convertibility, leaving the dollar as a purely “fiat” currency.

Dollars Not Holding Value

However, Americans have experienced a dramatic erosion in the value of their money under the fiat currency system. Since Nixon took the dollar off the gold standard in 1971, the U.S. dollar suffered a cumulative inflation of 688 percent. An item you could have purchased for $1 in 1971 costs $7.88 today, according to the U.S. Inflation calculator.

By contrast, gold, which was worth about $40 an ounce in 1971, is trading in the range of $3,000 per ounce today.

“In 1971, you could buy a house for $20,000 in Salt Lake, or 563 ounces of gold,” Ivory said. “Today, the average house is pushing $600,000, but with 563 ounces of gold you can buy more than three houses.

“Houses aren’t more expensive; they’re less expensive than ever on a fixed standard,” he said. “But our dollar has become this illusory standard where we’ve got unelected people deciding what the inflation rate is, which means how much of our money they’re going to take every year.”

During the past four years, Americans saw the value of their money fall by more than 20 percent, due to trillions of dollars in government spending that expanded the supply of money at a faster rate than the production of goods and services, driving up prices. And while inflation has come down from a high of more than 9 percent per year in 2022, it continues to hover around 3 percent today.

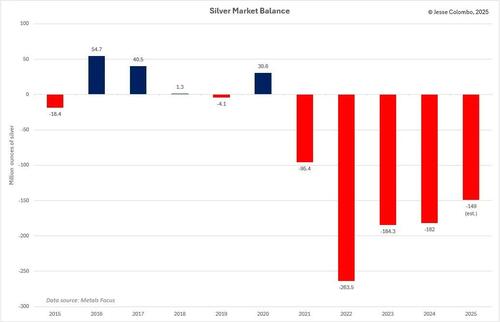

A number of other issues regarding the dollar, including federal debt and spending, could also erode people’s confidence that it can maintain its value as a fiat currency.

“Certainly as part of our working group, there was a lot of discussion around the impact of inflation, the impact of the amount of debt we have, and the erosion, potentially, of the reserve status of the dollar,” Oaks said. “With BRICS and other foreign entities trying to move away from the dollar, you’ve seen central banks accumulate physical gold.”

The working group that produced Utah’s legislation included former Fed Vice Chair Randal Quarles and former Citibank and American Express CFO Gary Crittenden.

Spending Gold with a Debit Card

According to Freeman, one thing that is necessary for gold to become a commonly used transactional currency is a proliferation of companies like Glint, which is based in the United Kingdom.

Glint holds gold deposits and issues debit cards that allow depositors to spend their gold deposits in any amount and in multiple currencies. The company states on its website that it “offers an alternative to fiat currencies enabling our clients to buy, save, and spend allocated gold with the flexibility of Mastercard.”

“It’s really the result of technological advancements that enable fractional gold transactions as easy as using a debit card,” Oaks said. “The value [of gold deposits] is tracked for you, and you can transact in the economy with the card technology that we have.”

While Freeman hopes that gold and silver will one day be widely available as a transactional currency, he expects this will be an alternative to, rather than a replacement for, the U.S. dollar.

“I don’t see it necessarily replacing the American dollar, unless the dollar were to fail,” he said.

“But money has changed a lot,” he said. “Now, we have Tap to Pay and Venmo and Bitcoin and PayPal; this is just another way to pay.”

Tyler Durden

Thu, 03/27/2025 – 11:10

via ZeroHedge News https://ift.tt/ESV1HNi Tyler Durden