Submitted by Charles Hugh-Smith via OfTwoMinds blog,

Memo to the D.C. Beltway/mainstream media apologists and propagandists: the 25 million Invisible Americans are no longer buying your shuck-and-jive con job.

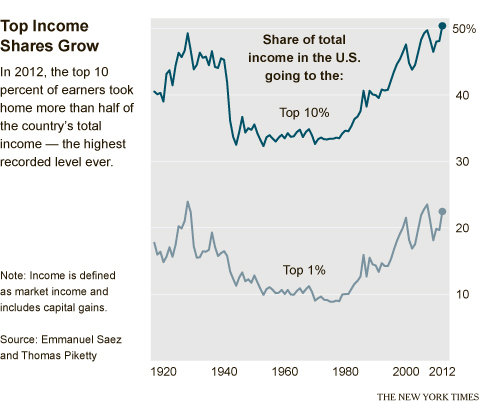

For the bottom 90% of American households, the "prosperity" of the "recovery" since 2009 is a bright shining lie. The phrase is from a history of the Vietnam War, A Bright Shining Lie: John Paul Vann and America in Vietnam.

Just as the Vietnam War was built on lies, propaganda, PR and rigged statistics (the infamous body counts–civilians killed as "collateral damage" counted as "enemy combatants"), so too is the "recovery" nothing but a pathetic tissue of PR, propaganda and lies. I have demolished the bogus 5.3% "increase" in median household income, the equally bogus "official inflation" body counts, oops I mean statistics, and the bogus unemployment rate:

Fun with Fake Statistics: The 5% "Increase" in Median Household Income Is Pure Illusion (September 19, 2016)

What's the Real Unemployment Rate? That's the Wrong Question (September 14, 2016)

Could Inflation Break the Back of the Status Quo? (August 5, 2016)

Revealing the Real Rate of Inflation Would Crash the System (August 3, 2016)

Inflation Hidden in Plain Sight (August 2, 2016)

The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016)

I'm not the only one calling the "recovery" a lie: the chairman of Gallup, Jim Clifton, recently unloaded on the "recovery":

The Invisible American.

"I've been reading a lot about a "recovering" economy. It was even trumpeted on Page 1 of The New York Times and Financial Times last week. I don't think it's true.

The percentage of Americans who say they are in the middle or upper-middle class has fallen 10 percentage points, from a 61% average between 2000 and 2008 to 51% today."

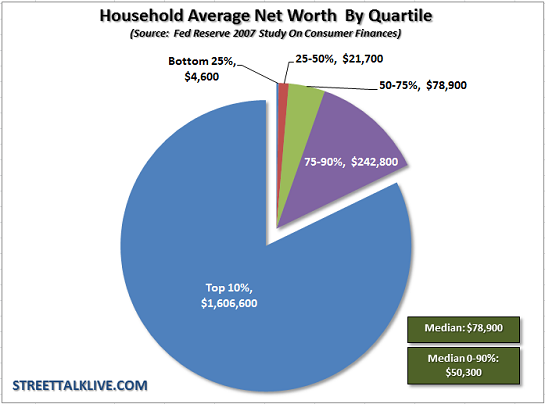

Now that is a self-reported number. The reality is much worse: only 20% of American households possess the income and assets that characterize the middle class in financial terms. Granted, someone making $28,000 a year can self-identify as middle class, but if we look at basic metrics of financial security, they're not even close.

I have analyzed this in depth for years:

The Three-and-a-Half Class Society (October 22, 2012)

What Does It Take To Be Middle Class? (December 5, 2013)

The Destabilizing Truth: Only the Wealthy Can Afford a Middle Class Lifestyle (May 6, 2014)

America's Nine Classes: The New Class Hierarchy (April 29, 2014)

We got your "middle class" right here: see that little green slice of the pie? The upper middle class is the purple slice, and the top 10% is blue (most of this wealth is held by the top 1% and top 5%.)

Jim Clifton calls those who have been pushed out of the middle class Invisible Americans: here is his report:

"Ten percent of 250 million adults in the U.S. is 25 million people whose economic lives have crashed.

What the media is missing is that these 25 million people are invisible in the widely reported 4.9% official U.S. unemployment rate.

Let's say someone has a good middle-class job that pays $65,000 a year. That job goes away in a changing, disrupted world, and his new full-time job pays $14 per hour — or about $28,000 per year. That devastated American remains counted as "full-time employed" because he still has full-time work — although with drastically reduced pay and benefits. He has fallen out of the middle class and is invisible in current reporting.

More disastrous is the emotional toll on the person — the sudden loss of household income can cause a crash of self-esteem and dignity, leading to an environment of desperation that we haven't seen since the Great Depression.

Millions of Americans, even if they themselves are gainfully employed in good jobs, are just one degree away from someone who is experiencing either unemployment, underemployment or falling wages. We know them all."

This is where the bright shining lies come in. The worker now earning $28,000 annually is counted as employed, but there is no official metric for the household's increasing insecurity and loss of opportunity.

Even worse, nobody tracks the erosion of benefits. Not only has nominal pay plummeted from $65,000 to $28,000, the deductions for the employee's share of healthcare insurance have skyrocketed, along with co-pays for meds, visits to a doctor, eyewear, etc.

The lucky employees may still receive the benefit of matching 401K retirement funds from the employer, but the matching sums have declined.

This is death by a thousand cuts. According to a report by the St. Louis Federal Reserve, real (adjusted for official inflation) wages have risen a mere 3% since 1970–46 years ago.

Could the 25 million Invisible Americans be the key swing demographic in the upcoming presidential election? As I noted in What If We're in a Depression But Don't Know It? (September 23, 2016), The top 5% of households that dominate government, Corporate America, finance, the Deep State and the media have been doing extraordinarily well during the past eight years of "recovery," and so they report that the economy is doing splendidly because they've done splendidly.

The gulf between reality and the official happy story of "recovery" spewed by the status quo's well-paid army of apparatchiks, flunkies, flacks, hacks, toadies, lackeys and functionaries gorging at the trough of the status quo is widening to the point of surrealism. Memo to the D.C. Beltway/mainstream media apologists and propagandists: the 25 million Invisible Americans are no longer buying your shuck-and-jive con job.

via http://ift.tt/2cKSQx8 Tyler Durden

Archaeology students at University College London are excused from attending any lectures that might disturb them.