Hedge Fund CIO: You Should Be Buying Vol – MMT Is Coming Next And It Will Be Preceded By An Explosion In Volatility

Submitted by Eric Peters, CIO of One River Asset Management

“We’re approaching a redistribution,” said the macro CIO, swinging through NY. We were discussing trades, themes, the big picture. “What lies behind us were all good things for asset owners, and what lies ahead is in many respects the opposite.” We were eating at some Greek place. “Investors rode a trend based on stock buybacks, high profit margins (which are the inverse of low wages), low taxes, and loose regulation of technology,” he said, holding up four fingers. “Now think about what lies ahead.” And he lowered each finger into a closed fist.

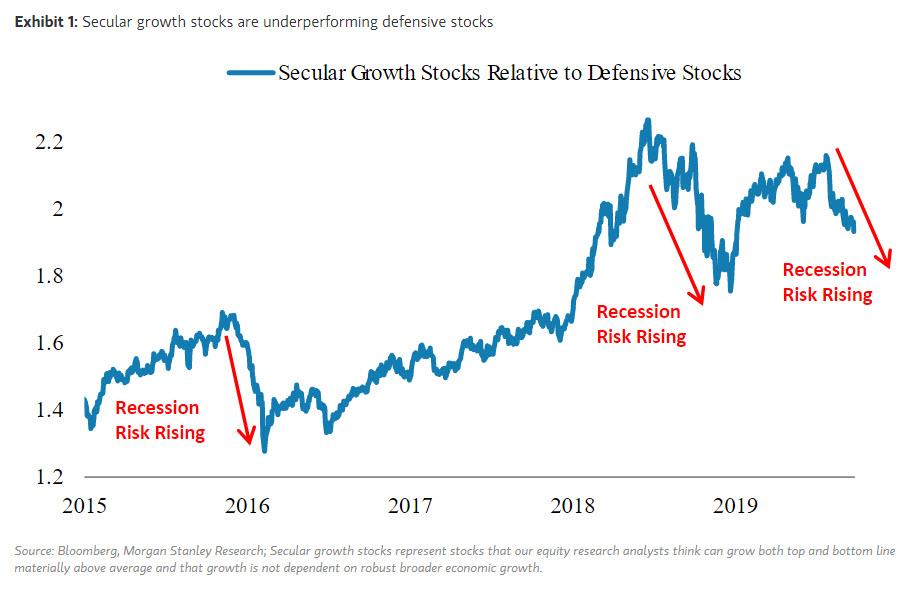

We hit peak inequality and it sparked a political response across the globe, I said. And it occurred at a time when monetary policy has largely hit its limit – those two things are obviously related. So now markets bump along with investors scrambling for sources of scarce yield, accepting more risk for less return, until something goes wrong – then the profound changes that are happening beneath the surface become clear. That’s when we see an enormous fiscal response, whether we call it MMT or not won’t matter. That’s what’s coming next.

“I spend a lot of time in Tokyo,” said the same CIO, dropping heavy names from his recent visit. “I’ve been pressing them for years to get seriously aggressive. When the government can borrow for 20-years at -0.20% in a nation filled with so many smart scientists, how can you not issue bonds and invest massively in primary science? Surely you’ll earn a positive return on that kind of investment – that’s not building bridges to nowhere,” he said. “But my contacts there can’t seem to wrap their heads around anything that challenges their orthodoxy.”

Established economic and political interests created myths about how economies work, I said in response. Entrenched interests fear change and will do everything possible to maintain the status quo. They created what we now call economic orthodoxy. But according to it, all this QE would have sparked massive inflation. Japan’s 250% Debt/GDP would have provoked economic collapse. But these things haven’t happened, because the myths are not truths. And as the faith in orthodoxy melts, established interests will fall, real change will come.

“When will the redistribution process really begins to manifest in markets? That’s the question,” said the CIO. “When it begins, there will be big trends to ride and leverage. That’s what happens in phase shifts. Until then there’s probably a tradeable move in bunds when yields jump on fiscal stimulus. That’ll be short lived, then rates will grind more and more negative until we hit the crisis,” he said. “Until then, it’s a hard trade, because all the pieces are in place but they haven’t come together in a way that forces investors to materially change their portfolios.”

You need to be buying volatility, I said. People are focused on interest rate vol, but central bankers are terrified of rates rising. They’ll try to engineer negative real rates for a decade or more to get us all out from beneath this debt pile. That means the volatility will surface elsewhere. FX implied volatility is near all-time lows and in a world where central banks are scared to hike to defend their exchange rates, currencies are where the volatility should first appear, and then the vol in equities will explode. That’s where the biggest structural shorts are.

Anecdote:

“I’m not yet sure how to think about the conflict,” said the same macro CIO. “I can imagine a world where East and West coexist peacefully, but I know some powerful people here who think the window is closing on America’s ability to contain China and maintain military superiority,” he said.

“That’s the kind of worldview that leads to kinetic conflict. But the US misunderstands China. Ironically, it is strong now but will grow brittle as time passes,” he said. “Their surveillance state is now firmly established and will only get stronger, more sophisticated. But there will be costs to that – to the dynamism of their society, economy. They may be able to anticipate dissent and crush it, but they’ll expose themselves to cracks and divisions from within,” he said.

“The deal was always that guys like Jack Ma could make billions, but the state would take most of it. When he started buying property overseas, you knew the process had started – this is an example of something that will undermine their economic strength,” he said. The real window that I see closing is different, I explained. Advances in processing speeds, artificial intelligence, weaponry and proliferation mean we’re approaching a point where there will be so little time to respond to an overwhelming military attack that we’ll need to turn our defensive systems over to machines. As we approach that moment, it’s conceivable that some nation will conclude that its most rational course of action is to strike preemptively.

So ironically, technology is closing the window on our ability to coexist peacefully. We need a radical rethink in terms of how we interact with one another to avoid catastrophe. And I often wonder if the reason we’ve not discovered signs of life in the universe is because the features that allow intelligent life to advance contain the seed of self-destruction.

Tyler Durden

Sun, 09/29/2019 – 20:00

via ZeroHedge News https://ift.tt/2nEf63L Tyler Durden