The total capitulation by the Federal Reserve which confirmed all it cares about is the stock market, propelled world stocks to their best January on record on Thursday, although in a deja vu of last January, when stocks similarly soared only to flop spectacularly, traders were trying not to get too carried away.

An overnight rally in global markets, helped by a dovish capitulation by the Fed which sent the S&P 1.55% higher on Wednesday as well as strong results from Facebook that sent the stock 11% higher premarket, faded overnight following another contractionary print in China’s official manufacturing PMI (49.5, up from 49.4 in Dec and above the 49.3 estimate), and the latest GDP print out of Italy which confirmed that the country had entered a recession for the first time in 6 years.

Even with the modest fade in sentiment, the MSCI world stocks index rose 0.5% and for the 20th day out of the last 23. For January it is up more than 7.2% which is its best January since the index began in 1988 and the best performance in any month since December 2015. “The rally really does lift all boats,” said Pictet emerging market portfolio manager Guido Chamorro.

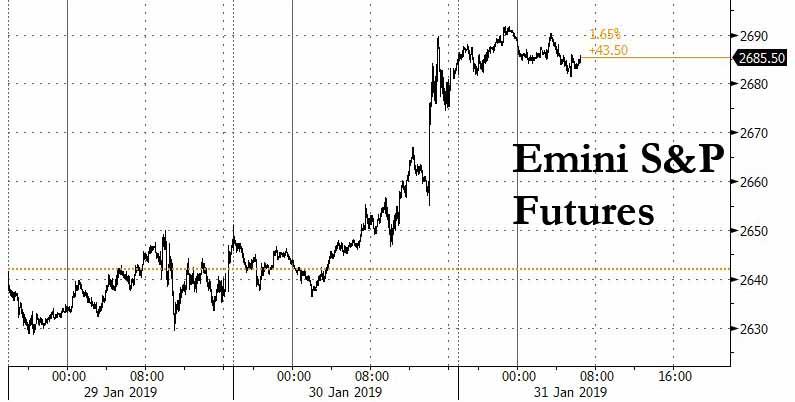

S&P futures and European stocks traded mixed on Thursday following catch up gains in Asia as investors took a pause in the wake of mixed corporate earnings despite now open support from the Federal Reserve which signaled an extended rate hike pause and announced it will be flexible on the path for reducing its balance sheet, sending the S&P to an 8-week high even as Nasdaq contracts stayed in the green, helped by better-than-expected results at Facebook. Meanwhile, Treasury yields and the dollar extended Wednesday’s declines. As a result, S&P futs were unchanged before President Trump was set to meet top China trade negotiator Chinese Vice Premier Liu He in the second day of the US-China trade talks.

Europe’s Stoxx 600 Index trimmed early gains of as much as 0.6%, dragged lower by banks and telecos as energy companies rose following strong results from Shell. Italy’s FTSE MIB index dropped on data showing the country fell into recession at the end of 2018, its first in 6 years.

Germany’s DAX drifted 1% off session high, as Deutsche Bank weighs on the index following news the German lender could be forced to merge with Commerzbank by mid-year if its results dont improve. FTSE-100 up 0.6%

MSCI’s index of Asia-Pacific shares rose to its highest since October helped by a 1% jump on Japan’s Nikkei which shrugged off the normal headwind of a higher yen. The main emerging market index skipped to a more than 8 percent January gain while the Shanghai Composite Index climbed 0.3 percent despite data showing China’s factory activity contracted for a second straight month.

Emerging-market stocks were poised for their best monthly gain in almost three years and while Powell’s dovish turn boosted currencies for a seventh day as the dollar extended its decline. The MSCI emerging-market equity index added to yesterday’s advance to head for a four-month high. The currency gauge was set for its longest winning streak in more than a year, with South Africa’s rand, Turkey’s lira and Brazil’s real leading gains since the U.S. central bank’s statement on Wednesday.

In FX, the Bloomberg Dollar index slipped to the the lowest since Sept. 27 as focus turned to US payrolls data due Friday; the greenback fell versus all G-10 peers, while the yen and risk-sensitive currencies led gains following the dovish Fed remarks; Treasuries rallied, outperforming Bunds. The euro reversed gains to trade below the 1.15 handle; the common currency initially shrugged off weaker-than-forecast German retail sales (-4.3% m/m in Dec. vs est. -0.6%) before edging lower despite euro-area growth in the three months through December matching estimates at 1.2% y/y, pressured by Italian GDP data.

