Previously, we have discussed the issue of a currency’s backing. From comments and emails, we realize this topic could use a bit more illumination. And there are some related concepts that should be addressed at the same time.

Let’s start with an analogy, the engineering concepts of accuracy and precision. These related words are oft-confused, but not the same thing. The former refers to how close a measurement gets to reality, and the latter refers the repeatability of the measurement. If you put 1kg mass on a scale and it says 1.9501kg it is not accurate. However, if you do it again and again, and it consistently reads 1.9501kg it is precise.

There are three concepts pertaining to a currency: fiat, irredeemable, and unbacked. Let’s compare and contrast the dollar and bitcoin with respect to each.

Fiat means law or force. It is a government decree. Obviously, the dollar is fiat and bitcoin is not. No one mistakes this, but confusion comes from substituting fiat for the other related concepts.

Irredeemable means the currency is not redeemable. You cannot present the currency to its issuer, and demand that he take back his currency and hand over a fixed amount of gold. This amount is the size of the deposit. No one would hand an ounce or a ton of gold over to a bank, without a contractual obligation that the bank must return that ounce or ton. No one would agree to allow the bank to hand over a reduced amount, or to allow the bank to say “hey, just walk to the market down the street, sell our paper for whatever amount of gold it might be worth today.” Both bitcoin and the dollar are irredeemable, and their value in an exchange market does not change this fact.

Redemption extinguishes the bank’s debt to the depositor. It is not a purchase of gold. The bank takes its paper out of circulation, the debt goes out of existence, and the depositor gets his gold back. This is a feature missing from both the dollar today and bitcoin.

Unbacked means there is no asset to match the liability. A currency issuer normally issues its currency to finance the purchase of an asset. The reason is that the asset pays a yield, but the currency does not. So the bank borrows at zero while earning something more than zero.

This is not a way to get rich, by the way, but to make a small spread by providing a useful service to the market. Note that the bank is not printing. If the bank issues 100oz of currency, it is not 100oz richer. The currency is the bank’s liability, and to balance this liability, the bank buys 100oz worth of bills of exchange. So the bank’s balance sheet has 100oz currency liability backed by 100oz bills asset. The bills pay 1%, but the currency pays no interest, so the bank makes 1oz a year.

The dollar is backed by the bonds purchased by the Federal Reserve. Bitcoin is unbacked.

Bitcoin does offer a way for miners to get rich. When a miner creates 100 btc, he gets 100 btc of value free and clear. He is not obligated to redeem it to a depositor, and he is not using it to finance a portfolio of earning assets. He is in business to simply print bitcoin. If the miners do not get rich doing this, it’s not because they have liabilities. It’s for an unrelated reason: Satoshi designed bitcoin mining like a treadmill, and its spins backward faster and faster as the total bitcoin compute power of the miners increases.

We have not commented much on this treadmill feature of bitcoin. It is, in essence, frivolous. Let’s look at why.

Bitcoin is based on the Quantity Theory of Money. This theory holds that the general price level rises with the quantity of money. A related view is that the value of money is defined as its purchasing power, or the inverse of the general price level. Taken together, these ideas mean that if you double the quantity of money, you will approximately halve the value of one monetary unit.

Satoshi contended with the problem of bitcoin’s value as a problem of quantity. He designed it with two variables that change as miners come online and bitcoins are produced. One keeps halving the number of bitcoins rewarded when a miner gets to create a new block in the blockchain. The other increases the difficulty of mining, based not on the number of bitcoins in existence but the amount of compute power dedicated to mining. No matter how many miners set up how many computers, the system is designed so that pay dirt is hit once about every 10 minutes, and the number of bitcoins rewarded to the miner is halved every time a certain number of blocks is created. It is mathematically elegant. However, it’s a solution to a problem that does not exist.

