Imagine, if you will, that you and your 15 closest unarmed, civilian friends are celebrating a young couple who has just started their lives together, and are on your way to their wedding party, when all of a sudden a remote-controlled US killing machine drops several air-to-surface tactical missiles on your group and kills you before you have a chance to blink. Macabre as it sounds, this is precisely what happened in the conflict-torn (courtesy of the CIA) republic of Yemen last month when a US drone mistakenly killed 15 people.

The US justification: the 15 civilians were mistaken for an Al Qaeda convoy (good thing this was not in Syria, where such an Al Qaeda convoy would have received US arms and funding), and in keeping with the US “superpower” walkthrough, the missiles were launched first, and questions would be asked later if ever. And while this happens daily around the globe (remember: they hate America for its freedoms, not because it rains hellfire on civilians without reason), this time the United Nations human rights watch actually had the temerity of calling out the US on its latest act of mass murder.

Reuters has the full story:

United Nations human rights experts told the United States and Yemen on Thursday to say whether they were complicit in drone attacks that mistakenly killed civilians in wedding processions this month.

The independent experts questioned the legitimacy of drone attacks under international law and said the governments should reveal what targeting procedures were used.

Local security officials said on December 12 that 15 people on their way to a wedding in Yemen were killed in an air strike after their party was mistaken for an al Qaeda convoy. The officials did not identify the plane in the strike in central al-Bayda province, but tribal and local media sources said that it was a drone.

Stressing the need for accountability and payment to victims’ families, the U.N. statement issued in Geneva said that two attacks, on two separate wedding processions, killed 16 and wounded at least 10 people.

“If armed drones are to be used, states must adhere to international humanitarian law, and should disclose the legal basis for their operational responsibility and criteria for targeting,” said Christof Heyns, U.N. special rapporteur on extrajudicial, summary or arbitrary executions.

Poor Yemen, unclear that others’ sovereignty does not matter to the US, voiced a feeble protest: “Yemen cannot consent to violations of the right to life of people in its territory,” he added.” Good luck with non-consenting.

However, it was the UN that surprised onlookers with one of the harshest condemnations of what is essentially unaccountable murder by an American remote-control plane, controlled from thousands of miles away:

Juan Mendez, U.N. special rapporteur on torture, voiced concern about the legitimacy of the airstrikes. Each state was obliged to undertake due investigation into the reported incidents, including their effect on civilians, he said.

“A deadly attack on illegitimate targets amounts to cruel, inhuman or degrading treatment if, as in this case, it results in serious physical or mental pain and suffering for the innocent victims,” Mendez said.

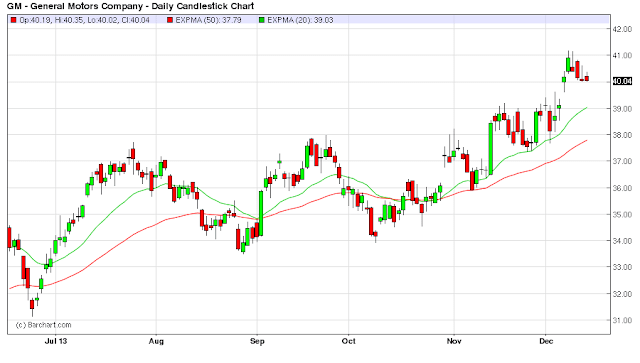

Wait, so cruel, inhuman and degra…. oh look, another all time high for the S&P! Quick BTFATH, and ignore all this irrelevant “stuff.”

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/uVo2hVw2zoY/story01.htm Tyler Durden