With Wednesday’s statement the Fed helped ease fears that it would continue with plans to tighten policy even in the face of cooling economic data. The Fed said it would be “patient” about any future rate hikes and signaled flexibility in reducing its bond holdings, adding fuel to the emerging-market rally that began as 2018 drew to a close.

Investors now have a wary eye on meetings between Chinese negotiators and their counterparts in Washington as talks to resolve the trade dispute continue.

“I suspect the Fed news will trump everything, and people will look at the news, whatever comes in these earnings, against the backdrop of what the Fed is doing,” Gavin Friend, senior market strategist at National Australia Bank in London, said in a podcast. “It could be the catalyst for a breakthrough in key levels in the dollar index against major currencies.”

Looking at today’s key event, President Trump will meet with Chinese Vice Premier Liu He at 15:30 EST today. Trump also said it is highly unlikely he would be willing to include ‘Dreamers’ in negotiations regarding border security and government funding, while there were separate reports that the White House is said to prepare an emergency wall plan. US Democrats reportedly suggested openness for a compromise with President Trump, despite unveiling initial proposal for border security which doesn’t include a physical barrier.

In the latest Brexit news, the EU stands ready to take Brexit to a last-minute summit rather than bend the knee to demands from UK PM May, according to diplomats citing the scheduled summit on March 21-22. UK PM May is also said to be putting together a series of measures in an attempt to woo Labour MPs to support her Brexit deal; measures include cash injections into leave-supporting deprived areas.

In the commodity markets, oil prices rose for a third day, pushed up by lower imports into the United States amid OPEC efforts to tighten the market, and as Venezuela struggles to keep up its crude exports after Washington imposed sanctions on the nation. U.S. West Texas Intermediate crude futures were at $54.47 per barrel, up 24 cents, or 0.4 percent, from their last settlement. Brent was up 36 cents, or 0.6 percent, at $62.01 per barrel.

Expected data include jobless claims and new home sales. Blackstone, Conoco, Ferrari, GE, Mastercard, UPS, and Amazon are among companies reporting earnings.

Market Snapshot

- S&P 500 futures little changed at 2,684.25

- STOXX Europe 600 up 0.1% to 358.96

- MXAP up 1.2% to 156.58

- MXAPJ up 0.8% to 510.49

- Nikkei up 1.1% to 20,773.49

- Topix up 1.1% to 1,567.49

- Hang Seng Index up 1.1% to 27,942.47

- Shanghai Composite up 0.4% to 2,584.57

- Sensex up 1.8% to 36,246.18

- Australia S&P/ASX 200 down 0.4% to 5,864.65

- Kospi down 0.06% to 2,204.85

- Brent futures up 0.4% to $61.90/bbl

- Gold spot up 0.2% to $1,321.92

- U.S. Dollar Index little changed at 95.31

- German 10Y yield fell 2.3 bps to 0.165%

- Euro up 0.06% to $1.1487

- Italian 10Y yield fell 3.4 bps to 2.243%

- Spanish 10Y yield fell 3.7 bps to 1.217%

Top Overnight News from Bloomberg

- U.S. President Donald Trump will meet China’s top trade negotiator in the Oval Office on Thursday for high-level talks, with little indication that Beijing will bend to American demands to deepen economic reforms

- Italy fell into recession at the end of 2018, capping a year of political turmoil, higher borrowing costs and fiscal tensions that took their toll on the economy. The contraction will put further pressure on the coalition government, which already appears to be fraying

- The European Union is prepared to take Brexit down to a last-minute, high-stakes summit rather than cave into U.K. Prime Minister Theresa May’s demands over the next few weeks, diplomats said

- The number of Chinese companies warning on earnings is turning into a flood as a deadline looms on Thursday, with no industry spared from worsening demand

