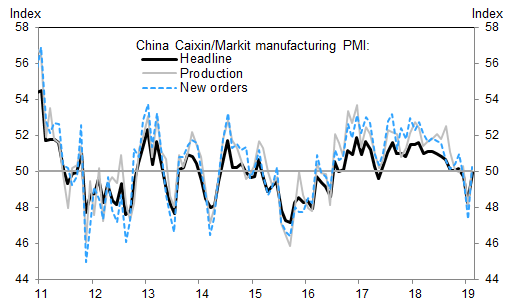

Just as the official Chinese manufacturing PMI’s disappointing Thursday print (3 year low) pressured stocks on the last day of February, and sent both the MSCI World Index and the Dow Jones to three consecutive days of declines, the longest such stretch of 2019 yet, overnight’s Caixin PMI which unexpectedly posted a sharp rebound in February, rising to 49.9 from 48.3 in January, offered some reassurance to investors concerned about the global growth outlook that the global economic drop may have troughed while “optimism” for a trade deal returned; Treasuries extended their recent decline and the dollar pushed higher for a third day before easing back. The result is a sea of green in global stocks with the S&P trading back over the critical 2,800 level.

Bullish sentiment stormed back led by China, where shares outperformed with the Shanghai Composite closing 1.8% higher following confirmation that MSCI Inc. will quadruple the weight of Chinese stocks in its global benchmarks from 5% to 20%, while in contrast to the small decline in NBS manufacturing PMI reported just one day earlier, the Caixin manufacturing PMI bounced back in February from the dip in January. It rose by 1.6pp to 49.9, although January-February combined, Caixin manufacturing PMI averaged at 49.1, lower than 49.7 in December last year. Most sub-indexes of the survey rebounded in February vs January. The fact that the index remained just barely in contraction territory was offset by a sharp increase in the forward-looking new orders index component.

According to Goldman, the Caixin manufacturing PMI showed “some early signs of better growth momentum in the manufacturing sector in February. However, the floating holiday and continued weakness shown in other indicators such as NBS manufacturing PMI added uncertainties to the above view, and for the period of January to February on average, growth momentum still likely softened from late last year. We continue to expect more policy easing to support the economy, and Jan-Feb industrial production data to be released in two weeks’ time will shed more light on the underlying growth trend early this year.”

As a result, China’s blue-chip CSI300 index surged 2.2% to land its best week since November 2015 after the MSCI announcement. It could potentially draw up to $80 billion of fresh foreign inflows to the world’s second-biggest economy.

“The news surrounding China and the Chinese economy has been better than news we’ve seen elsewhere,” Andrew Cole, head of multi asset at Pictet Asset Management Ltd., told Bloomberg TV in Hong Kong. “Clearly the central bank and the authorities are providing both fiscal and monetary stimulus.”

Elsewhere in Asia, Australia’s ASX 200 (+0.4%) extended on opening gains as IT and healthcare names led the advances, whilst heavy-exporter Nikkei 225 (+1.0%) outperformed after the yen dropped to a 10-week low against the greenback.

Later in the session, European shares opened notably higher, with the Stoxx Europe 600 Index rising to the highest in almost five months, as 18 of 19 industry sectors were in the green and car makers leading the charge, even after PMI data showed that euro-area manufacturing contracted last month, offset by the fastest rise in German retail sales since Oct 2016.

“We are seeing a fairly decent uptick in European markets,” said CMC Markets analyst David Madden, citing the combination of U.S. and China data as well as encouraging comments from the United States on China trade talks.

To be sure, the bad data in Europe continued and Spain’s manufacturing sector contracted for the first time for more than five years in February data from Madrid showed while in eastern Europe Czech manufacturing sentiment fell at its fastest rate in six years.

However, market reaction showed that “bad news can be good news” because it could well encourage the European Central Bank to hand out cheap TLTRO loans to euro zone banks in the coming months. Boosted by strong Chinese data and weak European data, futures on the S&P 500, Dow Jones and Nasdaq gained, with the EMini back over the critical 2,800 “quad top” resistance level. Emerging-market stocks snapped a three-day losing streak.

Traders will be relieved to see a strong close to the week after a 16% surge from Christmas through the start of this week, MSCI’s gauge of global equities has tread water as investors await progress in U.S.-China trade negotiations. American officials are preparing a final deal that Donald Trump and China President Xi Jinping could sign in weeks, even as a debate continues in Washington over whether to push Beijing for more concessions. Meanwhile, as Bloomberg notes, geopolitical concerns remain in the background, amid tensions between India and Pakistan and the failure of a summit between Kim Jong Un and Trump to achieve an agreement between the U.S. and North Korea on denuclearization.

