Futures Tumble, Dollar Surges After Trump Threatens To Restart China Trade War

With most global markets shutdown for May 1 celebration, US equity futures sank after President Donald Trump threatened to block a government retirement fund from investing in Chinese stocks and to slap new tariffs on China over the coronavirus crisis, while Apple and Amazon became the latest companies to warn of more pain in the future. As a result, the Emini wiped out virtually all of the weekly gains in one session.

Late on Thursday, Trump said his trade deal with China was now of secondary importance to the pandemic, as his administration crafted retaliatory measures over the outbreak. The threat confirmed that the global pandemic was now a top political issue for Trump who will seek to bash China as the US heads for the November election, and pulled attention back to the trade war between the world’s two largest economies that has kept global financial markets on tenterhooks for nearly two years.

Also weighing on sentiment was a 2.6% fall in Apple shares in premarket trading after the company said it was impossible to forecast overall results for the current quarter, even as it reported upbeat quarterly results. Amazon tumbled 5% after it warned it could post its first quarterly loss in five years as it was spending at least $4 billion in response to the coronavirus pandemic.

With European markets closed, equities dropped in the U.K., one of the few open markets, and the pound gave back some of this week’s gains as Prime Minister Boris Johnson pledged a “comprehensive plan” to lift the country’s lockdown, with details due next week. Stocks slumped in Tokyo and Sydney while most other Asian markets didn’t trade. While China was closed, China FTSE A50 Index futures, which trade in Singapore, were down over 4% as traders didn’t much like that a new trade war between the US and China may be imminent.

Wall Street fell on Thursday as grim economic data and mixed earnings prompted investors to take profits at the end of the S&P 500’s best month in 33 years, a remarkable run driven by hopes of reopening the economy from crushing virus-induced restrictions.

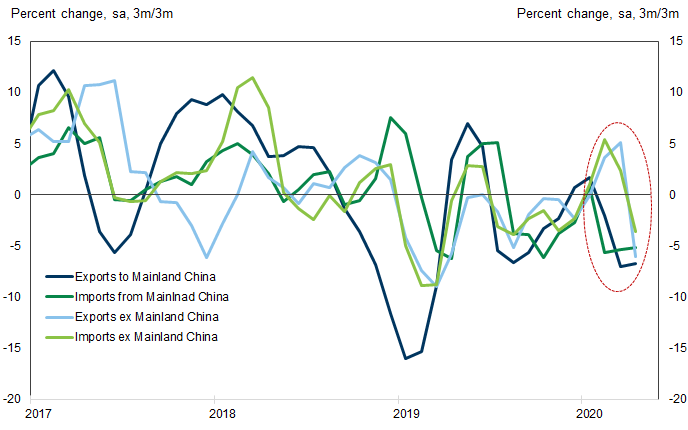

With global stocks posting their best month since 2011 in April spurred by a slowdown in coronavirus infections and $8 trillion promised in stimulus initiatives, earnings reports and economic data are serving a reminder of lasting pain. In addition to the disappointing earning reports from Amazon and Apple, data Friday showed South Korea’s exports plunged the most since the 2009, while a gauge of Japanese manufacturing did the same.

In FX, the Bloomberg Dollar Spot Index climbed for the first time in six days on the prospect of a renewed trade war, while the yen and Treasuries also gained on haven demand. The offshore yuan was among the biggest decliners in emerging markets, weakening by the most in a month.

Yuan derivatives – the Australian and New Zealand dollars – led losses among Group-of-10 currencies following poor local economic data. The euro rose a third day to a two-week high, extending Thursday’s rally that was fueled by month-end demand.

In rates, Treasuries gained in a bull- flattening move, with 10- and 30-year yields falling by 4 basis points.

Crude dipped on Friday but heading for its first weekly gain in about a month as global production cuts began to take effect; gold rebounded from an earlier slump.