Asian stocks were mostly higher across the board as they took impetus from their counterparts in US where sentiment was lifted on the back of earnings and a dovish Fed, while the region also digested better than expected Chinese PMI data. ASX 200 (-0.4%) and Nikkei 225 (+1.1%) both initially benefitted from the rising tide in the aftermath of the FOMC, although weakness in Australia’s largest weighted financial sector later dragged on the local bourse, while a slew of corporate updates shared the focus for Japan. Hang Seng (+1.1%) and Shanghai Comp. (+0.4%) conformed to the positive tone following better than expected Chinese Manufacturing PMI and Non-Manufacturing PMI data, while another PBoC liquidity injection ahead of next week’s Lunar New Year and ongoing US-China trade talks also contributed to the optimism. Finally, 10yr JGBs were initially higher as they tracked the upside in T-notes post-FOMC and as the BoJ Summary of Opinions unsurprisingly reiterated the need to persistently continue powerful monetary easing, although gains were later pared despite stronger 2yr auction results as upside was restricted by the firm risk sentiment.

Top Asian News

- Ship Giants to Join Forces in Korea to Fend Off China Threat

All Major European indices initially opened higher [Euro Stoxx 50 -0.3%] continuing the overnight gains seen in Asia which benefited from a dovish Fed alongside strong earnings from Facebook, who were up 11.5% after-market; although European indices have since reverted much of this following an earnings dominated open. FTSE 100 (+0.5%) is benefitting from Shell (+4.1%) and Diageo (+4.0%) due to both companies’ earnings beating on expectations; Shell’s strong performance has subsequently led to outperformance in the energy sector (+2.3%). The SMI (U/C) is the underperforming sector, weighed on by Swatch (-5.4%) who are at the bottom of the Stoxx 600 after their FY group sales missed expectations; although losses are capped by strong performance in Roche (+2.2%) following their earnings. Other notable movers include, Unilever (-3.7%) who anticipate 2019 underlying sales growth at the bottom of their 3-5% range; and as such are down on the day. Elsewhere, Wirecard (+1.8%) have recouped some of the losses seen in the previous session due to an FT article reporting that an executive has been accused of using forged contracts. And BT (-2.6%) are down despite reiterating EBITDA guidance at the top end of expectations for FY18/19, as Philip Jansen is to take over as CEO from Gavin Patterson on Friday.

Top European News

- Spain’s Economy Remains Bright Spot Amid Euro-Area Slowdown

- Shell Pledges to ‘Do It All’ as Cash Surge Underpins Returns

- As Wirecard Gets Bigger, So Does the Target on Its Back

- Nestle Chairman Signals He’s Open to a Full Sale of Skin Health

In FX, odds looked stacked against the Greenback following an arguably even more dovish twist from the FOMC than many or most were looking for (effectively announced a pause in the tightening cycle, with patience going forward and not necessarily further hikes at this stage, or much more balance sheet reduction). This, coupled with some ‘strong’ sell signals for month end portfolio rebalancing saw the Buck slump to new recent lows vs G10 peers, while the DXY slipped under its 200 DMA (95.290) at one stage to 95.127 before stabilising and perhaps benefiting from early SOMA-related positioning (front-running ahead of the usual flow window).

- JPY – The main beneficiary of post-Fed Dollar weakness and pronounced US Treasury curve bull-steepening, as Usd/Jpy reversed sharply from 109.50+ peaks into the FOMC to circa 108.50. Note, however, option expiries between 108.90-109.00 in 1 bn may limit further downside in the headline pair ahead of the NY cut.

- AUD/NZD – Also revelling in the broadly bearish Usd hue, plus a revival in risk appetite, which partly Fed induced and underscored by improvements in China’s manufacturing and services PMIs overnight. Aud/Usd is consolidating off fresh multi-week highs circa 0.7275 having blasted through daily tech resistance around 0.7207 that had been containing advances ahead of the FOMC, while Nzd/Usd is pivoting 0.6900 with the Kiwi drawing additional momentum from S&P’s NZ rating outlook upgrade to positive from stable.

- GBP/CHF/CAD – All firmer vs the US Dollar, albeit marginally, as Cable continues to trade heavily around 1.3150 amidst the ongoing Brexit hiatus, while the Franc remains in a 0.9900-50 range and Loonie meanders between 1.3120-55 awaiting some independent impetus from looming Canadian GDP and PPI data before a speech from BoC’s Wilkins.

