Today’s AM fix was USD 1,271.50, EUR 939.69 and GBP 787.11 per ounce.

Yesterday’s AM fix was USD 1,272.25, EUR 942.13 and GBP 790.12 per ounce.

Gold fell $0.30 or 0.02% yesterday, closing at $1,273.40/oz. Silver slipped $0.09 or 0.44% closing at $20.32/oz. Platinum climbed $3.40 or 0.2% to $1,411.40/oz, while palladium rose $3.75 or 0.5% to $718.47/oz.

Gold in GBP, 1 Year – (Bloomberg)

Gold in sterling terms is testing strong support at the £775/oz level. A breach of this level could lead to gold testing the next level of support at £740/oz and below that at £700/oz which was resistance in 2009 (see 5 year chart below).

Gold was trading in a tight range until it suffered another very sharp concentrated sell off at 1126 GMT which led to prices falling from $1,272/oz to $1,259/50 in seconds. The selling was so furious and concentrated that it led the CME to stop trading for a significant twenty seconds. Some entity appeared determined to get the gold price lower and they succeeded – for now.

Gold failed to make any headway despite dollar weakness after more dovish comments from exiting Fed Chairman Ben Bernanke about the bank’s bond purchases.

Bernanke said yesterday that the Fed will maintain an ultra loose U.S. monetary policy for as long as needed and will only begin to taper bond buying once it is assured that labour market improvements would continue.

The assumption that QE will be trimmed is like a lot of assumptions – wrong. There are strong grounds for believing that the weak state of the U.S. economy may lead to Bernanke’s even more dovish successor, Yellen, increasing the QE programme.

Physical demand continues at these levels but is not at the very high levels seen in recent months.

Many bullion coin and bar buyers have accumulated their allocation of gold and silver and are waiting for higher prices. There is a real sense of the calm before the storm in the gold market. How that will manifest and the catalysts for a resumption of the bull market is yet to be seen.

Gold in GBP, 5 Year – (Bloomberg)

?The Bank of England’s Systemic Risk Survey semi annual report to quantify and track market participants’ views of risks to, and their confidence in, the UK financial system shows increasing concerns of a house price crash.

The report presents the results of the 2013 H2 survey, which was conducted between 23 September and 24 October 2013 with 76 financial services companies.

Fears that a house price crash could damage the financial system have risen sharply in the last year, the key Bank of England survey shows. Increased concerns were expressed by the participants over ultra loose monetary policies and the extended low interest rate period.

Concerns about a property price bubble rose and were mentioned by 36% of respondents, up 21% from 14% since the previous survey in the second half of 2012. Concerns were concentrated almost exclusively on the residential market, where responses focused on the risk of a house price correction.

As we know house price corrections tend to feed on themselves and often lead to house price crashes.

Other Key Risks To The UK Financial System:

• Perceptions of the two main risks to the UK financial system remain sovereign risk and the risk of an economic downturn, although citations of both have fallen: 74% of respondents mentioned the former (-3 percentage points since May 2013) and 67% (-12 percentage points) the latter. Concerns over sovereign risk continue to focus on Europe, but unsurprisingly given the uncertainty surrounding the U.S. debt ceiling negotiations that prevailed during the survey period, there was a sharp increase in concerns around U.S. sovereign risk.

• For the second survey in succession, risk surrounding the low interest rate environment was the fastest growing, with 43% of respondents citing it, up 17 percentage points since May 2013. Over half of the responses emphasised risks around low rates, with the remainder referring to risks associated with a snapback in those low rates to more normal levels. Perceived risk around property prices also rose, being mentioned by 36% of respondents, up 11 percentage points since the previous survey. Concerns were concentrated almost exclusively on the residential market, where responses focused on the risk of a house price correction.

• Other top risks include regulation/taxes (cited by 41% of respondents, up 1 percentage point since May 2013), financial institution failure/distress (+4 percentage points to 30%) and operational risk (+1 percentage point to 25%).

Outside of the top seven, geopolitical risk has grown in prominence, with concern focusing on instability in the Middle East.

The report may have led to GBP weakness upon its release as the pound fell against the dollar, euro and gold.

