A controversial Republican president, who had squeaked into office after a famously tumultuous campaign then kept fanning the flames of a hate-hate relationship with coastal elites despite being one himself, prepared to deliver his first official State of the Union address to a restive Congress. So what, in those divisive times, did Richard Nixon say?

A controversial Republican president, who had squeaked into office after a famously tumultuous campaign then kept fanning the flames of a hate-hate relationship with coastal elites despite being one himself, prepared to deliver his first official State of the Union address to a restive Congress. So what, in those divisive times, did Richard Nixon say?

Plenty of things that would surprise modern listeners, accustomed as we are to the caricature of the 37th president as a constantly paranoid, strategically racist, law-breaking ogre. “It is no longer enough to live and let live,” he said at one of many hippie-lite portions of the speech. “Now we must live and help live.”

But the heart of Nixon’s address, bracketed by calls for Washington to be far more humble both here and abroad (!), were two big initiatives that ended up affecting millions of lives. One was his famous/infamous declaration of a “War on Crime.” The other was a set of ideas, taking up more than 30 paragraphs in the speech, that would eventually find expression in The Clean Air Act of 1970, which created the Environmental Protection Agency. “The great question of the seventies,” Nixon posited, “is: shall we surrender to our surroundings, or shall we make our peace with nature and begin to make reparations for the damage we have done to our air, to our land, and to our water?”

We almost certainly won’t be getting such far-reaching proposals in Donald Trump’s speech tonight, in no small part because Congress has lost most of its ability to do anything routine, let alone big. Surfing through the year-one SOTUs of presidents over the past century there are a surprising (to modern ears) number of extended riffs on laws that ended up passing—from Warren Harding’s Immigration Act of 1924 (actually signed into law by Calvin Coolidge) to Bill Clinton’s welfare reform to Barack Obama’s Affordable Care Act.

But there are also themes that come up in almost every speech, regardless of power. Washington really needs to prune regulations, cut taxes, and devolve power to the states, said Jimmy Carter, Clinton, Obama, and most of the Republicans listed below. At the same time, the federal government needs to get more involved with fighting crime and improving education.

And while Nixon is everyone’s go-to comp for Trump nowadays, there are important differences. Tricky Dick was nobody’s political outsider, for starters, having served as a two-term vice president and high-profile senator. And as the Me Decade began he was a popular president (approval ratings in the low 60s) with an overwhelmingly Democratic Congress, not a historically unpopular chief executive nursing a fragile majority.

If anyone’s year-one SOTU synched up with Trump it was Warren G. Harding’s, with its enthusiasm for tariffs, atavistic support for a Prohibition that was already leaking public support, and barely concealed hostility to “the alien who has come to our shores” and the “recrudescence of hyphenated Americanism.”

At any rate, there are lessons to be learned and historical curios to be mined from the ceremonial speeches of former presidents. The passage of time lets us see clearer the hubris of trying to shape human behavior from the White House, while also reminding us that some important aspects of both Trumpism and libertarianism always seem to lurk in American oratory and policy.

So, starting with Nixon (because it’s been that kind of fortnight), but then running in chronological order, here are some teachable highlights from the one-year anniversary State of the Union speeches of presidents over the past century. Omitted were those who (honorably!) delivered their reports in writing (Calvin Coolidge, Herbert Hoover), those who dwelled on recent calamities (Franklin Roosevelt‘s Great Depression, George W. Bush‘s 9/11) or triumphs (George H.W. Bush‘s collapse of communism). Let’s get started:

