Daily Briefing – July 1, 2020

Tyler Durden

Wed, 07/01/2020 – 18:10

via ZeroHedge News https://ift.tt/31yZZuf Tyler Durden

another site

Daily Briefing – July 1, 2020

Tyler Durden

Wed, 07/01/2020 – 18:10

via ZeroHedge News https://ift.tt/31yZZuf Tyler Durden

Russia Denies Causing Latest Radioactivity Over Europe; UN Agency Says Origin “Still Unclear”

Tyler Durden

Wed, 07/01/2020 – 18:05

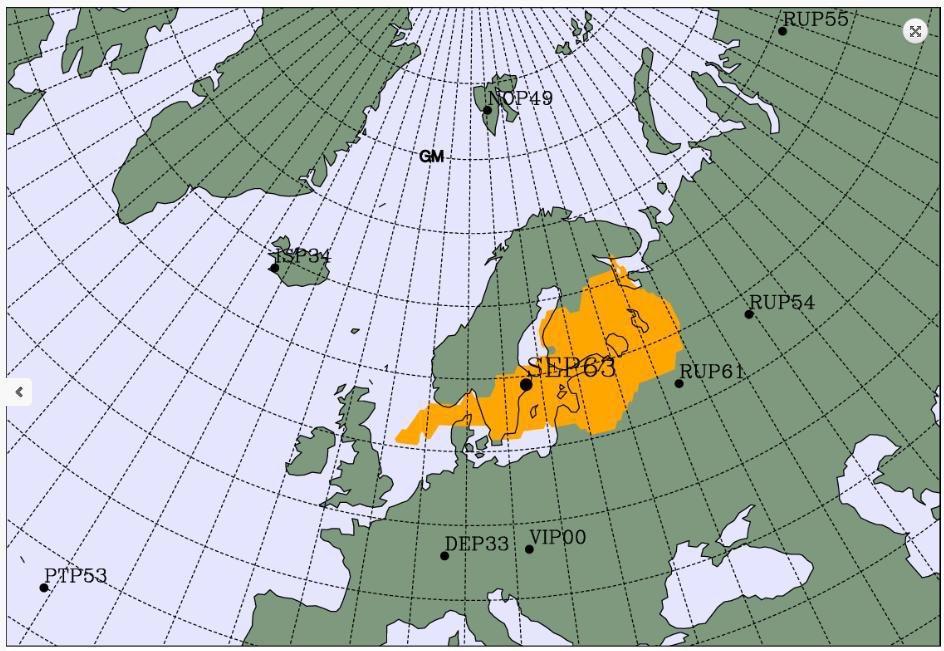

Last Friday monitors with the Comprehensive Nuclear-Test-Ban Treaty Organization (CTBTO) issued an alarming report that its radiation sensors based in Scandinavia picked up abnormal radioactivity levels in the air over the Baltics and Scandanavia. Its ultra-sensitive networked sensors set up across Europe and the world are capable of picking up nuclear weapons testing or possible nuclear power plant leakage anywhere around the globe.

The Stockholm monitoring station “detected 3 isotopes; Cs-134, Cs-137 & Ru-103 associated with Nuclear fission at higher than usual levels,” according to CTBTO chief Lassina Zerbo. The UN nuclear agency has been investigating the ‘mystery’ radioactivity, which while not considered in large enough concentrations to harm humans, still “are certainly nuclear fission products, most likely from a civil source,” according to the prior CTBTO statement. “We are able to indicate the likely region of the source, but it’s outside the CTBTO’s mandate to identify the exact origin.”

However it’s clear that there was a release of “very low” levels of man-made radioactivity.

The UN watchdog said Tuesday that the small amounts of radioactive isotopes detected over a significant area spanning from western Russia to Baltic countries to parts of Scandinavia still have an unclear origin and cause.

The International Atomic Energy Agency’s (IAEA) director general, Rafael Grossi, also sought to assure the public that “the levels reported to the IAEA are very low and pose no risk to human health and the environment.”

