Authored by Jeffrey Snider via Alhambra Investment Partners,

We don’t live in a perfect world by any means. Because of that, it may from time to time seem like mere noise when something just doesn’t to fit. There will always be irregularities in life, the inherent nature of humanity inherent in the systems humans create. Thus, it pays to remember not to let perfection become the enemy of good.

Even with that in mind, however, the current circumstances are being described as good not set against perfection but compared only with the worst. Upending that conventional wisdom, the economy in particularly is always judged from whatever trough rather than more appropriately to any prior peak. It’s easy to declare things are good compared to 2009, or even early last year; and it’s just as meaningless to say so.

There is, it seems, no compass with which to guide natural opinion on the subject. This isn’t a surprising result, if for no other reason than the uniqueness of the times. There aren’t many left from the generation who experienced the Great Depression, and so for the overwhelming majority of people especially in the developed world there is simply no personal frame of reference. It used to be enough that the “right” people would describe these sorts of conditions taken immediately at face value, but there has been a palpable disconnect that has left an indelible public perception that the experts have had it all wrong, and continue to be wrong even now.

The story isn’t playing out as expected this year, as investors and analysts navigate a slew of forces beyond just the path of short-term rates — faltering inflation data, waning confidence in Donald Trump’s agenda, haven demand and a growing conviction that the bond market will smoothly digest the transition to a smaller Fed balance sheet.

Not that long ago it was common for the third time to hear “interest rates have nowhere to go but up.” And each time that rallying cry of optimism is sounded the bond market is lower in yield than the last. It is perhaps not the most prominent and widely followed signal, but it is the most resolute and clear. The yield curve describes the economy particular the one expected in the near and intermediate future, and what it says today is unambiguous about the global state of economic affairs; “something” is still wrong. Liquidity preferences continue to be the dominant setting.

We can look to other places to confirm that diagnosis, a plethora of imperfections that in isolation would be curious oddities but all together describe a horrific imprint way worse than any single business cycle. The oil market was one of the chief symptoms of the “rising dollar”, whose crash in early 2015 was a prominent rejoinder to the mainstream narrative. It is ridiculous to try to claim the economy is about to take off at the same time as an outright collapse in crude, and those that tried in short order realized just how ridiculous it was.

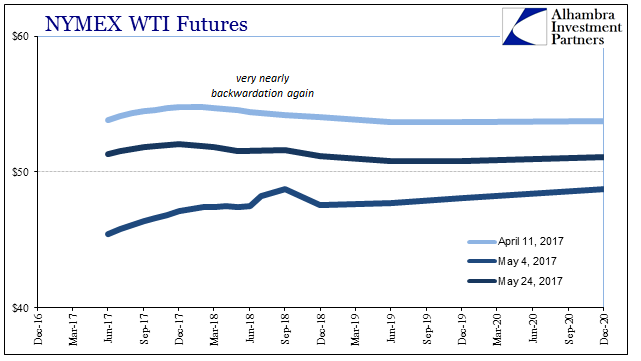

While there is a focus again on the oil price now as it is up from its trough last year, that indication was not alone the signal for distress. The futures curve went from its normal backwardation in the summer of 2014 to often unbelievably sharp contango. Despite the price drop which should have induced a pickup in demand as economics (small “e”) says, after just about three years the futures curve remains in contango. Even OPEC, they of the “supply glut” narrative feeding the one about “transitory”, now realizes it was always ever demand.

A more esoteric sign of great imbalance is swap spreads. It might be the most poorly understood given its complexity and situation far from everyday life, but swap spreads in general get our perceptions closer to the source. An interest rate swap is quoted by its fixed leg (an interest swap is itself an exchange of fixed payments for floating). Thus, in one sense it is a synthetic bond, with a coupon paid by a counterparty without a legal obligation to the notional value. If your choice is to repo a UST, which is free from credit risk, or engage in a synthetic bond (the floating rate payment mimics the repo aspect conceptually if more complicated in practice) you undertake the latter only if it pays for the increased risk of receiving the fixed payment from a financial counterparty rather than the US government.

The swap spread, the difference between the interest rate swap price (the fixed leg quote) and the same maturity UST, tells us about market perceptions of risk in terms of those swap counterparties paying fixed. Given that hierarchy, a negative swap spread, where the interest rate swap is priced below the same maturity UST yield, can only be gibberish, nonsense. There isn’t any realistic scenario where the credit markets would view largely bank and big name financials (like pension funds, insurance companies, and corporate treasuries) as less risky than the US government. If the US government has gotten itself into such a state where that might be possible, then those other counterparties would have been much worse off long before that point.

Therefore the nonsense of a negative swap spread is not purely so but rather meaningful in one vital respect. What it describes is not the same set of risks one way or the other but another more sinister one unrelated to comparable credit risks. If the market rate is paying less than UST yields at whatever maturity, or, as in 2015-16, almost all maturities (down to the 2-year), then there is open an immense arbitrage opportunity. Several if not dozens of trades (using the reverse of the synthetic repo paradigm) can be constructed to take advantage of the nonsense, all of which would be at close to zero risk.

While they would be free of risk, they are not free of every consideration. For the money dealers who are supposed to police this established hierarchy (covered interest parity), there are balance sheet considerations of all sorts, from capital ratio effects to VaR and other specific risk metrics. In a world where balance sheet risk capacity is not so freely traded, meaning volatility far more uncertain, while a negative swap spread represents the possibility of “free money” it might still be “too expensive” to undertake.

Given that demand on the fixed side is somewhat inflexible (the liability management of pension funds and insurance companies), a negative swap spread is indicative of the absence of dealers in that space because of those balance sheet constraints. Far from being totally nonsense, the appearance of a negative swap spread tells us that “something” is wrong deep inside the mathematics of wholesale banking. That swap spreads might persist as nonsense negative for so long, years even, tell us that “something” is fundamentally and structurally wrong deep inside the mathematics of what is the true global money system.

There is actually an economic equivalent to the negative swap spread, one that at first might be surprising. Deployed so easily and readily to fit the mainstream idea of an improving if not healthy economy, the unemployment rate upon closer inspection demonstrates instead the nature of its sickness. At such a low level, there should have been long before now significant wage acceleration due again to basic economics. Instead, economists and policymakers have for years now only been able to see “signs” of hastening.

Like a negative swap spread then, an extremely low unemployment rate that produces no wage inflation (at the point it happens let alone across several years) is similarly meaningful nonsense that points us in the direction of causation. Unlike swap spreads, the mystery of the unemployment rate is easily untangled; it applies to the official count of the employed as a percent of the official count of the labor force. If the latter is not comprehensive, neither can be the unemployment rate.

Therefore, a rate that signifies “full employment” but without the inflationary corroboration of that actual condition is instead describing an economy that shrunk apart from official acknowledgement. Ever since the mass layoffs in late 2008, economists have been telling us that those people outside the labor force don’t matter, at the very least for interpretation. But if you have to so fool yourself into rejecting what is a matter of pure common sense, then your position really is nonsense.

We have interest rates that don’t go up apart from brief but diminishing bursts despite the Federal Reserve’s “rate hikes”, an oil futures curve that after three years remains in contango, an interest rate swap paradigm declaring permanent nonsense, and an unemployment rate doing the same. None of these are trivial concerns, instead speaking directly about the real physical world behind the façade of mainstream description. Improving or healthy are economic qualifiers that would in the future only start to apply where all these imbalances have finally dissipated and disappeared for good.

After ten years now we are still stuck with them, a thoroughly disheartening picture of reality. To be cute, there is good reason why they used to call it depression.

via http://ift.tt/2rhP04b Tyler Durden