- EUR – The single currency finally breached its 100 DMA around 1.1443, and 1.1450 on its way to a 1.1515 peak vs the Usd, but has been undermined by more poor Eurozone data in the shape of German retail sales and Italian GDP (both negative and worse than forecast). Note, the aforementioned SOMA interests also have a tendency to weigh on Eur/Usd more than other Usd/major pairings.

In commodities, it was a mixed session in the commodities complex thus far, as the energy benchmarks pare back a bulk of yesterday’s Fed-induced gains with WTI (-0.2%) drifting into negative territory and Brent (+0.5%) off best levels. Oil prices have been on a downwards trajectory for most of the EU session with a brief Brent dip below USD 61.50/bbl, coinciding with the Iraqi oil ministry stating 40 oil wells are to be drilled in the Southern Manjoon oilfield. As reference the Manjoon oil field is estimated to have reserves of almost 12.6bln barrels. Otherwise, new-flow has been light in the complex with traders keeping a close eye on US-Sino trade developments with Vice Premier Liu He due to meet US President Trump at the Oval office around 20:30 GMT. On the Venezuelan front, Chinese energy giant PetroChina is reportedly planning to drop Venezuelan state-owned PDVSA amid the US oil sanctions on the company in the backdrop of Venezuela’s political turmoil. The sanctions seem to have a muted impact in the oil market thus far as US already stated that any shortfalls in output will be countered with the use of the US Strategic Petroleum Reserve. Meanwhile, prices are somewhat underpinned by the OPEC production cuts with figures stating output amongst the members fell 900k BPD, (vs. 800K planned at the latest meeting); as according to JBC.

Elsewhere, metal prices are supported by the still-subdued dollar with spot gold poised to end the month with a fourth consecutive monthly gain, prices reached levels last seen in May 2018 as the yellow metal advances above USD 1320/oz. Citigroup notes that the precious metal is benefitting from a weaker buck alongside safe-haven buyers hedging against the outcome of the US-China trade talks. Moving on, nickel and steel prices are expected to be weighed on by a soaring output of the raw material in China and Indonesia and as such, BMO analysts expect the nickel deficit to narrow to 96k tonnes in 2019 vs. current 129k tonnes.

Looking at the day ahead, we’re due to get Q4 ECI (+0.8% qoq expected), latest weekly initial jobless claims, November new home sales and the January Chicago PMI (2.3pt drop to 61.5 expected). Away from the data the ECB’s Coeure, Mersch and Weidmann are due to speak at separate events while earnings highlights include Amazon, Royal Dutch Shell, Unilever, DowDuPont, General Electrics, Diageo and ConocoPhillips.

US Event Calendar

- 7:30am: Challenger Job Cuts YoY, prior 35.3%

- 8:30am: Employment Cost Index, est. 0.8%, prior 0.8%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 199,000; Continuing Claims, est. 1.72m, prior 1.71m

- 9:45am: Chicago Purchasing Manager, est. 61.5, prior 65.4

- 10am: New Home Sales, est. 570,000, prior 544,000; MoM, est. 4.78%, prior -8.9%

- 4pm: Total Net TIC Flows, prior $42.0b

DB’s Jim Reid concludes the overnight wrap

If you’re in the U.K. I hope you’ve met today’s tax return deadline. I still haven’t quite finished mine and I’m a little stressed as to when I’ll get the chance. This is the most complicated of my life as during the last tax year I sold all my worldly possessions (apart from my family and my golf clubs) to buy our new house. I’ve had to go through 24 years of files to work out what I’d originally paid for all the assets that I subsequently sold. Surprisingly some were actually sold higher than where I’d bought them. Others less so! At least next year’s will now be easy as pretty much all I own is tied up in a vastly overpriced U.K. house in a post Brexit era.