According to the AP, European countries are being asked to self-report any radiation releases. So far at least 29 have voluntarily reported no known incidents within their borders, including Russia.

Recall the last major radiation release incident almost a year ago involved a failed ‘secret’ Russian advanced weapon test.

Dutch researchers have since said this latest incident likely came from “the direction of Western Russia”. This prompted a detailed denial from Kremlin spokesperson Dmitry Peskov:

“We have an exceptional and modern system of monitoring nuclear safety and as you’ve seen there were no alarms related to any threatening or emergency situations,” Peskov said Monday. “We don’t know what the source is for these reports of specialists in the Netherlands,” he added.

Recall that Russia admitted to releasing significant amounts of radiation into the air last August that triggered warning alerts in the region of the far north Arctic Circle port cities of Arkhangelsk and Severodvinsk.

That prior major incident occurred due to an acknowledged failed weapons test involving a “small-scale nuclear reactor” that killed Russian scientists – which was believed connected to Russia’s hypersonics program.

via ZeroHedge News https://ift.tt/3ikUqWn Tyler Durden

Superficially, Bostock may seem like a triumph for textualism. It wasn’t. Rather, Justice Gorsuch built a textualist edifice on top of non-textualist precedents from decades ago. His understanding of Title VII was governed by Justice Brennan’s plurality decision in Price Waterhouse v. Hopkins (1989). Randy Barnett and I called this approach “halfway textualism.” Going forward, judges should reconsider the relationship between textualism and statutory stare decisis: to what extent is a textualist analysis governed by precedents that disregarded textualism. Alas, Justice Gorsuch completely missed this issue.

Judges should also consider a closely related issue: the relationship between originalism and constitutional stare decisis. For argument’s sake, I’ll assume that statutory stare decisis differs from constitutional stare decisis. In theory, at least, if the Supreme Court interprets Title VII incorrectly, then Congress can amend the statute. (Congress revised Title VII in response to Justice Brennan’s Price Waterhouse plurality). In contrast, amending the Constitution is much more difficult. Justice Thomas sees no reason to follow constitutional stare decisis. But he is alone on the Court.

As a result, the Justices are constantly binding themselves to precedent, even where that precedent is utterly inconsistent with the original meaning of the Constitution–and even where those later-in-time precedents reversed earlier, better decisions!

Let’s consider a straightforward example. In Wolf v. Colorado (1949), the Supreme Court held that the states were not bound by the so-called exclusionary rule. Twelve years later, Mapp v. Ohio (1961) reversed Weeks. Now the states were bound by the exclusionary rule. What should a future Court do? Stand by the decision of the Vinson Court in Wolf? Or stand by the precedent of the Warren Court in Mapp? With halfway stare decisis means, you stand by the latter precedent, even if the former precedent was correct as an original matter.

Consider another example where the Court sets a new precedent. Griswold v. Connecticut (1965) held that the Constitution protects a right to privacy, and Connecticut’s prohibition on married couples using birth control was unconstitutional. The ruling was based on a bizarre analysis of penumbras and emanations from the Bill of Rights:

I don’t think anyone will defend its reasoning today.

Griswold did not overrule any precedents, though it was flatly inconsistent with Footnote Four of Carolene Products. In time, Griswold begat Eisenstadt v. Baird, which begat Roe v. Wade, which begat Casey, which begat Whole Woman’s Health, which begat June Medical, and so on. But the root of that doctrine is an indefensible decision. Yet, we are forever bound by the excesses of the Warren Court, because they were the first movers.

Adrian Vermeule describes this dynamic well:

If the very first decision freezes the law forever, obliging all subsequent Justices to put aside their disagreements permanently in the name of stare decisis, then the “bank and capital of nations and of ages” shrinks radically. The only depositors to the bank will be the Justices in the initial majority, which means in practice that a majority of only one or two will frequently determine the law forevermore.

On the Roberts Court, Stare Decisis is an old Latin phrase that means “Let the Decisions of the Warren Court Stand.”

