“This Market ‘Stalemate’ Is Coming To An End One Way Or Another…”

Authored by Sven Henrich via NorthmanTrader.com,

Where is it? The great bull market? Where is the imminent great bear market? Fact is markets are in engaged in a big game of stalemate. Bulls keep buying every dip, but all rallies are sold and are selling opportunities. Nobody’s making any progress whatsoever chasing from headline to headline that are associated with the various daily moves but accomplish previously little in the big scheme of things.

That said one can’t shake the sense that this stalemate is soon coming to an end and October may well be the month that provides clarity.

Let’s look at the facts and risk factors.

Fun facts:

On October 2, 2018 $DJIA made an all time high with a print of 26824. This past Friday, almost 1 year later, $DJIA closed at 26820. Virtually the same price.

On September 21, 2018 $SPX printed an all time high of 2940.91, last Friday’s intra-day low was 2945.53, both data points reflective of the nowhere state of affairs over the past year. That is on the surface. Underneath plenty of things have changed.

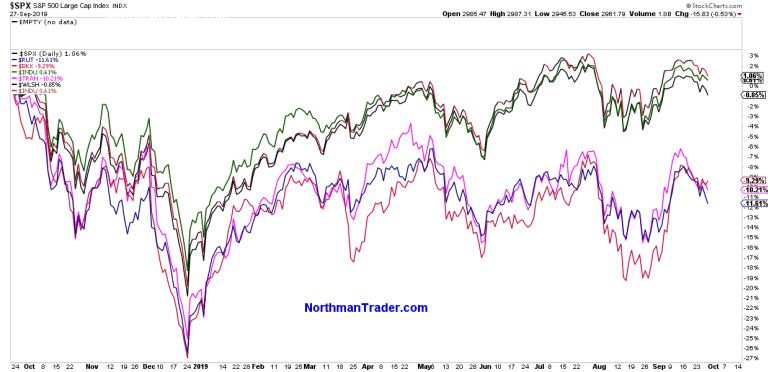

$DJIA, $SPX and $NDX are near the same levels, other indices such as the banking sector, small caps and transports are 9%-11% below last year’s levels:

These lagging indices continue to show no progress and continue to chop in the same range they’ve been in for months.

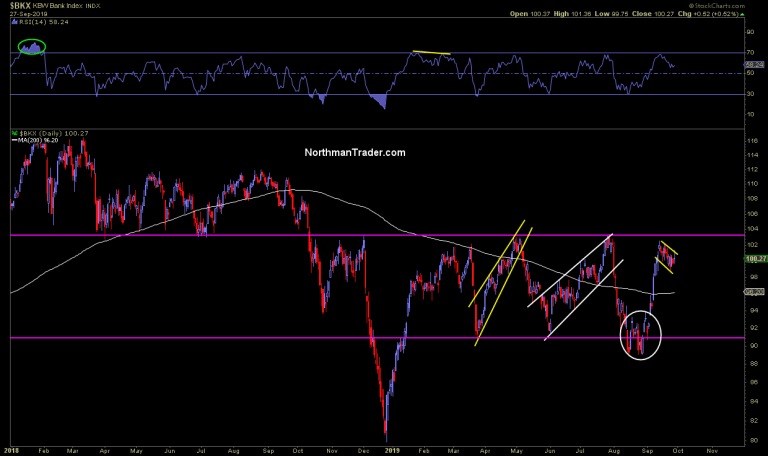

For $BKX the positive that may be said is that it may be setting up for a bull flag here that may push it across resistance:

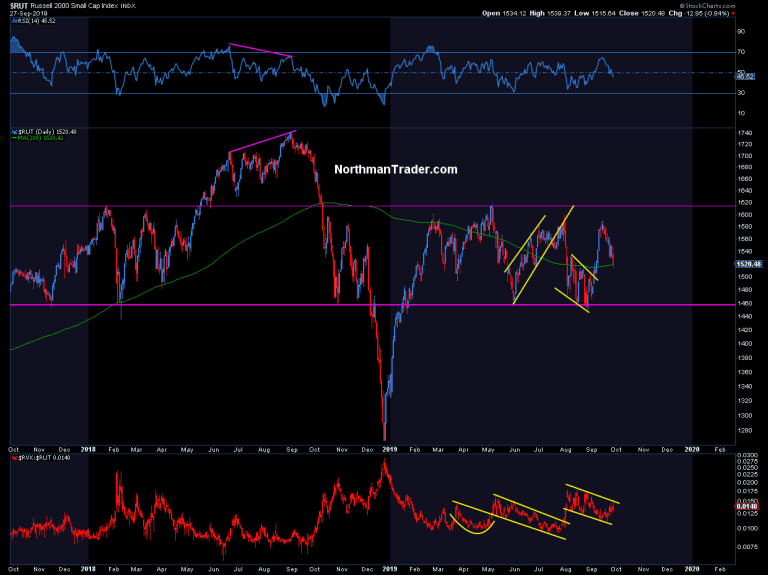

Small caps made another lower high and are currently trying to defend support at the 200MA while its underlying volatility index continues to show a well defined bull flag that shows risk of a coming volatility breakout:

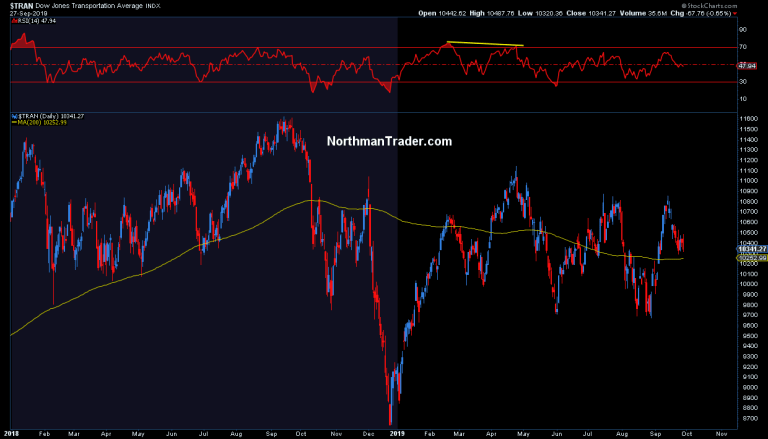

Transports? Stalemate and chop:

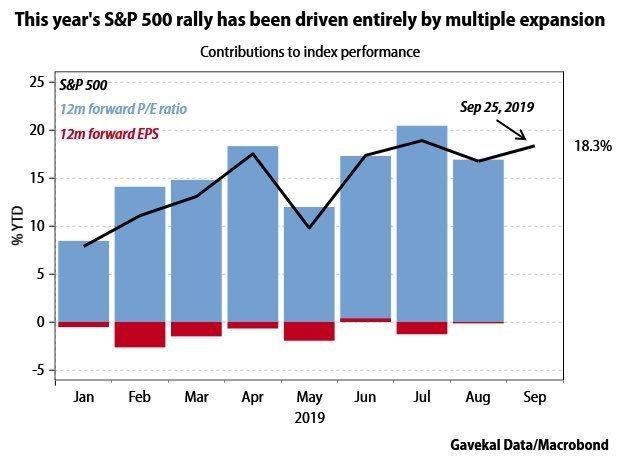

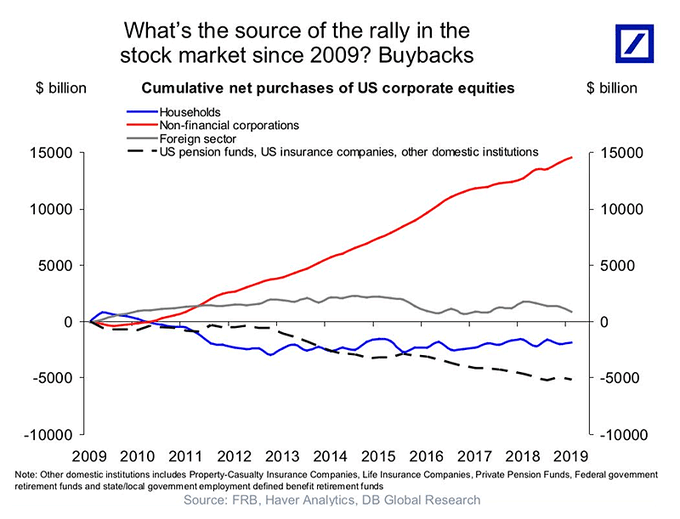

The great re-inflation trade in the main indices of course driven by multiple expansion pure:

