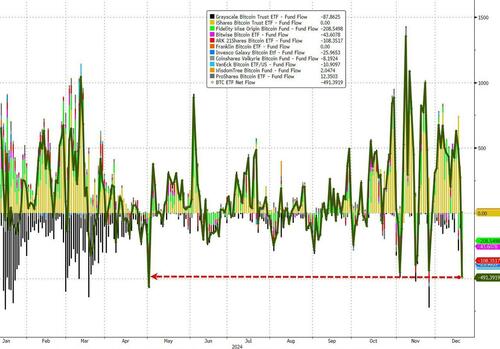

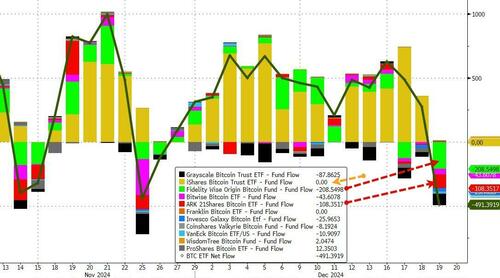

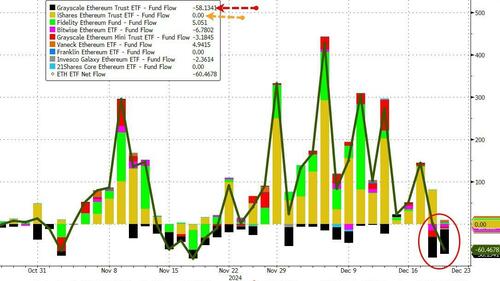

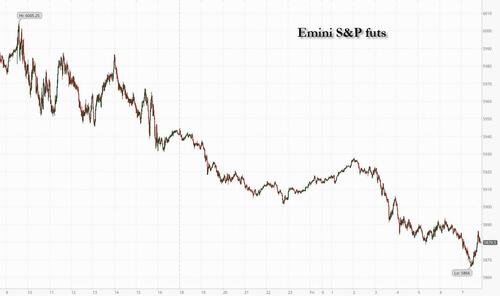

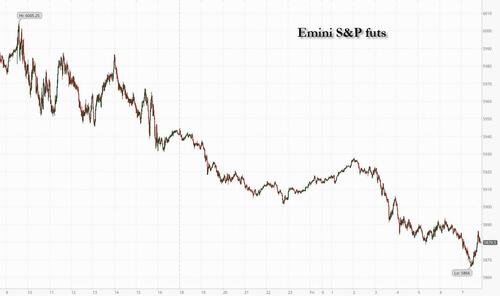

US equity futures and global markets are broadly risk-off to end a turbulent week after the US House rejected a temporary funding plan backed by Donald Trump (38 republicans voted against the bill) which would have avoided a gov’t shutdown that otherwise will start a midnight, with trade war concerns mounting (Trump said “I told the European Union that they must make up their tremendous deficit with the US by the large scale purchase of our oil and gas. Otherwise it is tariffs all the way!!!”). Expect elevated volumes today due to the last option expirty/quarterly rebalance of the year. As of 8:00am ET, S&P futures are down 0.8%, Nasdaq futs tumble 1.4%, with technology stalwarts such as Tesla and Nvidia sliding in early trading as momentum reversed with a bang. Europe’s Stoxx 600 weakened 1.7% as Novo Nordisk A/S fell by the most on record on the back of disappointing data from a treatment trial; the rest of the world not much better: FTSE -95bps, DAX -1.3%, CAC -1.05%, Nikkei-29bps, Hang Seng -16bps, Shanghai -6bps. 10Y treasury yields dipped a little after surging in the past three days, down 2bps to 4.54%, with the Bloomberg US dollar index also easing back a bit as both the yen and euro gain. Bitcoin tumbled amid the riskoff mood, sliding as much as 8% to a low of $92K and dragging down MicroStrategy Inc. and other crypto-related companies in premarket trading. Oil reversed earlier losses with gold also rising on expectations of aggressive Chinese stimulus. Today’s economic calendar will see the November core PCE, personal income and spending as well as the latest UMich data.

