Here We Go Again: China Puts Entire County On Lockdown After New Corona Cluster Emerges

China is no longer fixed.

Having lied for the past month that it has the coronavirus crisis “under control” just so people return to work, full of hope and enthusiasm, rejoicing at the surge in China’s just as fabricated PMI numbers, and willing to work their asses off (with Beijing so generously willing to risk everyone’s lives as the alternative is a complete collapse in China’s economy), earlier today the US finally cracked down on the relentless barage of Chinese lies, when US intelligence accused China of deliberately lying about its coronavirus figures.

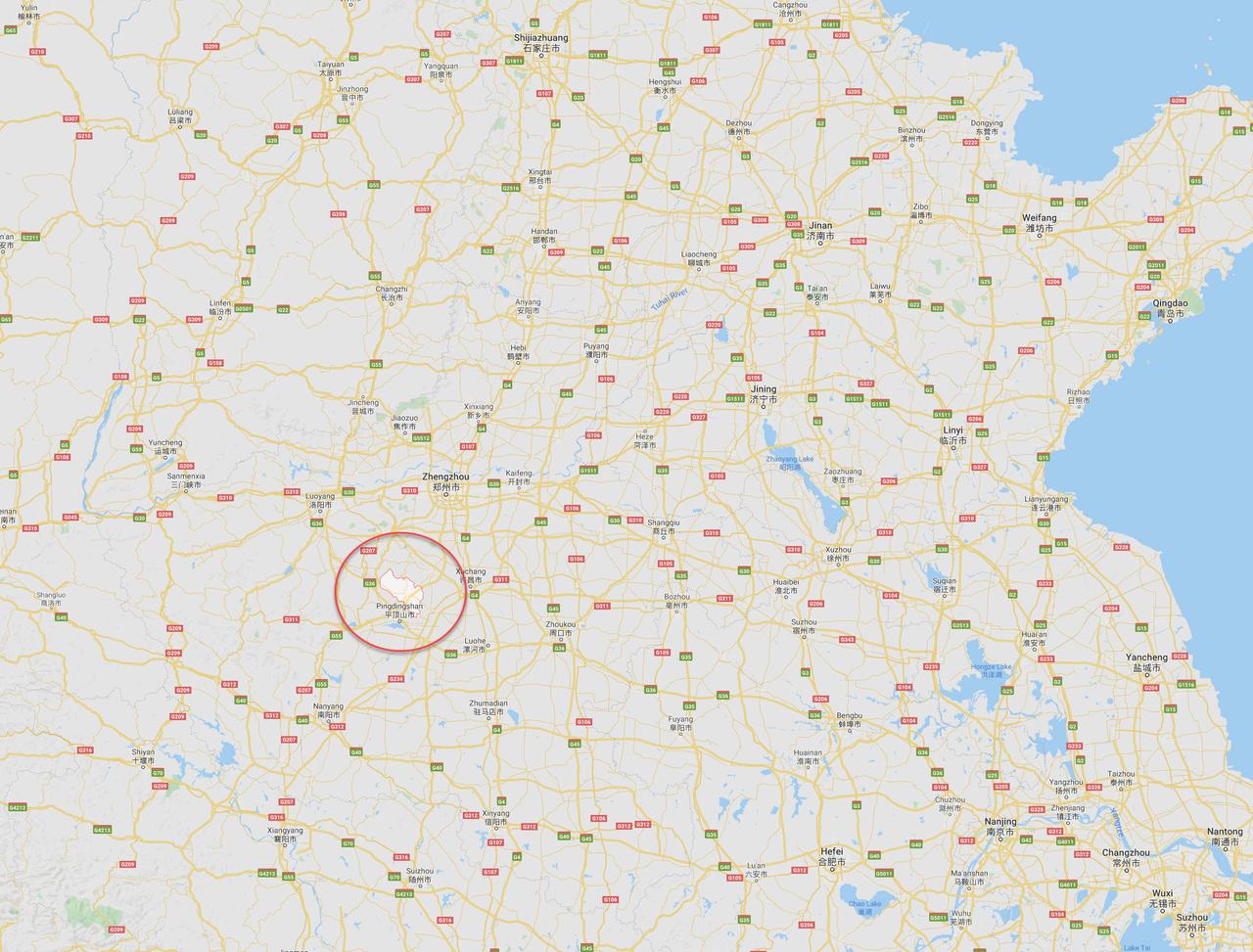

Then, in a miraculous coincidence, just moments later Reuters reported that a county in central China’s Henan province announced on Wednesday it had “virtually banned all outbound movement of people, following several cases of coronavirus infection in the area.”

According to a post on its social media account, Jia county – which has a population of about 600,000 – said that no one can travel out of Jia county without proper authorization. Additionally, residents are not allowed to leave their homes for work unless they have clearance to do so.