Looking at the day ahead, the calendar is a slightly lighter one thanks to the Labor Day public holiday in numerous countries. Data highlights include April’s manufacturing PMIs from the UK, Canada and the US, as well as April’s ISM manufacturing reading for the US as well. In addition to this, we’ll get the UK’s consumer credit and mortgage approvals for March, along with US construction spending for March too. Earnings releases include ExxonMobil, Chevron, Charter Communications, AbbVie and Honeywell International. Meanwhile, Exxon Mobil reported its first loss in 32 years.

Market Snapshot

- S&P 500 futures down 2% to 2,845.50

- STOXX Europe 600 down 0.6% to 338.02

- MXAP down 1.6% to 145.64

- MXAPJ down 1.1% to 473.45

- Nikkei down 2.8% to 19,619.35

- Topix down 2.2% to 1,431.26

- Hang Seng Index up 0.3% to 24,643.59

- Shanghai Composite up 1.3% to 2,860.08

- Sensex up 3.1% to 33,717.62

- Australia S&P/ASX 200 down 5% to 5,245.89

- Kospi up 0.7% to 1,947.56

- Brent Futures down 1.5% to $26.08/bbl

- Gold spot down 0.6% to $1,675.82

- U.S. Dollar Index down 0.02% to 99.00

- German 10Y yield fell 9.1 bps to -0.586%

- Euro up 0.1% to $1.0970

- Brent Futures down 1.5% to $26.08/bbl

- Italian 10Y yield rose 0.6 bps to 1.589%

- Spanish 10Y yield fell 7.6 bps to 0.723%

Top Overnight News from Bloomberg

- The euro-area economy could shrink as much as 12% this year and fail to return to its pre-coronavirus size until the end of 2022, according to the European Central Bank

- President Donald Trump is exploring blocking a government retirement fund from investing in Chinese equities considered a national security risk, a person familiar with the internal deliberations said

- U.K. Prime Minister Boris Johnson pledged a “comprehensive plan” to lift the lockdown that has crippled the economy, as he declared the U.K. has now passed the peak of the coronavirus outbreak. In his first press conference since recovering from Covid-19, Johnson promised to set out details next week on how businesses can get back to work

- The European Central Bank’s surprise tweaks to monetary policy amount to an effective interest-rate cut that puts banks on the front line of the euro-area economic recovery

- U.K. house prices rose last month before the full extent of the impact of the coronavirus pandemic hit the market, according to Nationwide Building Society

- The best month for global equities in almost a decade may be enough to convince investors the light at the end of the coronavirus tunnel isn’t a train, but the debate on what comes next is only just beginning as they adjust their focus to a financial landscape utterly changed by the pandemic

The tone in Asia was subdued owing to the mass closures in the region for Labor Day and following the negative handover from Wall St due to month-end rebalancing and with futures pressured after hours following mega-cap earnings from Amazon and Apple. Amazon shares declined around 5% in extended trade after mixed results in which the Co. missed on EPS but topped revenue forecasts and noted it expects to spend its entire USD 4bln of operating profit on COVID-related expenses, while Apple initially gained after it beat on top and bottom lines, boosted its share buyback by USD 50bln and raised its dividend, although the gains were only brief as the results were clouded by weaker than expected iPhone and iPad sales and after the tech giant refrained from providing a Q3 outlook. ASX 200 (-5.1%) was the laggard with downside led by heavy losses in the commodity related sectors and a slump in the top-weighted financials with selling exacerbated by profit taking after the index had rallied to its highest level in 6 weeks and notched its best month on record for April. Nikkei 225 (-2.8%) also suffered firm losses amid a slew of earnings and after Tokyo Core CPI data turned negative to trigger fears of a return to deflation, while reports also noted that PM Abe is to formally decide to extend the state of emergency due to coronavirus on Monday. As a reminder, markets in mainland China and Hong Kong were shut alongside most of the regional bourses, although China’s tensions with US remained in the spotlight after comments from US President who suggested he has seen evidence the virus had originated from the Wuhan Institute of Virology and that he can do tariffs to respond to China, with sources also later noting the US is considering blocking government retirement savings funds from investing in Chinese equities deemed a national security risk. Finally, 10yr JGBs were weaker amid spillover selling from T-notes which had reversed intraday gains and briefly fell below 139.00 amid heavy supply including Boeing’s USD 25bln 7-tranche offering, while JGB prices were also hampered by weaker demand at the enhanced liquidity auction for 2yr, 5yr, 10yr & 20yr JGBs.