Vermeule writes further:

From a Burkean standpoint, it is breathtaking epistemological arrogance to think that one or two Justices, deciding at a single time under conditions of sharply limited information, should be able to determine the permanent course of the law.

Forevermore, we are governed by the dead hands of William O. Douglas and William Brennan. (Forget the dead hands of Madison and Hamilton–those hands are too dead!)

Vermeule continues:

But the effect of the Chief’s approach is to require Burkean Justices to conform to the initial, maximally arrogant decision; conversely, more information would be contributed to the stock of epistemic capital if later Justices treated the second or subsequent case as one of first impression. The self-undermining approach of the Chief’s concurrence, then, actually embodies a kind of judicial hubris cloaked in the garb of humility. (I will leave it to other commentators to speculate about why a veneer of humility seems so often to appeal to the Chief Justice).

In short, the Chief’s judicial humility requires standing by decisions that he thinks lack humility. But only some of those decisions. Roberts will stand by Planned Parenthood v. Casey, but will not stand by Whole Woman’s Health. In the future, I suspect he will stand by Grutter v. Bollinger, but will not stand by Fisher v. University of Texas, Austin. And so on.

We should acknowledge the contradiction of halfway stare decisis.

from Latest – Reason.com https://ift.tt/3dVjXBT

via IFTTT

House Unanimously Passes China Sanctions Bill In Response To Hong Kong Law

Tyler Durden

Wed, 07/01/2020 – 17:45

The U.S. House of Representatives unanimously passed a bill imposing sanctions on banks that do business with Chinese officials involved in the national security law that cracks down on pro-democracy protesters in Hong Kong, a move many lawmakers said violated the government’s promise to honor the autonomy of the former British colony.

During a special appearance at a House Foreign Affairs Committee hearing on Wednesday, House Speaker Nancy Pelosi said the new law “signals the death of the one country, two systems” model followed by China with respect to Hong Kong

“The law is a brutal, sweeping crackdown against the people of Hong Kong, intended to destroy the freedoms they were promised,” Pelosi said.

As we noted earlier, China described the security law as a “sword of Damocles” hanging over its most strident critics.

The bill, which according to Bloomberg is similar to a measure passed by the Senate last week, would have to be approved by the Senate before going to President Donald Trump for a signature. The House bill, which was slightly modified from the Senate version sponsored by Senators Pat Toomey, a Pennsylvania Republican, and Chris Van Hollen, a Maryland Democrat, was changed because of a procedural snag that requires all revenue-producing bills to originate in the House.

via ZeroHedge News https://ift.tt/2Bkm31h Tyler Durden

It Is All About Waves: Tech Stocks & The Log-Periodicity Power Law Singularity Model

Tyler Durden

Wed, 07/01/2020 – 17:45

Authored by ‘Romain’ via The Swarm blog,

Many people claim that economics is not a science. Some of them say that because predictions often fail on the long run, while others think that a human science should not be treated like “rigorous disciplines” such as physics or chemistry.

However, that postulate is misleading. There are too many intriguing similarities between economic activity and natural phenomena such as seismic activity, species evolution, or epidemics.

According to Danish physicist Per Bak, science can be divided into two distinct categories:

“Hard sciences, in which repeatable events can be predicted from a mathematical formalism expressing the laws of nature, and soft sciences, in which, because of their inherent variability, only a narrative account of distinguishable events post mortem is possible.”

From that perspective, economics and finance can be treated as soft sciences.

It is true that predictive models are likely to fail, but mainly because of nonlinearity and unboundedness issues. Economics is a science, but most people apply wrong methodologies.

Bak wrote a brilliant book called How Nature Works, explaining that economic crises or capital market crashes are similar to earthquakes, solar flares, or floods, and empirical surveys show that volatility spikes are effectively distributed like earthquakes magnitudes (i.e. the Gutenberg-Richter law). If there are common patterns to markets and other natural phenomena, then it might be possible to formulate a general theory of complex systems that will help us to understand their dynamics. That intuition led to the concept of self-organized criticality.