In premarket trading, FedEx rose 6% after the company said it plans to spin off its freight division into a separate publicly traded company in a deal that will streamline the parcel giant. Eli Lilly jumped 5% after competitor Novo Nordisk A/S gave data from a highly anticipated trial of its experimental weight loss drug, CagriSema, that fell short of expectations. Nike meanwhile tumbled 7% as management expected revenue in the current quarter to decline in the low double digits, a steeper drop than the 7.7% decline posted last quarter. Here are the other notable premarket movers:

- Clearwater Paper Corp. (CLW) rises 14% as Brazil’s Suzano SA is exploring an offer for the company, according to people with knowledge of the matter.

- Coinbase (COIN) drops 6%, down along with other stocks that have exposure to cryptocurrencies, as interest-rate caution from the Fed this week dampens sentiment on speculative investments. Robinhood (HOOD) -6%, MicroStrategy (MSTR) -6%

- Humacyte (HUMA) jumps 56% after the Food and Drug Administration granted full approval of its bio-engineered human tissue product for adults with arterial injury.

- Occidental Petroleum (OXY) rises 2% after Warren Buffett’s Berkshire Hathaway increased its stake in the energy company.

- US Steel (X) drops 6% after the steel producer warned its fourth-quarter earnings will be lower than anticipated as steel prices remain depressed in the US and as the demand environment in Europe is weak.

The S&P 500 was heading for its biggest weekly drop since at least September, with the index down 3% on the week after the Fed’s political hawkish pivot sparked a global selloff.

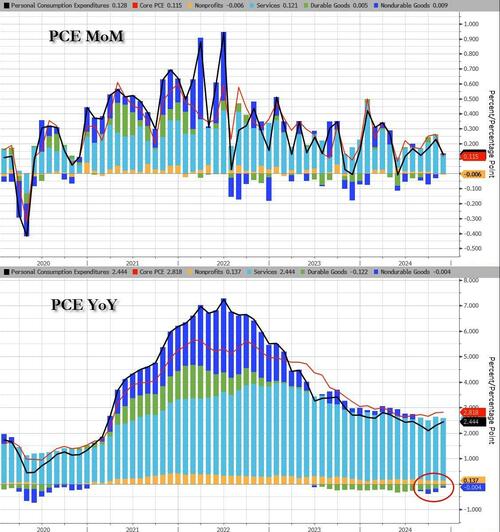

Stock market volatility spiked in recent days as a hawkish pivot by the Federal Reserve made traders question whether this year’s tech-fueled rally could extend further in a higher rates environment, despite a resilient US economy. Friday’s personal consumption expenditures data for November, the Fed’s preferred measure of underlying inflation, will offer further clues on 2025’s rate path. For now, the swaps market is implying between one and two quarter-point reductions for next year, a decrease from a month ago when two cuts were fully priced.

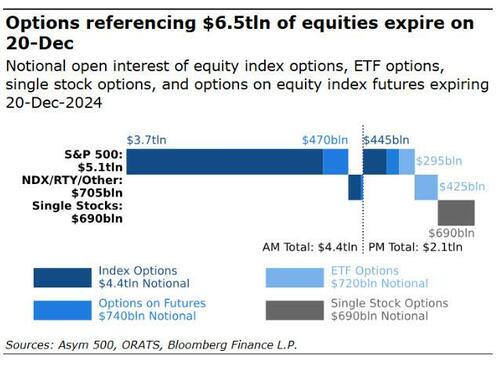

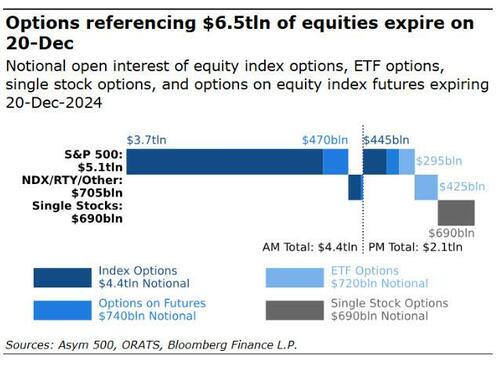

Adding to the nerves is Friday’s US options expiration, which has historically stoked turbulence, and offers a final hurdle to end-of-year calm. The quarterly “triple-witching” will see a whopping $6.5 trillion worth of options tied to individual stocks, indexes and exchange-traded funds fall off the board, this year’s largest. The opex will also collapse the dealer gamma, unclenching the market, and allowing for much wider volatility in the coming (very illiquid) days.

