America’s Giant Debt-For-Equity Swap Exposed

Authored by Colin Lloyd via The American Institute for Economic research,

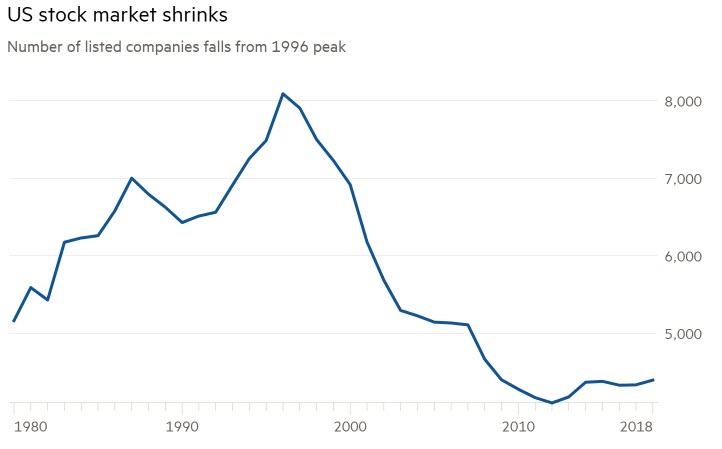

Since the mid-1990s, the number of companies listed on US stock exchanges has been steadily shrinking. There are currently just over 4,000 companies listed, up from the 2012 low but way down from a peak of more than 8,000 in 1996. Europe has not been immune; only 84 companies have listed this year, the lowest in a decade and the lowest by deal value since 2013. European capital markets have always been less equity-centric than the US, but even here the number of listings has shrunk by 29 percent since 2000.

Source: World Bank, Financial Times

In the post–financial crisis period, three factors have driven the retreat of listed equity:

-

the rise of private equity (an industry that is estimated to be sitting on more than $2 trillion in capital awaiting new opportunities),

-

the slower pace of new companies launching on public markets (due to the availability of private venture capital),

-

and mergers of existing listed companies. Behind these factors lies a more powerful force: artificially low interest rates.

In a low–interest rate environment, the appeal of debt financing increases relative to equity. This seemingly benign influence has profound implications for capital markets and the economy more broadly. By means of debt finance, earnings per share can be enhanced without the need for productivity gains. For the executives who direct those companies, the incentive to borrow externally, rather than improve internally, increases as debt-financing costs decline. Conversely, in a rising–interest rate environment these same executives are incentivized to improve the internal efficiency of their enterprises. To this extent, higher financing costs can contribute to improved productivity.

Financing costs have generally been falling since the 1980s. During this same period, executive compensation, especially via the award of stock options, has risen dramatically. Owning call options gives an investor a different incentive from a stockholder. The option holder’s preference is for capital over income; high dividends directly reduce capital value. Executive holders of stock options favor lower dividend payouts and higher earnings per share.

Falling interest rates have also impacted income-seeking investors. Faced with declining returns from fixed- and floating-rate investments, these investors have been forced to accept higher risk in the form of increased duration, greater credit risk, or leverage.

Duration risk is unique to fixed-income investment. All other things equal, the longer the maturity of a fixed-rate bond, the longer the duration — and therefore the more sensitive the price to a given change in the yield to maturity. As short-term interest rates have approached zero, the normally upward-sloping yield curve has flattened. In developed markets, this has been exacerbated by the central bank policy of quantitative easing. By this process, income investors are forced to look elsewhere for returns.

If the return from extending the duration of your portfolio has diminished, an alternative source of yield can be found by the purchase of less creditworthy debt. The insatiable investor’s thirst for yield has been quenched, at least in part, by private equity, venture capital, and leveraged-buyout funds that have securitized their borrowings. Demand has also been met by a wide array of corporate borrowers, many of whom issue debt simply to fund share buybacks. This debt may take the form of fixed- or floating-rate bonds or loans.

For a small group of income investors, the alternative to fixed coupons or floating-rate notes is the outright purchase of equity. In relative terms, this alternative has disappointed; income stocks have generally underperformed growth stocks during the last few years, in part because capital appreciation pushes stock prices higher, which attracts momentum investors. A stronger influence, however, is lower interest rates, which make higher price/earnings multiples more manageable. In addition, low rates encourage expectations of lower returns; they also make investors more fee conscious, favoring index-tracking products over discretionary funds.

Where Are We Now?

To recap, the breadth of the listed stock market is in long-term decline. Debt finance is cheaper than equity finance. For corporate executives, share buybacks are preferable to capital investment. Corporate debt levels are at or near all-time highs. The credit quality of the outstanding debt is deteriorating.