While Per Bak passed away in 2002, other physicists have explored this new exciting field called “econophyiscs” and have produced complex but interesting models describing asset prices dynamics. The most famous one is the so-called Log-Periodicity Power Law Singularity (LPPLS) model, as detailed by French professor Didier Sornette in Why Stock Market Crash: Critical Events in Complex Financial Systems.

Despite its intimidating name, the LPPLS model is an ambitious attempt to detect the formation of speculative bubbles and predict a future market crash. Indeed, Sornette and other researchers believe that significant booms and busts exhibit typical patterns, such as an acceleration of fluctuations before the crash. Thus, it might be possible to properly anticipate them.

It may sound crazy and some authors have already questioned the validity of the LPPLS model. However, we live in a time of madness and fundamentals do not seem to matter anymore (again), so it might be worth applying the LPPLS model to Nasdaq 100 index just out of curiosity.

We can start with a simple look at the NDX index chart which enables to visualize an acceleration of prices fluctuations from 2018 to 2020, a pattern that looks similar to the 1998-2000 period.

One could argue that such a pattern was not visible from 2006 to 2008. But this is exactly what it is all about. The 2008 bear market was triggered by an exogenous event, a mortgage crisis that turned into a severe credit crunch, while the 2000-2002 correction had pure endogenous causes, and so had the 1929 and the 1987 crashes.

Isn’t the Covid-19 pandemic an exogenous event too? Yes, but it has not led to a real bear market anyway, so there might be something bigger going on. Moreover, people like Nassim Nicholas Taleb have spent the past weeks claiming that coronavirus pandemic should not necessarily be regarded as a black swan.

In fact, if you look carefully, you will easily notice that the market has been more and more overwhelmed by the intersubjective “Fed put” narrative, and it has become so important that if has offset fears related to a trade war, a recession, a virus, or anything else. We could even call it “a new paradigm”.

While the market tends to display a macro-behavior, price fluctuations have accelerated since 2018 because the fight between bulls and bears has become more and more intense, a fiercer competition between the dominant narrative and the anti-narrative, a faster swing from positive feedback loops to negative feedback loops.

Thus, the question is, are we on the verge of collapse? Does the LPPLS model confirm such an intuition?

Folks from Boulder Investment Technologies blog developed a Python library which enables to run a straight-forward version of the model. The LPPLS model is an optimization problem with seven parameters, including the critical time (i.e. the date of termination of the bubble and transition in a new regime). In other words, if we find parameters that enable to generate predictions that fit well with real data, then we may have the confirmation that a bubble has formed and we might be able to determine when it is likely to end.

Of course, this is purely theoretical. Nevertheless, it is worth noting that the LPPLS model fits pretty well with NDX data from 2015 to 2020 (see chart below). Why do we start in 2015? Because there has been a significant upward acceleration of tech stocks since that date.

Then comes the question of the critical time.

Once again, this is purely theoretical, but the model suggests that the bubble terminates by the end of the summer.

This should not come as a surprise given US political agenda and C-19 threat.

Finally, it is all about the survival of the dominant narrative, and the idea that securities cannot drop just because there is another participant (i.e. the central bank) buying them. Unfortunately, history shows us that such interventions never succeeded into preventing a crash, so everyone should bear in mind that the “Fed put” is mainly an intersubjective postulate without any scientific foundation.

Somehow, if people start to think differently, then what will support the market? Especially given concentration risks and short-volatility bets (see my former posts To Be Passive Is to Let Others Decide for You and Stranger Things).

Sornette might be wrong and the LPPLS might fail. However, if it turns out that the model is right, then you’d better brace yourself for one of the biggest volatility spikes of your life.

via ZeroHedge News https://ift.tt/2NOi13K Tyler Durden

Firearms Background Checks Hit All Time High In June

Tyler Durden

Wed, 07/01/2020 – 17:25

A record 3.93 million firearms background checks were run in June, the highest volume since the inception of the National Instant Criminal Background Check System (NICS) in 1988, and over one million more than June, 2019.