The fact that CTAs are also sellers in all scenarios (according to Goldman) isn’t helping the already downbeat mood.

1 Week:

- Flat Tape = $10.2bn for SALE

- Up 2Stdv = $7bn for SALE

- Down 2.5Stdv = $14.5bn for SALE

1 Month:

- Flat Tape = $24bn for SALE

- Up 2Stdv = $2.5bn for SALE

- Down 2.5Stdv = $60bn for SALE

Concerns are also growing about the implications of the Republican-led House rejecting a temporary funding plan backed by President-elect Donald Trump on Thursday, with a US government shutdown looming in less than 24 hours.

The development can “inevitably increase the market volatility in the short term, especially after Fed’s hawkish pivot two days ago,” Jasmine Duan, a senior investment strategist at RBC Wealth Management Asia, told Bloomberg TV. Investors face risks from “potentially more sticky inflation and also the debt issue in the US,” she said.

“There’s plenty of room for volatility to kick in and a selloff to take place,” said Neil Birrell, chief investment officer at Premier Miton Investors. “There’s going to be less liquidity as well. You’ll see a rapid pace of moves taking place as people adjust their portfolios for the year-end and that could affect all asset classes.”

European stocks also slumped with all sectors dropping; banks, miners and construction are the worst-performing sectors. Euro Stoxx 50 slumps 1.2% as Novo Nordisk A/S fell by the most on record on the back of disappointing data from a treatment trial. FTSE 100 outperforms peers, dropping 0.5%. Here are some of the biggest movers on Friday:

- Fraport gains as much as 8% as JPMorgan upgraded the Frankfurt airport operator to overweight, following its announcement that it has closed a four-year deal with airlines on fees.

- Sobi gains as much as 3.1%, the most in almost a month, after the Swedish biotechnology firm saw its rating upgraded to buy from hold at DNB, with the broker saying the company is “on course for a strong 4Q.”

- Belships rises 27%. Blue Northern, an SPV, will start a recommended voluntary cash tender offer of NOK20.50 per share to acquire all issued and outstanding shares in Belships, according to a statement after market close Thursday.

- RAI Way shares rise as much as 4.1% in Milan trading after the owners of the state-backed TV operator and its local rival Ei Towers SpA signed a memorandum to explore a possible merger.

- Tomra gains as much as 7.3% after Pareto Securities double-upgraded the Norwegian recycling-systems manufacturer, citing improving long-term prospects in Europe.

- Zealand Pharma shares drop as much as 11% after the FDA wrote a letter recommending an additional clinical trial for the Danish drugmaker’s experimental medicine glepaglutide for short bowel syndrome.

- Hornbach shares fall as much as 13% after the German home store operator’s third-quarter results showed the impact of lower sales, especially in Germany, and salary increases.

- Idorsia shares plunge as much as 47%, the most on record, after the Swiss pharmaceuticals producer said it’s considering options to extend its operational cash runway after the signing of a planned global rights deal for aprocitentan won’t be achieved in 2024.

- TeamViewer shares fall as much as 4.6% on Friday to the lowest in over two years, as Goldman Sachs downgraded its recommendation on the stock to neutral from buy, saying the software firm’s recent acquisition of 1E makes its outlook for shareholder returns less attractive.

Asian stocks fell for a sixth day, heading for their longest losing streak in eight months, as traders continued to mull the prospect of a more hawkish Federal Reserve. The MSCI Asia Pacific Index dropped as much as 0.7%, with TSMC and Alibaba Group among the biggest contributors to its decline. Tech-heavy benchmarks in South Korea and Taiwan were among the region’s worst performers, declining more than 1% each. The after-effects of this week’s relatively hawkish Fed meeting continued to weigh on Asian stocks, with the regional benchmark less than 1% away from falling into a technical correction. Traders awaited US inflation data due later Friday for further clues on the central bank’s policy outlook.