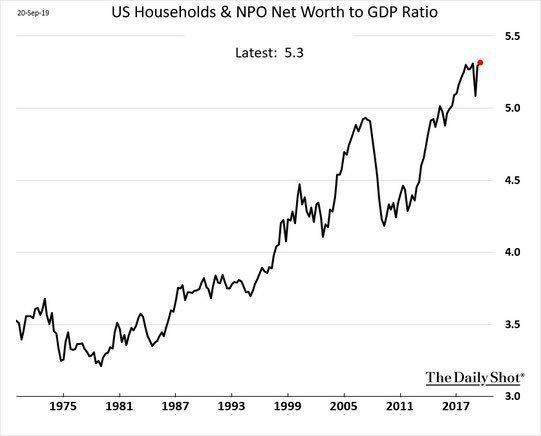

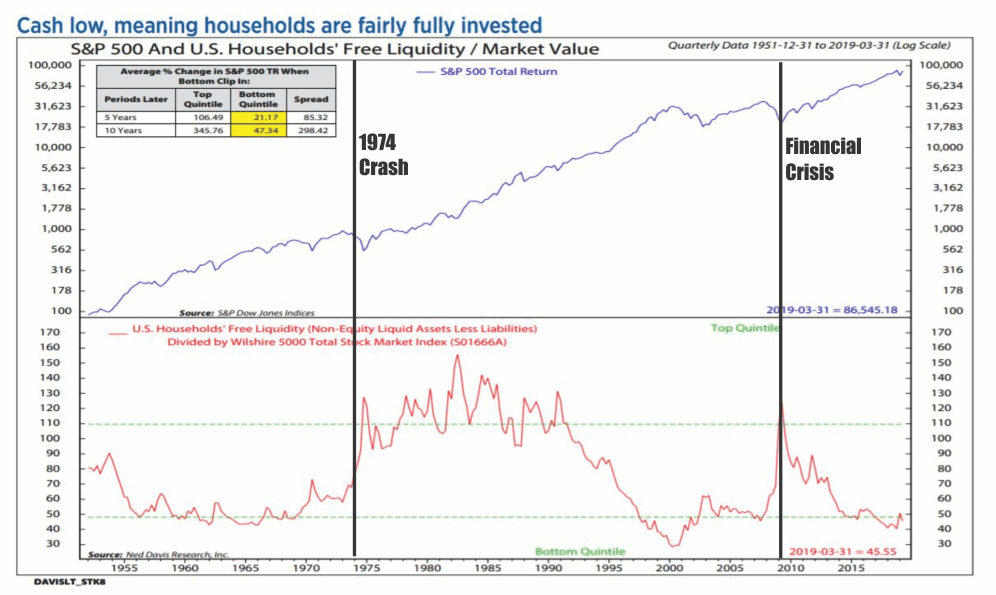

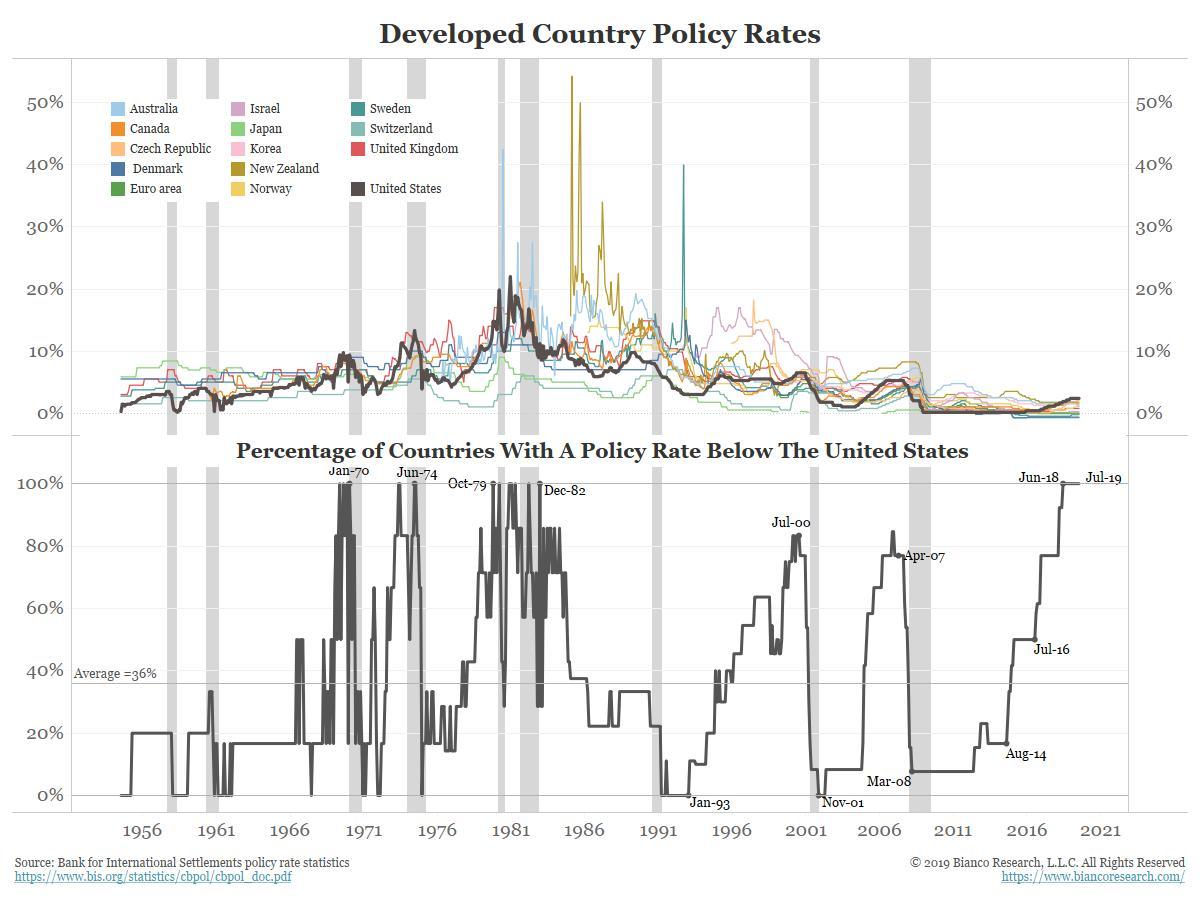

This multiple expansion greatly aided by a renewed intervention cycle of central banks desperate to keep extending an aging business cycle, but in doing so are re-inflating asset prices further above the underlying size of the economy reaching new record levels of household net worth versus GDP:

Money for free, value out of thin air.

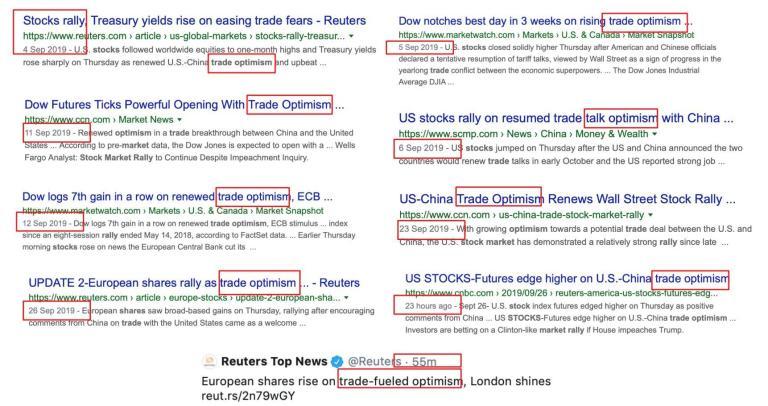

The other driver: Trade optimism headlines, a faithful source of market rallies in 2019, went into overdrive in September:

And as such expectations are high for the October 10 trade meetings set between the US and China. I’ve been saying for months a trade deal will be key for markets this year. The longer the trade war drags on the worse the continued uncertainty will dampen investment and consumer sentiment and this is precisely what we’re seeing with global PMIs not showing any real improvements and consumer uncertainty approaching levels that risk that consumer spending may get negatively affected.