Last month’s figure eclipses the previous record of 3.31 million in December, 2015, according to Bloomberg, citing FBI data. And according to The Trace, “all four weeks of June rank among the six busiest weeks NICS has ever recorded.”

The record jump comes amid national chaos, as BLM protests over the killing of George Floyd, a black man who died after a white police officer knelt on his neck for over eight minutes, has frequently featured looting and riots. It also comes as former Vice President Joe Biden has experienced a jump in polling against President Trump.

The only time when gun background checks rose at a faster pace was when President Obama started his second term. https://t.co/CdHbkn4Opy pic.twitter.com/fe9P1k7mcO

— Bespoke (@bespokeinvest) July 1, 2020

During June, Smith & Wesson Brands shares soared 82%, Vista Outdoor climbed 49% and Sturm Ruger rose 22%; all three stocks were adding to their gains Wednesday. -Bloomberg

That said, while background checks are the best approximation of how many guns have been sold in a given month, it may be an inaccurate indicator – as a single check can cover multiple guns, and there are non-purchase reasons for running one – such as permit applications, according to The Trace. Private gun sales are also excluded.

According to Small Arms Analytics, a consulting firm, the June background check figure translates to approximately 2.4 million gun sales. Handguns accounted for a larger share of sales than ever before, continuing several months of steady increases.

In May, The Trace and USA Today reported that gun sales had increased in several of the states that shuttered dealers, as many shops defied stay-at-home orders. All five of those states — Massachusetts, New York, Michigan, New Mexico, and Washington — have now allowed guns dealers to resume some business. –The Trace

Meanwhile, anti 2nd Amendment groups “Moms Demand Action” and “Everytown for Gun Safety” are utterly triggered by the record background checks.

“Polls show that the ongoing surge in American gun sales is being met with a surge in the number of Americans who want stronger gun law,” said John Feinblatt, president of Everytown for Gun Safety.

“If lawmakers are serious about public safety, they will take immediate action to ensure that a background check is completed before every single gun sale, even if that takes longer than the current federal limit of just three days.”

After leftist calls to defund the police – which have stopped responding to some of the most dangerous parts of US cities in recent weeks – leaving residents to defend themselves, we’re guessing any arguments for gun grabbing have fallen on deaf ears.

via ZeroHedge News https://ift.tt/31wUufP Tyler Durden

The Chain Reaction Is Now In Process

Tyler Durden

Wed, 07/01/2020 – 17:05

Submitted by Max Rangeley of The Cobden Center,

Much has been written about the economic consequences of Covid-19, yet, just as in many of the analyses of the Great Depression and the 2008 crisis, the years of accumulating debt preceding the event do not attract the attention they deserve. Covid-19—or to be more precise, the lockdown—has initiated a cascading liquidation of the debt bubble which has been building for a generation. From the early 1980s, each recession has been responded to with iteratively lower interest rates. Following the bursting of the late-1980s credit bubble, Greenspan inaugurated the loosest monetary policy for a generation, creating the Dot Com Bubble. When this burst in 2000, it was responded to with even lower interest rates, reaching 1% from 2003-4, generating the Housing Bubble. When this burst in 2007/8, the response was zero percent interest rates, turning a $150 trillion global debt bubble as it was then—already the largest In history—into a $250 trillion global debt bubble.

At the Cobden Centre we have organised many talks around the world on the nature of the debt bubble, including in the European Parliament, the Bank of England and the OECD headquarters. When central banks set interest rates it fundamentally distorts the pricing mechanisms of credit markets, just like price setting in other parts of the economy. Friedrich von Hayek won the Nobel Prize in 1974 for articulating that interest rates, like other prices, should be set by the market rather than central planning committees. We are not surprised when the government setting the price of food in Venezuela leads to food shortages so we should not be surprised that zero percent interest rates have led to a $250 trillion global debt bubble. Below is a speech I gave in the European Parliament in 2018 in which I adumbrated these points for a political audience:

With each wave of artificially low interest rates, generating ever more distortionary monetary effects, bond quality has fallen concomitantly, as shown by OECD research in 2019. We are now at the stage where low-quality debt, rather than being the exception, has metastasised through much of the economy.