U.S. President Donald Trump on Thursday fueled concerns over U.S.-China trade talks, warning that he could walk away from a trade deal with China if it were not good enough. But in subsequent comments Thursday, White House economic adviser Larry Kudlow called progress in the negotiations “fantastic” and said the countries were “heading towards a remarkable, historic deal.”

Mixed messages on trade combined with the collapse of the summit between Trump and North Korean leader Kim Jong Un on denuclearization, and data from China showing slowing factory activity to pressure U.S. stocks as Reuters notes. “News that President Trump walked out of the meeting with Supreme Leader Kim, because the two sides couldn’t reach an agreement over North Korea’s nuclear disarmament, dashed hopes for an easing in geopolitical tensions,” analysts at ANZ said in a morning note.Overnight, president Trump said he believes a good deal with North Korea will happen and added that North Korea did not want to fully denuclearise. Meanwhile, North Korea Foreign Minister said if US lifts sanctions, North Korea will denuclearise, whilst adding that Pyongyang will not change its stance even if the US seeks further talks. US Secretary of State Pompeo said that North Korea basically asked for all sanctions to be lifted.

In the latest Brexit news, UK’s Labour Party is reportedly moving towards a compromise plan which would allow PM May’s Brexit deal to pass but makes it clear that Parliament “withholds support” until the deal has been put to a public vote; according to multiple party sources.

Following a stronger than expected Q4 GDP print, Dallas Federal Reserve Bank President Robert Kaplan said on Thursday that it will take time to see how much the U.S. economy is slowing, supporting views of the Fed’s rate-hike holiday at least through to June.

In rates, long-dated government bond yields in Germany, the euro zone’s benchmark issuer, were set on Friday for their biggest weekly increase in more than year, reflecting easing concern about the global growth outlook and hopes that a no-deal Brexit will be avoided, and ignoring today’s equity euphoria. 10Y TSY yields meanwhile continued to rise, and were trading at 2.73% today after trading 10bps lower earlier in the week.

In FX, the Bloomberg Dollar Spot Index rose a third day, tracking a rise in Treasury yields; the dollar index which tracks the greenback against major rivals, was up 0.2 percent at 96.302, though it remained fractionally lower for the week overall. The yen led losses among G-10 currencies after better-than-expected China data sapped haven demand. The euro edged lower as PMIs out of the euro-zone confirmed a contraction in the manufacturing sector amid a slump in orders, while core CPI for the region slowed to 1.0% y/y, falling short of a 1.1% estimate. Britain’s pound has been the star of the week, jumping more than 1.5 percent after another set of twists in Brexit saga has cut the chances of the UK crashing out the EU at the end of the month with a transition deal. It was down a fraction on the day at $1.3250.

Elsewhere, iron ore extended its rally, stoking a gain in the Bloomberg Industrial Metals Subindex to the highest since early October. West Texas oil futures nudged toward $58 a barrel as strengthening economic trends in the U.S. signaled tightening supplies, and gold’s third successive drop set it up for the worst week since November.

Market Snapshot

- S&P 500 futures up 0.6% to 2,802.00

- STOXX Europe 600 up 0.8% to 375.62

- MXAP up 0.2% to 159.00

- MXAPJ up 0.4% to 524.20

- Nikkei up 1% to 21,602.69

- Topix up 0.5% to 1,615.72

- Hang Seng Index up 0.6% to 28,812.17

- Shanghai Composite up 1.8% to 2,994.01

- Sensex up 0.7% to 36,108.55

- Australia S&P/ASX 200 up 0.4% to 6,192.73

- Kospi down 1.8% to 2,195.44

- German 10Y yield rose 0.4 bps to 0.187%

- Euro down 0.1% to $1.1360

- Italian 10Y yield fell 3.2 bps to 2.393%

- Spanish 10Y yield rose 0.3 bps to 1.176%

- Brent futures up 0.3% to $66.51/bbl

- Gold spot down 0.5% to $1,306.59

- U.S. Dollar Index up 0.2% to 96.34

Top Overnight News from Bloomberg

- U.S. officials are preparing a final trade deal that President Donald Trump and his Chinese counterpart Xi Jinping could sign in weeks, people familiar with the matter said. The U.S. is eyeing a summit between the two presidents as soon as mid-March, said one of the people, who spoke on condition of anonymity because the preparations are confidential

