The answer: 160.

For the full breakdown of Obama’s favorite pastime, and his preferred golfing buddies can be found after the jump.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/uMGwNR9RGZ0/story01.htm Tyler Durden

another site

The answer: 160.

For the full breakdown of Obama’s favorite pastime, and his preferred golfing buddies can be found after the jump.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/uMGwNR9RGZ0/story01.htm Tyler Durden

Submitted by Gail Tverberg via Our Finite World blog,

Why is a finite world a problem? I can think of many answers:

1. A finite world is a problem because we and all of the other creatures living in this world share the same piece of “real estate.” If humans use increasingly more resources, other species necessarily use less. Even “renewable” resources are shared with other species. If humans use more, other species must use less. Solar panels covering the desert floor interfere with normal wildlife; the use of plants for biofuels means less area is available for planting food and for vegetation preferred by desirable insects, such as bees.

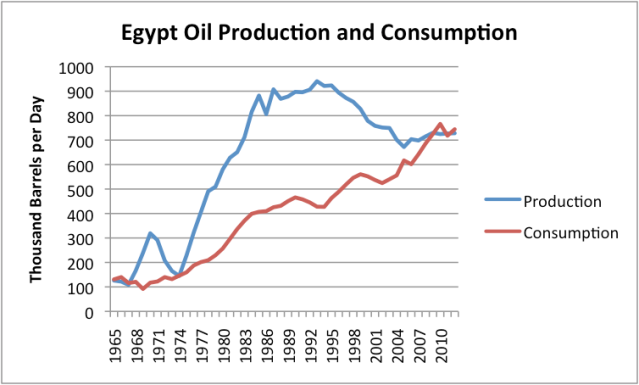

2. A finite world is governed by cycles. We like to project in straight lines or as constant percentage increases, but the real world doesn’t follow such patterns. Each day has 24 hours. Water moves in waves. Humans are born, mature, and die. A resource is extracted from an area, and the area suddenly becomes much poorer once the income from those exports is removed. Once a country becomes poorer, fighting is likely to break out. A recent example of this is Egypt’s loss of oil exports, about the time of the Arab Spring uprisings in 2011 (Figure 1). The fighting has not yet stopped.

Figure 1. Egypt’s oil production and consumption, based on BP’s 2013 Statistical Review of World Energy data.

The interconnectedness of resources with the way economies work, and the problems that occur when those resources are not present, make the future much less predictable than most models would suggest.

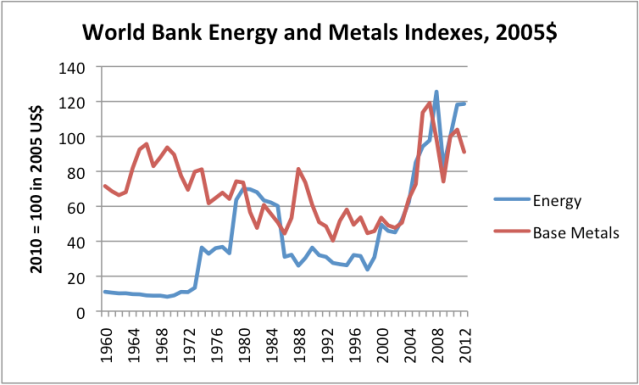

3. A finite world means that we eventually run short of easy-to-extract resources of many types, including fossil fuels, uranium, and metals. This doesn’t mean that we will “run out” of these resources. Instead, it means that the extraction process will become more expensive for these fuels and metals, unless technology somehow acts to hold costs down. If extraction costs rise, anything made using these fuels and metals becomes more expensive, assuming businesses selling these products are able to recover their costs. (If they don’t, they go out of business, quickly!) Figure 2 shows that a recent turning point toward higher costs came in 2002, for both energy products and base metals.

Figure 2. World Bank Energy (oil, natural gas, and coal) and Base Metals price indices, using 2005 US dollars, indexed to 2010 = 100. Base metals exclude iron. Data source: World Bank.

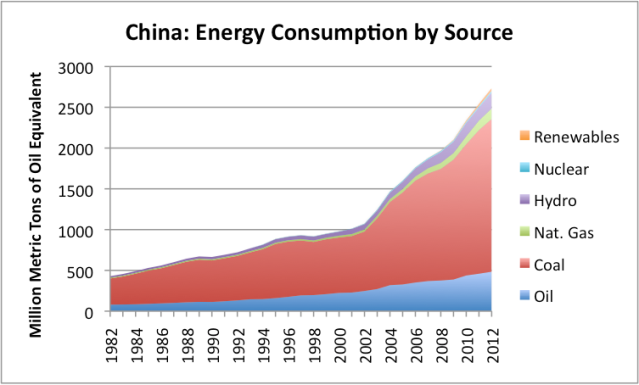

4. A finite world means that globalization will prove to be a major problem, because it added proportionately far more humans to world demand than it added undeveloped resources to world supply. China was added to the World Trade Organization in December 2001. Its use of fuels of all types skyrocketed quickly soon afterward (Figure 3, below). As noted in Item 3 above, the turning point for prices of fuels and metals was in 2002. In my view, this was not a coincidence–it was connected with rising demand from China, as well as the fact that we had extracted a considerable share of the cheap to extract fuels earlier.