Top Asian News

- Macau Casinos See Worst Month Yet as Gaming Revenue Plunges 97%

- SUVs Get Parked in the Sea and Reveal Scope of Auto Glut

- Stampede to Buy Euros at End-of-Month Fix Rattles FX Trading

- Biggest India Carmaker Clocks Zero Local Sales in April

Europe sees tumbleweeds amid mass closures in observance of Labor Day Holiday, as the UK’s FTSE 100 (-2.1%) remains the sole trading major index ahead of its market holiday next Friday. Sentiment remains on the backfoot, Nasdaq and Dow futures relinquished the 8800 and 24000 levels respectively before extending losses, as markets price in an escalation in US-Sino tensions after US President Trump threatened tariffs, whilst negatively perceived earnings from Apple (-3% pre-mkt) and Amazon (-4.5% pre-mkt) add further pressure to US equity futures. Apple beat on top and bottom line, but iPhone, iPad, and Mac sales fell short of forecasts. Amazon missed on EPS but topped revenue forecasts, albeit subscription services disappointed and the group expects to spend the entire USD 4bln of operating profit on virus-related expenses. Back to London, FTSE 100 sees most of its stocks in the red, with heavyweight Shell (-6%) continuing to be weighed on by its dividend cut alongside a broker downgrade and the pullback in the energy complex, BP (-4%) moves lower in tandem. Large-cap miners also reside towards the foot of the UK index as base metals take a hit from sentiment amid the prospect of escalating trade tensions between the world’s two largest economies: with Rio Tinto -3.7%, Glencore -5.3%, BHP -4%. On the flip side, RBS (+3.4%) is among one of the few gainers post-earnings after topping earnings and operating profit forecasts and despite Q1 impairments rising almost ten-fold YY to GBP 802mln from GBP 88mln.

Top European News

- Ryanair Cuts 3,000 Jobs, Challenges $33 Billion in State Aid

- Boris Johnson Pledges Lockdown Exit Plan With U.K. Past Peak

- Intu Drafts in Restructuring Chief as Talks With Creditors Loom

- ECB Says Economy Could Stay Below 2019 Level Through 2022

In FX, there was little respite for the Dollar in holiday-thinned volumes at the start of the new month due to Labour Day, but the DXY is clinging to or at least staying within sight of 99.000 by virtue of even more weakness in rival currencies amidst broad risk-off sentiment following US President Trump’s latest accusatory comments regarding COVID-19 and threat of reprisals against China, including more trade tariffs.

- GBP – Not the biggest G10 mover by a long chalk, but volatile given that the UK is one of the only European centres open on May 1st. Moreover, some payback after hefty month end gains has ensued, with Cable backing off further from 1.2600+ highs after failing to sustain momentum to test mid-April peaks and a key technical level in the form of the 200 DMA (1.2648 and 1.2654 respectively). Meanwhile, the Pound is also unwinding more upside vs the Euro as the cross rebounds further from sub-0.8700 levels towards 0.8750 and back above the 200 DMA yet again (now around 0.8722) on the usual RHS for fixing dynamic. For the record, an even weaker than prelim manufacturing PMI, collapse in consumer credit and miss in mortgage approvals were all largely brushed aside, along with significantly stronger than forecast Nationwide house prices.