- Federal Reserve Chairman Jerome Powell repeated the central bank’s recent mantra of pledging patience in the face of conflicting economic signals and subdued inflation. signals and subdued inflation. “The Federal Open Market Committee will be patient as we determine what future adjustments to the target range for the federal funds rate may be appropriate to support our dual-mandate objectives,” Powell said in the text of a speech Thursday evening in New York

- Federal Reserve Bank of Dallas President Robert Kaplan says “global growth is decelerating” and due to potential spillovers from this headwind and other sources of uncertainty, he has been advocating that “we should pause and be patient” on monetary policy.

- MSCI Inc. will expand the weighting of China-listed shares in benchmark indexes tracked by global investors, a decision that could see billions of dollars flow into one of the world’s most volatile major stock markets

- Oil was poised to eke out a third weekly gain after Saudi Arabia defied U.S. President Donald Trump’s call for lower prices, and a drop in American crude inventories signaled supplies are tightening.

- North Korean leader Kim Jong Un vowed to meet again with President Donald Trump to continue nuclear negotiations after a two-day summit between the leaders collapsed Thursday amid discord over sanctions and conflicting accounts of Pyongyang’s demands

- Bank of England Governor Mark Carney says the drop in business investment due to Brexit uncertainty will hamper the U.K. economy

- U.S. officials are preparing a final trade deal that President Donald Trump and his Chinese counterpart Xi Jinping could sign in weeks, people familiar with the matter said, even as a debate continues in Washington over whether to push Beijing for more concessions

- Underlying price pressures in the euro area remain weak, according to the latest inflation figures for the region, giving European Central Bank policy makers more to digest ahead of their crucial meeting next week

Asian equities started the first trading day of the month on an optimistic note, despite a relatively downbeat session on Wall Street where the three main indices closed lower by around three-tenths of a percent. The Dow was weighed on by UnitedHealth shares which trimmed around 50 points off the index, meanwhile Nasdaq was pressured as heavyweights Facebook, Apple and Netflix all fell over 0.5%. In terms of February performance, Dow rose 3.7%, S&P gained 3.0% and Nasdaq advanced 3.4% in the month. ASX 200 (+0.4%) extended on opening gains as IT and healthcare names led the advances, whilst heavy-exporter Nikkei 225 (+1.0%) outperformed on the back of a weaker domestic currency. Elsewhere, Shanghai Comp (+1.8%) was choppy as the third straight month of contraction in China’s manufacturing sector capped upside in the index, despite MSCI quadrupling China A-share weightings in global benchmarks to 20%. Goldman Sachs estimates that the MSCI move would lead to a potential USD 70bln net buying in A-shares, skewed towards the healthcare and consumer sectors. Finally, Hang Seng (+0.6%) edged higher during the session as the index felt support from its heavy-weight financial and energy sectors.

Top Asian News

- Hong Kong Dollar Near Weak End of Band Raises Tightening Risk

- New Philippines Central Bank Chief Eyed by Dominguez This Month

- Carlyle Buys Stake in Indian Life Insurer From BNP Paribas

Major European equities are in the green [Euro Stoxx 50 +0.7%], as markets follow from the positive risk sentiment seen overnight in Asia. Dax (+1.0%) is the outperforming index with all components in the green on the positive risk sentiment following concerns over China’s economy being somewhat alleviated after Chinese Caixin manufacturing PMI came in stronger than expected; as such the Auto sector is outperforming its peers. Other notable movers include Rheinmetall (+7.3%) leading the Stoxx 600 after the Co’s FY18 revenue was in-line with expectations. WPP (+8.2%) are also firmly in the green in-spite of the Co’s outlook for 2019 being rather downbeat, particularly regarding the first half, as they reported results that marginally beat on expectations. Elsewhere, Man Group (-4.2%) are towards the bottom of the Stoxx 600 after stating that their funds under management fell in 2018.

Top European News

- Italy’s Di Maio Trusts Salvini to Stand by Him for Long Term

- Deficit Conquered, Germany Is Finally Boosting Public Spending

- WPP Dodges Another Results Shock After Year of Client Losses

- Jupiter Rises Most in Five Years as Payout Beats Expectations

In FX, although the Dollar has pared some of its post-GDP and Chicago PMI gains vs certain major counterparts, the index has rebounded further from sub-96.000 lows towards 96.400, largely at the expense of safe-haven currencies, and especially the Jpy.

