Energy Collapse, Earnings Ennui, & Consumer Credit Cracks

Submitted by Peter Garnry, Head of Equity Strategy, Saxo Bank

Summary:

The energy sector has lost extraordinarily $1.15trn in market value this year as oil prices have plunged to almost unimaginable levels.

In this equity update we provide investors with different ways to play the havoc in the energy sector. We also take a look at earnings this week with especially Carnival earnings being the most interesting to watch as the cruise industry is in a severe crisis due to COVID-19.

Lastly, we focus on consumer credit and the apparent weakness observed in China and how that could be a forewarning of what to come in the US and Europe. As a result we recommend investors to add Mastercard and American Express to their watchlists.

The global energy sector has been punched in the gut by first a slowing economy last year and then this year by an oil price war between Russia and Saudi Arabia. Making things worst the sector is now experiencing an abrupt 20% oil demand reduction equivalent to 20mn barrels a day or the entire consumption of the US. The oil futures curve is in steep contango as the active contract in Brent today went below $23/brl and stories have recently surfaced that physical oil is being transacted at $8/brl and oil storage is running out of capacity. As we talked about on our Market Call this morning the constraint on physical storage and ongoing demand destruction could push the front-end of oil futures down even further.

The current oil price creates extreme shareholder destruction with the MSCI World Energy Index losing $1.15trn in market value this year.

High yield bonds in the energy sector have seen their option adjusted yield spread to Treasuries widen to the highest levels on record and implied default probabilities are rising fast. But how should investors play the energy sector from here? One way is to buy call options on ETFs tracking the US or European oil and gas industry preferably with expiry during the second half. Another option is to get long-term exposure through single stock but here we recommend opting for only the highest quality names (see table below). The most risky strategy is to buy into those names that have the highest bankruptcy risk when the market rebounds, but here we recommend traders to apply some short-term filter (moving average or the like) to get confirmation during the rebound phase.

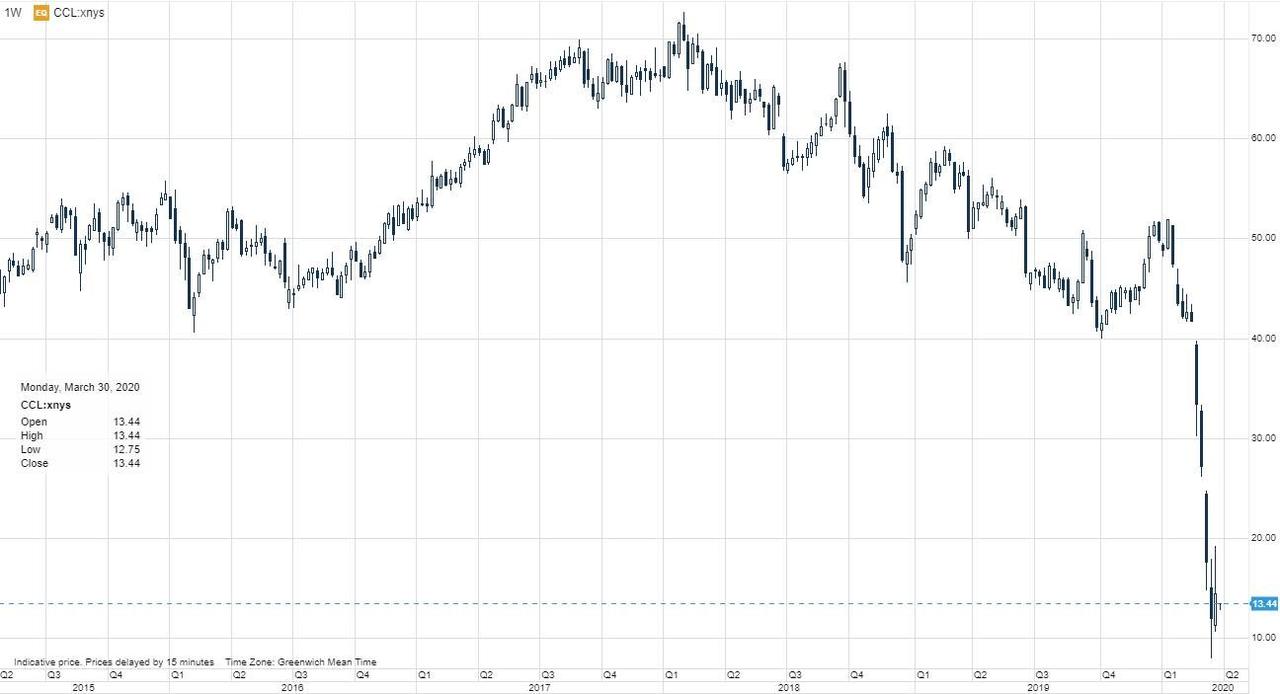

This week many Chinese companies will report earnings such as Geely Automobile and Air China, but also outside China interesting names such as Dollarama, Carnival, Walgreens Boots Alliance, CarMax, H&M and Constellation Brands will report earnings hopefully providing a picture of the demand situation in the US and Europe as these geographies are impacted by strict lockdowns due to COVID-19. With Carnival shares down 75% from this year’s peak in January and the trouble regarding many cruises during the last two months related to infected passengers with COVID-19 there will be a lot of focus on Carnival’s earnings. The main question is whether the cruise industry can stage a comeback and survive this serious threat to the industry.

