Total US Coronavirus Cases Likely 10x Higher Than Official Tally, CDC Warns

Tyler Durden

Thu, 06/25/2020 – 17:30

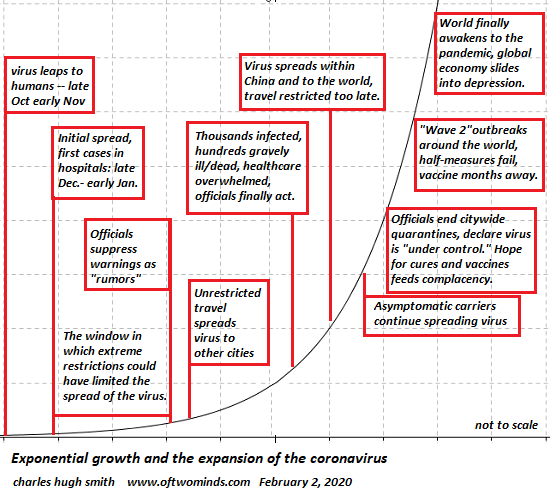

As public health officials argue about whether the US will see the coronavirus death rate return to its deadliest peak back in late April/early May, the CDC just issued a warning claiming that the number of Americans infected with the coronavirus is probably 10x higher than we know.

If accurate, that would mean the total number of cases in the US alone is closer to 20 million. These numbers are based on the results of a few rounds of surveillance testing using antibody-detection tests. While the CDC stands by the numbers, some experts have raised questions about antibody tests and their susceptibility to false positives. However, some rounds of surveillance testing in NY and NYC have found that as many as 1/5 people tested (in NYC) tested positive for antibodies.

Here’s more from Reuters:

Government experts believe more than 20 million Americans could have contracted the coronavirus, 10 times more than official counts, indicating many people without symptoms have or have had the disease, senior administration officials said.

The estimate, from the Centers for Disease Control and Prevention, is based on serology testing used to determine the presence of antibodies that show whether an individual has had the disease, the officials said.

The officials, speaking to a small group of reporters on Wednesday night, said the estimate was based on the number of known cases, between 2.3 million and 2.4 million, multiplied by the average rate of antibodies seen from the serology tests, about an average of 10 to 1.

“If you multiply the cases by that ratio, that’s where you get that 20 million figure,” said one official.

If true, the estimate would suggest the percentage of U.S. deaths from the disease is lower than thought. More than 120,000 Americans have died from the disease since the pandemic erupted earlier this year.

With 20 million infected, the mortality rate in the US of just 0.6%. That would also explain why deaths have continued to plateau, or even trend lower, even as new infections are being diagnosed. One widely quoted epidemiologist from Harvard, Dr. Eric Feigl-Ding, said he felt the numbers were ‘reasonable’ given his experience with serology testing.

Wow- 10x more #COVID19 than expected: many new cases are showing up in young people who do not exhibit symptoms and may not know they have it.

young people with no symptoms, but in regular contact with vulnerable population, should proactively get tested! https://t.co/fwRwRnVX82

— Eric Feigl-Ding (@DrEricDing) June 25, 2020

2) “We have heard from Florida and Texas that roughly half of the new cases that are reporting are people under the age of 35, and many of them are asymptomatic,” one official said.”

— Eric Feigl-Ding (@DrEricDing) June 25, 2020

3) 10x estimate was based on the number of known cases, between 2.3 million and 2.4 million, multiplied by the average rate of antibodies seen from the serology tests, an average of 10 to 1.

“If you multiply the cases by that ratio, that’s where you get that 20 million figure”

— Eric Feigl-Ding (@DrEricDing) June 25, 2020

4) Though 20-25 million would still be just 6-7.5% of total US population. Nothing suggesting anything approaching the 60% minimum and 75-80% optimal needed for herd. So don’t use this to suggest herd immunity!

— Eric Feigl-Ding (@DrEricDing) June 25, 2020

5) I think this estimate is reasonable. We use serology to estimate flu epidemic as well since we rarely have good testing for flu, but rather serology. It’s not bad news per se. most importantly is the new testing recs for young people regardless of symptoms!

— Eric Feigl-Ding (@DrEricDing) June 25, 2020

Still, as Dr. Feigl-Ding pointed out, these data shouldn’t be used to support the notion that the US has developed high enough levels of ‘herd immunity’ to move forward without a vaccine. As Sweden’s top epidemiologist pointed out just the other week, herd immunity for COVID-19 is something that takes a surprisingly long time to develop. Especially since we don’t know yet whether mutations in the virus will render these anti-bodies, or any forthcoming vaccine, obsolete.

via ZeroHedge News https://ift.tt/3dzPtFJ Tyler Durden