In Groundbreaking Move, Fed Excludes Treasurys From Leverage Ratio Rule: Here’s What That Means

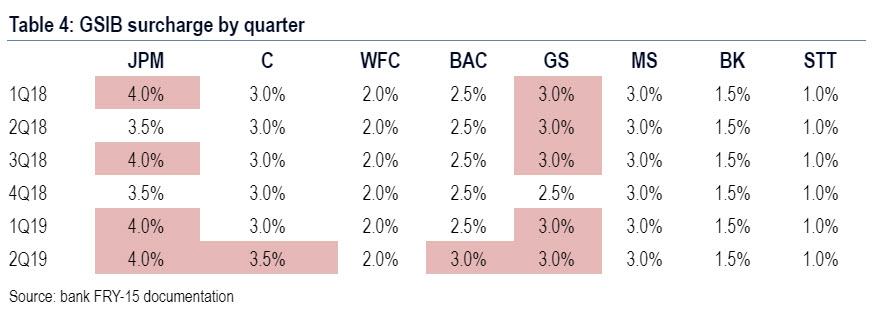

For the past few weeks, most of Wall Street’s Fed watchers and STIR experts such as Zoltan Pozsar and Marc Cabana had lamented that one trick the Fed could pull to ease the tension in the Treasury market and to potentially unlock hundreds of billions in new lending capacity among US commercial banks, was to exclude Treasuries and deposits from the Fed’s much maligned Supplementary Leverage Ratio Rule, which forces banks to hold ultra safe Treasuries and/or deposits on their books (which are traditionally viewed by the Fed as less risky than loans) or else suffer a G-SIB capital surcharge.

Specifically, the Fed’s supplementary leverage ratio applies to financial institutions with more than $250 billion in total consolidated assets, and requires them to hold a minimum ratio of 3%, measured against their total leverage exposure, with more stringent requirements for the largest and most systemic financial institutions.

As we showed in November, JPMorgan’s aggressive dumping of Treasurys is why the bank’s GSIB surcharge was the highest across all US banks despite being widely seen as the safest US commercial bank.

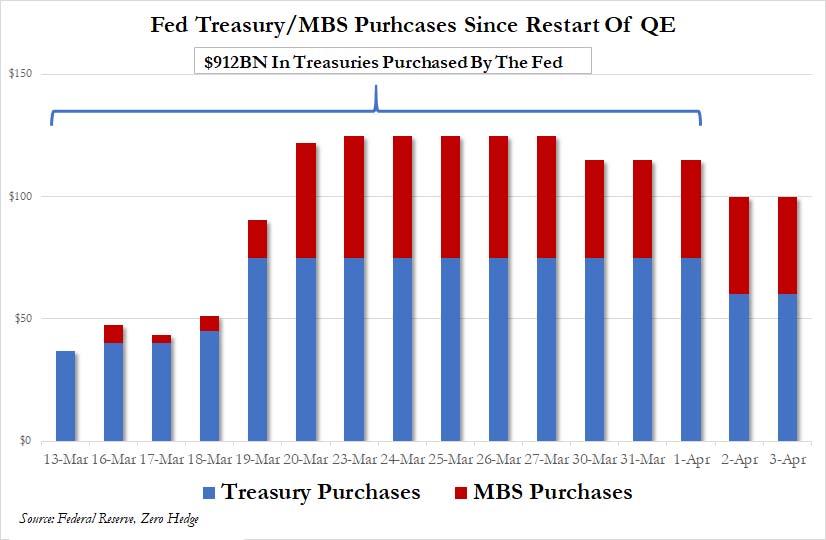

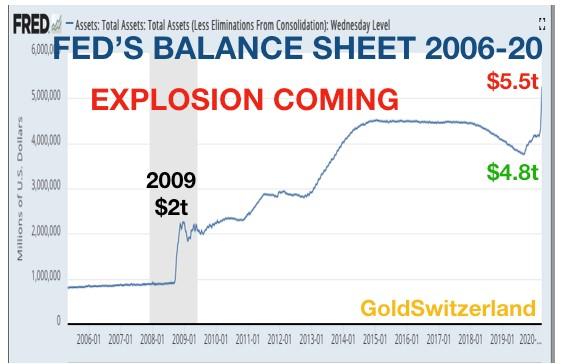

Well, after trying pretty much everything else, including unleashing unlimited QE, expanding swap lines, opening unlimited repos to both domestic Dealers and Foreign central banks, and restarting the entire Lehman alphabet soup toolkit, on Wednesday after the close, the Fed did just that, and announced that to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses, the Fed announced a temporary change to its supplementary leverage ratio rule, which would exclude U.S. Treasury securities and deposits at Federal Reserve Banks from the calculation of the rule for holding companies, and will be in effect until March 31, 2021.