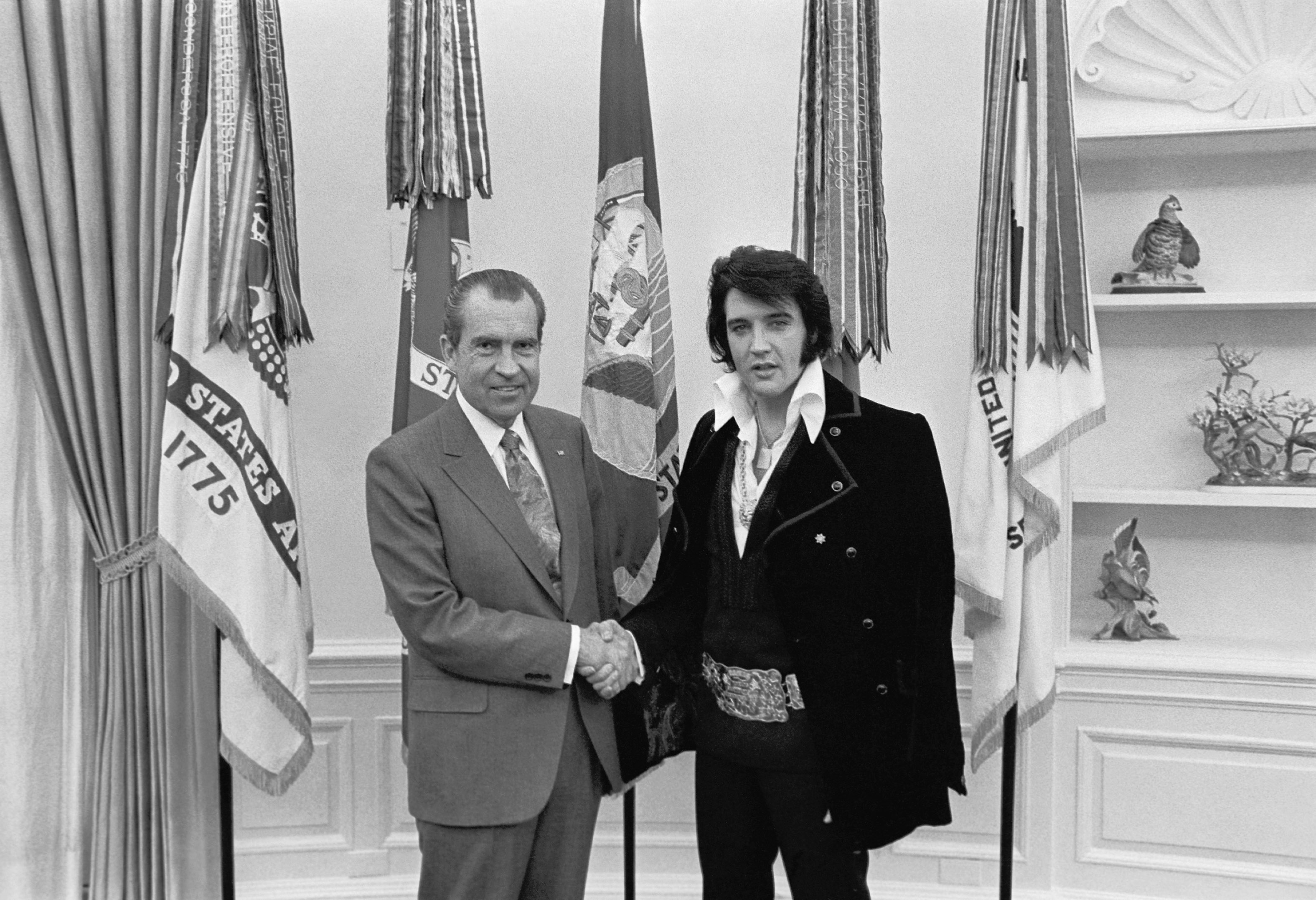

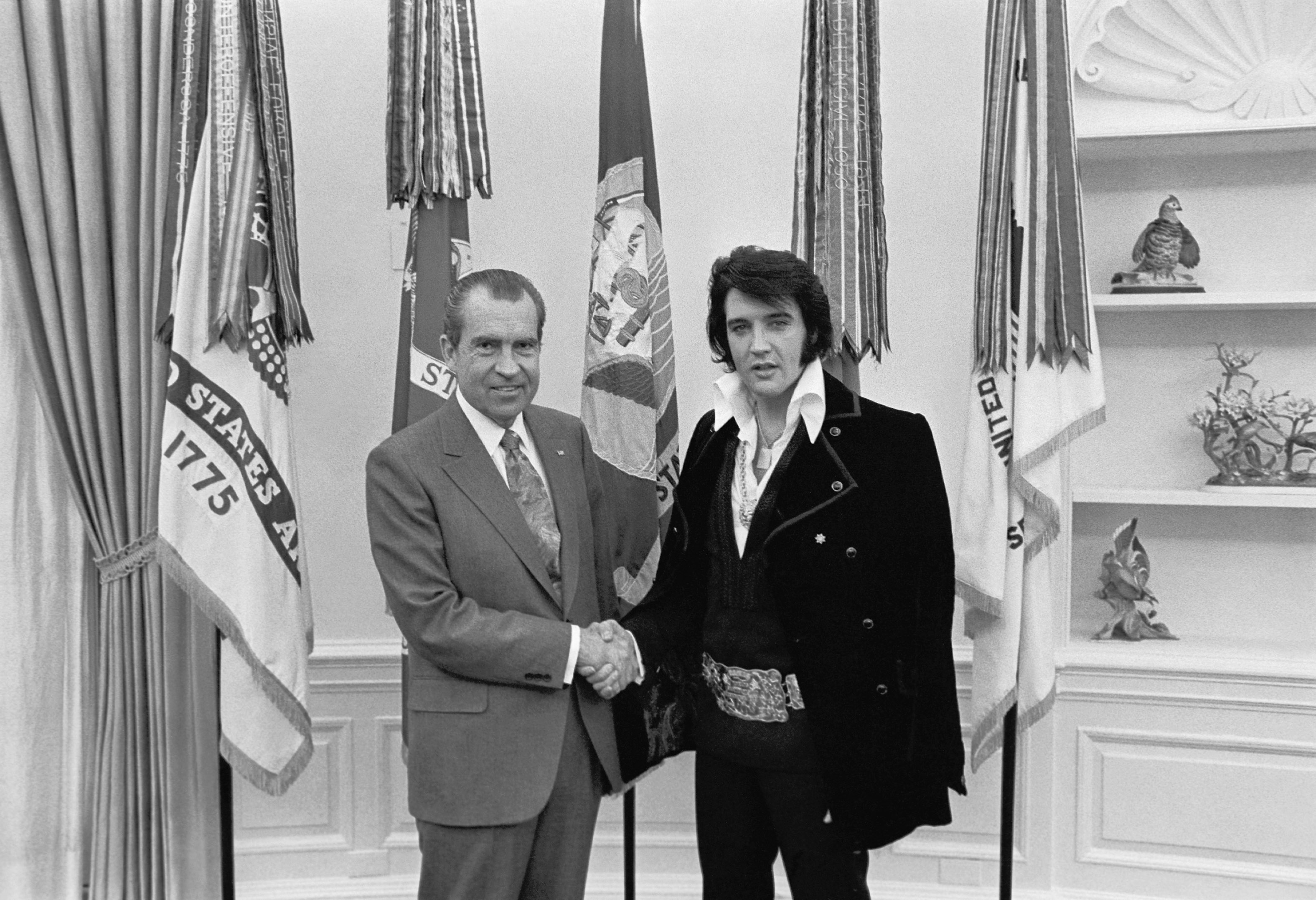

RICHARD NIXON, 1970

RICHARD NIXON, 1970

Approval rating: First-year average, 61 percent. One-year anniversary: 63 percent.

Congressional support for the president’s party: 43-57 in the Senate, 192-243 in the House.

Biggest topic: Environmental protection.

Whatever, proto-Trump!: “The violent and decayed central cities of our great metropolitan complexes are the most conspicuous area of failure in American life today.”

Closet libertarianism alert: “It is time for a New Federalism, in which, after 190 years of power flowing from the people and local and State governments to Washington, D.C., it will begin to flow from Washington back to the States and to the people of the United States.”