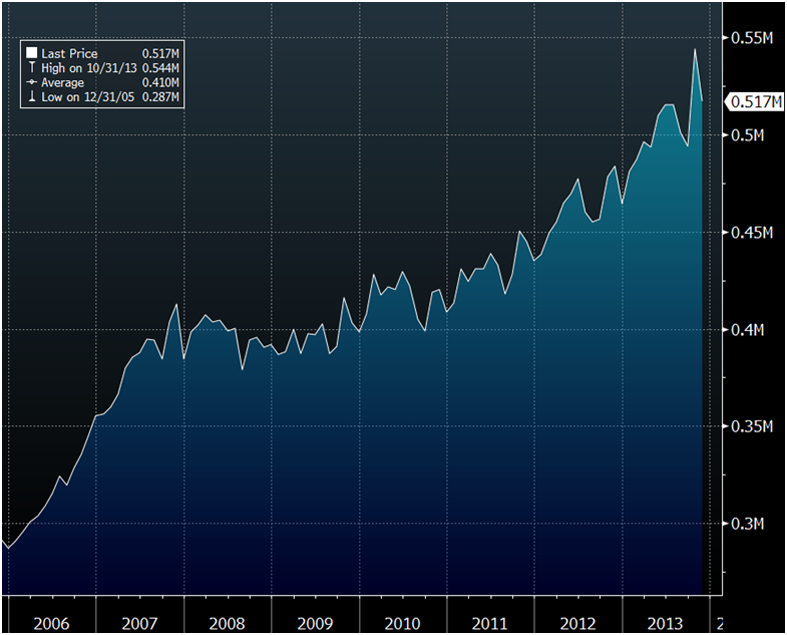

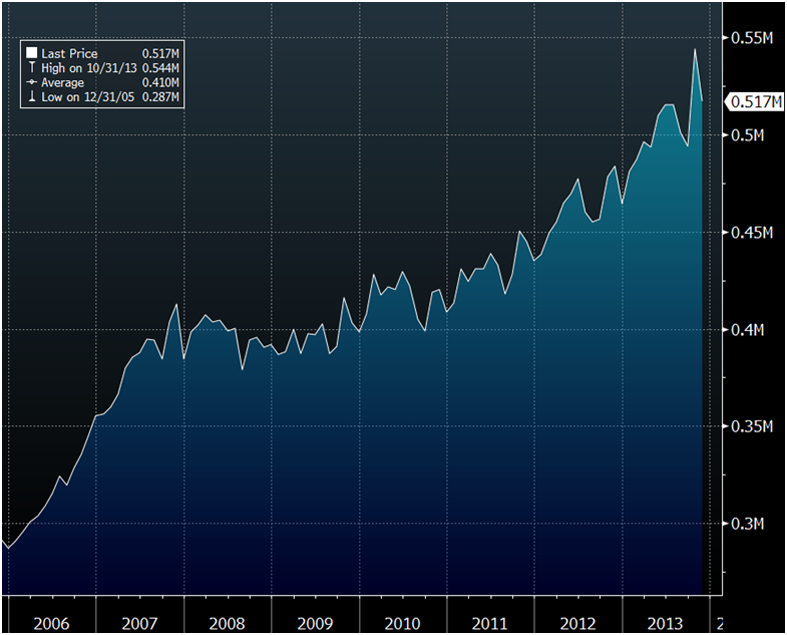

UK Rightmove Regional Avg Asking Price Greater London, 2002-Today – (Bloomberg)

Interestingly, also on Monday came news of a sharp 5% drop in London property prices in what could portend a bust of the London property bubble.

Values in the U.K. capital dropped 5%, or 26,956 pounds ($43,500), from the previous month to an average 517,276 pounds, Rightmove PLC said Monday. Across England and Wales, average prices declined by 2.4%.

Estate agents and property industry blamed the falls on a seasonal pre-Christmas decline, however valuations are extremely stretched with very low yields and the hot money that has fueled the huge increase in London property prices may be pulling back.

UK Rightmove Regional Avg Asking Price Greater London, 2006-Today – (Bloomberg)

“This is different” and “this location is different” is the mantra of every property bubble. We will soon see if the London property bubble is truly different or will suffer the fate of bubbles throughout history.

Of the four charts in our market update today, which ones do you think show characteristics of a bubble?

Those diversifying and buying gold in the UK today will be rewarded in the coming years. The smart money is reducing exposure to overvalued London property and increasing exposure to undervalued gold.

Click Gold News For This Week’s Breaking Gold And Silver News

Click Gold and Silver Commentary For This Week’s Leading Gold, Silver Opinion

Like Our Facebook Page For Interesting Insights, Blogs, Prizes and Special Offers

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/NDm_dzpCGv0/story01.htm GoldCore

![]()