In FX, a Bloomberg gauge for the dollar was on course for its best week in a month despite ticking down on Friday. AUD and SEK are the weakest performers in G-10 FX; JPY and CHF outperform. The yen erased losses after Japan’s key inflation gauge strengthened for the first time in three months and Finance Minister Katsunobu Kato warned Japan would take appropriate action if there are excessive moves in the yen. BRL leads gains in EMFX, rising 2.5% with Brazil’s congress inching closer to delivering a diluted spending plan. A key gauge of Asian shares dropped for a sixth day.

In rates, treasuries are richer across the curve with gains on the day led by the front- and belly, keeping 2s10s and 5s30s spread near Thursday’s session highs. Treasury yields richer by 4bp to 1bp across the curve with front-end led gains steepening 2s10s spread by 1.5bp on the day and 5s30s by 3.5bp; 10-year yields trade around 4.54%, richer by 2bp on the day with bunds lagging by 1.5bp in the sector and gilts slightly outperforming. Similar bull-steepening trends seen across core European rates over the early London session while S&P futures, European stocks trade lower in a risk-off backdrop. Treasury auctions resume Dec. 23 with $69b 2-year note sale, followed by $70b 5-year and $44b 7-year note sales Dec. 24 and Dec. 26

In commodities, WTI drifts 1% lower to trade near $68.68. Most base metals are in the green. Spot gold rises roughly $10 to trade near $2,604/oz. Bitcoin falls below $95,000.

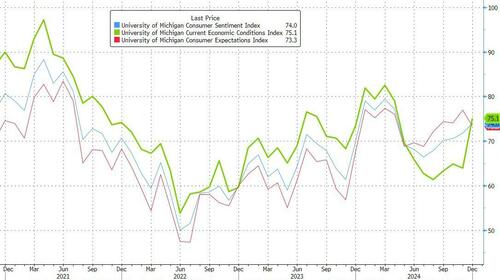

Today’s US economic calendar includes November personal income/spending, PCE price index (8:30am), December University of Michigan sentiment (10am) and Kansas City Fed services index (11am). The Fed speaker schedule includes Daly due to appear on Bloomberg TV (7:30am) and Williams on CNBC (8:30am)

Market Snapshot

- S&P 500 futures down 0.7% to 5,826.50

- STOXX Europe 600 down 1.0% to 501.63

- MXAP down 0.8% to 179.14

- MXAPJ down 1.2% to 565.83

- Nikkei down 0.3% to 38,701.90

- Topix down 0.4% to 2,701.99

- Hang Seng Index down 0.2% to 19,720.70

- Shanghai Composite little changed at 3,368.07

- Sensex down 1.5% to 78,039.19

- Australia S&P/ASX 200 down 1.2% to 8,066.96

- Kospi down 1.3% to 2,404.15

- German 10Y yield little changed at 2.31%

- Euro up 0.2% to $1.0383

- Brent Futures down 1.0% to $72.17/bbl

- Gold spot up 0.4% to $2,603.73

- US Dollar Index down 0.17% to 108.22

Top Overnight News

- China’s one-year bond yields plunged 17 bps to the lowest since 2003, just a few hours after sliding below the psychological barrier of 1%. The stars seem to be aligned for this year’s rally to extend well into 2025. BBG

- Japan’s national CPI for Nov accelerates vs. Oct, with the headline jumping to +2.9% (up from +2.3% in Oct and inline w/the Street) and ex-food/energy climbing to +2.4% (up from +2.3% in Oct and inline w/the Street). WSJ

- Russia’s central bank unexpectedly held rates at 21%, saying monetary conditions tightened and inflation expectations continue to rise. BBG

- UK retail sales for Nov rebounded from Oct, but still fell short of the consensus forecast at +0.3% M/M ex-fuel (vs. -0.9% in Oct and vs. the Street consensus of +0.5%). WSJ

- US president-elect Donald Trump has warned the EU that it must commit to buying “large scale” amounts of US oil and gas or face tariffs. The EU has spent the past month increasing purchases of US goods such as liquified natural gas and agricultural products as means to potentially avoid tariffs from the US. FT

- Brazil’s senators are set to vote on a bill today that further dilutes a package of spending cuts meant to buoy markets. The central bank will step in again to support the real with a FX credit line auction of as much as $4 billion and a spot auction of up to $3 billion. BBG

- The Republican-led House rejected a temporary funding plan backed by Donald Trump to avoid a government shutdown that’ll otherwise happen at midnight. Trump wants a deal that sets March 14 as the new funding deadline and either raises or eliminates the debt ceiling. Thirty-eight GOP lawmakers and almost all Democrats voted against the package. BBG

- NKE (Nike) -4% in the pre as forward guidance/commentary given on call last night came in well below consensus and overshadowed the strong quarter that originally drove stock +10% to $85 post press release.

