Why Crypto Bulls May Not Want It To Be A Safe-Haven Asset

Authored by Omid Malekan via Medium.com,

All eyes were glued to the quote screens this past week to see how crypto would react to the virus-inspired selloffs in other markets. Many were hoping that Bitcoin would finally show off its bonafides as a “safe haven” or flight to quality asset — something I myself have wondered about in the past.

But crypto mostly tanked alongside everything else.

There are two ways market watchers are interpreting this.

-

Some observers now (disappointedly) think that crypto is just another risk-on asset, to be sold during a crisis.

-

Others still think it’s a safe haven, and point to the fact that gold fell this past week as well (there is some precedence of precious metals falling during the peak of a crisis, then rebounding strongly. Make of that what you will).

My hunch is that it’s neither. Crypto is mostly doing its own thing. Too few big players own any of it, or even consider owning it, for it to be caught up in the usual “risk-on, risk-off” calculations. Asking the average Wall Streeter what happened to Bitcoin while the Nasdaq was tanking is sort of like asking them what happened to the Mexican Peso. Most traders probably weren’t even thinking about it. More importantly, I wonder whether crypto investors should want their preferred investment to be a flight to quality asset. I certainly don’t.

My belief is based on volatility:

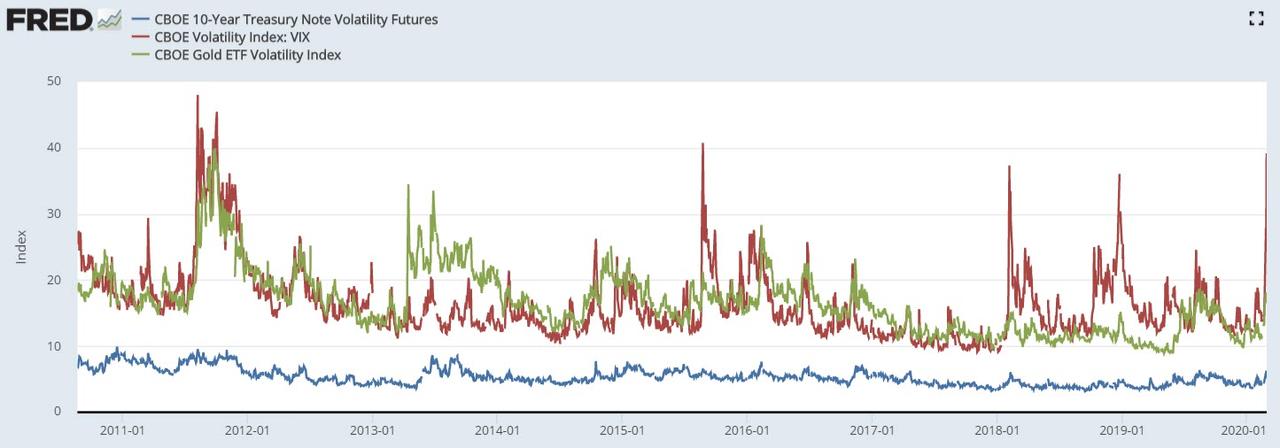

To be a safe haven, an asset needs to be less volatile than the thing investors are fleeing. This is as much a mathematical truth as it is common sense. The reason why you’d rather own treasuries or gold during a market crash is because — regardless of the market mood — they usually don’t move as much as Tesla. You can see what I mean in the following chart of the implied volatility of stocks, treasuries and gold.

Although their relative vols tend to be correlated, one is almost always much higher than the other two. Bond volatility actually spiked to a multiyear high last week, but it was still less than a quarter of stock volatility.

Crypto volatility doesn’t even register on this chart because it’s an order of magnitude higher. That alone disqualifies it for proper “safe haven” status. Case in point, the price of Bitcoin rallied by over 50% in the two months prior to this week, with alts rallying even more. Nobody wants something that can double that quickly as their store of value. Things that go up quickly can come down just as fast.

So in order for crypto to become a true safe haven, its volatility would have come down drastically. This is not something hodlers should want. A less volatile asset is one that by definition has less potential upside. To put it in industry slang, less vol equals much later moon.