According to local media reports, on March 29, Henan Province broke its 30-day streak of reporting no new coronavirus cases, saying one person tested positive after a trip to Pingdingshan, where Jia County is located. Specifically, on Saturday, Henan province reported one confirmed case in Luohe city; local authorities said the infected person had been in contact with two doctors based in Jia county who later tested positive for the virus even though they had showed no symptoms.

As a result, Bloomberg adds that starting April 1, all residential compounds will be under “closed-off management” and all residents need to wear masks and have temperature taken entering or exiting the compounds.

And so the virus is back to China, despite the best intentions of the Chinese World Health Organization and its Beijing sponsors to make it seem that China had managed to defeat the virus.

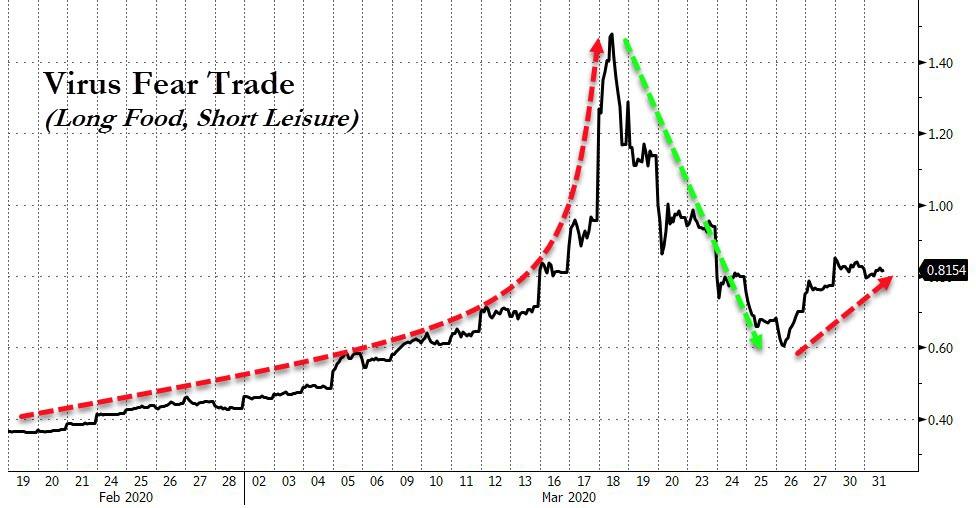

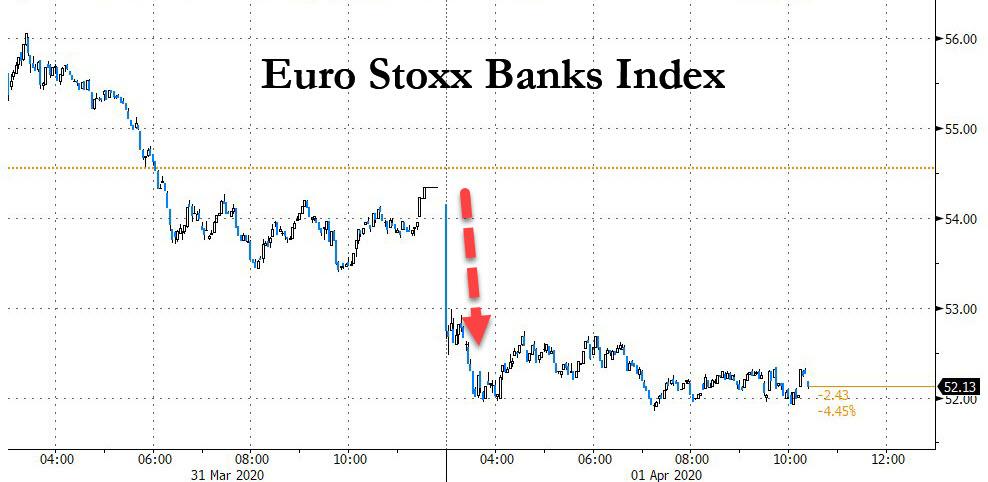

Needless to say this is a problem, because the risk of stop-start restrictions on people’s movements mean that any calls for a V-shaped rebound in global economies and stocks can now be ignored as China will soon be forced to go through the entire shut down exercise all over again.

Indeed, as Bloomberg’s Simon Flint wrote presciently overnight, “as China’s economy restarts, there is every risk infection rates to tick higher once again, requiring renewed control measures and potentially the beginning of a stop-start pattern of lockdowns followed by eased restrictions.”

“Multiply that pattern by the growing number of countries in lockdown – and the unknown impact of a rampant virus in nations with fewer restrictions – and the much hoped for V-shaped recovery could quickly become a series of W’s”… and since “there is no blueprint for jump-starting a stalled economy in the midst of a global pandemic, a fresh waves of infections following production restarts could quickly snuff out any rally in global stocks.”

In other words, back to square one we go, only maybe this time China will tell the truth.

Tyler Durden

Wed, 04/01/2020 – 12:47

via ZeroHedge News https://ift.tt/2R5QVqW Tyler Durden