Figure 3. Energy consumption by source for China based on BP 2013 Statistical Review of World Energy.

5. In a finite world, wages don’t rise as much as fuel and metal extraction costs rise, because the extra extraction costs add no real benefit to society–they simply remove resources that could have been put to work elsewhere in the economy. We are, in effect, becoming less and less efficient at producing energy products and metals. This happens because we are producing fuels that are located in harder to reach places and that have more pollutants mixed in. Metal ores have similar problems–they are deeper and of lower concentration. All of the extra human effort and extra resource expenditure does not produce more end product. Instead, we are left with less human effort and less resources to invest in the rest of the economy. As a result, total production of goods and services for the economy tends to stagnate.

In such an economy, workers find that their inflation-adjusted wages tend to lag. (This happens because the total economy produces less, so each worker’s share of what is produced is less.) Companies producing energy and metal products are also likely to find it harder to make a profit, because with lagging wages, consumers cannot afford to buy very much product at the higher prices. In fact, there is likely to be the danger of an abrupt drop in production, because prices remain too low to justify the high cost of additional investment.

6. When workers can afford less and less (see Item 5 above), we end up with multiple problems:

a. If workers can afford less, they cut back in discretionary spending. This tends to slow or eventually stop economic growth. Lack of economic growth eventually affects stock market prices, since stock prices assume that sale of their products will continue to grow indefinitely.

b. If workers can afford less, one item that is increasingly out of reach is a more expensive home. As result, housing prices tend to stagnate or fall with stagnating wages and rising fuel and metals prices. The government can somewhat fix the problem through low interest rates and more commercial sales–that is why the problem is mostly gone now.

c. If workers find their wages lagging, and some are laid off, they increasingly fall back on government services. This leaves governments with a need to pay out more in benefits, without being able to collect sufficient taxes. Thus, governments ultimately end up with financial problems, if extraction costs for fuels and metals rise faster than can be offset by innovation, as they have been since 2002.

7. A finite world means that the need for debt keeps increasing, at the same time the ability to repay debt starts to fall. Workers find that goods, such as cars, are increasingly out of their ability to pay for them, because car prices are affected by the rising cost of metals and fuels. As a result, debt levels need to rise to buy these cars. Governments find that they need more debt to pay for all of the services promised to increasingly impoverished workers. Even energy companies find a need for more debt. For example, according to today’s Wall Street Journal,

Last year, 80 big energy companies in North America spent a combined $50.6 billion more than they brought in from their operations, according to data from S&P Capital IQ. That deficit was twice as high as in 2011, and four times as high as in 2010.

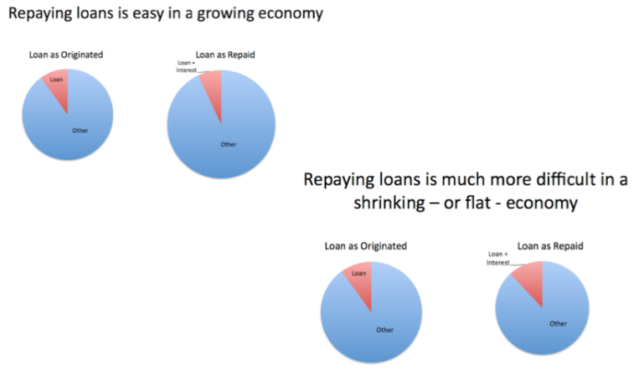

At the same time that the need for debt is increasing, the ability to pay it back is falling. Discretionary income of workers is lagging, because of today’s high prices of fuels and metals. Governments find it difficult to raise taxes. Fuel and metal companies find it hard to raise prices enough to finance operations out of cash flow. Ultimately, (which may not be too in the future) this situation has to come to an unhappy end.

Figure 4. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

Governments can cover up this problem for a while, with super low interest rates. But if interest rates ever rise again, the increase in interest rates is likely to lead to huge debt defaults, and major financial failures internationally. This happens because higher interest rates lead to a need for higher taxes, and because higher interest rates mean purchases such as homes, cars, and new factories become less affordable. Rising interest rates also mean that the selling price of existing bonds falls, potentially creating financial problems for banks and insurance companies.

8. The fact that the world is finite means that economic growth will need to slow and eventually stop. We are already seeing slower economic growth in the parts of the world that have seen a drop in oil consumption (European Union, the United States, and Japan), even as the rest of the world has seen rising oil consumption.

