Watch Live: Powell & Mnuchin Explain To Congress How They Saved The ‘Economy’

Tyler Durden

Tue, 06/30/2020 – 12:20

The Treasury Secretary and Fed chair will discuss their approach to rescuing the economy at a House Financial Services Committee hearing on Tuesday.

We suspect the two will have somewhat different views of the way ahead with Mnuchin signaling confidence in the v-shaped recovery and Powell continuing to stress unprecedented uncertainty.

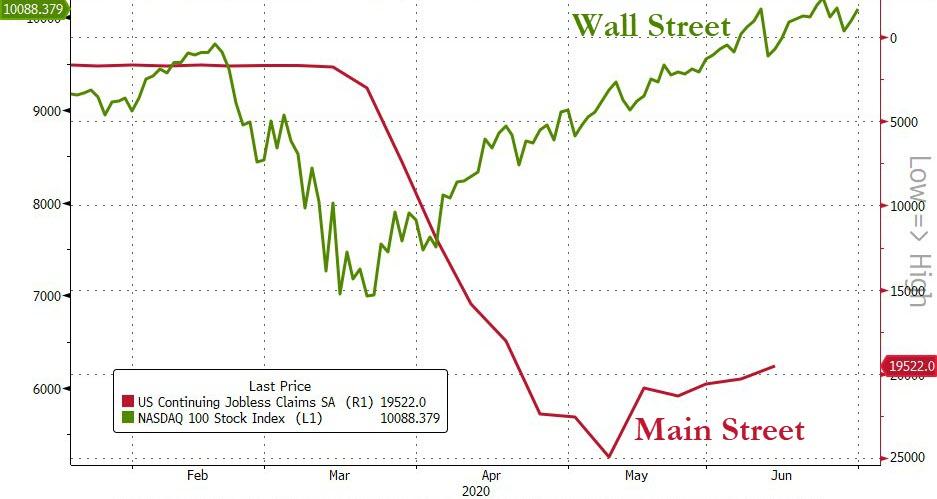

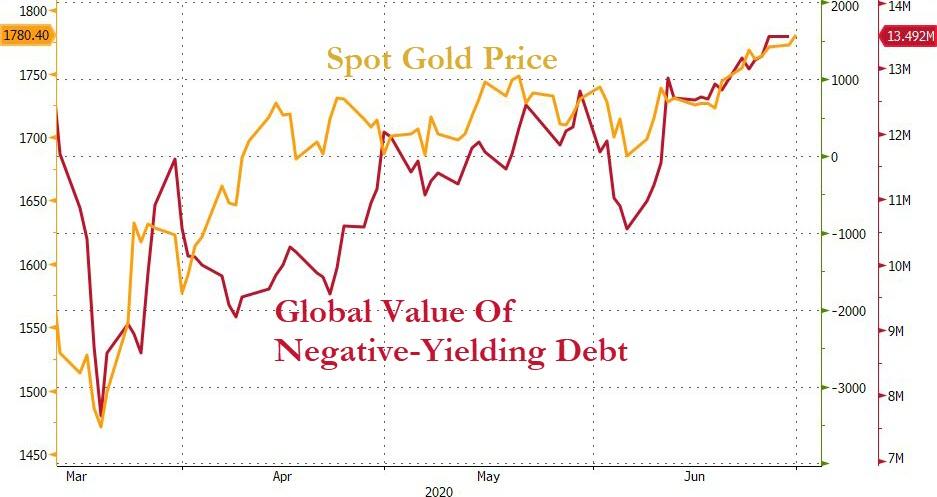

Both will likely agree that their efforts saved the ‘economy’ (and by economy, we mean the stock market)…

Watch Live:

* * *

Fed Chair Powell’s Full Prepared Remarks below: (emphasis ours)

Chairwoman Waters, Ranking Member McHenry, and other members of the Committee, thank you for the opportunity to testify today to discuss the extraordinary challenges our nation is facing and the steps we are taking to address them.

We meet as the pandemic continues to cause tremendous hardship, taking lives and livelihoods both at home and around the world. This is a global public health crisis, and we remain grateful to our health-care professionals for delivering the most important response, and to our essential workers who help us meet our daily needs. These dedicated people put themselves at risk day after day in service to others and to our country.