- AUD/NZD/CAD/NOK/SEK – The major laggards, and in the case of the Aussie and Kiwi also the notable underperformers as overall aversion is compounded by a bearish research note from Westpac overnight. In short, the bank based its bleak outlook for the Antipodeans on prospects of ‘brutal’ earnings and data in coming weeks, and on that note AIG manufacturing PMI plunged deep below 50, while ANZ consumer confidence dropped to sub-100. Aud/Usd has duly retreated from 0.6500+ to under 0.6450 and Nzd/Usd has lost grip of the 0.6100 handle with Aud/Nzd pivoting 1.0600. Elsewhere, the Loonie has detached further from its close crude correlation, albeit with oil prices recoiling this is also keeping Usd/Cad afloat near 1.4050 vs 1.3850 at one stage on Thursday, pending the possible appointment of a new BoC Governor later today and Canada’s manufacturing PMI. Similarly, the Scandinavian Crowns have been scuppered by the downturn in crude and risk appetite, with Eur/Nok and Eur/Sek both nudging the tops of ranges near 11.3300 and 10.7500 respectively.

- JPY/CHF/EUR – All benefiting from the aforementioned ongoing Buck weakness, as the Yen bounces from circa 107.40, Franc eyes 0.9600 and Euro grinds closer to 1.1000 having breached the 55 DMA (1.0949) and yesterday’s best (1.0972) to expose resistance at 1.0991 before the 200 DMA (1.1035).

- EM – The ramp up in US vs China vitriol over the coronavirus has obviously taken its toll on the Yuan, as Usd/Cnh extends beyond 7.1300, but the contagion is spreading through the region like the global pandemic itself with Usd/Try up around 7.0400, Usd/Rub back over 75.0000 to name and highlight just a few.

In commodities, WTI and Brent futures gave up earlier mild gains as the positive sentiment seen earlier in the week peters out, whilst a lion’s share of market closures in Asia and Europe keep volumes subdued. Today marks the official inauguration of the OPEC+ output curtailment pact, albeit markets have already priced in the event. “The output cuts while significant may not be enough to fully offset demand destruction in the global market in the short term and the inventory build-up could continue for the rest of 2Q20, though at a slower pace”, ING reaffirms. That being said, reports noted that Iraq could face difficulties in adhering to its obligations under the deal. WTI June trades on either side of USD 19/bbl for a large part of the session before dipping below the psychological USD 18.50/bbl (high USD 20.50/bbl), whilst Brent July also resides closer to the bottom of its current USD 27.67-29.67/bbl intraday band. Spot gold remains on the backfoot sub USD 1700/oz, with some attributing a correction amid a lack of fresh buyers. Copper continues its deterioration throughout the session on the risk-averse tone and absence of regional participants including its largest buyer China – prices eye the 24th Apr low at USD 2.30/lb.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 36.7, prior 36.9