Countries that have had particularly steep drops in oil consumption, such as Greece (Figure 6 below), have had particularly steep drops in their economic growth, while countries with rapid increases in oil and other energy consumption, such as China shown in Figure 2 above, have shown rapid economic growth.

The reason why we are already reaching difficulties with oil consumption is because for oil, we are reaching limits of a finite world. We have already pulled out most of the easy to extract oil, and what is left is more expensive and slow to extract. World oil production is not rising very fast in total, and the price needs to be high to cover the high cost of extraction. Someone has to be left out. The countries that use a large proportion of oil in their energy mix (like Greece, with its tourist trade) find that the products they produce are too expensive in a world marketplace. Countries that use mostly coal (which is cheaper), such as China, have a huge cost advantage in a cost-competitive world.

9. The fact that the world is finite has been omitted from virtually every model predicting the future. This means that economic models are virtually all wrong. The models generally predict that economic growth will continue indefinitely, but this is not really possible in a finite world. The models don’t even consider the fact that economic growth will scale back in mature economies.

Even climate change models include far too much future fossil fuel use, in both their standard runs and in their “peak oil” scenarios. This is convenient for regulators. Oil limits are scary because they indicate a possible near-term problem. If a climate change model indicates a need to cut back on future fossil fuel use, these models give the regulator a more distant problem to talk about instead.

10. Even the most basic economic relationships tend to be mis-estimated in a finite world. It is common for economists to look at relationships that worked in the past, and assume that similar relationships will work now. For example, researchers like to look at how much debt an economy can afford relative to GDP, or how much debt a business can afford. The problem is that the amount of debt an economy or a business can afford shrinks dramatically, as the economic growth rates shrinks, unless the interest rate is extremely low.

As another example, economists believe that higher prices will lead to substitutes or a reduction in demand. Unfortunately, they have never stopped to consider that the reduction in demand for an energy product might have a serious adverse impact on the economy–for example, it could mean many fewer jobs are available. Fewer jobs mean less demand (or affordability), but is that what is really desired?

Economists also seem to believe that prices for oil products will keep rising, until they eventually reach the price level of substitutes. If people are poorer, this is not necessarily the case, as discussed above.

11. Besides energy products and metals, there are many other limits that are a problem in a finite world. There is already an inadequate supply of fresh water in many parts of the world. This problem can be solved with desalination, but doing so is expensive and takes resources away from other uses.

Arable land in a finite world is subject to limits. Soil is subject to erosion and degrades in quality if it is mistreated. Food is dependent on oil, water, arable land, and soil quality, so it quickly reaches limits if any of these inputs are disturbed. Pollinating insects, such as bees, are also important.

Probably the biggest problem in a finite world is the problem of too high population. Before fossil fuel use was added, the world could feed only 1 billion people. It is not clear that even that many could be fed today, without fossil fuels. The world’s population now exceeds 7 billion.

Where We Are Now in a Finite World

At this point, the problem of hitting limits in a finite world has morphed into primarily a financial problem. Governments are particularly affected. They find that they need to borrow increasing amounts of money to provide promised services to their citizens. Debt is a huge problem, both for governments and for individual citizens. Interest rates need to stay very low, in order for the current system to “stick together.”

Governments are either unaware of the true nature of their problems, or are doing everything they can to hide the true situation from their constituents. Governments rely on economists for advice on what to do next. Economists’ models do a very poor job of representing today’s world, so they provide little useful guidance.

The primary way of dealing with limits seems to be “solutions” dictated by concern over climate change. These solutions are of questionable benefit when it comes to the real limits of a finite world, but they do make it look like politicians are doing something useful. They also provide a continuing revenue stream to academic institutions and “green” businesses.

The public has been placated by all kinds of misleading stories about how oil from shale will be the solution. Quantitative Easing (used by governments to lower interest rates) has temporarily allowed stock markets to soar, and allowed interest rates to stay quite low. So superficially, everything looks great. The question is how long all of this will last. Will interest rates rise, and undo the happy situation? Or will a different financial problem (for example, a debt problem in Europe or Japan) bring the house of cards down? Or will the ultimate problem be a decline in oil supply, perhaps caused by oil and gas companies reaching debt limits?

2014 will be an interesting year. Let’s all keep our fingers crossed as to how things will work out. It is surreal how close we can be to limits, without major media catching on to what the problem really is.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/dxBnf3XSi_4/story01.htm Tyler Durden

Presented with little comment, as the chart speaks for itself, but for those greatly rotating their ‘cash on the sidelines’ into stocks; JPMorgan points out that US equities are 2 standard deviations rich to their average valuation and are in fact the most expensive in the developed world…

Just don’t tell Tom Lee…

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/vg0TKfF8bmw/story01.htm Tyler Durden

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

What if our commoditized, financialized definition of wealth reflects a staggering poverty of culture, spirit, wisdom, practicality and common sense?