Looking at gold, we see the metal is not limited in quantity (bitcoin is limited to 21 million). In fact, gold is not scarce. It is the most abundant commodity (not counting water or air). Not in terms of ounces, of course, but as a ratio of stocks to flows. We have accumulated enormous inventories over at least 5000 years of mining the stuff, and it is not consumed. So over time, the total stocks of gold increases. And the rate of annual mine production is a small fraction of this total (under 2% by current official estimates, which we believe understates the existing stocks).

Gold mining does not become exponentially more expensive as the quantity of outstanding gold rises. Nature does not dictate any equation to make it so. Nor does it need to. Gold worked fine as money for thousands of years, sans this feature. Our hypothesis is that it has always cost around one ounce of gold to produce one ounce of gold. When the cost of mining an ounce falls below an ounce, it is a powerful signal and incentive. The gold miners spring into action. When the cost of mining goes above one ounce, the gold miners must stop. This is a very interesting economic feature of gold. Its quantity is neither fixed, nor elastic at the whim of a bureaucrat. The quantity rises in response to market demand.

Satoshi was faced with a conundrum. He knew that initial demand for bitcoin was nearly zero, so common sense told him that the Quantity Theory could not kick in until the market was mature. So how to grow into the final quantity? He not only wanted to limit the ultimate quantity, but also the rate at which the quantity increased towards that limit. So, how to handle this?

Enter, the Labor Theory of Value.

Make the miners do work. Most people think of work as a sacrifice, giving up something valuable such as your time and/or resources. The ultimate version of this is a government jobs program, with unwilling participants generating and checking each other’s useless papers in exchange for a government check. Or, using up perfectly good computing power to calculate hashes to mine more bitcoins.

Note that the miner is not computing anything that matters in the real world. He is not calculating what protein will block the growth of brain cancer, or even the launch trajectory for the next probe to the planet Jupiter. He is calculating something, for the sake of proving that he did a certain amount of work in calculating it. This work has little real value (they are validating transactions, but this is a small proportion of the work they do), except that it determines which miner is to be rewarded with the next bitcoin. Doing work serves to limit the rate of bitcoin creation.

This is frivolous. It serves no real purpose. Our definition of work is different, based on adding value, rather than sacrificing resources. Mining computation does not add value.

Make-work calculation is perfectly suited to bitcoin. Bitcoin’s ledger references only itself. It tracks each liability perfectly, but there are no external assets. So it makes sense, in a certain way, that to add more liabilities to the blockchain (which are the asset of the miner), the miner does work for its own sake.

The labor theory of value was debunked at least 146 years ago (when Carl Menger published Principles of Economics).

Proponents of bitcoin respond to our contention that its extreme volatility renders it useless as money, by arguing that its value will stabilize. This is because the quantity is limited and it takes work to produce. But if these theories were false, then that would mean…

Bitcoin is often likened to gold, but it’s different in every way. The quantity of gold is not capped. Gold does not become exponentially more expensive to produce. Gold’s value does not come from the labor or electricity used to produce it. Bitcoin is not a commodity, it is a self-referential ledger of liabilities unbacked by assets. It is produced by increasing amounts of work for work’s sake.

Bitcoin has precise formulas for setting the mining reward and difficulty, and an extremely precise ledger of every transaction. However, we must look past this precision to see that it is based on the inaccurate quantity and labor theories of value. Come to think of it, the Fed itself has precise mathematical models.

The prices of the metals dropped this week, $24 and $0.38. This could be because the asset markets have returned to their happy, happy place where every day the stock market ticks up relentlessly. The major currencies have been rising all year—we insist that this is a rise in these dollar derivatives, not a fall in the dollar—and this is a risk-on pattern. Borrow dollars, sell dollars, buy another currency to buy an asset and pocket (A) the yield of the asset, (B) the rise in price of that asset, and (C) the rise in the currency.

The dollar has been falling this year. You can’t measure it in terms of its derivatives such as euro. You can measure it in terms of gold. Here is a chart, showing the drop in the dollar, from about 27 milligrams at the start of January to 23.5mg on Friday. The dollar has fallen about 13%.

