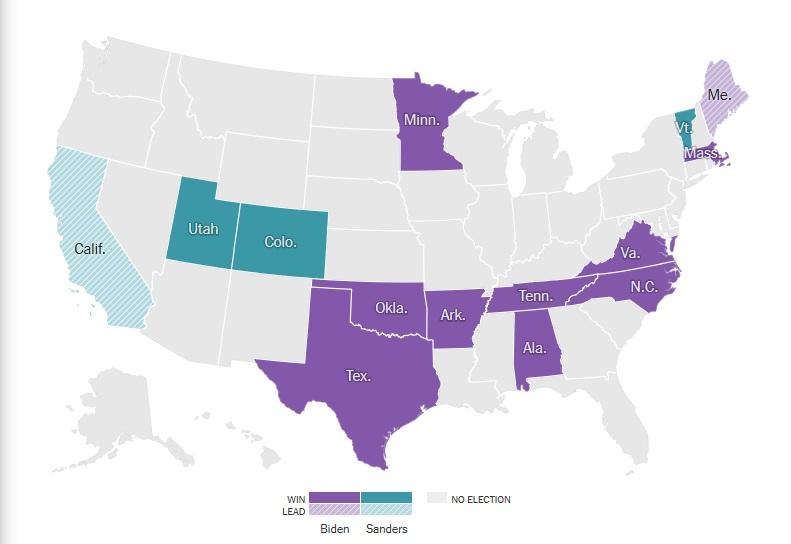

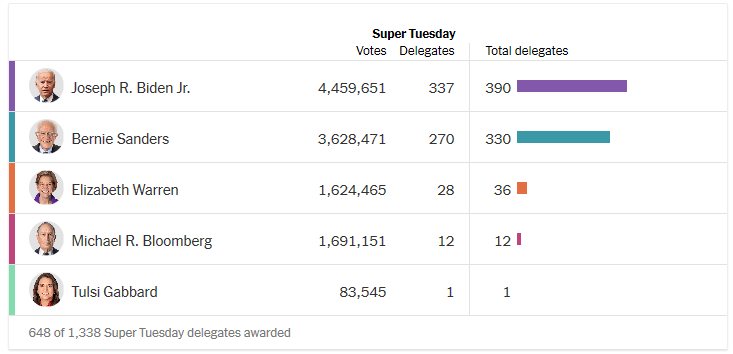

Joe Biden and Bernie Sanders were the big winners on Super Tuesday. Former Vice President Joe Biden took top place in nine Democratic Party presidential contests yesterday, while Sen. Bernie Sanders (I–Vt.) was the top choice of Democratic voters in four states. The biggest states holding contests yesterday were split between the two candidates, with Texas going for Biden and California going for Sanders.

Alabama, Arkansas, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee, and Virginia also went for Biden yesterday, with Sanders winning in Colorado, Utah, and his home state of Vermont. (The Maine primary results are still not out.) This gives Biden at least an additional 337 delegates (bringing him up to 390 total), and Sanders at least 270 new delegates (bringing him up to 330 total).

The roughest night was had by Sen. Elizabeth Warren (D–Mass.), who not only finished third in her home state of Massachusetts but failed to win top place in a single state. Warren picked up just 27 new delegates in yesterday’s primaries, which now gives her a total of 36.

Rep. Tulsi Gabbard (D–Hawaii) earned one delegate in American Samoa, which may at least be enough to get her on the last Democratic primary debate stage with Biden, Bloomberg, Sanders, and Warren. Gabbard did not take first place in any states.

If Tulsi Gabbard gets a delegate out of American Samoa, as it appears she has done, she will likely qualify for the next Democratic debate. We don't have new debate rules yet, but party has been inviting any candidate who gets a delegate.

— Dave Weigel (@daveweigel) March 4, 2020

Billionaire former New York City Mayor Michael Bloomberg got the most votes in American Samoa, earning him four delegates. Bloomberg also picked up a few delegates in Arkansas, Colorado, and Texas—bringing him to a total of 12—but overall failed to make much of an impact.

What does it all mean? For one thing, it means there were a whole lot of irate leftists on Twitter last night. Sanders supporters seem to have been counting on Biden’s big shaming yesterday, which clearly didn’t pan out.

(Perhaps Sanders following up his early primary wins with praise for Fidel Castro’s literacy programs wasn’t the best move?)

In hindsight the week you took the frontrunner position was not the right time to get into the weeds on Cuba

— ed (@edkrayewski) March 4, 2020

Many on the left blamed Warren for supposedly siphoning off votes from Sanders and have been calling for her to drop out.

The biggest mistake I see Sanders folks making is assuming that all of Warren's supporters would have gone to Sanders if she weren't in the race. This just isn't true, especially in the last few days.

— Justin Hendrix (@justinhendrix) March 4, 2020

The night also cast doubt on the idea that Sanders is better at motivating voter turnout than Biden.

In states with the biggest differences in voter turnout between yesterday and Super Tuesday 2016—Virginia and South Carolina—Biden was the top candidate. And “exit polls for five southern states that Biden won—Alabama, North Carolina, South Carolina, Tennessee and Virginia—found that young voters did not show up at the polls in the numbers they did in 2016,” notes USA Today.