The conventional definition of wealth is solely financial: ownership of universally valued money and assets. The assumption is that money can buy anything the owner desires: power, access, land, shelter, energy, transport and if not love, then a facsimile of caring.

The flaw in this reductionist definition is obvious: not everything of value can be purchased at any price–for example, health, once lost, cannot be purchased for $1 million, $10 million or even $100 million. A facsimile of friendship can be purchased (i.e. companions willing to trade fake friendliness for money), but true friendship cannot be bought at any price: its very nature renders friendship a non-commodity.

This explains the abundance of wealthy people who are miserable, lonely and phony to the core. Only commoditized goods and services can be bought with money or assets.

Given the limits of the conventional model of wealth, the question naturally arises: what if we defined wealth more by what cannot be bought rather than by what can be bought? Another way of making the distinction is to ask: what has been commoditized/globalized such that any person with money anywhere on the planet can buy it? What cannot be commoditized because it is intrinsically inaccessible to commodification?

We can start our inquiry with a series of questions:

1. What would be the impact on an individual's health if modern medicine/pharmaceuticals were no longer available? Put another way: how dependent is one's "good health" on commoditized interventions? How independent is an individual's health/vitality from commoditized medicine?

Health that is sufficiently vibrant that it has no need for commoditized medicine cannot be bought, and therefore it is a form of intrinsic (non-commodity) wealth.

2. Can a shipwrecked individual swim two miles through open ocean from a doomed ship/yacht to safety? Money has no value if there is no help that can be bought; the individual's only wealth in this situation (assuming they know how to swim) is their core physical strength and endurance–forms of wealth that cannot be substituted with money.

3. If Cicero was correct and "The man who has a garden and a library has everything," then let's ask not how extensive one's library might be in terms of the number of volumes, but ask how many of the books (or ebooks) have been read, absorbed and enjoyed by the owner?

In other words, it's not the ownership of a library which creates non-commoditized wealth but the joy, knowledge and pleasure derived from the reading of the books which defines wealth.

4. The same analysis can also be applied to a garden/orchard: what if we ask not how large the garden/orchard is in terms of square meters, but how expansive is the owner's participation in the care of the garden/orchard, how much pleasure is created by the toil and harvest, and how much of the bounty is shared with others?

5. How many friendships does an individual have that began in high school or earlier and are still vibrant? How many friends does one have who can be entrusted with the deepest personal crises? How many friends' homes are open to you, rain or shine?

What if we defined the person with no true friends as impoverished, regardless of their ownership of assets and cash? Many people seem to have professional acquaintances they call "friends" to mask their bottomless poverty of real friends and friendships.

6. What if wealth were measured in personal integrity, i.e. honesty, trustworthiness, compassion and the ability to remain accountable even as things fall apart?

This of course just a start: we could continue our redefinition of wealth to include kindness, empathy, the skills needed to organize volunteer community work parties, and so on.

As we explore what actually cannot be bought or commoditized, it raises this question: what if our commoditized, financialized definition of wealth reflects a staggering poverty of culture, spirit, wisdom, practicality and common sense?

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/KMAdIdEr1i0/story01.htm Tyler Durden

The Department of Defense today

The Department of Defense today

announced it would be revising the list of places where

military personnel receive imminent danger pay for serving,

something the Pentagon’s been working on since 2011, effective June

1. A DOD spokesperson insisted the decision wasn’t driven by

budgetary concerns (or it would be effective immediately and

wouldn’t have taken two years and who knows how much money to

make?).

From the Marine Corps Times:

The Defense Department has removed 20 areas from its

list of locations that qualify for imminent danger pay, effective

June 1, potentially affecting tens of thousands of troops.As of that date, service members deployed to these areas no longer

will qualify for the $225 monthly imminent danger stipend. The

change would affect thousands serving on land or on ships in those

areas.

See the full list here.

Follow these stories and more at Reason 24/7 and don’t forget you

can e-mail stories to us at 24_7@reason.com and tweet us

at @reason247.

from Hit & Run http://reason.com/blog/2014/01/03/defense-department-cuts-list-of-areas-wh

via IFTTT

As we reported earlier, 1.5 billion adults around the world, or a whopping one in three, may be obese or overweight. But, as any marketer will tell you, this is merely an untapped opportunity: it simply means that two out of three can still “unobese“. And doing its best to hit the goal of 100% obesity, is IHOP which, for the first time in more than two years, has just unleashed Pancake Pandemonium: “You can choose a stack of five Buttermilk pancakes as a main course or you can opt to add them to a combo which features eggs any style, hash browns, and a choice of pork sausage links, bacon, or ham.” Remember: “With authentic country flavor, our fluffy buttermilk pancakes are the signature favorite we’re famous for. Order early and often—All-You-Can-Eat Pancakes are unlimited!”

Wait, what are America’s healthcare costs again?

Why, at $852 billion or 25% of all government spending, only the single biggest item in the entire US budget. And growing.