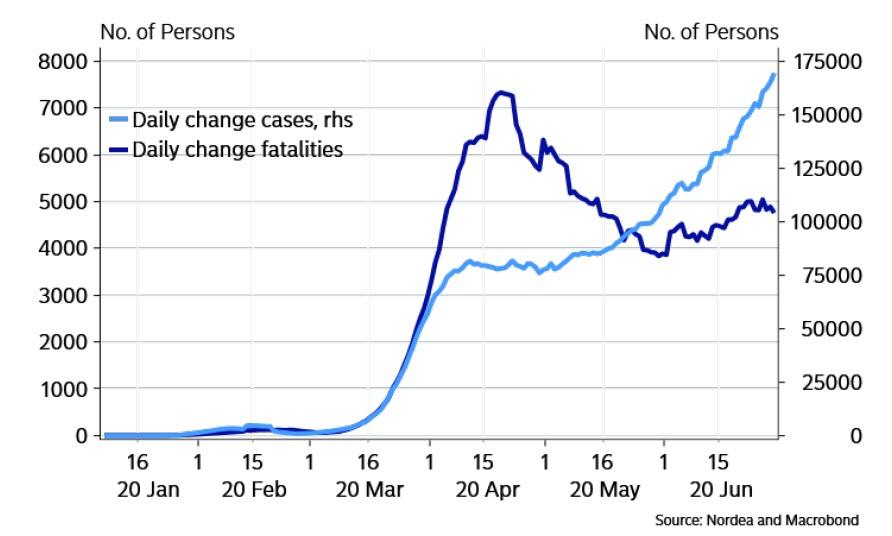

Beginning in March, the virus and the forceful measures taken to control its spread induced a sharp decline in economic activity and a surge in job losses. Indicators of spending and production plummeted in April, and the decline in real gross domestic product, or GDP, in the second quarter is likely to be the largest on record. The arrival of the pandemic gave rise to tremendous strains in some essential financial markets, impairing the flow of credit in the economy and threatening an even greater weakening of economic activity and loss of jobs.

The crisis was met by swift and forceful policy action across the government, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This direct support is making a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our economy.