And while it will surely do nothing to dampen enthusiasm for hysteria about “money in politics,” Bloomberg’s huge personal cash infusion doesn’t seem to have helped him subvert democracy, or whatever it is that establishment Democrats have been fretting over. Besides embarrassing himself in a spectacular fashion, he helped show that fears about American oligarchs openly “buying elections” are overwrought.

Dude dropped literally half a billion of his own dollars and got nothing

Can we start to acknowledge the difference between reach and influence? https://t.co/nBrf0iYecW

— Jen Monroe ???????? ???? (@jenniferm_q) March 4, 2020

FREE MINDS

Libertarian Party (L.P.) primary contests were held yesterday in California, Massachusetts, and North Carolina. In North Carolina, the top vote-getting L.P. presidential candidates were Jacob Hornberger (8.7 percent), John McAfee (8.2 percent), Kim Ruff (7.9 percent), Vermin Supreme (5.9 percent), and Kenneth Armstrong (5.3 percent). But the top choice overall was no preference/none of the above, with nearly 30 percent of the vote:

The resounding win by No Preference/None of the Above in North Carolina’s Libertarian Party Presidential Primary, featuring an unfathomable list of potential follow-ups to what they built in a 2016 that 2020 is starting to echo, is the only interesting part of Super Tuesday. pic.twitter.com/IjSrkrAoZ8

— E. (@liberatore_e) March 4, 2020

As of Wednesday morning, California and Massachusetts winners were still unclear (with Hornberger, Jo Jorgensen, and Supreme leading in California).

Meanwhile, McAfee announced Wednesday that he was leaving the L.P. presidential race.

I regret

That I am ending my campaign for President.I am instead

Attempting to run

For the Vice Presidential slot.I have asked my Campaign Manager@Loggiaonfire

To contact the Campaign of Libertarian @VerminSupremeAnd offer to be his VP pick.

Full explanation in video. pic.twitter.com/750ggzJdBY

— John McAfee (@officialmcafee) March 4, 2020

FREE MARKETS

California legislators are making changes to a much criticized “sex worker permit” bill, but its sponsor still doesn’t seem to get it. “We want to identify who can be the folks that can help us sound the alarm when there are any problems,” Assemblyperson Cristina Garcia told NPR, adding that the bill would apply to “dancers, web performers, porn stars.”

Garcia’s comments “confirm[ed] the suspicions of adult performers that AB2389 is a law enforcement bill disguised as a workers’ safety bill,” writes Gustavo Turner at XBiz. More:

The bill would, among other things, require government-sponsored training of sex workers on “safety” issues—something that Alana Evans, president of the Adult Performers Actors Guild (APAG), said groups like hers have long provided for performers themselves. From XBiz:

“[AB2389] is an unnecessary thing for the government to get involved in,” Evans added, before tallying up the annual cost to California taxpayers to $468,000 dollars, or $1.1 million if a new set of amendments Gullesserian has recently proposed were to be adopted.

“That’s over $1 million to have people do something I already do,” said Evans.

[…] The segment’s final guest was Antonia Crane, introduced as “a stripper and a sex worker for 26 years and a leader of Soldiers of Pole, a California exotic dancers union.”

Asked about whether her group thought the state should be more involved in their work, Crane was unequivocal and succinct. “‘Role for the state?’ I’m with Alana. Kill the bill,” she said. “This is a money grab dressed up as a safety issue.”

More here.

QUICK HITS

-

- San Francisco Supervisor Rafael Mandelman wants to bring back bathhouses.

- Italy is closing all schools and colleges for two weeks to try to stop the spread of coronavirus in the country.

- “Will the millennial aesthetic ever end?“

- Computer scientist and Stanford professor Alex Stamos with a brief but good thread on gatekeeping information. Start here:

Outside of the academic work in this area (like @Klonick, @daphnehk and @evelyndouek) most people calling for short-term speech controls almost always call for censorship that lines up exactly with their own political beliefs without considering the long-term downsides.

— Alex Stamos (@alexstamos) March 3, 2020

Next up: progressives who called for strict political ad controls realizing that Twitter’s celebrated political ad ban benefits rich incumbents that can afford TV or already draw massive organic amplification.

— Alex Stamos (@alexstamos) March 3, 2020

- The more you know:

7 USC §7414(i)(4)(D) & 7 CFR §1212.81 make it a federal crime for an employee of the National Honey Board to reveal how a honey handler voted in a honey referendum.

— A Crime a Day (@CrimeADay) March 4, 2020

- How Reason staffers got through Super Tuesday results night:

This is, in fact, what I look like after I successfully make a peanut-butter-infused rum daiquiri with banana liqueur for the first time.

Recipe: https://t.co/UyuqpwA1gv https://t.co/vVNQpQw9tl

— Peter Suderman (@petersuderman) March 4, 2020

from Latest – Reason.com https://ift.tt/2uRnPU8

via IFTTT