Oh well, that’s some other generation’s problems. But for now, the tapped out US consumer must be fed (any similarity between the verb and an identically spelled noun is purely accidental).

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/y_NeFTlVYf0/story01.htm Tyler Durden

As we reported earlier, 1.5 billion adults around the world, or a whopping one in three, may be obese or overweight. But, as any marketer will tell you, this is merely an untapped opportunity: it simply means that two out of three can still “unobese“. And doing its best to hit the goal of 100% obesity, is IHOP which, for the first time in more than two years, has just unleashed Pancake Pandemonium: “You can choose a stack of five Buttermilk pancakes as a main course or you can opt to add them to a combo which features eggs any style, hash browns, and a choice of pork sausage links, bacon, or ham.” Remember: “With authentic country flavor, our fluffy buttermilk pancakes are the signature favorite we’re famous for. Order early and often—All-You-Can-Eat Pancakes are unlimited!”

Wait, what are America’s healthcare costs again?

Why, at $852 billion or 25% of all government spending, only the single biggest item in the entire US budget. And growing.

Oh well, that’s some other generation’s problems. But for now, the tapped out US consumer must be fed (any similarity between the verb and an identically spelled noun is purely accidental).

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/y_NeFTlVYf0/story01.htm Tyler Durden

As the New Year brings the actual implementation of Obamacare, it appears in reality things are not as great as many were promised. A recent Gallup survey found that only 7% called their Obamacare experience “very positive” with a stunning 29% seeing it “very negative.” But as The Daily Mail found, from Northern Virginia hospitals turning away sick people because they can’t determine whether their Obamacare insurance plans are in effect to high deductibles and long waits for authorizations; as many as one-third of the administration’s claimed 2.1 million enrollees remain unsure of their coverage. The ‘lie of the year’ in 2013 may be even bigger in 2014.

No one knows if they are covered…

Hospital staff in Northern Virginia are turning away sick people on a frigid Thursday morning because they can’t determine whether their Obamacare insurance plans are in effect.

Patients in a close-in DC suburb who think they’ve signed up for new insurance plans are struggling to show their December enrollments are in force, and health care administrators aren’t taking their word for it.

In place of quick service and painless billing, these Virginians are now facing the threat of sticker-shock that comes with bills they can’t afford.

‘They had no idea if my insurance was active or not!’ a coughing Maria Galvez told MailOnline outside the Inova Healthplex facility in the town of Springfield.

She was leaving the building without getting a needed chest x-ray.

‘The people in there told me that since I didn’t have an insurance card, I would be billed for the whole cost of the x-ray,’ Galvez said, her young daughter in tow. ‘It’s not fair – you know, I signed up last week like I was supposed to.’

The x-ray’s cost, she was told, would likely be more than $500.

And no one knows for sure of those who signed up – how many have actually paid?

Galvez said she enrolled in a Carefirst Blue Cross bronze plan at a cost of about $450 per month through healthcare.gov, three days before Christmas.

‘No one has sent me a bill,’ she said.

Health and Human Services Secretary Kathleen Sebelius testified… ‘Some may have paid, some may have not,’

The government’s advice?…

“We’re telling consumers if they’re not sure if they’re enrolled they should call the insurer directly,” White House Press Secretary Jay Carney old reporters on December 2.

But the insurers are overwhelmed by the numbers…

The Washington Post reported that day that because of computer glitches in the ‘back end’ of healthcare.gov, enrollment records for as many as one-third of new insurance customers were corrupted or otherwise contain errors.

Given the Obama administration’s latest claim that 2.1 million have signed up nationwide, that means as many as 700,000 Americans might falsely believe they have a current health insurance policy.

Mary and others like her, who took the time to enroll but may not follow the daily flood of news about Obamacare, likely don’t know one way or the other.

‘Why is this so complicated?’ she asked. ‘I had my own private insurance last year, but they cancelled me in November. I’m not sure which end is up.’

Private industry estimates put the number of policy cancellations as high as 4.7 million in the last quarter of 2013, mostly involving health care plans that didn’t meet the Affordable Care Act’s strict minimum standards.

How Life Changes Affect Your Care?

How Long Will Doctors Keep Providing Service For Free?

President Obama has attracted widespread criticism, and a ‘lie of the year’ award from one newspaper’s fact-checker, for promising that Americans who liked their health plans would be allowed to keep them.

Dr. John Venetos, a Chicago gastroenterologist, told the Associated Press on Thursday that he is seeing ‘tremendous uncertainty and anxiety’ among his patients who signed up for Obamacare plans but don’t have insurance cards.

‘They’re not sure if they have coverage,‘ Venetos said. ‘It puts the heavy work on the physician.’

‘At some point, every practice is going to make a decision about how long can they continue to see these patients for free if they are not getting paid.’