- JPY – No respite for the Yen after yesterday’s slide through 111.00 and accelerated losses below the 200 DMA as US Treasury yields continue to rally and the 10 year benchmark clears 2.70% in wake of the aforementioned stronger than forecast data and survey news. Usd/Jpy is now just a whisker away from the next big figure where more offers are touted, and with key Fib resistance residing not far above at 112.08.

- CHF/GBP – Also victims of the broad Greenback revival, but the former unwinding more of its safe-haven premium as well, with the Franc back under parity vs the Buck and below 1.1350 against the Euro. Meanwhile, Cable’s pull-back from recent Brexit no deal highs has extended to 100+ pips and not far from Fib support around 1.3215, with little reaction or independent direction gleaned from a bang in line with consensus UK manufacturing PMI.

- EUR – The single currency has pulled back further from best levels too (1.1400+), but holding up relatively well amidst mixed Eurozone data and perhaps with the aid of hefty option expiry interest at the 1.1350 level for today’s NY cut (2 bn) plus M&A news that has lifted Eur/Jpy very close to a key Fib. On that note, the 30 DMA in Eur/Usd at 1.1363 could also be influential on a closing basis along with 0.8593 in Eur/Gbp.

- CAD/NZD/AUD – All on a firmer footing vs their US peer, and particularly the Loonie that has rebounded strongly from sub-1.3200 lows on Thursday ahead of Canadian GDP data and gleaning some traction from steadier oil prices. Usd/Cad is currently near the bottom of a 1.3132-77 range, and a big option expiry between 1.3140-50 may also have a bearing on trade given 1.4 bn rolling off later today. Meanwhile, the Kiwi and Aussie have both managed to regain composure and round number status after falling below 0.6800 and 0.7100, with some comfort drawn from the overnight Caixin Chinese manufacturing PMI that was sub-50 again, but not as weak as the official version.

In commodities, Brent (U/C) and WTI (+0.1%) prices are essentially flat, in-spite of trading positively overnight and initially during the European session, although they are once again trading within a fairly narrow range of less than USD 2/barrel. Elsewhere, since the imposition of US sanctions on the 28th January on Venezuelan oil, Venezuela’s oil exports have dropped by 40% for the month to around 920k BPD. Separately, Lukoil have agreed to reach the OPEC+ targets in April, and Rosneft’s VP state that they fully comply with the pact. Gold (-0.3%) is weaker as the USD moves higher recouping recent losses, with the yellow metal hitting a two-week low and currently trading around USD 1306/oz; however, analysts do highlight that the metal has strong support at the USD 1300/oz level. Elsewhere, copper weakened following China printing a 3rd month of contraction in their Caixin Manufacturing PMI, although the metal did recover as the figure was above expectations and risk sentiment remained positive. Separately, Goldman Sachs trade ideas include Long Dec’19 copper vs. Dec’19 zinc, Long jun’19 and short June’20 aluminium.

Looking at the day ahead, the big highlight in the US today meanwhile is the December PCE report which is expected to show a +0.2% mom core reading (+1.9% yoy and unchanged versus November). We’ll also get the December personal income and spending reports, January manufacturing PMI and February ISM manufacturing – the latter of which is expected to fall just under 1pt to 55.7. The final revisions to the February University of Michigan consumer sentiment survey round out the data. Away from all that, it’s the turn of the Fed’s Bostic to speak this evening.

US Event Calendar

- 8:30am: Personal Income, est. 0.3%; Personal Spending, est. -0.3%, prior 0.4%

- 8:30am: Real Personal Spending, est. -0.3%, prior 0.3%

- 8:30am: PCE Deflator MoM, est. 0.0%, prior 0.1%; PCE Deflator YoY, est. 1.7%, prior 1.8%

- 8:30am: PCE Core MoM, est. 0.2%, prior 0.1%; PCE Core YoY, est. 1.9%, prior 1.9%

- 9:45am: Markit US Manufacturing PMI, est. 53.7, prior 53.7

- 10am: ISM Manufacturing, est. 55.8, prior 56.6

- 10am: U. of Mich. Sentiment, est. 95.9, prior 95.5; Current Conditions, prior 110; Expectations, prior 86.2

DB’s Jim Reid concludes the overnight wrap

With it being the first day of March, this morning Craig was up in the middle of the night publishing the February performance review as a standalone document which you should see in your inbox an hour or so before this one. You’ll find the usual charts and tables in that document too which will help show that it’s actually been one of the better starts to a year on record.