Explaining the move, the Fed argued that as a result of the dramatic increase in deposits observed in recent weeks as investors dumped risky assets, banks may be limited in their abilities as “financial intermediaries and to provide credit to households and businesses.” The change to the supplementary leverage ratio should therefore “mitigate the effects of those restrictions and better enable firms to support the economy.”

Liquidity conditions in Treasury markets have deteriorated rapidly, and financial institutions are receiving significant inflows of customer deposits along with increased reserve levels. The regulatory restrictions that accompany this balance sheet growth may constrain the firms’ ability to continue to serve as financial intermediaries and to provide credit to households and businesses. The change to the supplementary leverage ratio will mitigate the effects of those restrictions and better enable firms to support the economy.

The Fed also said that “financial institutions have more than doubled their capital and liquidity levels over the past decade and are encouraged to use that strength to support households and businesses.”

However, to make sure that the expanded balance sheet capacity is not used by banks simply to accelerate stock buybacks, it explicitly stated that “the Board is providing the temporary exclusion in the interim final rule to allow banking organizations to expand their balance sheets as appropriate to continue to serve as financial intermediaries, rather than to allow banking organizations to increase capital distributions, and will administer the interim final rule accordingly.”

Finally, as explained above, whereas the supplementary leverage ratio “generally applies to financial institutions with more than $250 billion in total consolidated assets” and requires them to hold a minimum ratio of 3 percent, measured against their total leverage exposure (with more stringent requirements for the largest and most systemic financial institutions), the SLR change would temporarily decrease tier 1 capital requirements of holding companies by approximately 2 percent in aggregate.

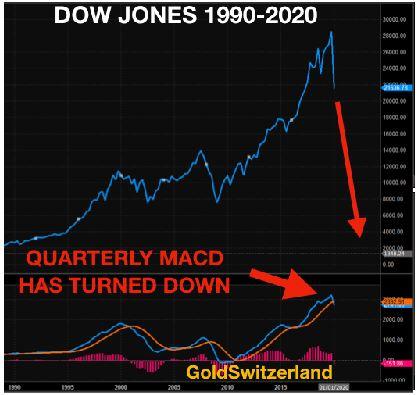

Translation: what the Fed is effectively granted banks some 2% in balance sheet capacity to use as they see fit, as long as it is not for buybacks, eligible capital which they can – and likely will – use to buy more Treasurys knowing they can then just flip those Treasurys back to the Fed with a profit. Sure enough, Treasury yields immediately dumped after the news…

… although they have since rebounded. Why?

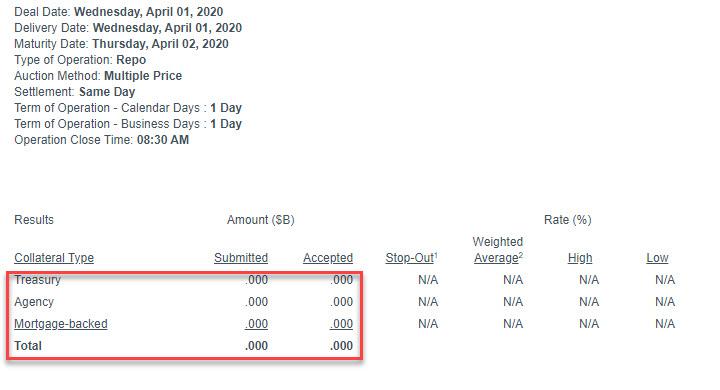

Perhaps because the market took one look at the recent usage of the Fed’s repo facilities where any ongoing SLR stresses would have emerged, as Dealers would be forced to pledge more Treasurys to the Fed in exchange for reserves. Instead… crickets: not only have Dealers virtually stopped parking Treasuries at either the overnight or term repo facility…

… but today saw the second “no bid” repo operation ever, as not a single Treasury or MBS was pledged to the Fed in return for cash.

Why? It is not immediately clear what prompted Dealers to shun the Fed’s repo operation, although some have speculated that faced with a choice of parking safe assets at the Fed which paying a modest interest payment, or selling the paper to the Fed as part of the massive unlimited repo, virtually everyone has chosen the second option.

It could also mean that as a result of the meteoric changes observed in the banking system in recent days, the SLR ratio is no longer the bottleneck that either the Fed or strategists think it is.

Instead one possible reason for the operation is to make sure banks have the capacity to lend out the $350BN in loans to small and medium businesses under the Fed’s $2 trillion fiscal stimulus which as a reminder will start being funded as soon as this Friday, and the Fed’s SLR easing provides banks with the needed space to expand their balance sheets to accommodate all the incremental loans. Finally, for those who believe that as a result of this Fed action, the US economy will somehow soar, please remember that loans are not a function of supply but demand, and the last thing on cash-strapped Americans’ minds right now is how to get even deeper in debt.

Tyler Durden

Wed, 04/01/2020 – 17:43

via ZeroHedge News https://ift.tt/39GNAoN Tyler Durden