Witnesses Tell House Task Force To Reinvestigate JFK Assassination

Authored by Travis Gillmore via The Epoch Times (emphasis ours),

WASHINGTON—A panel of expert witnesses that included renowned filmmaker Oliver Stone told the House Committee on Oversight and Government Reform’s Task Force on the Declassification of Federal Secrets on April 1 that more work is needed to uncover the truth about the assassination of President John F. Kennedy.

“Let us see past the lies, and let us hear what happened,” Stone told the task force. “The truth is the greatest treasure a Socratic soul can attain in this lifetime.”

The three-time Academy Award-winning director released a movie titled “JFK” in 1991 and followed that with a documentary in 2021 called “JFK: Revisited.”

He questioned the role played by the CIA, saying it “operates arrogantly outside our laws.”

A litany of motives for removing Kennedy existed at the time, including those related to expanding the Vietnam War and securing power for the military-industrial complex, among others, according to the director.

“He was changing things, changing too many things too fast. It was a major problem for some, and he was going to win a second election,” Stone told The Epoch Times after the hearing. “And he had a brother, a younger brother, and there was fear of a dynasty. They were terrified of that possibility.”

Expressing doubt about the Warren Commission’s findings in 1964, which fingered Lee Harvey Oswald as a lone gunman responsible for Kennedy’s murder, he asked the committee to reopen an investigation into the incident.

Some lawmakers on the dais acknowledged a need to follow up on questions regarding the chain of custody of evidence and discrepancies in testimony and records related to the crime, saying the lack of transparency over nearly 62 years has eroded trust in government.

“For over six decades, questions have lingered, shrouded in secrecy and speculation,” task force chairwoman Rep. Anna Paulina Luna (R-Fla.) said during opening remarks. “What has been alarming to me is the amount of stonewalling the federal government put forth to hide this information from the American people.”

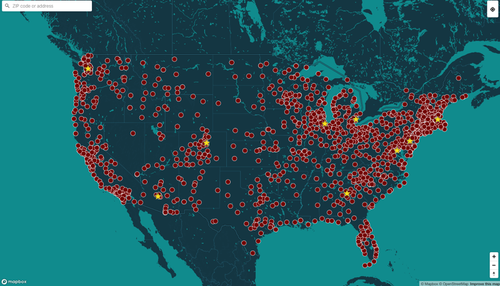

She said revelations in the approximately 80,000 pages of documents that were declassified by President Donald Trump on March 18 are “staggering” and raise “serious concerns.”

Task force members in both parties denounced what they called overclassification and called for increased transparency from the government.

“This is a known fact that we all should agree on. Federal agencies, obviously, have in the past obscured information and key facts from the public for too long,” Rep. Robert Garcia (D-Calif.) said during the hearing. “The CIA and [FBI], especially in this period of time, were deeply flawed institutions.”

Others on the panel, however, including Rep. Jasmine Crockett (D-Texas), used their allotted time to criticize the sitting president for what she described as a rush to release classified material that could result in the release of private information, such as Social Security numbers.

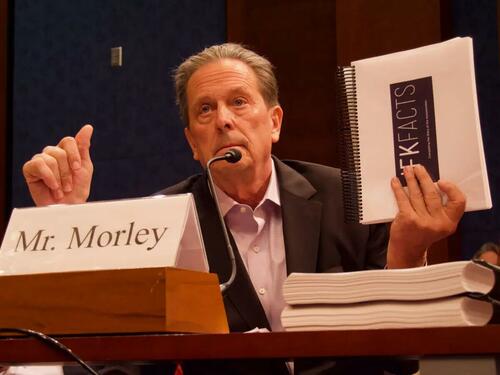

One witness called to testify, Jefferson Morley—an author and independent journalist who has researched the JFK assassination for 30 years and told the commission that he is a “liberal Democrat”—dismissed the line of inquiry.

He said some of the new files show that James Angleton, longtime counterintelligence chief for the CIA; Richard Helms, who was the director of the CIA; and agency liaison to Congress George Joannides all lied under oath about the killing.

“Obstructing Congress cannot be considered evidence of incompetence,” Morley said. “Three false statements by top CIA officers about Kennedy’s accused killer, that is a pattern. It’s a pattern of misconduct; it’s a pattern of malfeasance.”

Author James DiEugenio highlighted a document written by Arthur Schlesinger—special assistant to Kennedy—and long redacted by the CIA, as of paramount importance in understanding the context of the murder, as it reveals Kennedy’s intention to reorganize the agency and minimize its authority.

He called for a new investigation, warning that “secrecy is the enemy of democracy.”

“I really hope that people will learn from the past and learn from experiences,” DiEugenio told the task force. “The CIA and the FBI should not have the last word on JFK’s murder. You should.”

Tyler Durden

Fri, 04/04/2025 – 22:35

via ZeroHedge News https://ift.tt/ZeU6bLd Tyler Durden