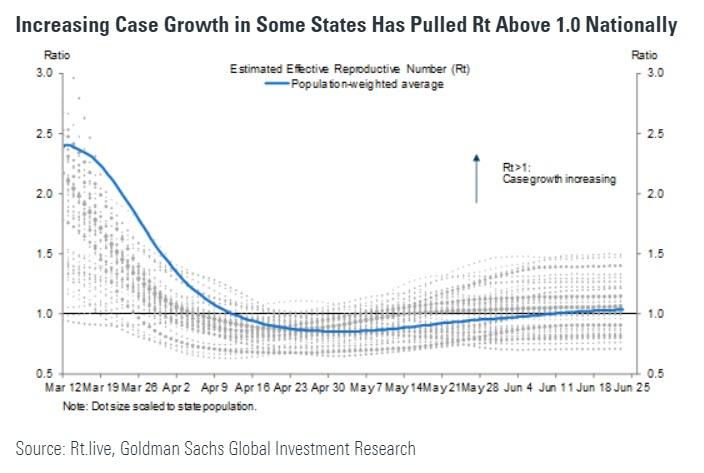

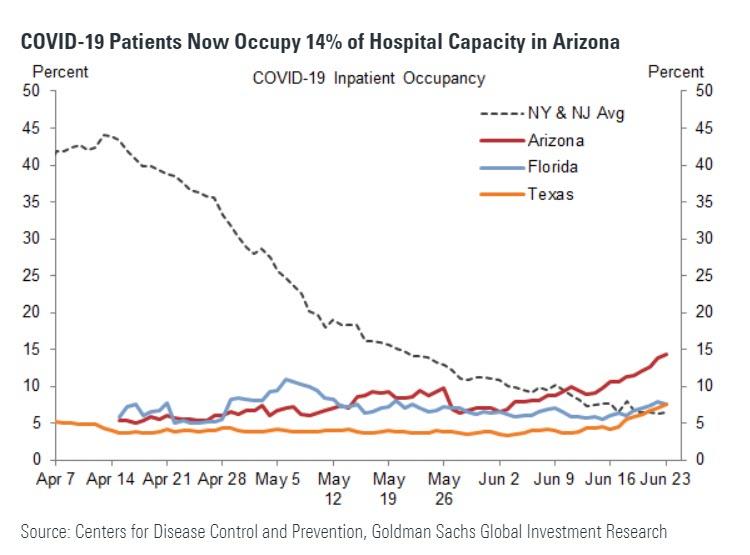

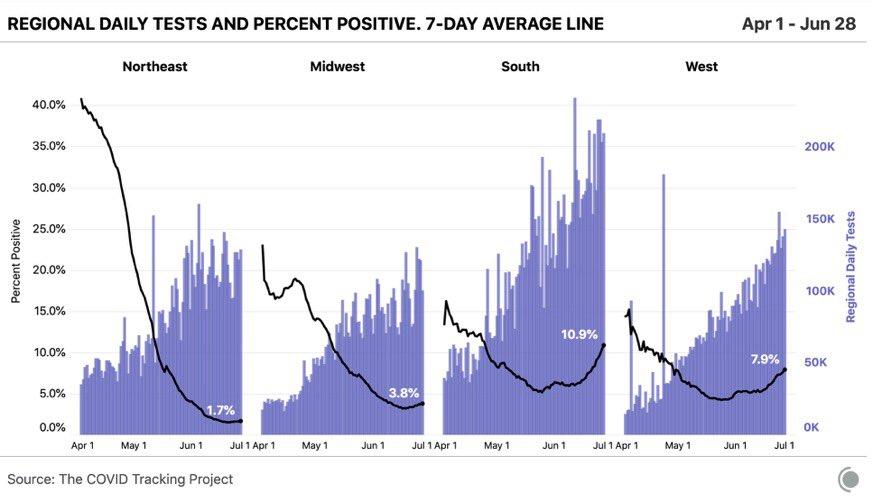

As the economy reopens, incoming data are beginning to reflect a resumption of economic activity: Many businesses are opening their doors, hiring is picking up, and spending is increasing. Employment moved higher, and consumer spending rebounded strongly in May. We have entered an important new phase and have done so sooner than expected. While this bounceback in economic activity is welcome, it also presents new challenges—notably, the need to keep the virus in check.

While recent economic data offer some positive signs, we are keeping in mind that more than 20 million Americans have lost their jobs, and that the pain has not been evenly spread. The rise in joblessness has been especially severe for lower-wage workers, for women, and for African Americans and Hispanics. This reversal of economic fortune has caused a level of pain that is hard to capture in words as lives are upended amid great uncertainty about the future.

Output and employment remain far below their pre-pandemic levels. The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.

The path forward will also depend on the policy actions taken at all levels of government to provide relief and to support the recovery for as long as needed.

The Federal Reserve’s response to these extraordinary developments has been guided by our mandate to promote maximum employment and stable prices for the American people as well as our role in fostering the stability of the financial system. Our actions and programs directly support the flow of credit to households, to businesses of all sizes, and to state and local governments. These programs benefit Main Street by providing financing where it is not otherwise available, helping employers to keep their workers, and allowing consumers to continue spending. In many cases, by serving as a backstop to key financial markets, the programs help increase the willingness of private lenders to extend credit and ease financial conditions for families and businesses across the country. The passage of the CARES Act by Congress was critical in enabling the Federal Reserve and the Treasury Department to establish many of these lending programs. We are strongly committed to using these programs, as well as our other tools, to do what we can to provide stability, to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy.

In discussing the actions we have taken, I will begin with monetary policy. In March, we lowered our policy interest rate to near zero, and we expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.

In addition to these steps, we took forceful measures in four areas: open market operations to restore market functioning; actions to improve liquidity conditions in short-term funding markets; programs, in coordination with the Treasury Department, to facilitate more directly the flow of credit to households, businesses, and state and local governments; and measures to encourage banks to use their substantial capital and liquidity buffers built up over the past decade to support the economy during this difficult time.

Let me now turn to our open market operations. As tensions and uncertainty rose in mid-March, investors moved rapidly toward cash and shorter-term government securities, and the markets for Treasury securities and agency mortgage-backed securities, or MBS, started to experience strains. These markets are critical to the overall functioning of the financial system and to the transmission of monetary policy to the broader economy. In response, the Federal Open Market Committee purchased Treasury securities and agency MBS in the amounts needed to support smooth market functioning. With these purchases, market conditions improved substantially, and in early April we began to gradually reduce our pace of purchases. To sustain smooth market functioning and thereby foster the effective transmission of monetary policy to broader financial conditions, we will increase our holdings of Treasury securities and agency MBS over the coming months at least at the current pace. We will closely monitor developments and are prepared to adjust our plans as appropriate to support our goals.