Whether the recent positive signals on trade were partially fueled by the Chinese’s desire to have a positive social mood for the upcoming 70 year celebration on October 1st remains to be seen. Like the rest of the world they are likely to closely watch the upcoming impeachment inquiry in the US. The US election is a mere 14 months away and the Chinese will want to assess the unfolding developments in their strategic assessment on how to proceed in their trade negotiation strategy.

Why accept a bad deal if things can change rapidly?

Can things change rapidly? Conventional wisdom currently suggests that nothing much will change as Donald Trump’s continued support in the Senate is presumed and even is House Democrats were to impact him a Clinton like outcome would support a continued market rally into 2020.

The alternative being the unexpected Berlin Wall effect. Assumed to be the status quo for years sentiment suddenly changed out of the blue and the Berlin Wall was no more. A similar fate that Richard Nixon experienced when impeachment was initially not viewed as popular either by voters nor by Republicans, but then the tapes came out and 3 days later Nixon resigned knowing he lost support by Republicans.

None of us can know how events will unfold, but as we are rapidly approaching the 2020 elections history teaches that strong support can dwindle rapidly when new facts emerge hence they next few weeks may well be critical in determining whether the status quo remains or whether a new unexpected reality emerges.

I recognize readers may have strong feelings and views on the subject one way or the other, what I am suggesting is that everyone stay open minded as unfolding events may well impact trade negotiations and thereby markets.

In last week’s bear case I made the argument that downside may well emerge and that a generally assume market breakout to new highs was perhaps not sustainable or perhaps not even in the cards.

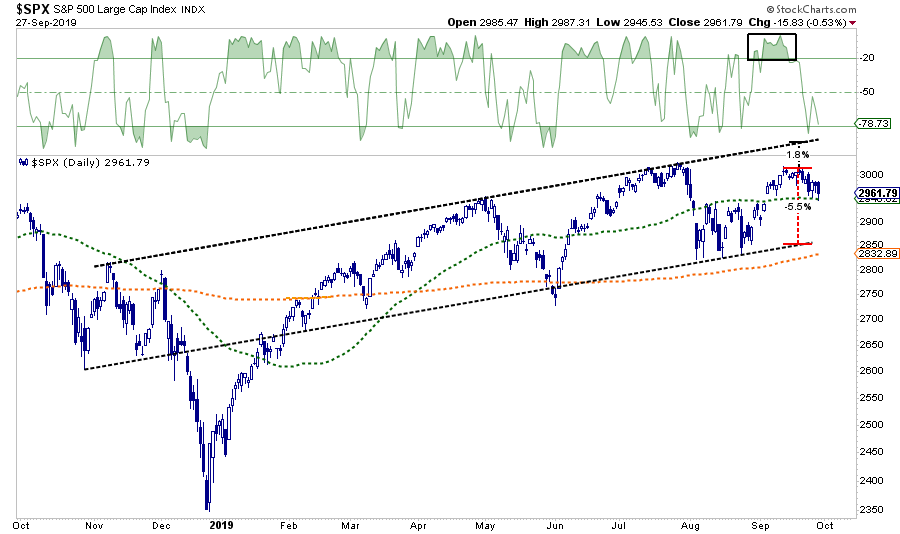

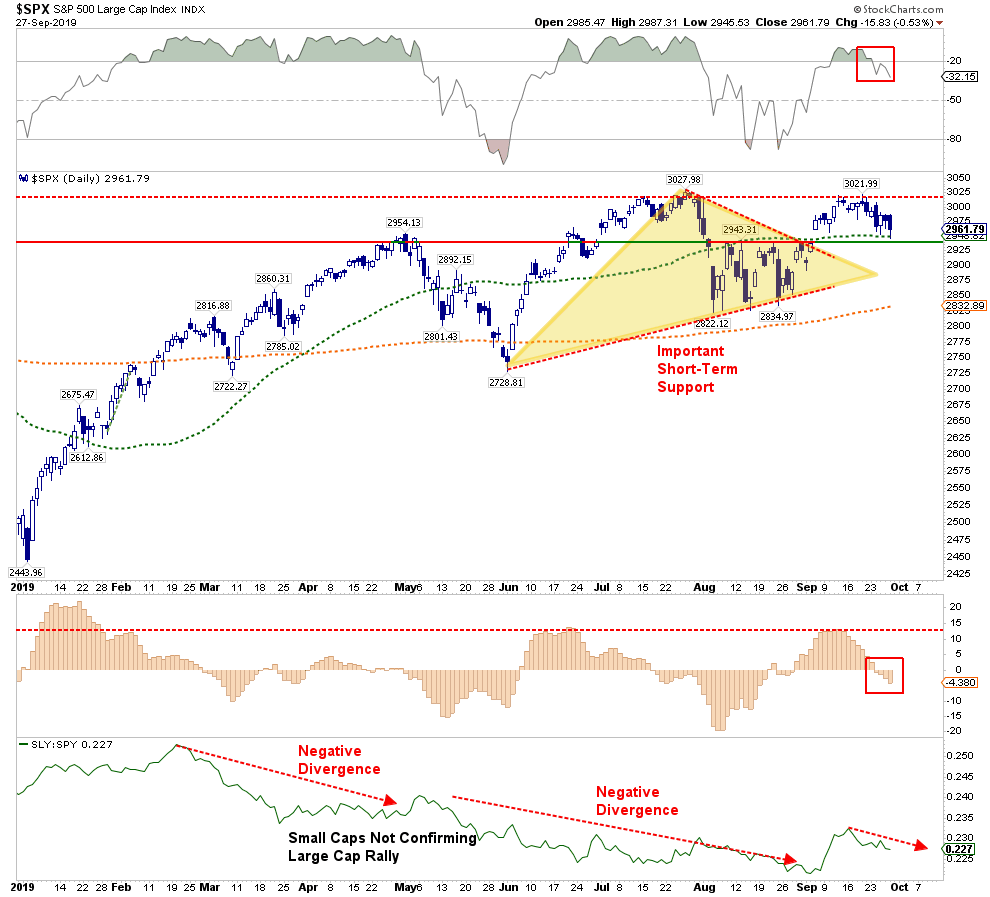

As it were markets took the route south and again rejected any attempts above $SPX 3,000:

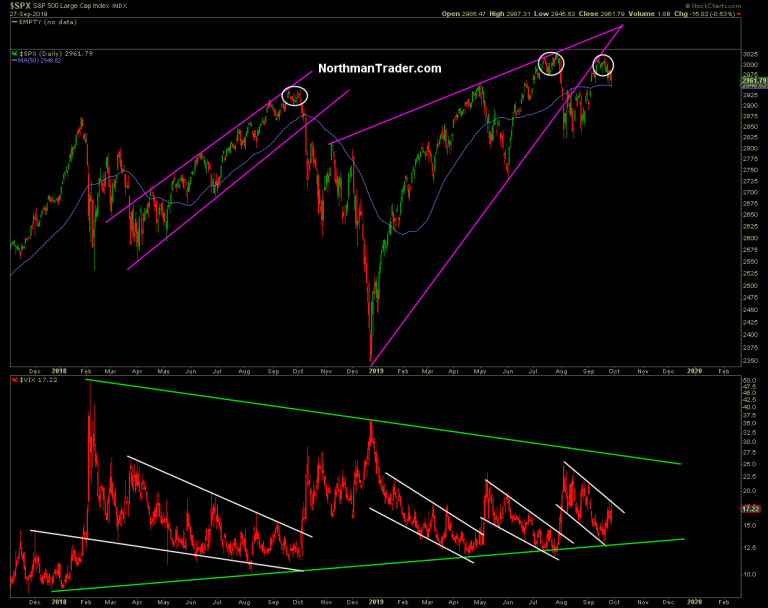

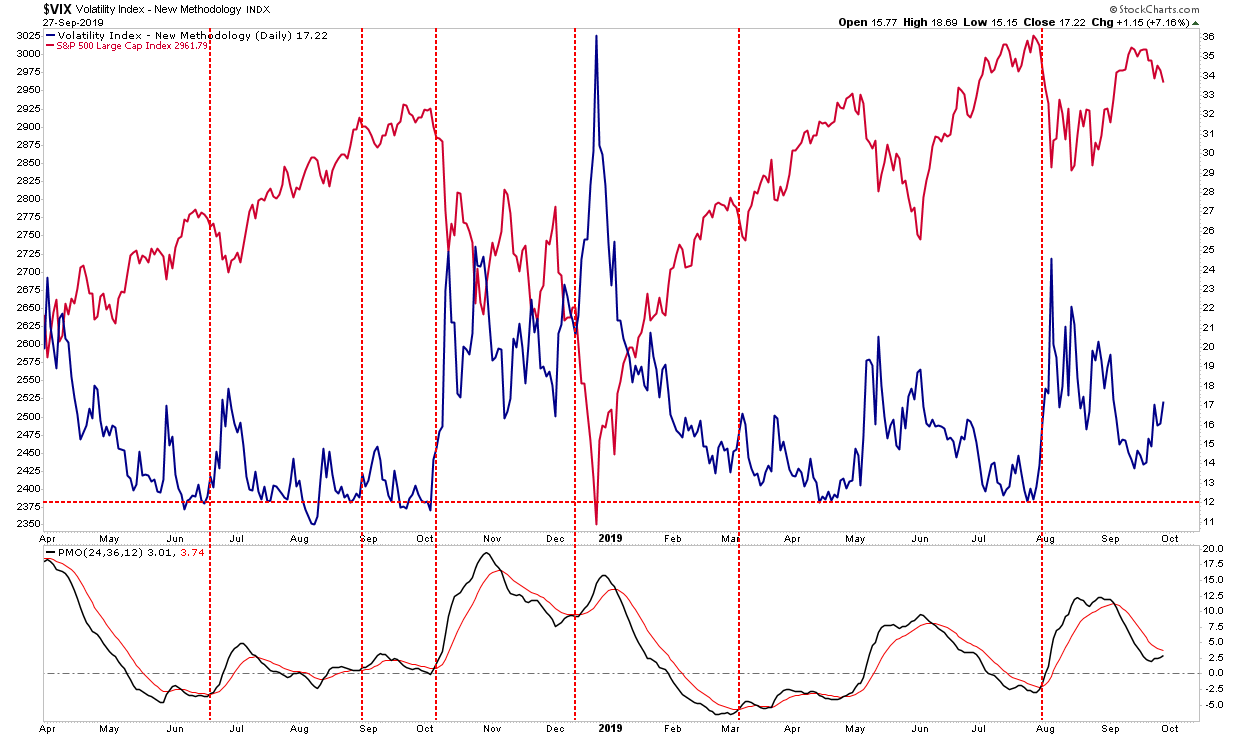

While $SPX saved 50MA support on Friday markets are now also confronted with the prospect of a potential double top on $SPX while $VIX continues to build its bull flag pattern (see also $VIX getting jiggy). Friday’s rejection at the trend line again confirming the relevance of the structure.