- AVGO (Broadcom) CEO Hock Tan says the AI spending boom will continue until the end of the decade (“they are investing full-tilt”) as customers seek out the company’s chips as a cheaper alternative to Nvidia. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed following a mostly lower open after the lead from Wall Street as markets digest a slew of central bank decisions whilst still feeling the hangover from the Fed. ASX 200 was pressured by heavyweight financial, materials, and healthcare sectors, whilst Utilities and IT bucked the trend and posted mild gains. Nikkei 225 was briefly supported by the recent JPY weakness, although later faltered as JPY eventually strengthened following hotter-than-expected CPI and currency jawboning by Japanese officials. Hang Seng and Shanghai Comp both opened lower and trimmed losses to later trade, with Chinese markets unfazed as the PBoC maintained its LPRs.

Top Asian News

- Japan cuts view on corporate profits for the first time since March 2023; says economy is recovering moderately.

- China intends to cut tax evasion at online platforms, according to Xinhua.

- PBoC maintained 1yr LPR at 3.10% and 5yr LPR at 3.60% as expected.

- Japan Finance Minister Kato said no comment on FX levels; recently seeing one-sided, sharp moves; will take appropriate action against excessive moves; concerned about recent FX moves, including those driven by speculators, according to Reuters Kato added that it is important for currencies to move in a stable manner reflecting fundamentals.

- Japan’s top currency diplomat Mimura said gravely concerned about forex moves, and will take appropriate action against excessive forex moves, alarmed including over speculative moves, according to Reuters.

- South Korea to relax FX regulations to improve liquidity conditions, according to the finance ministry.

European bourses began the morning entirely in the red, and continued to proceed lower as the session progressed; as it stands, indices generally reside at worst levels. As it stands, all European sectors find themselves in the red; in-fitting with sentiment. Whilst still in the red, Real Estate fares the best vs peers. Banks are by far the clear underperformer, weighed on by Deutsche Bank, which expects a Q4 EUR 300mln hit due to its Polish subsidiary litigation. US equity futures are in negative territory and drifting lower as the session progresses, following the glum mood seen in European trade. Foxconn (2354 TT) to pause pursuit of Nissan (7201 JT) as Honda (7267 JT) deal talks unfold, via Bloomberg citing sources

Top European News

- UK Chancellor Reeves is posed to visit China in January to revive high-level economic and financial talks, according to Reuters sources.

- NIER sees Swedish GDP for 2025 +1.2%. See the Riksbank rate averaging 1.5% in 2025 and 1.5% in 2026

FX

- USD is giving back some of its gains which saw DXY top the 11th November 2022 peak overnight (108.44) to make a 108.48 high. Today will see a slew of Fed speakers on the wires who can help further explain the announcement. Williams, Daly, Hammack are all due on deck with particular interest on the latter given her hawkish dissent at the meeting.

- EUR is edging out slight gains vs. the USD but remains on a 1.03 handle after printing a fresh low for the month earlier @ 1.0344 in the wake of comments from US President-elect Trump cautioning that the EU “must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!”. It is worth noting that there is some huge option activity in EUR/USD for today’s NY cut, detailed below.

- JPY is attempting to undo some of the damage seen over the past few sessions as a hawkish Fed cut and lack of a hike from the BoJ has driven the pair from a 153.32 base on Wednesday to a multi-month high overnight at 157.92. Some respite has been granted following hotter-than-expected Japanese CPI overnight and currency jawboning by Japanese officials, who expressed concerns over recent JPY moves.