Unintentional lesson about the futility of central planning:

I propose that before these problems become insoluble, the Nation develop a national growth policy.

In the future, government decisions as to where to build highways, locate airports, acquire land, or sell land should be made with a clear objective of aiding a balanced growth for America.

In particular, the Federal Government must be in a position to assist in the building of new cities and the rebuilding of old ones.

Wait, he really said that?: “Neither the defense nor the development of other nations can be exclusively or primarily an American undertaking. The nations of each part of the world should assume the primary responsibility for their own well-being; and they themselves should determine the terms of that well-being.”

Bonus speechifying flourish: “The seventies will be a time of new beginnings, a time of exploring both on the earth and in the heavens, a time of discovery.”

*

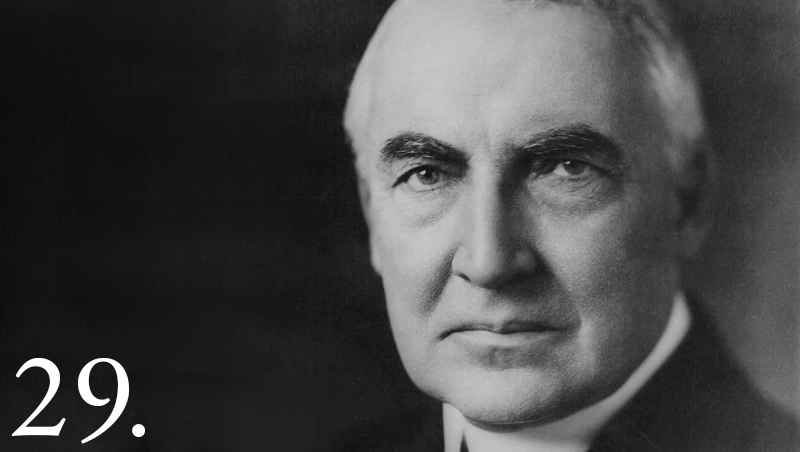

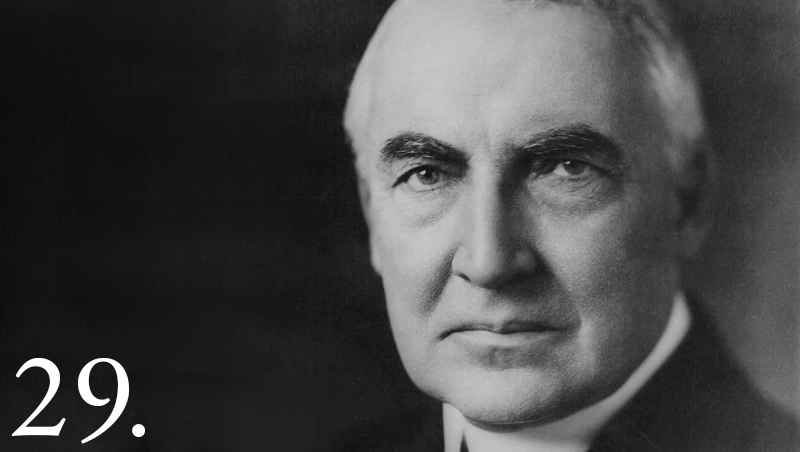

WARREN G. HARDING, 1922

WARREN G. HARDING, 1922

Congressional support for the president’s party: 59-37 in the Senate, 302-131 (!) in the House.

Biggest topic: Coal and railway strikes.

Whatever, proto-Trump!:

There is the recrudescence of hyphenated Americanism which we thought to have been stamped out when we committed the Nation, life and soul, to the World War. There is a call to make the alien respect our institutions while he accepts our hospitality. There is need to magnify the American viewpoint to the alien who seeks a citizenship among us. There is need to magnify the national viewpoint to Americans throughout the land. More there is a demand for every living being in the United States to respect and abide by the laws of the Republic.