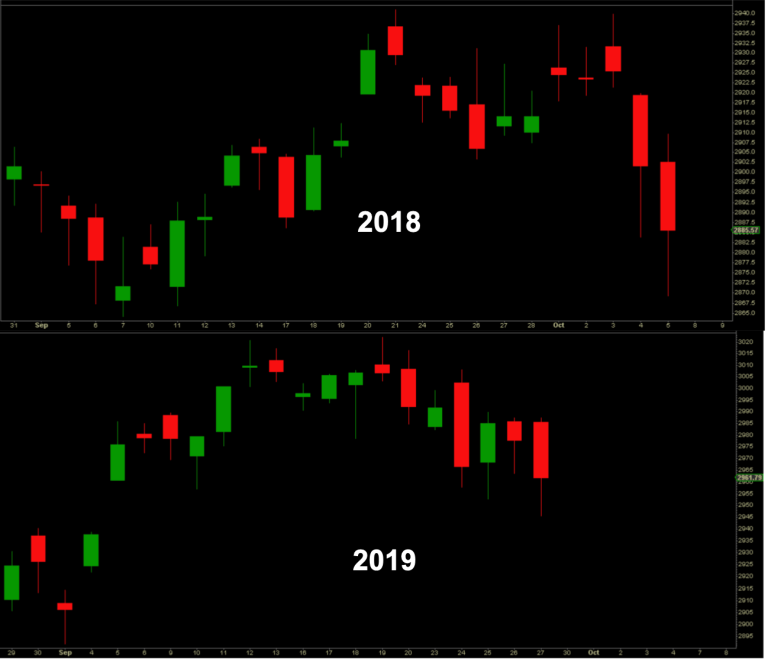

In Replay in early September I suggested that markets appear to be following a similar script to last September and for all the noise in headlines one can’t help but be impressed how similar in structure the price action keeps unfolding compared to the same month last year:

An early month dip followed by a rally into September Opex, then a dip following Opex. If the script continues it suggests another rally into early October. In 2018 markets peaked in early October followed by a 20% correction into December. It seems incredulous to think that markets will follow a similar path into Q4 of 2020, rather, with continued central bank support, one may expect a buyable dip scenario followed by a year end rally before a larger bear market is to unfold into 2020.

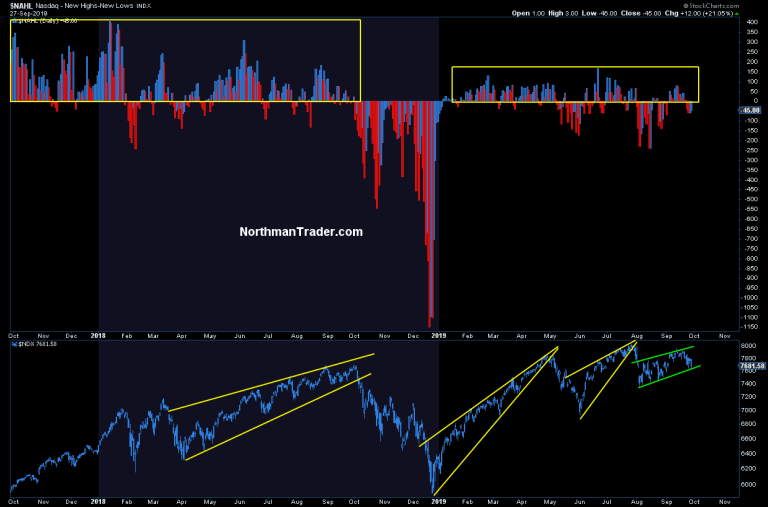

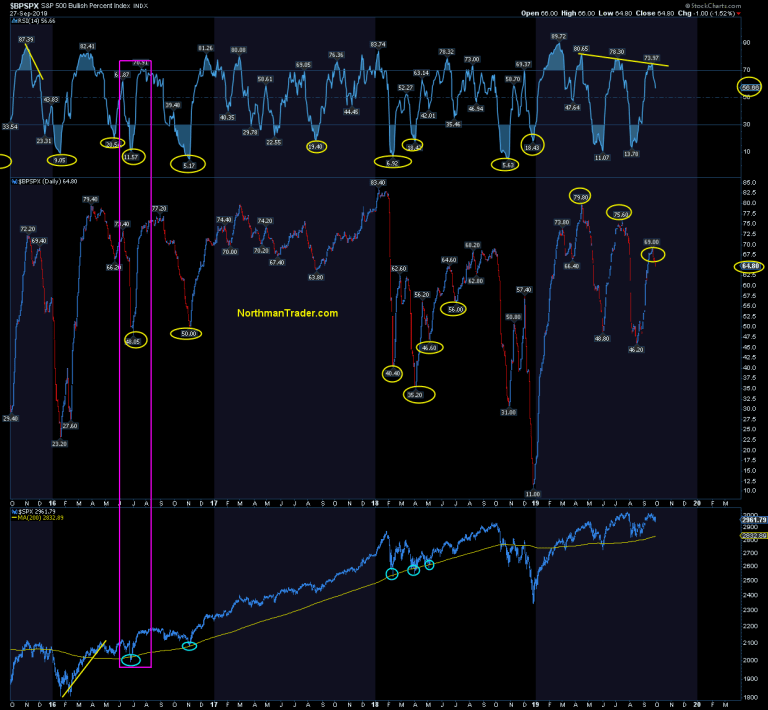

But note the road of reflation in asset prices to new highs in 2019 has come on a much weaker participation even in the strong indices and negative divergences once again permeate the landscape.