Amid the tensions and uncertainties of mid-March and as a more adverse outlook for the economy took hold, investors exhibited greater risk aversion and pulled away from longer-term and riskier assets as well as from some money market mutual funds. To help stabilize short-term funding markets, we lengthened the term and lowered the rate on discount window loans to depository institutions. The Board also established, with the approval of the Treasury Department, the Primary Dealer Credit Facility (PDCF) under our emergency lending authority in section 13(3) of the Federal Reserve Act. Under the PDCF, the Federal Reserve provides loans against good collateral to primary dealers that are critical intermediaries in short-term funding markets. Similar to the large-scale purchases of Treasury securities and agency MBS that I mentioned earlier, this facility helps restore normal market functioning.

In addition, under section 13(3) and together with the Treasury Department, we set up the Commercial Paper Funding Facility, or CPFF, and the Money Market Mutual Fund Liquidity Facility, or MMLF. Millions of Americans put their savings into these markets, and employers use them to secure short-term funding to meet payroll and support their operations. Both of these facilities have equity provided by the Treasury Department to protect the Federal Reserve from losses. After the announcement and implementation of these facilities, indicators of market functioning in commercial paper and other short-term funding markets improved substantially, and rapid outflows from prime and tax-exempt money market funds stopped.

In mid-March, offshore U.S. dollar funding markets also came under stress. In response, the Federal Reserve and several other central banks announced the expansion and enhancement of dollar liquidity swap lines. In addition, the Federal Reserve introduced a new temporary Treasury repurchase agreement facility for foreign monetary authorities. These actions helped stabilize global U.S. dollar funding markets, and they continue to support the smooth functioning of U.S. Treasury and other financial markets as well as U.S. economic conditions.

As it became clear the pandemic would significantly disrupt economies around the world, markets for longer-term debt also faced strains. The cost of borrowing rose sharply for those issuing corporate bonds, municipal debt, and asset-backed securities (ABS) backed by consumer and small business loans. In effect, creditworthy households, businesses, and state and local governments were unable to borrow at reasonable rates and other terms, which would have further reduced economic activity. In addition, small and medium-sized businesses that traditionally rely on bank lending faced large increases in their funding needs as measures taken to contain the spread of the virus forced them to temporarily close or limit operations, substantially curtailing revenues.

To support the longer-term financing that is critical to economic activity, the Federal Reserve, in cooperation with the Department of the Treasury and using equity provided for that purpose under the CARES Act, announced a number of emergency lending facilities under section 13(3) of the Federal Reserve Act. These facilities are designed to ensure that credit would flow to borrowers and thus support economic activity.

On March 23, the Board announced that it would support consumer and business lending by establishing the Term Asset-Backed Securities Loan Facility (TALF). The TALF is authorized to extend up to $100 billion in loans and is backed by $10 billion in CARES Act equity. This facility lends against top-rated securities backed by auto loans, credit card loans, other consumer and business loans, commercial mortgage-backed securities, and other assets. The TALF supports credit access by consumers and businesses and provides liquidity to the broader ABS market. The facility made its first loans on June 25, and, to date, has extended $252 million in loans to eligible borrowers. Since the TALF was announced, ABS spreads have contracted significantly. Thus, the facility might be used relatively little and mainly serve as a backstop, assuring lenders that they will have access to funding and giving them the confidence to make loans to households and businesses.

To support the credit needs of large employers, the Federal Reserve also established the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF). These facilities primarily purchase bonds issued by U.S. companies that were investment grade on March 22, 2020. The two facilities have a combined purchase capacity of up to $750 billion and are backed by $75 billion in CARES Act equity. Final terms and operational details on the PMCCF were announced on June 29, and it stands ready to purchase newly issued corporate bonds and syndicated loans, serving as a backstop for businesses seeking to refinance their existing credit or obtain new funding. The SMCCF buys outstanding corporate bonds and shares in corporate bond exchange-traded funds (ETFs) to facilitate smooth functioning of the secondary market. The SMCCF complements the PMCCF, because improvements in secondary-market functioning associated with the SMCCF facilitate access by companies to bond and loan markets on reasonable terms. The SMCCF launched with ETF purchases on May 12. Earlier this month, the facility began gradually reducing purchases of ETFs as it started buying a broad and diversified portfolio of individual corporate bonds to more directly support smooth functioning and market liquidity in the secondary market. Purchase volumes are tied to market functioning and are currently at very low levels. The facility currently holds a total of about $10 billion in bonds and ETF shares.

