Hong Kong Property Prices Plunge For 8 Straight Weeks

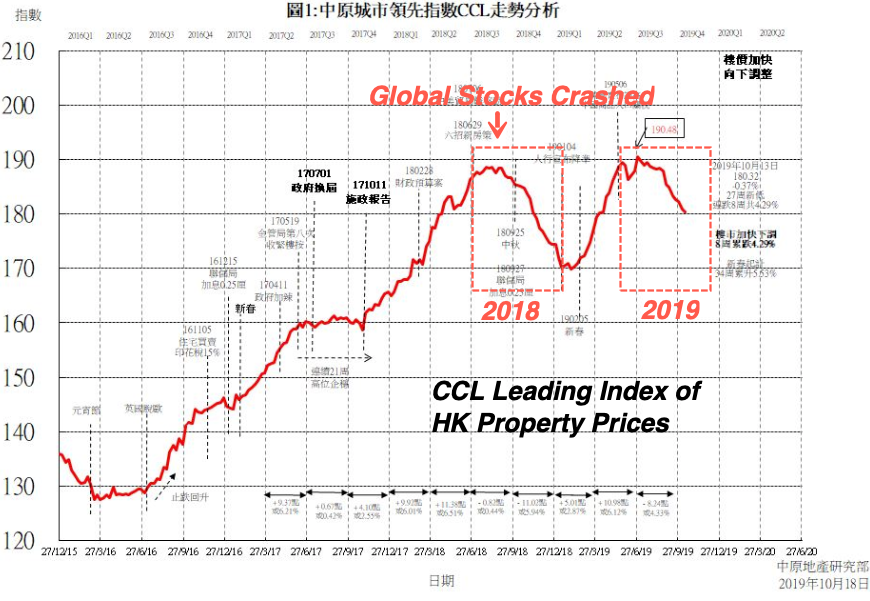

A new report from Centaline Property, a research firm providing private data on the property market in Hong Kong, has shown property prices are experiencing their worst downturns since late last year during the global growth scare, which sent global equity markets crashing.

Centaline’s report said property prices in the city have plunged for eight straight weeks, mostly tied to an extreme economic deceleration in the region as macroeconomic headwinds continue to increase.

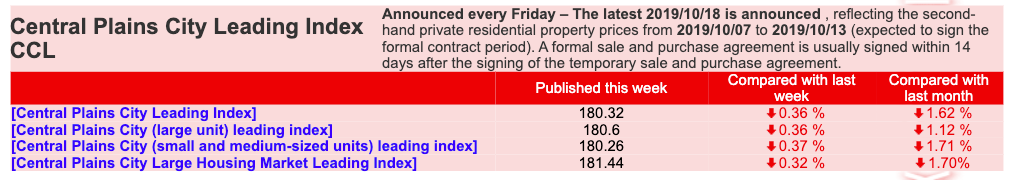

The Central Plains City Index (CCL) is a monthly leading index that tracks property prices in Hong Kong. Regional investors use CCL to track the changing trend of the Hong Kong property market.

As a whole, the CCL Leading Index has tumbled to 180.32, -.36% w/w, -1.62% m/m, and has recorded the lowest level in 27-weeks.

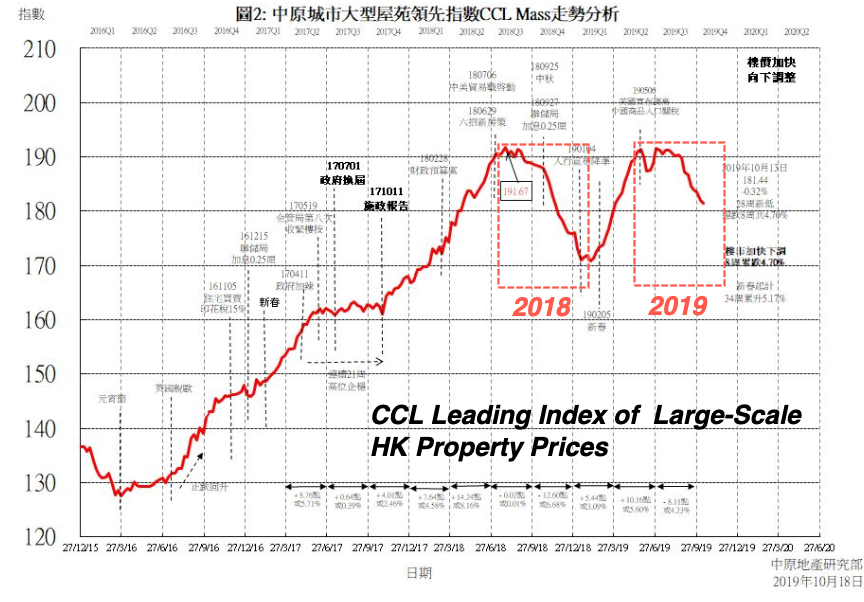

The CCL Leading Index for Large-Scale housing in Hong Kong printed at 181.44, -.32% w/w, -1.70% m/m, and now at a 28-week low.

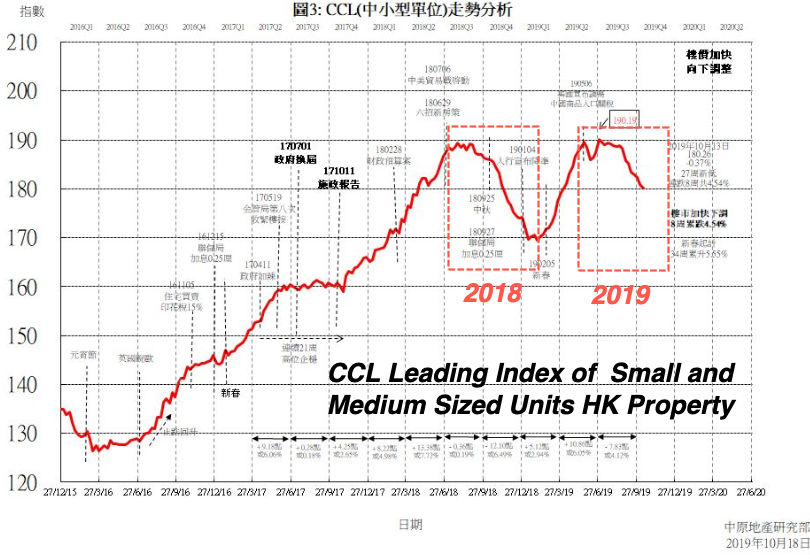

The CCL Leading Index for Small and Medium-Sized Units printed 180.26, -.37% w/w, -1.71% m/m, and now at the lowest levels in 27-weeks.

The three major leading indexes for Hong Kong property prices (above) slid for eight consecutive weeks, falling -4.29 %, -4.70%, and -4.54%, respectively.

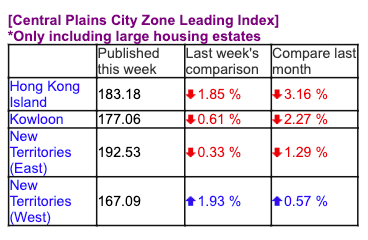

As shown below, 75% of the top regions in Hong Kong saw the CCL leading index drop, indicating price deceleration continued through late summer into fall.

And with a recession and social unrest expected to deepen in Hong Kong through year-end, it’s likely that CCL’s leading property price indicators will point down into 1H20.

Tyler Durden

Sun, 10/20/2019 – 23:20

via ZeroHedge News https://ift.tt/2Mx3tpn Tyler Durden