In $NDX new highs versus new lows have been much weaker compared to 2018:

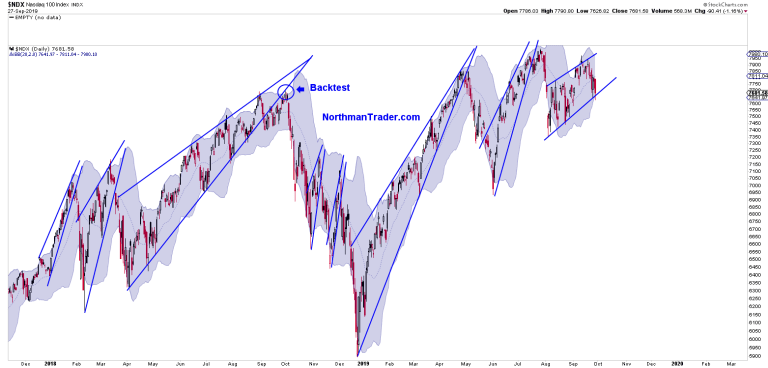

Indeed $NDX may actually be engaged in a bear flag pattern which again serves as tenuous support on Friday:

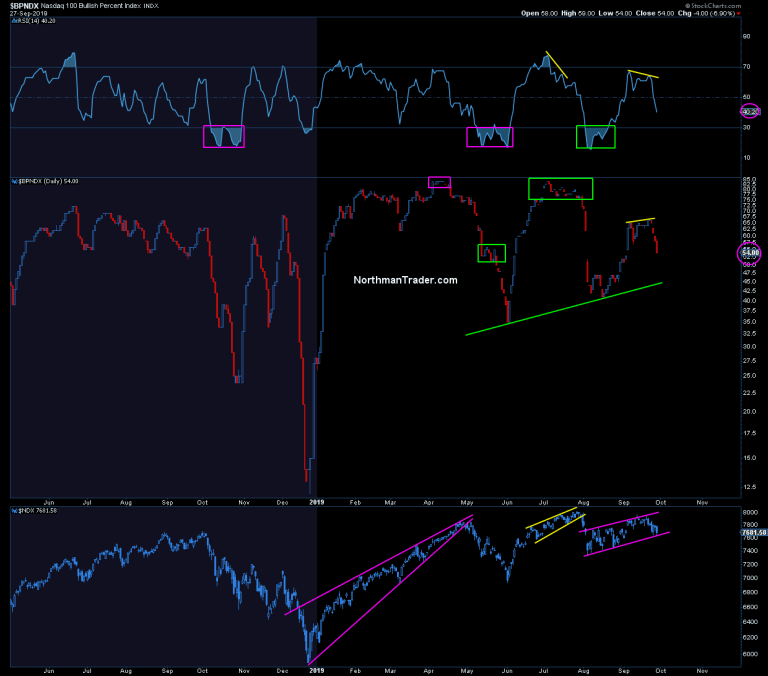

$BPNDX showed a rollover in September:

While $BPSPX printed lower highs all summer:

Where’s the bull market in that?

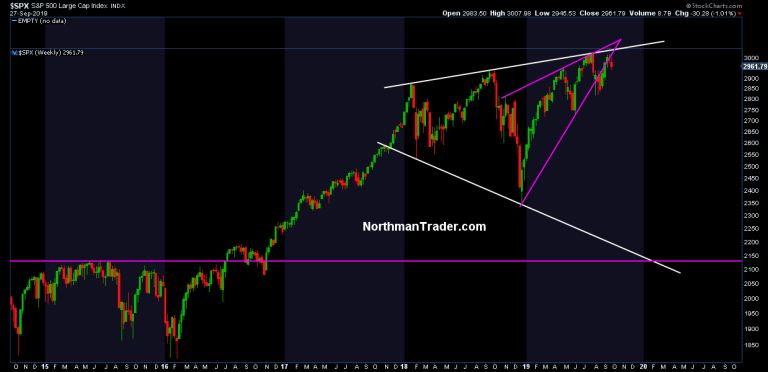

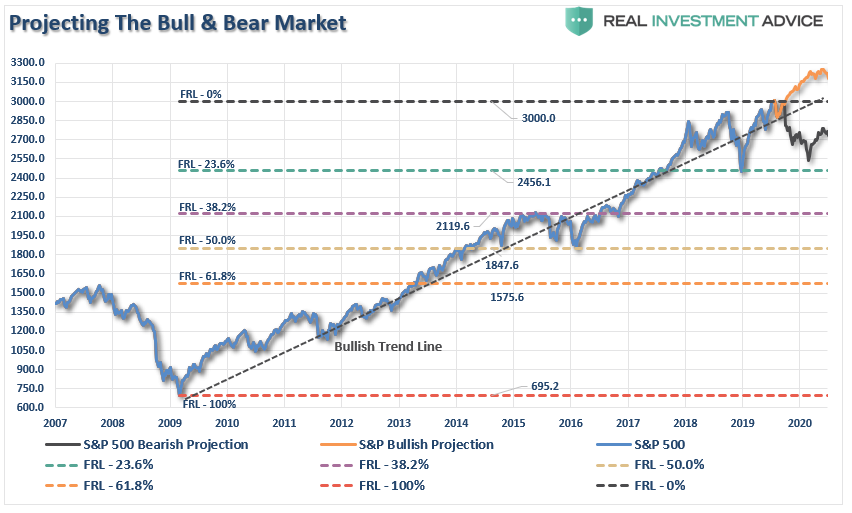

And so the main facts I outlined on CNBC Fast Money at the end of August remain: The larger megaphone pattern has not been invalidated and the 2019 trend remains unprepared:

Here’s the original clip for reference:

Was a real pleasure discussing markets on @CNBCFastMoney last night.