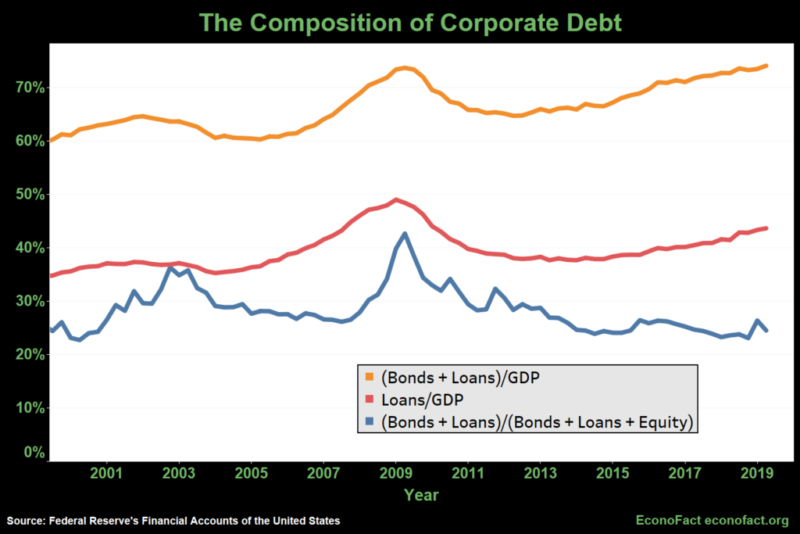

Further cause for concern is the changing makeup of debt. While corporate bond issuance has been growing, the corporate loan market has been in the vanguard of the expansion. The chart below shows the changing relationship between bonds and loans.

Source: EconoFact, Federal Reserve

The level of debt relative to GDP may be at new highs, but the cost of servicing the debt interest is relatively low, due to historically low official interest rates. The real risk in a recession is that credit spreads widen even as official rates are eased. As growth slows, US Treasury bonds may reach make new highs but lower-rated bonds and loans will still be sold. The credit intermediation process relies on the banks continuing to lend, but banks are notoriously procyclic, pulling in their horns just when they are needed most.

The current environment is not entirely negative. Robust corporate profits, during the long, slow recovery, mean that debt as a share of the total firm-financing mix is much lower today (25 percent) than it was during the 1980s and early 1990s (50 percent). The debt mix has tilted, however, toward floating-rate loans rather than fixed-coupon bonds. The weakest link for financial markets today may be found among leveraged loans and their investors.

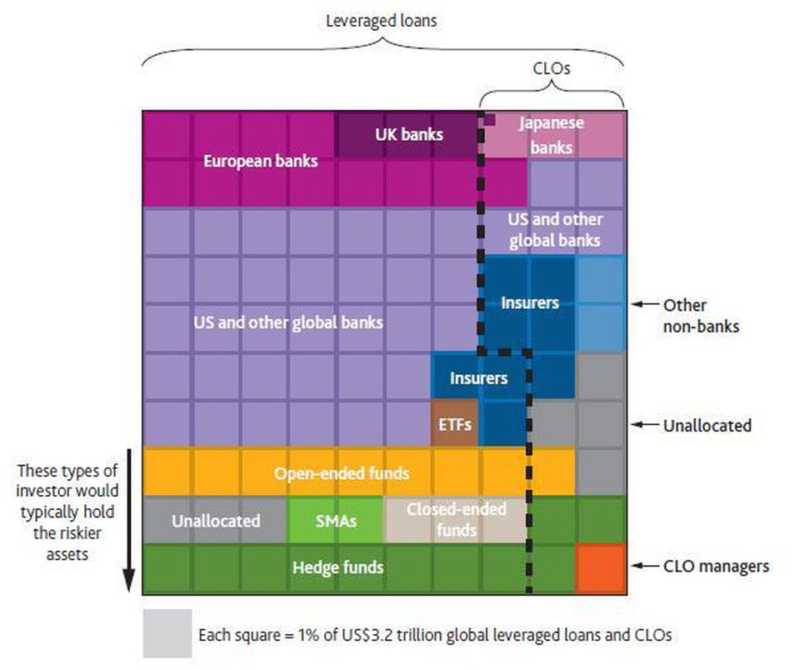

The principal buyers of leveraged loans are banks and insurance companies. The table below shows the current mix.