There are pending bills for the registration of the alien who has come to our shores. I wish the passage of such an act might be expedited. Life amid American opportunities is worth the cost of registration if it is worth the seeking, and the Nation has the right to know who are citizens in the making or who live among us anti share our advantages while seeking to undermine our cherished institutions. This provision will enable us to guard against the abuses in immigration, checking the undesirable whose irregular Willing is his first violation of our laws. More, it will facilitate the needed Americanizing of those who mean to enroll as fellow citizens.

Before enlarging the immigration quotas we had better provide registration for aliens, those now here or continually pressing for admission, and establish our examination boards abroad, to make sure of desirables only. By the examination abroad we could end the pathos at our ports, when men and women find our doors closed, after long voyages and wasted savings, because they are unfit for admission It would be kindlier and safer to tell them before they embark.

Closet libertarianism alert: “I bring you no apprehension of war. The world is abhorrent of it, and our own relations are not only free from every threatening cloud, but we have contributed our larger influence toward making armed conflict less likely.”

Unintentional lesson about the futility of central planning: There are so many to choose from (see below). But this one’s rich: “The motor car…long ago ran down Simple Living, and never halted to inquire about the prostrate figure which fell as its victim. With full recognition of motor-car transportation we must turn it to the most practical use. It can not supersede the railway lines, no matter how generously we afford it highways out of the Public Treasury…. Costly highways ought to be made to serve as feeders rather than competitors of the railroads, and the motor truck should become a coordinate factor in our great distributing system.”

Wait, he really said that?: “The day is unlikely to come when the eighteenth amendment will be repealed. The fact may as well be recognized and our course adapted accordingly.”

Bonus speechifying flourish: “It is an impotent civilization and an inadequate government which lacks the genius and the courage to guard against such a menace to public welfare as we experienced last summer.”

*

DWIGHT EISENHOWER, 1954

DWIGHT EISENHOWER, 1954

Approval rating: First-year average, 69 percent. One-year anniversary: 69 percent.

Congressional support for the president’s party: 48-47 in the Senate, 221-213 in the House.

Biggest topic: Foreign policy/military preparedness.

Whatever, proto-Trump!:

Under the standards established for the new employee security program, more than 2,200 employees have been separated from the Federal government. Our national security demands that the investigation of new employees and the evaluation of derogatory information respecting present employees be expedited and concluded at the earliest possible date. […]

From the special employment standards of the Federal government I turn now to a matter relating to American citizenship. The subversive character of the Communist Party in the United States has been clearly demonstrated in many ways, including court proceedings. We should recognize by law a fact that is plain to all thoughtful citizens that we are dealing here with actions akin to treason—that when a citizen knowingly participates in the Communist conspiracy he no longer holds allegiance to the United States.

Closet libertarianism alert: “The nation has just completed the most prosperous year in its history. The damaging effect of inflation on the wages, pensions, salaries and savings of us all has been brought under control. Taxes have begun to go down. The cost of our government has been reduced and its work proceeds with some 183,000 fewer employees; thus the discouraging trend of modern governments toward their own limitless expansion has in our case been reversed. The cost of armaments becomes less oppressive as we near our defense goals; yet we are militarily stronger every day.”

Unintentional lesson about the futility of central planning: “I shall ask the Congress to authorize continued material assistance to hasten the successful conclusion of the struggle in Indo-china. This assistance will also bring closer the day when the Associated States may enjoy the independence already assured by France.”

Wait, he really said that?: “Because of the present need for revenue the corporation income tax should be kept at the current rate of 52% for another year[.]”

Bonus speechifying flourish: “I am flatly opposed to the socialization of medicine. The great need for hospital and medical services can best be met by the initiative of private plans.”

*

JOHN F. KENNEDY, 1962

JOHN F. KENNEDY, 1962

Approval rating: First-year average, 76 percent. One-year anniversary: 79 percent.

Congressional support for the president’s party: 65-35 in the Senate, 264-173 in the House.

Biggest topic: Fighting the Cold War.