- GBP flat vs. the USD and lagging peers following soft UK retail sales data for November in what has been a generally busy week for UK data as well as yesterday’s dovish hold by the BoE. Cable has slipped onto a 1.24 handle for the first time since 22nd November with a current session trough at 1.2476.

- AUD unable to make much headway vs. the broadly softer USD in what has been a bruising week for AUD/USD after the pair made a fresh YTD low yesterday at 0.6200 to hit its lowest level since October 2022. Similar price action for NZD/USD which hit a fresh YTD low yesterday at 0.5609 to trade at its lowest level since October 2022.

- PBoC set USD/CNY mid-point at 7.1901 vs exp. 7.3086 (prev. 7.1911)

- Brazil called an FX credit line auction of up to USD 4bln on December 20th, according to Bloomberg.

USTs

- USTs are modestly firmer but yet to significantly deviate from the unchanged mark in 108-19+ to 108-26+ parameters. Docket ahead features monthly PCE data before the docket turns to Central Bank speak with Fed’s Williams, Daly & Hammack scheduled; the latter is set to explain her dissent. The yield curve continues to steepen though action is modest and a function of the short-end continuing to pull back from post-Fed highs.

- Bunds are incrementally firmer, but similarly to USTs are yet to deviate lastingly from the unchanged mark but have printed a slightly more expansive 133.81 to 134.10 range. Bunds did come under modest pressure on a much hotter than expected German PPI release; but did since pare alongside peers.

- Gilts opened higher by a single tick before slipping to a 92.18 trough and then paring back to unchanged. Since, action has been very limited and choppy in 92.18-48 parameters. Before the open, Retail Sales came in softer than expected but still posted a recovery from the prior.

Commodities

- WTI and Brent are softer, continuing to falter after Thursday’s reports that the G7 could adjust the Russian energy price cap with pressure also stemming from the downbeat risk tone. Brent’Feb 25 currently reside near lows at USD 72.20/bbl.

- Gold is firmer and holding around the USD 2.6k/oz mark in a thin range with catalysts for the metal light and after trading flat overnight. XAU is holding in proximity to the 100-DMA at USD 2606/oz.

- 3M LME Copper is defying the risk tone and holding modestly in the green, though still yet to test USD 9k/handle yet.

- India’s finished steel imports from China reach all-time high during April-November, according to Govt data.

- German Parliament has passed its energy law: will accommodate the waiver of internal gas storage levy at intra-EU border points and virtual trading hubs. This entails the gas levy payable to the operator Trading Hub Europe to apply to domestic customers only from Jan 1st 2025.

- Russia’s Kremlin says will act to counter the possible new G7 oil sanctions; will act to minimise any consequences and protect Russian companies, measures will backfire on those who take them.

Geopolitics

- “Israel’s Channel 14 on security officials: Israel is preparing for a new attack against the Houthis in Yemen”, according to Sky News Arabia.

- “Israel’s Channel 13 on officials: optimism remains high that a deal with Hamas is imminent.”, according to Sky News Arabia

- “7 strong explosions are heard in the Ukrainian capital Kiev”, according to Sky News Arabia; Ukraine air defence repelling an attack on Kyiv, according to official cited by Reuters.

- Russia fired a series of Kinjal hypersonic missiles on the capital Kiev, according to Sky News Arabia.