On the positive side this last day of January will be greeted with more enthusiasm than the last day of the previous two very poor months for performance. The Fed helped supercharge this last night with US markets advancing to their highest levels since early December after delivering a surprisingly dovish policy statement at yesterday’s meeting. It marked the first Fed meeting day in which the S&P 500 rallied since Chair Powell’s tenure began, snapping a streak of seven straight losses on Fed meeting days. Has Mr Powell now yielded to the desires and moods of financial markets? Indeed, yesterday was the best “Fed day” performance since December 2014, when then-Chair Yellen struck a similarly dovish tone and the committee inserted a reference to being “patient” into the statement.

The p-word was again a key factor at yesterday’s meeting, as its re-introduction marked one of several notably dovish changes that supported yesterday’s market reaction. As a reminder, yesterday was the first of the previous “off” meetings with a press conference. There was also the normal policy statement, but no update to FOMC participants’ macro and interest rate forecasts.

The new policy statement had four notable changes that all leaned in a dovish direction: theyi) removed the “further gradual increases” description of the policy path, ii) added “market-based measures of inflation compensation have moved lower,” iii) added a reference to “muted inflation pressures,” and iv) added a sentence saying “the Committee will be patient as it determines what future adjustments” to rates will be appropriate. Taking items i and iv together, the committee therefore removed its tightening bias, and looking at ii and iii this indicates that incoming hard data and market pricing on the inflation front are the key variables to watch before the fed returns to its tightening track. The policy statement was accompanied by a separate note which committed to using the fed funds rate as the main policy tool and to maintaining enough excess reserves moving forward to maintain the “floor” system. That was consistent with our economists’ expectations, but still represents an official confirmation.

Our economists now believe that the risk to their call for two more rate hikes later this year and another one next year has shifted a bit further to the downside, though the substantial further lift to financial conditions resulting from yesterday’s announcement somewhat limits this downside risk. See here for their full summary of the meeting.

Now to recap the strong day of market rallies. Yields on two-year Treasuries rallied -6.5bps while 10-year yields fell a more modest -3.2bps, leading the yield curve to bull steepen +3.2bps. The dollar dropped -0.50%, with the euro gaining +0.41% and emerging markets outperforming, up +0.65%. The NASDAQ advanced +2.20%, while the S&P 500 and DOW rallied +1.57% and +1.77% respectively, though to be fair the major indexes were already around 1 percent higher on the session before the Fed gave the rally an extra boost. The main factor during morning trading in New York was positive earnings reports (more details below).

After the close markets also had to contend with a couple of bellwether numbers in the tech space, with Facebook and Microsoft highlighting results. Thesocial media giant beat expectations on profits, revenue, and active users, and shares rallied over 11% overnight. Microsoft’s earnings and sales figures were slightly below analysts’ expectations, and shares slid -4%. Qualcomm’s revenues were a touch soft as well, but a healthy beat on profits helped shares rally over 2%. Net-net, NASDAQ futures are up +0.42% while the rest of Asia is taking the lead from Wall Street with healthy gains for the Nikkei (+1.16%), Hang Seng (+1.06%), Shanghai Comp (+0.69%) and Kospi (+0.36%).

We haven’t heard any sound bites to come from the US-China trade talks as of yet with talks continuing today however sentiment overnight has also partially been helped by the January PMIs in China where both the manufacturing (54.7 vs. 53.8 expected) and services (49.5 vs. 49.3 expected) prints came in higher than expected. The manufacturing reading also rose 0.9pts from December and it leaves the composite 0.6pts higher at 53.2, and therefore the highest since September last year.

Back to yesterday, where the earnings highlights included a +6.83% rally for Apple (post the numbers after the close on Tuesday), Boeing (+6.30%), AMD (+19.95%) and Anthem (+9.12%). The Boeing numbers were notable insofar as the company reported $100bn of annual sales for the first time in its 102-year history, while also forecasting further revenue growth for this year. Management also eased some of the recent concerns over China’s outlook, saying “we continue to see strong demand in China.”

Closer to home, Italy is starting to creep up on people’s radars again. Yesterday there was some focus on a Bloomberg story suggesting that Deputy PM Salvini is facing internal pressure to force early elections due to frustration over the League’s coalition partner 5SM. Cabinet Undersecretary Giorgetti is one who has publically voiced frustration. This story is also having legs given the rising support for the League based on a weekly average of opinion polls (Bloomberg) which puts their support at 32% (from 20% in April 2018) versus 25% for the 5SM (from 35%). The same article does however go on to say that Salvini is not looking at early elections and is supposedly talking down such expectations within the party. That said we’ve become more than accustomed to elections in Italy with 65 governments since 1946, equivalent to a new government every 1.1 years and 91 in the last 117 years.