Whatever, proto-Trump!: “[We need] to stop the waste of able-bodied men and women who want to work, but whose only skill has been replaced by a machine, or moved with a mill, or shut down with a mine.”

Closet libertarianism alert: “[I]t is not our military might, or our higher standard of living, that has most distinguished us from our adversaries. It is our belief that the state is the servant of the citizen and not his master…. We can welcome diversity—the Communists cannot. For we offer a world of choice—they offer the world of coercion. And the way of the past shows dearly that freedom, not coercion, is the wave of the future.”

Unintentional lesson about the futility of central planning: “A satisfactory settlement in Laos would also help to achieve and safeguard the peace in Viet-Nam—where the foe is increasing his tactics of terror—where our own efforts have been stepped up—and where the local government has initiated new programs and reforms to broaden the base of resistance. The systematic aggression now bleeding that country is not a ‘war of liberation’—for Viet-Nam is already free. It is a war of attempted subjugation—and it will be resisted.”

Wait, he really said that?: “‘Civilization,'” said H. G. Wells, ‘is a race between education and catastrophe.’ It is up to you in this Congress to determine the winner of that race.”

Bonus speechifying flourish: “And I have found—as I am sure you have, in your travels—that people everywhere, in spite of occasional disappointments, look to us—not to our wealth or power, but to the splendor of our ideals. For our Nation is commissioned by history to be either an observer of freedom’s failure or the cause of its success. Our overriding obligation in the months ahead is to fulfill the world’s hopes by fulfilling our own faith.”

*

JIMMY CARTER, 1978

JIMMY CARTER, 1978

Approval rating: First-year average, 62 percent. One-year anniversary: 52 percent.

Congressional support for the president’s party: 61-39 in the Senate, 292-143 in the House.

Biggest topic: Reforming government.

Whatever, proto-Trump!: “Our trade deficit is too large….[F]ree trade must also be fair trade. And I am determined to protect American industry and American workers against foreign trade practices which are unfair or illegal.”

Closet libertarianism alert:

[W]e really need to realize that there is a limit to the role and the function of government. Government cannot solve our problems, it can’t set our goals, it cannot define our vision. Government cannot eliminate poverty or provide a bountiful economy or reduce inflation or save our cities or cure illiteracy or provide energy. And government cannot mandate goodness. Only a true partnership between government and the people can ever hope to reach these goals.

Those of us who govern can sometimes inspire, and we can identify needs and marshal resources, but we simply cannot be the managers of everything and everybody. […]

We have also proposed abolishing almost 500 Federal advisory and other commissions and boards. But I know that the American people are still sick and tired of Federal paperwork and redtape. Bit by bit we are chopping down the thicket of unnecessary Federal regulations by which Government too often interferes in our personal lives and our personal business. We’ve cut the public’s Federal paperwork load by more than 12 percent in less than a year. And we are not through cutting.

Unintentional lesson about the futility of central planning: “[T]he greatest future contribution that America can make to the world economy would be an effective energy conservation program here at home.”

Wait, he really said that?: “Federal spending has taken a steadily increasing portion of what Americans produce. Our new budget reverses that trend, and later I hope to bring the Government’s toll down even further. And with your help, we’ll do that. In time of high employment and a strong economy, deficit spending should not be a feature of our budget.”

Bonus speechifying flourish: n/a

*

RONALD REAGAN, 1982

RONALD REAGAN, 1982

Approval rating: First-year average, 57 percent. One-year anniversary: 49 percent.

Congressional support for the president’s party: 53-46 in the Senate, 191-244 in the House.

Biggest topic: Economic recovery/restructuring.

Whatever, proto-Trump!: “What we do and say here will make all the difference to autoworkers in Detroit, lumberjacks in the Northwest, steelworkers in Steubenville who are in the unemployment lines; to black teenagers in Newark and Chicago; to hard-pressed farmers and small businessmen; and to millions of everyday Americans who harbor the simple wish of a safe and financially secure future for their children.”