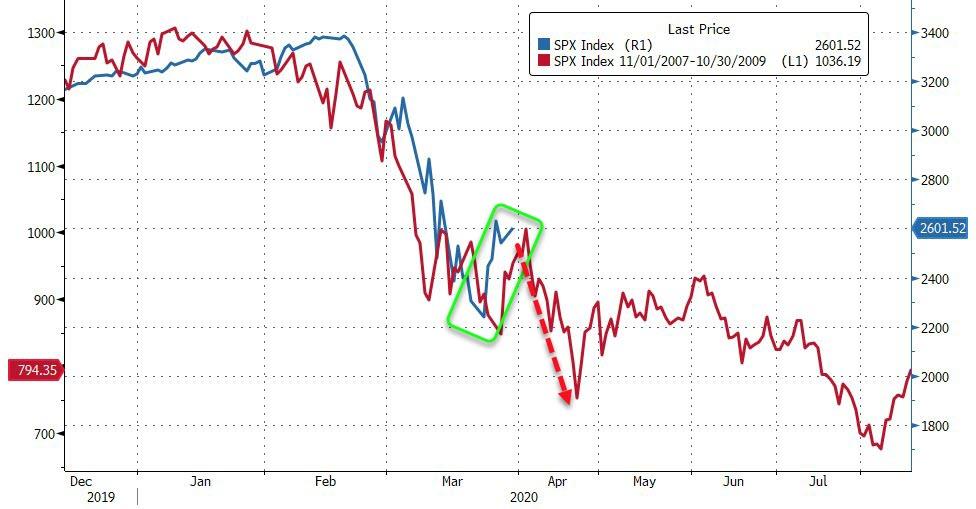

In past couple of weeks we have highlighted many times on our Market Call podcast that investors and traders should watch oil, USD and VIX for guidance on market temperature. We have had focus on credit as well but with central banks stepping in the bleeding has stopped for now, but in other parts of the credit market outside corporate bonds there are now cracks happening.

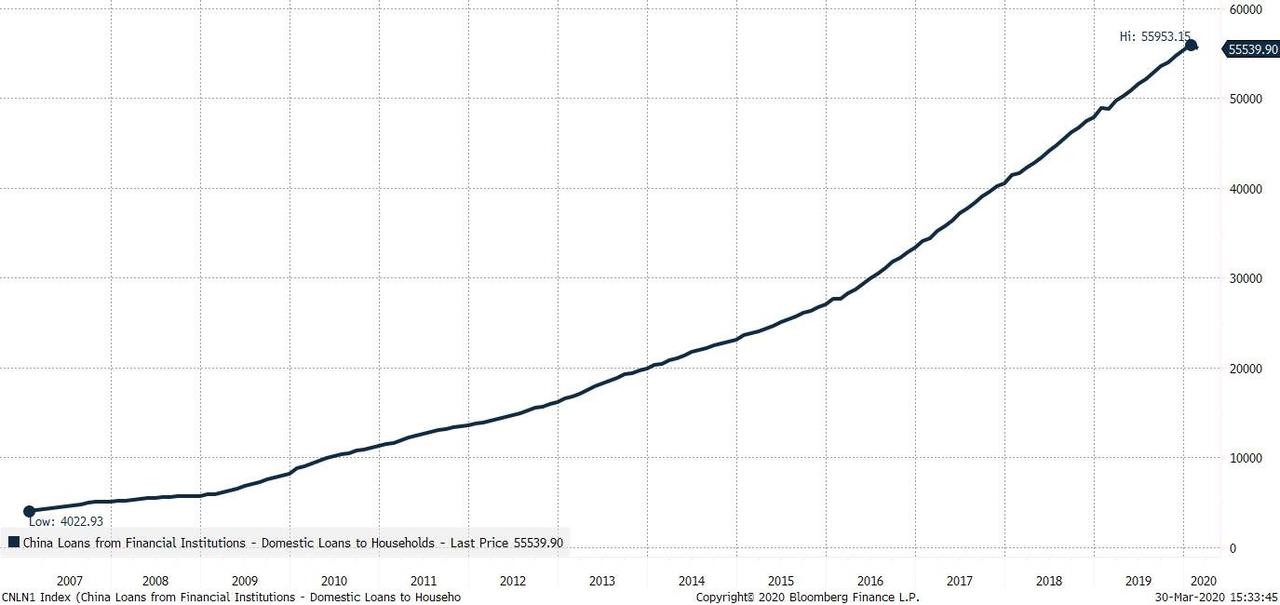

Especially consumer credit in China is weaker as the weaker employment is spilling into repayment ability and is likely an indicator of what is coming for the US and Europe. So we recommend investors to put Mastercard and American Express on their watchlists.

In China loans to households have risen by 22% annualised and our worry is that at some point this credit expansion will lead to an abrupt halt like we saw in 2008 in the developed world.

Tyler Durden

Mon, 03/30/2020 – 13:50

via ZeroHedge News https://ift.tt/2xz8MQ8 Tyler Durden