- 10am: Construction Spending MoM, est. -3.5%, prior -1.3%

- 10am: ISM Manufacturing, est. 36, prior 49.1

- Wards Total Vehicle Sales, est. 7m, prior 11.4m

DB’s Jim Reid concludes the overnight wrap

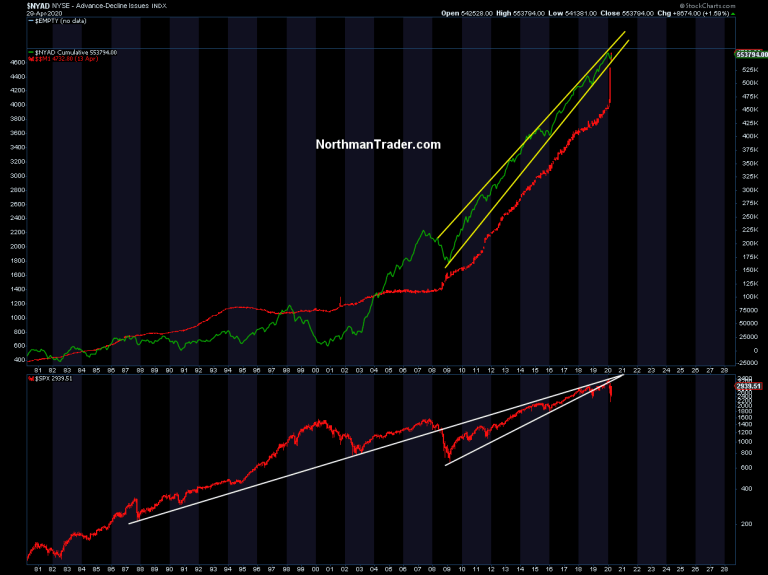

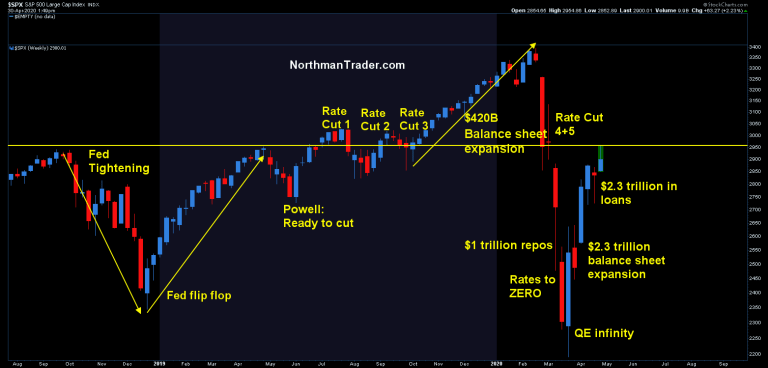

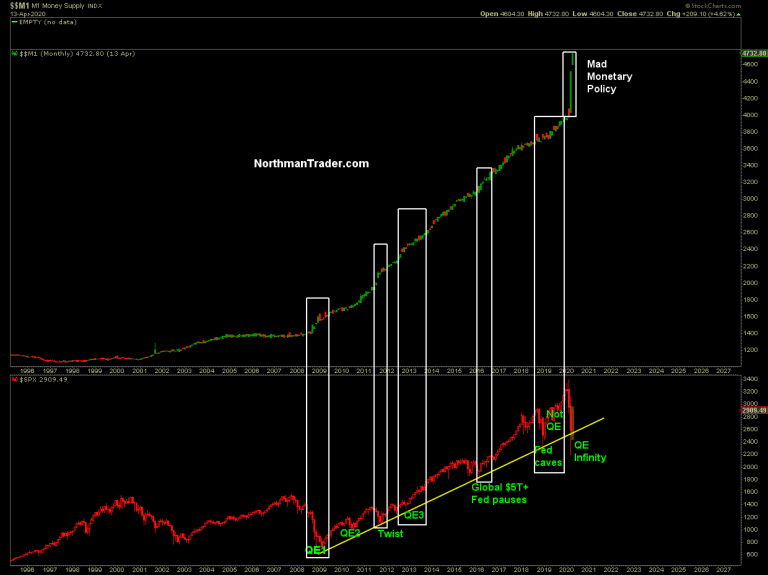

Happy 1st of May to you all. We’ve already published our monthly performance review in what was the best month for the S&P 500 since January 1987. It was on track to be the best since October 1974 until the mild sell off yesterday. See the note in your inboxes for more on an incredibly strong month for asset returns in a period where the world economy practically ground to a standstill. Impressive stuff. Try explaining that to a new graduate. You’d probably want to send them towards a chart of the Fed balance sheet to help try to rationalise it.

Talking of central banks, yesterday’s main news came from the ECB, who in many ways reverted to type. They always pull out the heavy artillery in the heat of the battle but tend to retreat a bit when hostilities calm down. Although they announced that the interest rate on TLTRO III operations from June 2020 to June 2021 would be reduced to 50bps below the refi rate they didn’t increase PEPP (not expected at this stage) and most importantly downplayed the chances of OMT being used. Before we discuss the OMT we should note that for those banks whose net lending is above the lending performance threshold, the interest rate falls to 50bps below the average deposit facility rate, which is itself 50bps below the main refinancing rate. Furthermore, the ECB announced a new series of non-targeted pandemic emergency longer-term refinancing operations, which will start in May 2020.