This big pattern structure is the global recession risk-off scenario if there’s no China deal & central bank efficacy fails.

I’ll add more color this weekend.

thx @GuyAdami @MelissaLeeCNBC @RiskReversal https://t.co/YLBAGPQ9Er— Sven Henrich (@NorthmanTrader) August 30, 2019

And hence markets remain in a state of stalemate. Bulls continue to fail to making a sustained breakout and bears have not been able to bring about a breakdown, but keeping lagging indices at bay.

October may likely be a decisive month on this front. Aside from trade talks earnings reports will bring about some clarity as to the impact of continued of uncertainty not only on earnings but also on forward outlooks. The big question: Will we get a sense if compressing operating margins will filter into the unemployment picture the missing link to the bear case?

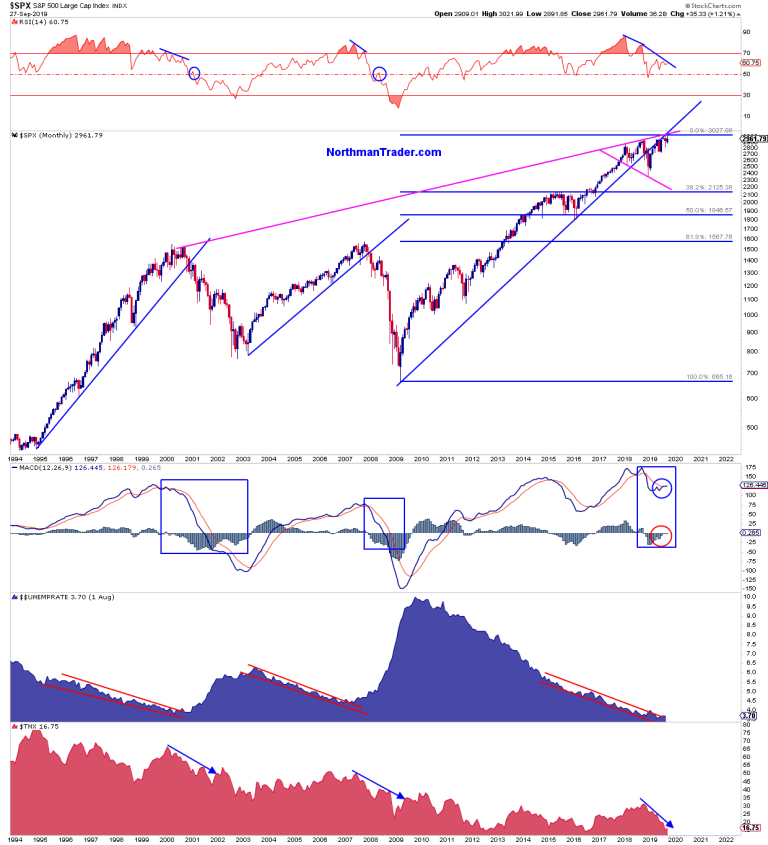

The larger market structural view suggests we’ve arrived at a key decision node:

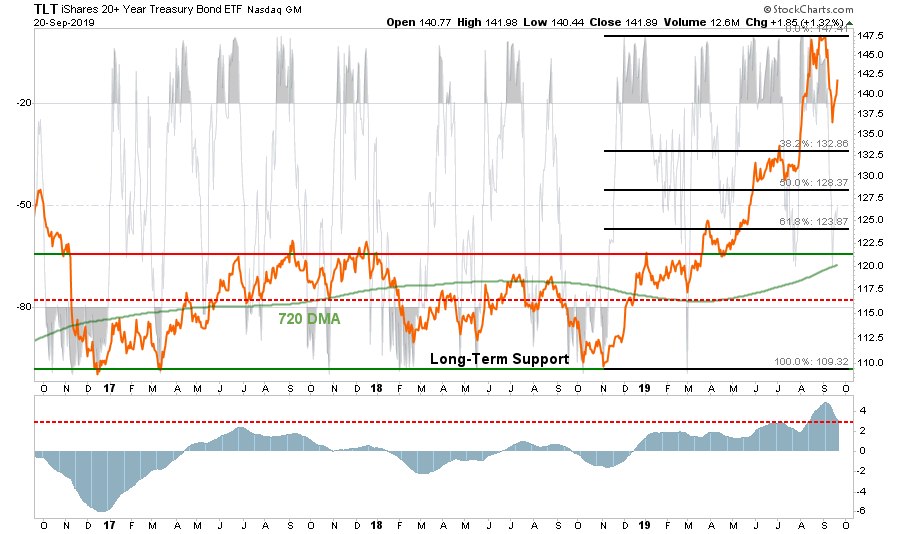

Market strength continues to be sold and shows negative divergences, but dips keep being bought. Volatility structures continue to show higher lows and patterns suggestive of a coming volatility spike. I maintain that a market driven by pure multiple expansion on headlines and central bank actions alone can ill afford disappointments. Market indices trading near all time highs chasing every trade optimism headline appear to have not priced in any continued failure in trade talks. An interim deal or news of progress may well be a source of future rallies and even new highs, the question is one of sustainability.

Political uncertainty has suddenly become front and center and its impact on consumer confidence and spending has to be carefully gauged in the weeks ahead.

Having failed to make new highs in September market now face the technical prospect of a potential double top. The message is clear: Bulls absolutely need sustained new highs in October or Q4 may have to contend with the ghosts of Q4 2018. This stalemate is coming to and end one way or the other.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sun, 09/29/2019 – 11:00

via ZeroHedge News https://ift.tt/2onIewJ Tyler Durden