Markets are also well versed on recessions in Italy with 5 since the adoption of the euro (equivalent to an average real GDP growth rate of +0.12% qoq). This morning we get a first look at Q4’18 GDP with the consensus expecting a -0.1% qoq reading. As a reminder this follows -0.1% qoq in Q3 and so assuming the consensus is correct, a negative reading will push Italy into another technical recession. For all the above BTPs outperformed yesterday with 10y yields -3.4bps lower compared to -1.1bps for Bunds and -1.5bps for OATs. At 2.596%, yields are now rivalling July levels from last year. It’s worth adding that the FTSE MIB (+0.36%) also outperformed the DAX (-0.33%) yesterday and performed in line with the STOXX 600 (+0.36%).

As for Brexit it was another day of swings and roundabouts for Sterling which traded as high as $1.315 and as low as $1.306. The newsflow mainly centered around the EU side yesterday with Juncker saying that a “disorderly Brexit is now more likely” and that the “withdrawal accord won’t be renegotiated”. That’s not a great surprise as it’s a reiteration of what Juncker has said previously. Ireland PM Varadkar also said that the “EU is not offering a renegotiation of a deal” and there are “no plans to organize an emergency summit”. Ireland’s Foreign Minister Coveney also said that he’s skeptical that there are workable alternatives to the backstop, a view reinforced by Angela Merkel’s spokesman who said “the opening of the exit deal is not on the table”. Comments then that hardly fuel much confidence that the stalemate will be broken. Over to Mrs May. My personal view is that there is scope for a deal but that the EU and Irish might conclude that Parliament is so anti no-deal and slowly gaining more control that if they hold off long enough the chamber will find a way of forcing the government to commit to this. This weakens the UK’s negotiating position in my opinion. As bad as no-deal might be, if you’re negotiating you need the genuine threat of it to strengthen your hand.

Back to the continent, where yesterday in Germany, the Economy Ministry officially slashed its forecast for 2019 growth to 1.0% compared to the 1.8% forecast made in October. That would be the weakest since 2013. It’s worth noting that Bunds are back to within just 3.5bps off the early January closing lows, which at the time were the lowest since 2016.

As far as yesterday’s data was concerned, in the US the ADP employment change report for January surprised to the upside at 213k (vs. 181k expected) ahead of payrolls tomorrow while pending home sales for December printed at -2.2% mom (vs. +0.5% expected). In Germany consumer confidence for Germany ticked up 0.3pts to 10.8 while for the Euro Area, economic, business and services confidence indicators all weakened marginally. Here in the UK net consumer credit was slightly weaker than consensus in December (0.7bn vs. 0.8bn expected) while mortgage approvals fell slightly to 63.8k (vs. 63.1k expected).

To the day ahead now, where the early data this morning comes from Germany with the December retail sales report. January house price data in the UK follows before we get the preliminary January CPI print in France (-0.6% mom expected) and a first look at Q4 GDP for the Euro Area. The consensus is for +0.2% qoq which would have the effect of lowering the annual rate to +1.2% yoy (from +1.6%). At the same time we’ll also get the aforementioned Q4 GDP for Italy which is expected to come in at -0.1% qoq and therefore confirm two consecutive negative quarters and a technical recession. Across the pond today we’re due to get Q4 ECI (+0.8% qoq expected), latest weekly initial jobless claims, November new home sales and the January Chicago PMI (2.3pt drop to 61.5 expected). Away from the data the ECB’s Coeure, Mersch and Weidmann are due to speak at separate events while earnings highlights include Amazon, Royal Dutch Shell, Unilever, DowDuPont, General Electrics, Diageo and ConocoPhillips.

via ZeroHedge News http://bit.ly/2UsG1KV Tyler Durden

Police in Locust Grove, Oklahoma, are investigating a viral video that shows a boy

Police in Locust Grove, Oklahoma, are investigating a viral video that shows a boy