The conclusion is that its lots of free money for banks, especially if they can lend it out. However the net impact was disappointment for European equities (including banks) as Lagarde downplayed the imminent use of the OMT and argued that the PEPP is the weapon of choice. The main issue with this is that OMT can be used more efficiently to divert from capital keys and help the likes of Italy. They may end up having to do more now with PEPP than they would have with a combination of OMT and PEPP. See Mark Wall’s piece on the meeting here. As a result of the meeting, the main European equity bourses were -2 to -2.25% lower with banks -5.5%.

Core sovereign debt rallied with yields on 10yr bunds falling by -9.1bps to a 7-week low of -0.586%. 10yr spreads widened somewhat in southern Europe however, particularly for Italy, where the spread over bunds was up +9.8bps, while Greece (+7.2bps) and Spain (+1.5pbs) also saw moves wider. The 2yr BTP/Bund spread was actually tighter which perhaps highlights not too much market concern over the ECB message. Over in the US, 10yr Treasury yields were down as much as 4.6bps to 0.58%, less than 5bps away from their all-time record closing low, before spiking higher in the US afternoon session to finish +1.2 bps higher at 0.639%.

Poor economic data along with negative earnings news saw equities give up their gains as we reached month-end, with the S&P 500 falling by -0.92% yesterday, while the VIX index of volatility, which had been trending downward from its highs in mid-March, saw its biggest increase in over a week, up +2.92pts to 34.15pts. Roughly 80% of the stocks in the index were lower on the day. Interestingly the two best performing subsectors in the US were Retailing and Technology Hardware. Both were led higher by their largest respective components, Amazon and Apple, which both reported after the close.

In terms of those earnings yesterday, Apple was down -2.59% after the market closed. This was even after the company saw quarterly earnings rise 1%, as CEO Tim Cook cited a drop in demand in late March/early April before rebounding in recent weeks. Though sentiment shifted more negative as the company declined to offer guidance for the first time in over ten years. Amazon was down -5.09% in after-hours trading after announcing a profit drop of 29% in the first quarter. The company offered a very wide range for operating income in the second quarter of a $1.5 billion gain to a $1.5 billion loss. The company is expecting to spend nearly $4 billion on “Covid-related expenses getting products to customers and keeping employees safe,” according to CEO Jeff Bezos.

Futures on the S&P 500 and NASDAQ are down -1.41% and -1.91% this morning respectively post those results. Those markets that are open in Asia this morning haven’t fared much better with the Nikkei down -2.49% and ASX -3.50%. In FX the dollar index is up a modest +0.12% while 10y Treasuries are down 2.2bps. The only data of note to flag this morning were the April export numbers in South Korea which revealed a larger than expected decline of -24.3% yoy (vs. -23.0% expected). That’s the biggest decline since May 2009.

Back to central banks, the Fed separately announced yesterday that it was expanding the scope and eligibility for its Main Street Lending Program. Businesses with up to 15,000 employees or up to $5bn in annual revenue are now eligible, an increase from before when it was up to 10,000 employees and $2.5bn in revenue. Furthermore, the minimum loan size for certain loans would go down from $1m to $500,000, and there’d also be a new loan option for more leveraged companies where lenders would retain a 15% share on loans.

The central bank moves came against the backdrop of some of the worst GDP stats we’ve seen in many years yesterday. Starting with the overall Euro Area number, Q1 saw the economy contract by -3.8% compared with the previous quarter, in line with expectations and the largest quarterly contraction since the formation of the single currency back in 1999. However as we’ve been saying, given the lockdowns only started at the end of the quarter in March, this actually gives an incomplete picture of the extent to which the economy has shrunk, and we’re not likely to see the largest moves in the data until Q2. Indeed, ECB President Lagarde said in her press conference yesterday that in a severe scenario, their Q2 forecast pointed to a contraction as large as -15%.