Source: Bank of England

As the table reveals, many of the higher-risk tranches of loans are purchased by open-ended mutual funds or ETFs, but a substantial proportion, especially those with lower risk, are held in collateralized loan obligations (CLOs). CLOs are, generally, floating-rate tradable securities backed by a pool of, usually, first-lien loans of corporations. Often these loans have poor credit ratings, many emanating from private equity, venture capital, and leveraged-buyout transactions. On their own, these leveraged loans may rank below investment grade, but, by bundling them together with better-quality loans, CLO managers contrive to turn base metal into gold.

If this sounds remarkably like the collateralized debt obligations (CDOs) that harbored covenant-lite subprime mortgages, which precipitated the financial crisis of 2008, then you would not be too far from the mark. CLOs do not contain mortgages or credit default swaps, but they do rely on the assumption that a diversified pool of loans has an inherently lower credit risk than the loan of an individual corporation with the same credit rating. Issuers argue that unlike the individual “liar loans” at the heart of the subprime-mortgage debacle, CLOs contain loans of corporations that have been audited and these corporations are from a wide range of industries. Suffice it to say, auditors can be deceived and recessions sink all ships.

CLOs are also a challenge for investors to value. CLO managers actively adjust their portfolios, and the risk profile is in a constant state of flux. These are opaque investments that are hard to evaluate and difficult to liquidate.

It is not all gloom; despite rating downgrades, CLO defaults are at a seven-year low of 3.42 percent. Investors may not be able to get out, but they should get paid. Or perhaps not. According to an October article in the American Banker, the loans of more than 50 companies have seen their prices decline by more than 10 percent. Moody’s, the rating agency, admits that more than 40 percent of loans are rated B3 or below. While CLOs, by some estimates, hold more than half of all loans, most are not mandated to hold more than 7.5 percent of CCC-rated paper, since CCC is below investment grade.

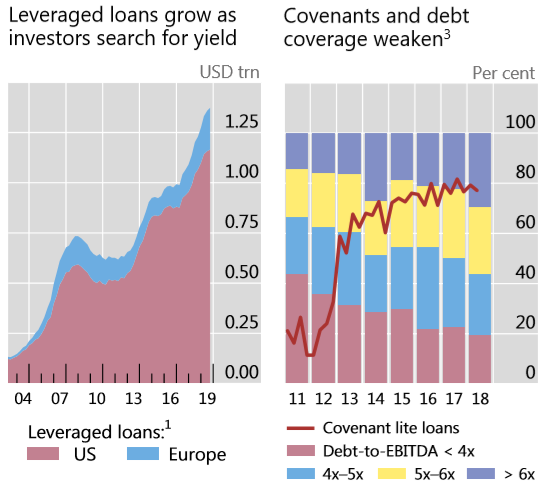

In a recent post from the Bank of England (“How Large Is the Leveraged Loan Market?”), the authors estimate that there are more than $2.2 trillion of leveraged loans outstanding worldwide, of which $1.8 trillion are denominated in US$. The chart below shows (left-hand side) the speed at which the market has grown and (right-hand side) the increasing leverage of the overall market together with the alarming rise in covenant-lite issuance.

Source: BIS

It is some comfort to know that central banks and financial regulators are cognizant of the potential systemic risk: they may yet contrive to avert a crisis. Covenant-lite loans, however, remain a near and present danger; they constitute 80 percent of issuance, and, by some estimates, as much as 29 percent of investment-grade loans are at risk of downgrade to CCC. If those downgrades come to pass, CLOs’ managers will be forced to liquidate in concert.

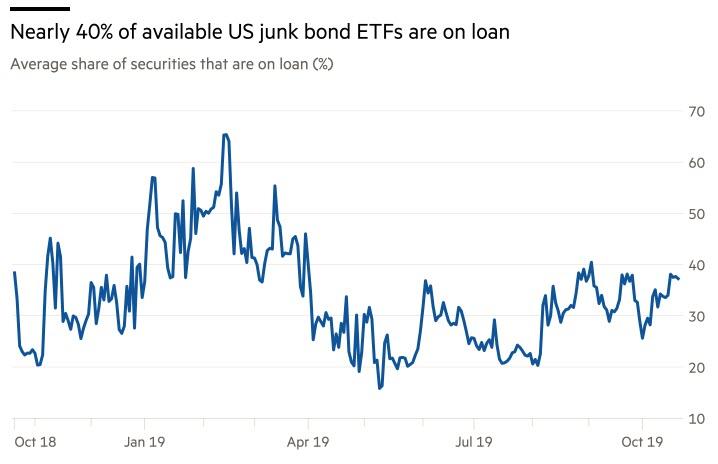

The natural buyers of less creditworthy leveraged loans have been notably absent of late. Leveraged-loan mutual funds and ETFs have seen redemptions for most of the past year. Insurers and banks are mostly full up, and the underwriting banks have been saddled with a large proportion of recent issues that failed to find buyers. Hedge funds are not stepping in to fill the void. Instead they are short-selling high-yield bond ETFs. Short exposure is down from the highs seen in Q1 2019 (which followed the high-yield rout of Q4 2018, when 25 percent of high-yield ETFs were liquidated), but around 40 percent of the market is now out on loan. The chart below highlights the recent change in appetite.