Overnight we’ve already seen China’s Caixin February manufacturing PMI. It came in at 49.9 (vs. 48.5 expected), marking the third consecutive month below 50 but obviously showing some signs of improving. Sub-index level details were more mixed with new orders returning above 50 (at 50.2) after 2 months below while new export orders slipped back ( at 49.4 vs. 50.4 last month). The accompanying statement from Markit with the release stated that the domestic manufacturing demand improved significantly in February while foreign demand was not deteriorating as quickly as last year. However, we need to be cautious on over interpreting domestic demand in February as the significant improvement could be on the back of higher spending on account of Lunar New Year holidays. Nevertheless some signs of green shots. Elsewhere, Japan’s final February manufacturing PMI came +0.4pts above the preliminary read at 48.9 (vs. 50.3 last month). In other news, MSCI has said that it will expand the weighting of China-listed shares in its benchmark indexes which is helping sentiment there.

Geo-political tensions are also showing signs of de-escalation as the week closes with Pakistan’s PM Imran Khan saying yesterday that he will return the captured Indian pilot back to India today while overnight, North Korea’s Kim Jong Un said that he will meet again with President Donald Trump to continue nuclear negotiations after a two-day summit between the leaders collapsed yesterday and expressed appreciation for Trump’s “active efforts toward results” and called the summit talks “productive.”

The better than expected China’s PMI, China’s MSCI news and de-escalation of geo-political risks has helped sentiment overnight with markets in Asia trading largely up with the Nikkei (+1.13%), Hang Seng (+0.31%) and Shanghai Comp (+0.21%) advancing while the Kospi (-1.76%) is down after the disappointing end to the summit yesterday. Elsewhere, futures on the S&P 500 are up +0.40% and the Japanese yen is weak (-0.30%) this morning.

As we start a new month, markets will do well to match the heady gains of the last two months however the last day of February proved to be a bit of a damp squib for risk assets. That being said, it’s bond markets that continue to remain (relatively speaking) lively with yields finally deciding to move against zero’s gravitational pull in the last 48 hours. Better than expected Q4 GDP and Chicago PMI readings in the US – more on those below – was as good an excuse as any yesterday and it helped Bunds (+3.5bps) climb to 0.183% and the highest since 30 January. Treasuries were also up as much as +7.2bps from the intraday lows at one stage and ultimately finished +3.6bps on the day at 2.719%. Amazingly, despite all the excitement of the last two days, on an intra-day basis the range for Treasuries in February was just 11.6bps and we’d completed that by February 5th. If we look at the period since then, the range is just 9.3bps. So it wasn’t exactly the most exciting month for Treasuries despite the mini tantrum in the last couple of days.

By contrast, there was some divergence across risk assets yesterday. The various geopolitical noise hasn’t helped sentiment this week, including talks between Trump and Kim Jong Un being cut short in Hanoi. This was offset to some degree by the more upbeat trade comments from Kudlow and Mnuchin. The S&P 500 ended -0.28%, and traded in an intraday range of just 40bps, its tightest range since last September. The STOXX 600 finished +0.06%, while there were outsized gains for the IBEX (+0.72%) and FTSE MIB (+0.78%). Banks appeared to play a role in that, with European Banks as a sector up +2.01% reflecting the bond move and Spanish and Italian Banks up +1.86% and +2.12%. Meanwhile, HY credit spreads were -4bps and -3bps tighter in the US and Europe. The euro traded close to flat versus the dollar at 1.1374, capping its narrowest three month stretch ever, with a range of just 2.9% over that period.

Back to that data yesterday, Q4 GDP in the US printed at a better-than-expected +2.6% qoq saar (vs. +2.2% expected). The breakdown was equally supportive with private domestic demand up +3.1% and consumer spending reasonable following concerns post the odd December retail sales report. Trade also subtracted less than expected from the overall headline number. Core PCE prices rose at an annualized pace of 1.7% on the quarter, a touch above expectations, which presents some upside risks to today’s December print. As for the Chicago PMI, the February reading jumped a whopping 8pts to 64.7 and far exceeded expectations for a more moderate 57.5. That is the highest reading since December 2017 and like the GDP report, the details also made for pleasant reading with new orders up over 15pts and production over 8pts higher. As you’ll see in the day ahead at the end, we’ve got the ISM manufacturing reading today which is expected to fall slightly from 56.6 to 55.8 however recent regional surveys perhaps indicate some upside risk to the headline reading now, since the Chicago, Dallas, Empire, and Richmond prints all moved higher this month, leaving the weak Philly print as an outlier.