US event calendar

- 08:30: Nov. Personal Income, est. 0.4%, prior 0.6%

- 08:30: Nov. PCE Price Index MoM, est. 0.2%, prior 0.2%

- 08:30: Nov. Core PCE Price Index YoY, est. 2.9%, prior 2.8%

- 08:30: Nov. Core PCE Price Index MoM, est. 0.2%, prior 0.3%

- 08:30: Nov. PCE Price Index YoY, est. 2.5%, prior 2.3%

- 08:30: Nov. Real Personal Spending, est. 0.3%, prior 0.1%

- 08:30: Nov. Personal Spending, est. 0.5%, prior 0.4%

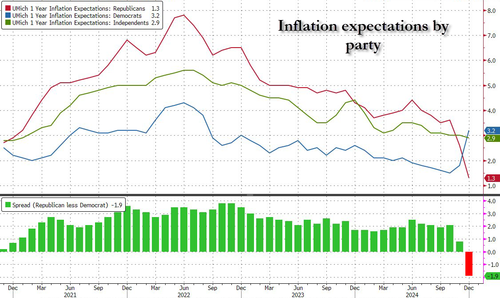

- 10:00: Dec. U. of Mich. 5-10 Yr Inflation, est. 3.1%, prior 3.1%

- 10:00: Dec. U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

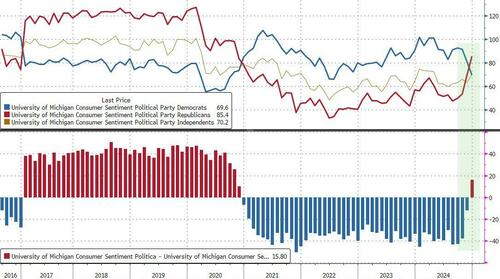

- 10:00: Dec. U. of Mich. Expectations, est. 71.9, prior 71.6

- 10:00: Dec. U. of Mich. Current Conditions, est. 77.1, prior 77.7

- 10:00: Dec. U. of Mich. Sentiment, est. 74.2, prior 74.0

- 11:00: Dec. Kansas City Fed Services Activ, prior 9

DB’s Jim Reid concludes the overnight wrap

Welcome to the last EMR of 2024. Happy holidays from Henry, Peter, Asim and myself. I say this every year but a huge thanks for reading and interacting with us this year. Thanks for voting in the II survey again where we found out last week we had another couple of 1st places in the global analyst awards. It really means a lot that you took the time to vote, so many thanks. I’ll be off skiing as of Monday but before I go it’s become a tradition to list my favourite TV shows of the year which I’ll do at the end. Regular readers know that if I’m not travelling I try to escape to an hour of TV a night with my wife in between edits of the EMR. I hope you’ve enjoyed some of these too.

Before unveiling the rather salacious number one entry on the list, we have the small matter of a nervy last full week of the year to comment on with a possible US government shutdown dominating proceedings. For those wanting a quiet run up to Xmas, the good news is that there hasn’t been any real follow-through to the Fed-induced slump on Wednesday. The bad news is that an initial recovery in markets struggled to gain traction yesterday, with the S&P 500 (-0.09%) posting a joint record 14th consecutive day of decliners outnumbering advancers. The data stretches back 100 years so this is some stat. Futures on the S&P 500 are down another -0.36% this morning, so will we break the record today?

There was also scar tissue in bond markets, with 10yr (+4.8bps) and 30yr (+6.0bps) Treasury yields reaching their highest levels since May. The one area where there was a sense that the moves may have been overdone was at the front end, where the rate priced in by the December 2025 meeting was down -4.5bps on the day to 3.96%. For all the speculation about the Fed returning to hikes, it’s worth remembering they still cut rates this week and signalled more ahead, so the easing bias remains, even if it’s not as aggressive as it was. Indeed, investors are still pricing in 37bps of cuts next year, which isn’t too far off the Fed’s median dot at 50bps. So for DB to be correct that there are no cuts next year, we will need the Fed and the market to continue to change their minds.

But when it comes to the next 24 hours, the big question now is whether a US government shutdown is about to happen. The situation has moved quickly since Wednesday, when Elon Musk fiercely criticised the stopgap spending bill negotiated in Congress, with Trump and JD Vance then coming out against it later that day. Yesterday saw House Republicans put forward an alternative proposal that would fund the government through March and raise the debt limit for two years. The debt limit issue had been pushed by Trump who even said he’d be open to abolishing the debt limit altogether, saying he “would support that entirely”. However, the latest bill was voted down by 235 votes to 174 in the House last night, with 38 Republicans joining virtually all Democrats in voting against it. This leaves the Republican House leadership searching for a Plan C with less than 24 hours to go before the shutdown deadline. And as it stands, Polymarket are currently pricing in a 64% chance of a shutdown before year-end.