But even then… people have apparently been misled into believing Obamacare is ‘affordable’ – it appears not…

Her Carefirst plan, identified on the Obamacare website as BlueChoice Plus Bronze, carries a $5,500 per-person deductible for 2014 – an amount she would have to pay out-of-pocket before her coverage would apply to medical expenses.

…

A similar situation frustrated Mary, an African-American woman small businesswoman who asked MailOnline not to publish her last name. She was leaving the Inova Alexandria Hospital in Alexandria, Virginia with two family members.

‘I had chest pains last night, and they took me in the emergency room,’ Mary said. ‘They told me they were going to admit me, but when I told them I hadn’t heard from my insurance company since I signed up, they changed their tune.’

She told MailOnline that a nurse advised her that her bill would go up by at least $3,000 if she were admitted for a day, and her doctor told her the decision was up to her.

As Gallup found:

Fifty-nine percent of Americans told Gallup pollsters that they have had negative experiences with the Affordable Care Act, according to the public opinion giant’s latest survey.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/IxdTHtJJfs0/story01.htm Tyler Durden

Submitted by Lance Roberts of STA Wealth Management,

While the markets finished 2013 less than two points from my target of 1850; the start of 2014 was less than exuberant as the markets turned in the steepest loss for the first trading day of a new year since 2008. What does this mean for the rest of 2014? Likely not much. The old Wall Street axioms of "the first 5 trading days" and "so goes January, so goes the year" tend to be statistically more important. However, it did get me thinking about the new year from a more macro perspective. This weekend's "Things To Ponder" is a collection of ideas to get you to do the same.

1) No Catalyst Needed by Henry Blodgett

"I own stocks, so I'm certainly enjoying the advance. But unlike some other investors, I'm not feeling more comfortable as they move higher. Rather, I'm feeling less comfortable.

Why?

Because I do not think that time-tested market valuation measures have recently become out-moded and irrelevant. As I've described, these valuation measures suggest that today's stock prices have gotten so extreme that returns over the next decade are likely to be lousy (less than 2% per year, including dividends). So that's what I'm expecting long-term stock returns from these prices to be.

Now, valuation is not helpful as a market-timing tool, so today's prices do not mean that stocks will crash anytime soon (or ever). Instead, stocks could deliver lousy returns just by moving sideways for a decade.

But anyone who has followed the stock market for a while knows that stock prices do not generally correct valuation extremes by moving sideways. Rather, stocks generally correct sharply.

That's why I've said I think the odds of a market crash are increasing."

The entire article is worth reading, but the key point is that history suggest that corrections can happen without there being some major economic or financial catalysts. Reversions to the mean can, and do, happen throughout history and wreck havoc on individuals retirement goals. Avoid becoming too complacent with the financial markets, and the amount of risk that you are taking within your portfolio.

2) Q&A On The 2014 Outlook by Pragmatic Capitalist

My friend Cullen Roche took a stab at answering 10 questions for 2014.

1. Will the economy accelerate to above-trend growth? No.

2. Will consumer spending improve? Consumer spending is likely to continue stagnating.

3. Will capital expenditures rebound? Corporations are increasingly picking up the slack in the US economy and as has been historically true, as we enter the latter stages of the business cycle, capital expenditures are picking up.

4. Will housing continue to recover? National housing prices have risen too far too fast in many areas of the USA and should see much more modest improvements in the coming years.

5. Will labor force participation rate stabilize? The improvement in the economy combined with the structural negatives do not leave me entirely optimistic that the labor force participation rate will see material improvement in 2014.

6. Will profit margins contract? The likely risk to profit growth and margins is to the downside.

7. Will core inflation stay below the 2% target? I would expect core inflation to remain low as consumer demand for shelter, autos and other core items remains tepid.

8. Will QE3 end in 2014? QE is likely to taper in increasing increments during 2014, but I do not think the Fed will pull the punch bowl away just yet.

9. Will the market point to the first rate hike in 2016? I am going to go way against the consensus here and argue that the next recession is likely to occur before the next rate hike.

10. Will the secular stagnation theme gain more adherents? I think the fragile economy combined with the potential for an overly bullish stock market could pose risks to the economy in the coming years.

3) Gleaning Clues For A Forecast Of Year Ahead via NY Times

Why do we forecast when the majority of forecasts are always wrong? Paul Sullivan explores this idea.

"WHY PREDICT? Whatever its value, the one-year prediction, Mr. Ryan said, is ingrained in who we are as people. 'We account for our life in four seasons," he said. 'What did farmers focus on in the summer? What the fall crop was going to be. What did they focus on in the winter? How much rain they were going to get in the spring. We talk and think in temporal terms. The year ahead — it's always reinforced.'

Others find the exercise of one-year predictions a waste of time. 'Nine out of 10 times when I'm asked what will happen next year, I say stocks will tend to perform along the historical average, which is 10 to 12 percent a year,' said John Buckingham, chief investment officer of Afam Capital and editor of the Prudent Speculator newsletter. 'Have I ever been right? No. I don't care what the market will do. I had an expectation of 12 percent at the beginning of the year, and I was wrong. But I'm up 30 some percent in my portfolios and I'll take that.'