The other data of note in the US yesterday was the latest weekly initial jobless claims print, which rose 8k and a bit more than expected to 225k. That said, the four-week average has dropped for two consecutive weeks now to 229k. As for the data in Europe, it was a busy day for inflation releases. In a nutshell, Germany (+0.5% mom vs. +0.6% expected) and France (+0.1% mom vs. +0.3% expected) missed, Spain (+0.2% mom vs. +0.1% expected) beat and Italy (-0.2% mom) was in line. Today we’ve got the broader Euro Area reading with the consensus pegged at an unchanged +1.1% yoy for the core reading. Our economists had expected it to also come in at a weak +1.1% yoy however yesterday’s country level data likely puts the risk at that coming in below market.

Turning to Fedspeak, where the most interesting comments were from Vice Chair Clarida, who noted that “market-based measures of inflation compensation have moved lower, on net, since last summer, though they have increased some recently.” This suggests that Clarida wants to see higher inflation pricing before endorsing another rate hike, which is the rationale behind one of our rates strategists’ favorite trades of being long US breakevens. The rest of Clarida’s comments conformed to recent FOMC rhetoric emphasizing patience and data dependence as a response to financial market volatility and slower global growth. Elsewhere, Philadelphia Fed President Harker reiterated his preference for one hike each this year and next. That was likely also his view as of December, so his stasis suggests reduced scope for the dots to fall at the March FOMC meeting.

Finally to the day ahead, which kicks off this morning with January retail sales data in Germany before all eyes turn to the final revisions of the February manufacturing PMIs. For what it’s worth, no change in the Euro Area reading of 49.2 is expected, while the same applies for Germany and France at 47.6 and 51.4, respectively. Italy and Spain are expected to fall slightly to 47.2 and 51.7, respectively. Away from that this morning we also get February employment data in Germany and January money and credit aggregates data in the UK, as well as the advanced February CPI reading for the Euro Area as mentioned above. The big highlight in the US today meanwhile is the December PCE report which is expected to show a +0.2% mom core reading (+1.9% yoy and unchanged versus November). We’ll also get the December personal income and spending reports, January manufacturing PMI and February ISM manufacturing – the latter of which is expected to fall just under 1pt to 55.7. The final revisions to the February University of Michigan consumer sentiment survey round out the data. Away from all that, it’s the turn of the Fed’s Bostic to speak this evening.

via ZeroHedge News https://ift.tt/2Eo7h6W Tyler Durden

The Daley dynasty has not been restored. Richard J. Daley, the prototypical 20th-century big-city mayor and party boss, ruled Chicago for 21 years; the only man who held the office longer than that was his son, Richard M. Daley, who reigned for 22. This year Bill Daley, Richard M.’s brother, ran for the mayorship himself. But he finished third in the opening round of voting this week, so he won’t be on the ballot when Lori Lightfoot and Toni Preckwinkle meet for the run-off in April.

The Daley dynasty has not been restored. Richard J. Daley, the prototypical 20th-century big-city mayor and party boss, ruled Chicago for 21 years; the only man who held the office longer than that was his son, Richard M. Daley, who reigned for 22. This year Bill Daley, Richard M.’s brother, ran for the mayorship himself. But he finished third in the opening round of voting this week, so he won’t be on the ballot when Lori Lightfoot and Toni Preckwinkle meet for the run-off in April.

The world would be a less-stressful place, or at least a less silly one, if clueless people would stop checking into creaky old houses on the edge of dark forbidding forests. Especially if they’re unstable young moms accompanied by their small sons. And extra-especially if they can experience an encounter with a crazy old lady who shuffles up to them and screams “It’s not your boy!” and somehow fail to accept this as food for thought.

The world would be a less-stressful place, or at least a less silly one, if clueless people would stop checking into creaky old houses on the edge of dark forbidding forests. Especially if they’re unstable young moms accompanied by their small sons. And extra-especially if they can experience an encounter with a crazy old lady who shuffles up to them and screams “It’s not your boy!” and somehow fail to accept this as food for thought.