Whilst all that was happening, we did get some very positive US data yesterday, which helped to reassure investors about the near-term outlook and encouraged a huge curve steepening. That included the weekly initial jobless claims, which fell back to 220k in the week ending December 14 (vs. 230k expected). In addition, the Q3 GDP data was revised higher, coming in at an annualised pace of +3.1% (vs. +2.8% before) and with the PCE inflation for Q3 revised up from +2.1% to 2.2%. The stronger data encouraged a steepening in rates with the 2s10s curve moving up +8.8bps to 24.1bps, which is its steepest closing level since June 2022, back when the Fed began to hike by 75bps per meeting. That came amidst a continued move higher for long-end Treasury yields, as both 10yr yields (+4.8bps to 4.56%) and 30yr yields (+6.0bps to 4.74%) rose to their highest levels since May. This was again driven by real yields, with the 10yr real yield on course to post its largest weekly increase since October 2023 (+21.6bps so far this week). Higher real yields also helped the dollar index (+0.35%) advance for the 9th time in 10 sessions, and up to its highest level since November 2022.

A more bullish narrative initially helped to boost US equities, with the S&P trading more than 1% higher early in the session. But this optimism faded as the day went on and the index was -0.09% lower by the close, building on its -2.95% slump the previous day. The moves were fairly muted across the major indices. The Magnificent 7 (+0.25%) edged higher but the NASDAQ (-0.10%) declined and the small-cap Russell 2000 (-0.45%) fell back to its lowest level since the US election.

Since I asked on Wednesday for a new moniker for the Mag-7 which may include fast rising Broadcom, I’ve had a wave of suggestions emailed through. Some of them great, some of them funny. However its hard to beat the “BAATMAAN” moniker that’s been quietly doing the rounds for several weeks now. I’ve no idea who first came up with it but well played to them. I’m not sure if our “The Innov-eightors” or “The Domin-eightors” will catch on.

Over in Europe, the main news yesterday came from the Bank of England, who struck a more dovish note than expected. The main decision wasn’t a surprise, keeping the policy rate at 4.75%. But the decision was only made by a 6-3 vote, with the minority preferring a 25bp cut. Moreover, the statement made clear that the path was still towards further easing, and that a “gradual approach to removing monetary policy restraint remained appropriate.” In turn, that meant yields on 10yr gilts were only up +2.0bps yesterday to 4.58%, which was a much smaller rise than for 10yr bunds (+5.8bps) and OATs (+6.9bps). And perhaps most fascinatingly, 30yr gilt yields (+5.1bps) reached their highest since 2002 at 5.11% and above where they were a couple of years back during the LDI crisis.

Elsewhere in Europe, markets were catching up to the Fed’s hawkish moves the previous day, which happened after the European close. That pushed the STOXX 600 to a sharp -1.51% loss, with similar moves for the DAX (-1.35%), the CAC 40 (-1.22%) and the FTSE MIB (-1.78%). There was a particular underperformance for Swedish assets after the Riksbank’s latest policy decision as well. They cut their policy rate by 25bps, in line with expectations. But they also signalled that easing was nearing its end, saying that if the outlook were unchanged, “the policy rate may be cut once again during the first half of 2025”, with the policy rate forecast showing no further cuts beyond that out to 2027. That backdrop saw the OMX Stockholm 30 Index fall -2.23%, which was the biggest decline for the major European indices, whilst Sweden’s 10yr government bond yield was up +10.6bps.

Overnight, there’s been a fairly mixed performance for the major equity indices. In South Korea, the KOSPI (-1.58%) has experienced sharp losses, along with Australia’s S&P/ASX 200 (-1.24%). However, Japanese equities have been broadly unchanged after the latest inflation data was mostly as expected. It showed headline CPI moving back up to +2.9% in November as expected, whilst core-core inflation was up to a 7-month high of +2.4%. So the Nikkei is holding steady this morning with a +0.03% gain. The main outperformer have been Chinese equities, with the CSI 300 up +0.27%, whilst the Shanghai Comp is up +0.54%. That also comes as China’s 1yr bond yield fell to 1% for the first time since 2009.

To the day ahead now, and data releases from the US include PCE inflation for November, along with the University of Michigan’s final consumer sentiment index for December. Over in Europe, we’ll get UK retail sales for November, and the European Commission’s preliminary consumer confidence reading for the Euro Area in December. Otherwise, central bank speakers include the Fed’s Daly.

See you on the other side. Happy holidays……