He added that revising predictions during the year could

be equally perilous: 'The best time to get out of equities this year was August. We had Syria, the Fed talking about tapering, a government shutdown and September and October are generally bad months. What happened? We were up 4 percent each month.'

But his biggest worry was the predictions he had seen for another 20 percent increase in stock prices. 'I'd rather have a contrarian view,' he said.

Of course, that is still a prediction, even if it goes against the grain.'"

4) Can The Wall Street Bull Continue Charging In 2014? by Adam Shell, USA Today

"Do U.S. stocks have any rocket fuel left in the tank after skyrocketing to their steepest annual price climb in 16 years?

After posting its best return since 1997, the odds of the broad Standard & Poor's 500 stock index delivering an encore performance of similarly epic proportions in 2014 is unlikely.

Yet, while Wall Street isn't expecting gains of 25% to 30% again in 2014, after a 29.6% return for the S&P 500 index in 2013, most stock market predictions lean bullish. More gains (albeit, less sizable ones) and more record highs are likely. There's a long list of positive propellants working in the stock market's favor."

He specifically notes:

5) On The Other Hand Stocks Could Fall By 20% via Wall Street Journal

"U.S. stocks can't go straight up forever. And if the end of QE1 and QE2 taught investors anything, the market could suffer a significant correction this year as the Federal Reserve starts dialing back its stimulus.

That view comes courtesy of Peter Boockvar, managing director and chief market analyst at the Lindsey Group, who on Thursday predicted the S&P 500 could drop 15% to 20% in 2014 and finish the year between 1550 and 1600.

'QE doesn't create a safer world, it is just a temporary high and the danger always comes on the flip side as previously seen,' he says. 'Let's be honest, we are in an investing world that none of us has ever seen before with central banks around the world being aggressive in concert on a scale never seen.'

'These are not normal times where the ordinary analysis of company fundamentals and the economic and earnings outlook are the main drivers.'

'Our drunken friends have had some cheap thrills in 2013, but this stock market growth rests on an unstable foundation of artificial stimulus and cheap money,' writes Peter Schiff of Euro Pacific Capital. 'We are more interested in waking up without a hangover, a wrecked car, or worse. The longer interest rates remain suppressed, the crazier markets will behave when rates rise.'

'QE puts beer goggles on investors by creating a line of sight where everything looks good, but the Fed's current plan is to end it by year end,' he says. 'While the bull case says this is no problem because it only happens coincident with a better economy, the bond market is repricing the cost of capital higher and that will clear out the goggles as our economy is still very leveraged…and highly dependent on free flowing and abnormally cheap money.'"

Regardless of what actually happens in the year ahead – may your year be healthy, safe and happy.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/A3laUhMYe1w/story01.htm Tyler Durden

Submitted by Lance Roberts of STA Wealth Management,

While the markets finished 2013 less than two points from my target of 1850; the start of 2014 was less than exuberant as the markets turned in the steepest loss for the first trading day of a new year since 2008. What does this mean for the rest of 2014? Likely not much. The old Wall Street axioms of "the first 5 trading days" and "so goes January, so goes the year" tend to be statistically more important. However, it did get me thinking about the new year from a more macro perspective. This weekend's "Things To Ponder" is a collection of ideas to get you to do the same.

1) No Catalyst Needed by Henry Blodgett

"I own stocks, so I'm certainly enjoying the advance. But unlike some other investors, I'm not feeling more comfortable as they move higher. Rather, I'm feeling less comfortable.

Why?

Because I do not think that time-tested market valuation measures have recently become out-moded and irrelevant. As I've described, these valuation measures suggest that today's stock prices have gotten so extreme that returns over the next decade are likely to be lousy (less than 2% per year, including dividends). So that's what I'm expecting long-term stock returns from these prices to be.

Now, valuation is not helpful as a market-timing tool, so today's prices do not mean that stocks will crash anytime soon (or ever). Instead, stocks could deliver lousy returns just by moving sideways for a decade.

But anyone who has followed the stock market for a while knows that stock prices do not generally correct valuation extremes by moving sideways. Rather, stocks generally correct sharply.

That's why I've said I think the odds of a market crash are increasing."

The entire article is worth reading, but the key point is that history suggest that corrections can happen without there being some major economic or financial catalysts. Reversions to the mean can, and do, happen throughout history and wreck havoc on individuals retirement goals. Avoid becoming too complacent with the financial markets, and the amount of risk that you are taking within your portfolio.

2) Q&A On The 2014 Outlook by Pragmatic Capitalist

My friend Cullen Roche took a stab at answering 10 questions for 2014.