Gold, which is historically a reliable tore of value, has had an impressive rally over the past five years, climbing by 44%. If Bitcoin were to follow the same trajectory, it would barely break above $12,000 in the year 2025 — still 40% below its previous high. How terribly disappointing that would be for most investors

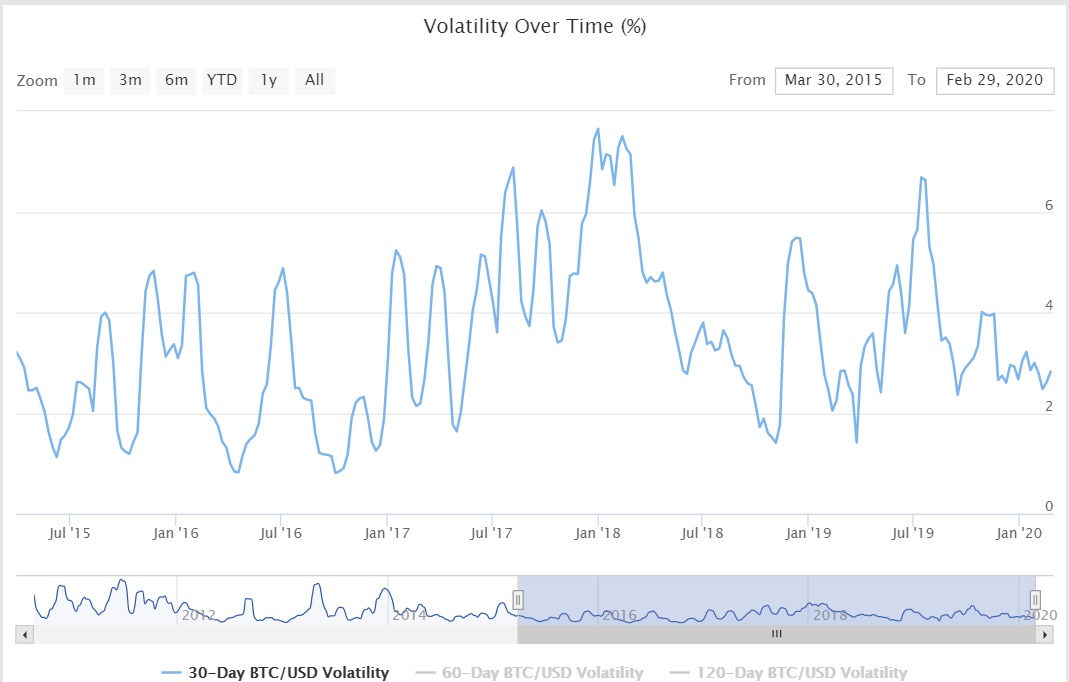

So as far as crypto’s safe-haven status is concerned, be careful what you wish for. There are still many risks and unknowns to owning these things, so investors should expect disproportionate upside as their reward. This is even truer given crypto’s backwards volatility profile. Unlike stocks, bonds, gold and almost everything else – cryptocoins are more volatile during bull markets than bear ones. The current five year high realized 30 day vol in Bitcoin was recorded right around the time of the late 2017 peak. The low came 11 months later as she was making her 2018 lows.

https://www.bitpremier.com/volatility-index

This begs the question: if not risk on vs risk off, what drives crypto prices?

It’s still too hard to know for sure, but my guess is that the performance of relative market infrastructure matters more than relative asset prices. There are now two competing models for a financial system:

-

the legacy one, which emphasizes centralized control by large commercial entities whipped around by their central banking overlords,

-

and the newer one, which emphasizes decentralized protocols driven by a global community.

My admittedly non-mathematical correlation analysis shows changing perceptions about how value is best moved around are the biggest drivers of crypto valuations.

-

When the old way fails its users, as was the case during the great financial crisis that launched Bitcoin, the Cypriot bail-in that lead to the 2013 highs or more recent Chinese capital controls, crypto goes up.

-

When the new way shows its own problems, like the Ethereum DAO crisis of 2016, or the contentious Bitcoin Cash split that marked the 2018 lows, crypto goes down.

Ironically, the biggest gains have happened when the stalwarts of the old guard bless the new way, like when the CME announced Bitcoin futures in 2017 or Facebook launched Libra in 2019.

If this analysis holds true, then the question crypto longs should be asking is not how stocks or bonds will do as the Coronavirus situation unfolds, but rather how the legacy financial infrastructure holds up during this period, and just as importantly, the ensuing response.

My prediction is not so good. The current attitude towards easy money from the world’s central banks reminds me of what Homer Simpson once said about alcohol: it’s the cause, and cure, of all of life’s problems. All of the instabilities that have built up from a decade of easy money — like an insane debt load in China or the destruction of commercial banking in Europe — are about to be pushed to a new extreme. It might take a few years to play out, but it won’t end well, increasing the appeal of an alternative

There’s also the possible catalyst of a central bank digital currency using some kind of blockchain infrastructure, an event made more likely by a scary contagious disease. If you believe in the price impact of blessings by the old guard, then it doesn’t get any better than a tokenized CBDC, a friendly blink from the Eye of Sauron himself.

Tyler Durden

Mon, 03/02/2020 – 18:40

via ZeroHedge News https://ift.tt/2TrSXC0 Tyler Durden