Closet libertarianism alert:

Together, we not only cut the increase in government spending nearly in half, we brought about the largest tax reductions and the most sweeping changes in our tax structure since the beginning of this century. And because we indexed future taxes to the rate of inflation, we took away government’s built-in profit on inflation and its hidden incentive to grow larger at the expense of American workers….

Together, we have cut the growth of new Federal regulations nearly in half. In 1981 there were 23,000 fewer pages in the Federal Register, which lists new regulations, than there were in 1980. By deregulating oil we’ve come closer to achieving energy independence and helped bring down the cost of gasoline and heating fuel….

We must cut out more nonessential government spending and rout out more waste, and we will continue our efforts to reduce the number of employees in the Federal work force by 75,000.

Unintentional lesson about the futility of central planning: “The policies we have in place will reduce the deficit steadily, surely, and in time, completely.”

Wait, he really said that?: “The budget plan I submit to you on February 8th will realize major savings by dismantling the Departments of Energy and Education and by eliminating ineffective subsidies for business.”

Bonus speechifying flourish: “In the face of a climate of falsehood and misinformation, we’ve promised the world a season of truth—the truth of our great civilized ideas: individual liberty, representative government, the rule of law under God. We’ve never needed walls or minefields or barbed wire to keep our people in. Nor do we declare martial law to keep our people from voting for the kind of government they want.”

*

BILL CLINTON, 1994

BILL CLINTON, 1994

Approval rating: First-year average, 49 percent. One-year anniversary: 54 percent.

Congressional support for the president’s party: 57-43 in the Senate, 258-176 in the House.

Biggest topic: Health care reform.

Whatever, proto-Trump!: “But while Americans are more secure from threats abroad, I think we all know that in many ways we are less secure from threats here at home. Every day the national peace is shattered by crime. In Petaluma, California, an innocent slumber party gives way to agonizing tragedy for the family of Polly Klaas. An ordinary train ride on Long Island ends in a hail of 9-millimeter rounds….Right here in our Nation’s Capital, a brave young man named Jason White, a policeman, the son and grandson of policemen, is ruthlessly gunned down. Violent crime and the fear it provokes are crippling our society, limiting personal freedom, and fraying the ties that bind us. […]

“[T]hose who commit repeated violent crimes should be told, ‘When you commit a third violent crime, you will be put away, and put away for good; three strikes and you are out.'”

Closet libertarianism alert:

Last year we began to put our house in order by tackling the budget deficit that was driving us toward bankruptcy. We cut $255 billion in spending, including entitlements, and over 340 separate budget items. We froze domestic spending and used honest budget numbers.

Led by the Vice President, we launched a campaign to reinvent Government. We cut staff, cut perks, even trimmed the fleet of Federal limousines. After years of leaders whose rhetoric attacked bureaucracy but whose action expanded it, we will actually reduce it by 252,000 people over the next 5 years. By the time we have finished, the Federal bureaucracy will be at its lowest point in 30 years. […]

Next month I will send you one of the toughest budgets ever presented to Congress. It will cut spending in more than 300 programs, eliminate 100 domestic programs, and reform the ways in which governments buy goods and services. This year we must again make the hard choices to live within the hard spending ceilings we have set. We must do it.

Unintentional lesson about the futility of central planning: “[T]his year, we will make history by reforming the health care system.”

Wait, he really said that?: “And the Vice President is right, we must also work with the private sector to connect every classroom, every clinic, every library, every hospital in America into a national information superhighway by the year 2000. Think of it: Instant access to information will increase productivity, will help to educate our children. It will provide better medical care. It will create jobs. And I call on the Congress to pass legislation to establish that information superhighway this year.”

Bonus speechifying flourish: “I’m not at all sure what speech is in the TelePrompter tonight, but I hope we can talk about the state of the Union.”

*

BARACK OBAMA, 2010

BARACK OBAMA, 2010

Approval rating: First-year average, 57 percent. One-year anniversary: 51 percent

Congressional support for the president’s party: 59-41 Senate, 255-179 House.