Looking at the country-by-country releases where we got them, the French economy saw a quarterly contraction of -5.8% (vs. -4.0% expected), the largest quarterly decline in the data series going back to 1949, and exceeding the -5.3% quarterly decline in Q2 1968 when the country was gripped by social unrest. Following the previous quarterly -0.1% decline, this means the French economy has now experienced two consecutive quarterly contractions, a measure which is often taken to be the definition of a recession. Over in Italy, the economy contracted by -4.7% (vs. -5.4% expected) and on a technical basis went into its 6th recession of the Euro era. This one will only be Germany’s 5th over the same period. Meanwhile the Spanish economy saw a -5.2% (vs. -4.3% expected) contraction.

The only one of the 4 largest Euro member states left to report GDP is Germany now, and given all three of the others above came in worse than the Euro Area average, this implies that Germany could well have done significantly better than the others when we get their data in a couple of weeks (our economists think maybe -1.5%). It’s also noticeable, if unsurprising given the virus struck Europe first, that the Euro Area did much worse than the US. The US number from the previous day of -4.8% was on an annualised basis, meaning that the comparable quarter-on-quarter contraction for the US was “only” -1.2%, much smaller than the -4.8% decline in the Euro Area.

Staying on the ECB and the Euro Area, the flash CPI estimate for April yesterday came in at +0.4%, which the lowest inflation print since September 2016, though still above the +0.1% reading expected. The main reason for the decline was energy prices, which fell by -9.6% compared with a year earlier thanks to the recent plunge in oil, and the core CPI component was at a higher +0.9%. And speaking of oil, yesterday saw yet another rebound in prices, with WTI up +25.10% at $18.84/barrel, bringing its gains over the last two sessions to +54.70%. Brent crude also advanced with a +12.11% increase to $25.27/barrel. There was also news that ConocoPhillips will cut output by over 400k barrels a day in June. Norway also said it will reduce production yesterday. With the Nordic country producing 250k less barrels a day in June and then cutting 134k barrels during the second half of the year.

Looking at yesterday’s other data, the weekly initial jobless claims from the US provided yet another sign of how the economy has continued to slide well into April. Initial claims were at 3.839m in the week to April 25, above the 3.5m consensus expectation, while the previous week’s reading was revised up by further 25k. While this is the 4th week in a row that the number has declined, down from a peak of 6.867m in late March, the total number of claims in the last 6 weeks now stands at over 30m. Given the pre-covid number of nonfarm payrolls in February stood at 152m, we’re looking at around 20% of the labour force having now sought unemployment benefits, so some shocking numbers, and all eyes will be on the jobs report for April coming out a week today, where it’s widely expected we could see the highest unemployment rate for the US since before WWII.

Concluding with the final data points now, and German retail sales in March fell by -5.6%, the biggest monthly decline since January 2007, while the number of jobless claims rose by 373k in April. In the US, personal spending fell by a record -7.5% in March, the largest in data going back to 1959, while personal income was down -2.0%. The MNI Chicago PMI fell further to 35.4, and French consumer spending in March saw a monthly decline of -17.9%, far exceeding the -5.8% reading expected.

To the day ahead now, and the calendar is a slightly lighter one thanks to the Labour Day public holiday in numerous countries. Data highlights include April’s manufacturing PMIs from the UK, Canada and the US, as well as April’s ISM manufacturing reading for the US as well. In addition to this, we’ll get the UK’s consumer credit and mortgage approvals for March, along with US construction spending for March too. Earnings releases include ExxonMobil, Chevron, Charter Communications, AbbVie and Honeywell International.

Tyler Durden

Fri, 05/01/2020 – 08:02

via ZeroHedge News https://ift.tt/2VQCUQC Tyler Durden