The Twin Cities have spent gobs of public money on new baseball, football, and soccer stadiums in recent years. Not to be outdone, a Minneapolis suburb is now planning to flush away $7.5 million designing what would be one of the country’s largest indoor water parks.

The city council of Bloomington, Minnesota, voted unanimously last month to team up with the privately owned Mall of America (located in Bloomington) on the water park project. That $7.5 million covers 75 percent of a development contract that will design the park; the Mall of America is paying for the other 25 percent. The mall plans to build the park on land currently occupied by a parking lot, the Minneapolis Star-Tribune reports.

The water park itself will be owned by a nonprofit that will lease the land from the corporation that owns the mall. If the water park failed to turn a profit, Bloomington would be allowed to impose a sales tax on the Mall of America to make up the difference—thanks to the state legislature, which passed a bill several years ago allowing the city to create a special sales tax zone specifically for the Mall of America.

“There really haven’t been any red lights that have popped up as this thing has been looked at and studied,” Mayor Gene Winstead tells the paper.

He must not be looking very hard. As the Star-Tribune previously reported, the Mall of America has sought for years to build a giant water park alongside the nation’s biggest shopping mall, but Mall executives don’t think the water park would generate enough revenue to be viable if it were privately funded.

That’s a pretty damn big red flag right there.

In the long run, taxpayers could be soaked for another $50 million to pay for a parking garage (or “parking ramp” in Minnesotan) and another $8 million in infrastructure upgrades to get the site ready.

The project doesn’t just look like a waste of Bloomington taxpayers’ money. It seems fundamentally unfair. There’s already a niche market for indoor water parks across the Upper Midwest, where they provide an easily accessible faux-tropical respite from the bitterly cold winters. If chains like Great Wolf Lodge—which owns an indoor water park literally right across the street from the Mall of America—and other privately owned operations can survive without government handouts, there doesn’t seem to be a compelling reason for Bloomington to dive into that market.

“Cannibalizing existing business enterprises in order to add a new attraction for the Mall of America is bad strategy for long-term business development and tax stability,” Murray Hennessy, CEO of Great Wolf Resorts, wrote in a letter to the Bloomington City Council. “If the water park project does not perform as projected, to recoup losses, Bloomington would have to levy additional taxes on admissions, food/beverage, lodging and sales tax. The additional taxes would further hinder tourism, and burden residents who routinely visit the Mall of America with their families.”

After years of lobbying city officials and the state legislature, the mall seems to be closing in on getting the public funds it wants. Bloomington has approved what the Star-Tribune calls an “intricate plan” that “stretches the intended purpose of tax-exempt borrowing” to make all the numbers work.

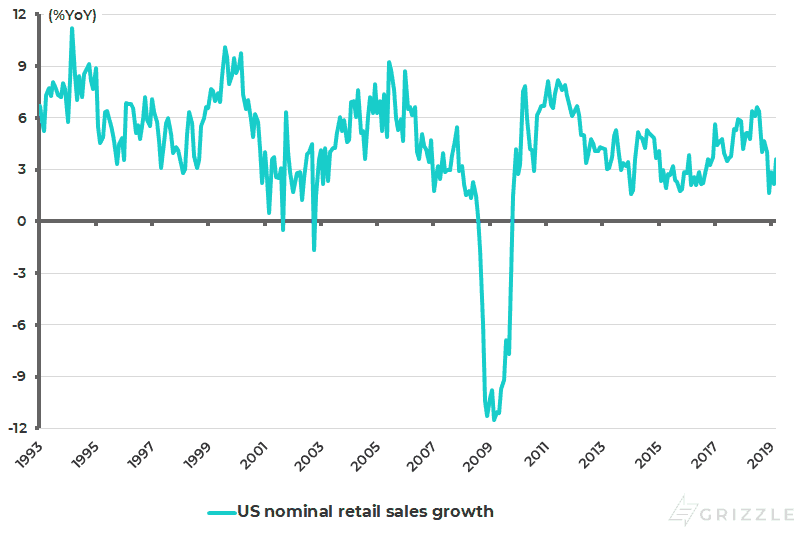

“It appears like there is a desire by the [Mall of America] to have a water park attraction but not necessarily a tenant who wants to rent out the space and build it out to meet its needs,” says Kimberly Lowe, a Minnesota-based attorney who specializes in nonprofit law. She tells Reason that the city may be trying to help the mall because “traditional lenders” are now less willing to finance mall projects given the recent contraction in retail sales.

The logic, such that it is, seems much like the justification for spending public money on sports stadiums. Sure, those are privately owned facilities built for privately owned teams, but they sorta seem like public spaces, since they serve as a gathering point for so many people. But in the end they’re just cronyist giveaways to politically favored activities—a list that now apparently includes “watersliding.”

If the city cared to look for more red flags, it could cast its eyes south to Nashville, Tennessee, where city officials recently drained $14 million out of public accounts to help build a private water park at the Gaylord Opryland Resort, open exclusively to hotel guests. In a 2017 poll conducted by the Beacon Center of Tennessee, a pro-market think tank, voters named that water park project the second worst example of government waste in the state (trailing only a state-level economic development program that spent $67 milllion to create 55 jobs).

At least Bloomington’s taxpayer-funded water park won’t require a $250-per-night hotel stay for access, but that hardly justifies the project. If the Mall of America can’t make a splash without getting a handout, maybe it should stay out of the pool.

from Latest – Reason.com http://bit.ly/2VFhQNG

via IFTTT