Source: Financial Times, Astec Analytics

The size of the high-yield bond ETF market is small (estimates range from $34 to $60 billion) and the cost of borrowing stock to fund short exposure is relatively high, but there is more than $500 billion of high-yield bond mutual funds that could follow. The liquidity mismatch between the exchange-traded ETFs and mutual funds on the one hand, and the underlying securities on the other , should not be underestimated. The total outstanding issuance of high-yield bonds is around $1.2 trillion, added to which the risk of contagion spreading to loans and CLOs cannot be ruled out.

Back in the loan market, it seems, the rating agencies are finally beginning to confront reality. S&P recently announced that the number of loan issuers rated B- or lower, referred to as “weakest links,” rose from 243 in August to 263 in September. Notwithstanding the significant increase in the number of issuers, this is still the highest figure recorded since 2009.

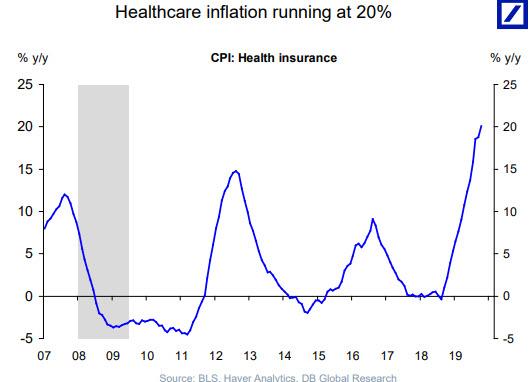

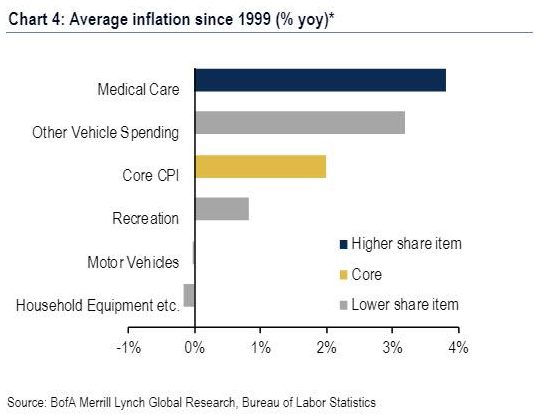

The Federal Reserve has been proactive, cutting rates even as unemployment data made fresh lows. In the near term, some headline measures of inflation have increased, but the amount of debt is so vast as to be almost self-righting; any hint that the Fed may raise rates to head off inflation will see stocks fall and credit spreads widen. The effect of these market moves on expectations for economic growth will be negative; commodity prices will decline, inflation will stall, and, provided the Fed moves swiftly enough, a full-blown credit crisis may be averted. Nonetheless, as rates approach the zero bound, the central bank has progressively less room for maneuver.

At the risk of repetition, in the longer term the deleterious effect of artificially low interest rates discourages capital expenditure in favor of debt issuance to fund stock buybacks. It undermines productivity and reduces the long-run rate of economic growth.

The number of stock market listings will continue to decline while the sustainable level of price-to-earnings ratios will rise due to the diminishing supply. With interest rates near zero, stocks will be supported: there are few viable investment alternatives in public markets. Income inequality will rise in tandem with the stock market, as will the ratio of debt to equity.

If governments choose to adopt a fiscal rather than a monetary solution to the lack of economic growth (and I am not advocating negative interest rates), they will pile even more debt onto an already over-encumbered marketplace.

Given the demographic headwinds facing most developed countries, consumption demand is likely to remain lackluster for the foreseeable future. Inflation and interest rates are unlikely to rise in this scenario, while corporate earnings growth will be forced to rely on financial alchemy rather than sustainable productivity.

Source: Bloomberg

Artificially low interest rates are hollowing out the productive capacity of the economy. The price of stocks and bonds may remain exalted, but this is not a sign of economic health.

Tyler Durden

Mon, 12/02/2019 – 15:05

via ZeroHedge News https://ift.tt/2DHt3T6 Tyler Durden