Biggest topic: Economic recovery.

Whatever, proto-Trump!: “To encourage these and other businesses to stay within our borders, it is time to finally slash the tax breaks for companies that ship our jobs overseas and give those tax breaks to companies that create jobs right here in the United States of America.”

Closet libertarianism alert:

[F]amilies across the country are tightening their belts and making tough decisions. The Federal Government should do the same. So tonight I’m proposing specific steps to pay for the trillion dollars that it took to rescue the economy last year.

Starting in 2011, we are prepared to freeze Government spending for 3 years. Spending related to our national security, Medicare, Medicaid, and Social Security will not be affected. But all other discretionary Government programs will. Like any cash-strapped family, we will work within a budget to invest in what we need and sacrifice what we don’t. And if I have to enforce this discipline by veto, I will. […]

But understand, if we don’t take meaningful steps to rein in our debt, it could damage our markets, increase the cost of borrowing, and jeopardize our recovery, all of which would have an even worse effect on our job growth and family incomes.

Unintentional lesson about the futility of central planning: “There’s no reason Europe or China should have the fastest trains or the new factories that manufacture clean energy products. Tomorrow I’ll visit Tampa, Florida, where workers will soon break ground on a new high-speed railroad funded by the Recovery Act. There are projects like that all across this country that will create jobs and help move our Nation’s goods, services, and information.”

Wait, he really said that?: “Our approach would preserve the right of Americans who have insurance to keep their doctor and their plan. It would reduce costs and premiums for millions of families and businesses. And according to the Congressional Budget Office, the independent organization that both parties have cited as the official scorekeeper for Congress, our approach would bring down the deficit by as much as $1 trillion over the next two decades.”

Bonus speechifying flourish: “[I]f there’s one thing that has unified Democrats and Republicans and everybody in between, it’s that we all hated the bank bailout. I hated it. I hated it; you hated it. It was about as popular as a root canal.”

United Airlines employees recently stopped a passenger from boarding a flight with her emotional support animal in tow, because the animal was a peacock. Good for them—the emotional-support-animal-as-travel-buddy is an annoyance to other passengers, and of dubious therapeutic value, according to the relevant science.

United Airlines employees recently stopped a passenger from boarding a flight with her emotional support animal in tow, because the animal was a peacock. Good for them—the emotional-support-animal-as-travel-buddy is an annoyance to other passengers, and of dubious therapeutic value, according to the relevant science. As the nation gets ready for the constitutionally mandated State of the Union Address tonight, it’s worth considering whether Donald Trump represents a continuation of the “imperial presidency” or its denouement.

As the nation gets ready for the constitutionally mandated State of the Union Address tonight, it’s worth considering whether Donald Trump represents a continuation of the “imperial presidency” or its denouement.

A controversial Republican president, who had squeaked into office after a famously tumultuous campaign then kept fanning the flames of a hate-hate relationship with coastal elites despite being one himself, prepared to deliver his first official State of the Union address to a restive Congress. So what, in those divisive times, did Richard Nixon say?

A controversial Republican president, who had squeaked into office after a famously tumultuous campaign then kept fanning the flames of a hate-hate relationship with coastal elites despite being one himself, prepared to deliver his first official State of the Union address to a restive Congress. So what, in those divisive times, did Richard Nixon say? RICHARD NIXON, 1970

RICHARD NIXON, 1970 WARREN G. HARDING, 1922

WARREN G. HARDING, 1922 DWIGHT EISENHOWER, 1954

DWIGHT EISENHOWER, 1954 JOHN F. KENNEDY, 1962

JOHN F. KENNEDY, 1962 JIMMY CARTER, 1978

JIMMY CARTER, 1978 RONALD REAGAN, 1982

RONALD REAGAN, 1982 BILL CLINTON, 1994

BILL CLINTON, 1994 BARACK OBAMA, 2010

BARACK OBAMA, 2010