Following the announcement of the two corporate credit facilities in late March, conditions in the corporate bond market improved significantly. Credit spreads on investment-grade bonds retraced much of the widening experienced in February and March, and issuance in the primary market rebounded strongly. In the secondary market, liquidity also improved, and by mid-April, flows out of mutual funds and ETFs specializing in corporate bonds reversed.

The Federal Reserve also launched the Main Street Lending Program, which is designed to provide loans to small and medium-sized businesses that were in good financial standing before the pandemic; such firms generally are dependent on bank lending for credit because they are too small to tap bond markets directly. Under the Main Street program, banks originate new loans or increase the size of existing loans to eligible businesses and sell loan participations to the Federal Reserve. The facility is backed by $75 billion in CARES Act equity and can purchase up to $600 billion in loan participations. The Federal Reserve has published all of the legal documents that borrowers and lenders will need to sign under the program and lender registration began on June 15. Loan participations will be purchased soon. Additionally, the Federal Reserve recently sought feedback on a proposal to expand the Main Street program to include loans made to small and medium-sized nonprofit organizations, such as hospitals and universities. Nonprofits provide vital services around the country, and the program would likewise offer them support.

While businesses in certain sectors that were particularly hard hit by the pandemic have reported continued difficulty in accessing credit, the Small Business Administration’s Paycheck Protection Program (PPP), which draws from existing bank lines, has apparently met the immediate credit needs of many small businesses. In the months ahead, Main Street loans may prove a valuable resource for firms that were in sound financial condition prior to the pandemic.

To bolster the effectiveness of the Small Business Administration’s PPP, on April 16, the Federal Reserve launched the Paycheck Protection Program Liquidity Facility. The facility supplies liquidity to lenders backed by their PPP loans to small businesses and has the capacity to lend up to the full amount of the PPP. As of last week, the facility held over $65 billion in outstanding term loans to participating financial institutions. The most recent monthly survey from the National Federation of Independent Business released in May indicates that small businesses have been able to meet their funding needs in recent months largely due to the PPP.

To help state and local governments better manage cash flow pressures in order to continue to serve households and businesses in their communities, the Federal Reserve, together with the Treasury Department, established the Municipal Liquidity Facility (MLF). The MLF is backed by $35 billion of CARES Act equity and has the capacity to purchase up to $500 billion of short-term debt directly from U.S. states, counties, cities, and certain multistate entities. The facility became operational on May 26, and, to date, the MLF has purchased $1.2 billion worth of short-term municipal debt. With the MLF and other facilities in place as a backstop to the private market, many parts of the municipal bond market have significantly recovered from the unprecedented stress experienced earlier this year. Municipal bond yields have declined considerably, issuance has been robust over the past two months, and market conditions have improved

The tools that the Federal Reserve is using under its 13(3) authority are for times of emergency, such as the ones we have been living through. When economic and financial conditions improve, we will put these tools back in the toolbox.

The final area where we took steps was in bank regulation. The Board made several adjustments, many temporary, to encourage banks to use their positions of strength to support households and businesses. Unlike the 2008 financial crisis, banks entered this period with substantial capital and liquidity buffers and improved risk-management and operational resiliency. As a result, they have been well positioned to cushion the financial shocks we are seeing. In contrast to the 2008 crisis when banks pulled back from lending and amplified the economic shock, in this crisis they have greatly expanded loans to customers and have helped support the economy.

The Federal Reserve has been entrusted with an important mission, and we have taken unprecedented steps in very rapid fashion over the past few months. In doing so, we embrace our responsibility to the American people to be as transparent as possible. With regard to the facilities backed by equity from the CARES Act, we have conducted broad outreach and sought public input that has been crucial in their development. For example, in response to comments received, the Treasury and the Federal Reserve have made a number of changes to expand the scope of the Main Street Lending Program to cover a broader range of borrowers and to increase the flexibility of loan terms. And we are now disclosing and will continue to disclose, on a monthly basis, names and details of participants in each facility; amounts borrowed and interest rate charged; and overall costs, revenues, and fees for each of these facilities.

We recognize that our actions are only part of a broader public-sector response. Congress’s passage of the CARES Act was critical in enabling the Federal Reserve and the Treasury Department to establish many of the lending programs. The CARES Act and other legislation provide direct help to people, businesses, and communities. This direct support can make a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our economy. We understand that the work of the Federal Reserve touches communities, families, and businesses across the country. Everything we do is in service to our public mission. We are committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible.

Thank you. I’d be happy to take your questions.

via ZeroHedge News https://ift.tt/2YMIAMW Tyler Durden