1. Will the economy accelerate to above-trend growth? No.

2. Will consumer spending improve? Consumer spending is likely to continue stagnating.

3. Will capital expenditures rebound? Corporations are increasingly picking up the slack in the US economy and as has been historically true, as we enter the latter stages of the business cycle, capital expenditures are picking up.

4. Will housing continue to recover? National housing prices have risen too far too fast in many areas of the USA and should see much more modest improvements in the coming years.

5. Will labor force participation rate stabilize? The improvement in the economy combined with the structural negatives do not leave me entirely optimistic that the labor force participation rate will see material improvement in 2014.

6. Will profit margins contract? The likely risk to profit growth and margins is to the downside.

7. Will core inflation stay below the 2% target? I would expect core inflation to remain low as consumer demand for shelter, autos and other core items remains tepid.

8. Will QE3 end in 2014? QE is likely to taper in increasing increments during 2014, but I do not think the Fed will pull the punch bowl away just yet.

9. Will the market point to the first rate hike in 2016? I am going to go way against the consensus here and argue that the next recession is likely to occur before the next rate hike.

10. Will the secular stagnation theme gain more adherents? I think the fragile economy combined with the potential for an overly bullish stock market could pose risks to the economy in the coming years.

3) Gleaning Clues For A Forecast Of Year Ahead via NY Times

Why do we forecast when the majority of forecasts are always wrong? Paul Sullivan explores this idea.

"WHY PREDICT? Whatever its value, the one-year prediction, Mr. Ryan said, is ingrained in who we are as people. 'We account for our life in four seasons," he said. 'What did farmers focus on in the summer? What the fall crop was going to be. What did they focus on in the winter? How much rain they were going to get in the spring. We talk and think in temporal terms. The year ahead — it's always reinforced.'

Others find the exercise of one-year predictions a waste of time. 'Nine out of 10 times when I'm asked what will happen next year, I say stocks will tend to perform along the historical average, which is 10 to 12 percent a year,' said John Buckingham, chief investment officer of Afam Capital and editor of the Prudent Speculator newsletter. 'Have I ever been right? No. I don't care what the market will do. I had an expectation of 12 percent at the beginning of the year, and I was wrong. But I'm up 30 some percent in my portfolios and I'll take that.'

He added that revising predictions during the year could be equally perilous: 'The best time to get out of equities this year was August. We had Syria, the Fed talking about tapering, a government shutdown and September and October are generally bad months. What happened? We were up 4 percent each month.'

But his biggest worry was the predictions he had seen for another 20 percent increase in stock prices. 'I'd rather have a contrarian view,' he said.

Of course, that is still a prediction, even if it goes against the grain.'"

4) Can The Wall Street Bull Continue Charging In 2014? by Adam Shell, USA Today

"Do U.S. stocks have any rocket fuel left in the tank after skyrocketing to their steepest annual price climb in 16 years?

After posting its best return since 1997, the odds of the broad Standard & Poor's 500 stock index delivering an encore performance of similarly epic proportions in 2014 is unlikely.

Yet, while Wall Street isn't expecting gains of 25% to 30% again in 2014, after a 29.6% return for the S&P 500 index in 2013, most stock market predictions lean bullish. More gains (albeit, less sizable ones) and more record highs are likely. There's a long list of positive propellants working in the stock market's favor."

He specifically notes:

5) On The Other Hand Stocks Could Fall By 20% via Wall Street Journal

"U.S. stocks can't go straight up forever. And if the end of QE1 and QE2 taught investors anything, the market could suffer a significant correction this year as the Federal Reserve starts dialing back its stimulus.

That view comes courtesy of Peter Boockvar, managing director and chief market analyst at the Lindsey Group, who on Thursday predicted the S&P 500 could drop 15% to 20% in 2014 and finish the year between 1550 and 1600.

'QE doesn't create a safer world, it is just a temporary high and the danger always comes on the flip side as previously seen,' he says. 'Let's be honest, we are in an investing world that none of us has ever seen before with central banks around the world being aggressive in concert on a scale never seen.'

'These are not normal times where the ordinary analysis of company fundamentals and the economic and earnings outlook are the main drivers.'

'Our drunken friends have had some cheap thrills in 2013, but this stock market growth rests on an unstable foundation of artificial stimulus and cheap money,' writes Peter Schiff of Euro Pacific Capital. 'We are more interested in waking up without a hangover, a wrecked car, or worse. The longer interest rates remain suppressed, the crazier markets will behave when rates rise.'

'QE puts beer goggles on investors by creating a line of sight where everything looks good, but the Fed's current plan is to end it by year end,' he says. 'While the bull case says this is no problem because it only happens coincident with a better economy, the bond market is repricing the cost of capital higher and that will clear out the goggles as our economy is still very leveraged…and highly dependent on free flowing and abnormally cheap money.'"

Regardless of what actually happens in the year ahead – may your year be healthy, safe and happy.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/A3laUhMYe1w/story01.htm Tyler Durden