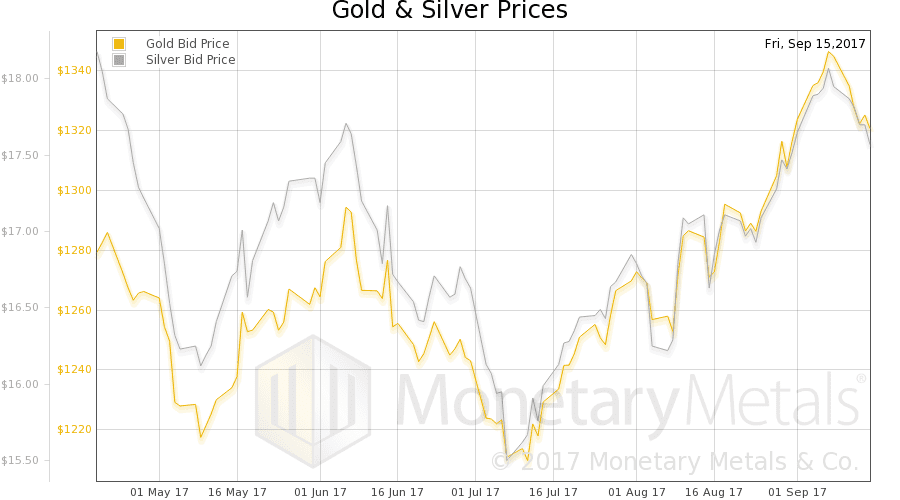

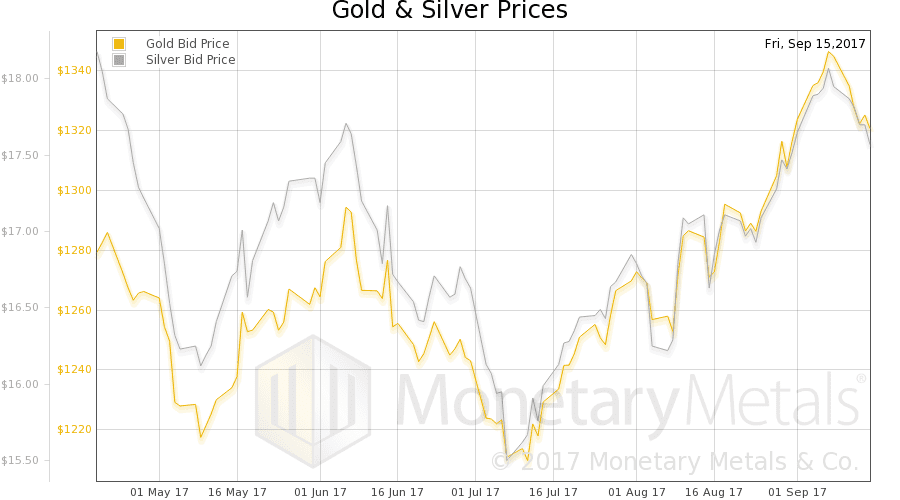

Will the dollar fall further? As always, we are interested in the fundamentals of supply and demand as measured by the basis. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose a bit.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

This is the October contract, which is under selling pressure (pushing down basis and up cobasis). This week, the moves in the basis and cobasis are due to this contract roll process (see the continuous gold basis chart here). The dollar rose somewhat (the inverse of the falling price of gold).

Our calculated Monetary Metals gold fundamental price dropped $9, to $1,370.

Now let’s look at silver.

In silver, being the December contract which is farther away, it’s clearer. There was little move in the basis (around 0.07%) as the price of the dollar went up / price of silver went down.

Our calculated Monetary Metals silver fundamental price fell $0.50 to $17.38.

© 2017 Monetary Metals

via http://ift.tt/2yjpFKh Monetary Metals