While debt quality has fallen, we have seen a proliferation of so-called “zombie companies”. Research at the Bank for International Settlements showed a cyclical growth in zombie companies from 2% of companies in the late 1980s to 12% in 2016, corresponding empirically to the waves of artificially low interest rates. The BIS, in its well-written 2018 paper, noted that:

“Lower rates boost aggregate demand and raise employment and investment in the short run. But the higher prevalence of zombies they leave behind misallocate resources and weigh on productivity growth….Our study cannot answer this question. We leave the exploration of this trade-off to future research.”

The “boost” to the economy is the very same poison that makes it worse. Artificially low interest rates send false price signals to markets: debt goes up, savings go down and resources are directed from productive uses to more interest rate-sensitive, debt-fuelled sectors (including, of course, financial speculation).

A lot of attention has been paid to stock market bubbles and housing bubbles during this period, yet the bubble is in fact an aggregate asset bubble which has had a series of different instantiations. Young people cannot buy houses, P/E ratios are at similar levels to 1929, but almost all assets have been inflated by artificially cheap credit in a series of waves corresponding to the waves of lower interest rates.

The virus was not predictable, but what is happening to the economy is entirely predictable. Sooner or later something was going to burst the bubble. To appropriate Rumsfeld’s famous monologue, what is happening now is a “known unknown” rather than an “unknown unknown”. It could also have been a war or terrorist attack that brought about the bursting of the bubble; indeed, it would have burst at some point by itself, just as it began to burst in 2008.

Most of the policies pushed by the establishment over the preceding decade have made things worse. Zero percent interest rates, bailouts, preserving zombie companies, quantitative easing and encouraging debt-fuelled consumer spending as a path to economic growth.

At the Economic Freedom Summit in the European Parliament in 2018 I had a debate with the head of IMF Europe on policies following the economic crisis. The position of the establishment is clear: central banks saved the day. I made the case that most of the metrics were worse 10 years after the crisis than they were in 2008—debt levels, zombie companies, financial speculation and transfers of wealth from hard-working, productive people to spivs who know how to play the game created by an extractive system.

What Is To Be Done?

When we give seminars at central banks, the OECD and elsewhere we make the case that interest rates should be set by the market rather than central banks and that zero percent interest rates have made things worse since 2008. One of the responses was interesting: “what would you expect us to do, just let the whole thing collapse?” We are now entering Act V of the bubble — negative interest rates. Negative interest rate mortgages have already been given in Denmark. Once interest rates go negative—a complete aberration for the principles of market economics—the nature of debt will fundamentally change. But it will collapse. Covid-19 has seen to it that the bubble inflated by zero per cent interest rates will collapse shortly, but the level of accumulated malinvestment means that negative interest rates will not have the steroidal effect that is hoped for. It will deliver another few years of sub-par debt-fuelled economic activity—I hesitate to call it “growth”—before an even larger debt liquidation becomes necessary.

Just two generations ago governments in Britain, the US and elsewhere engaged in widespread price-fixing including fuel, wages and consumer goods. The abject failure of those policies was a painful lesson to learn, but the most important lesson of all will soon be delivered—interest rates, like other prices in a capitalist economy, should be set by the market rather than by central planning committees.

* * *

References

Banerjee, R and B. Hofmann (2018); The rise of zombie firms: causes and consequences; BIS Quarterly Review | September 2018

Böhm-Bawerk, Eugen v. (1884) (William A. Smart, trans.). Capital and Interest: A Critical History of Economical Theory. London: Macmillan and Co.

Çelik, S., G. Demirtaş and M. Isaksson (2019); “Corporate Bond Markets in a Time of Unconventional Monetary Policy”, OECD Capital Market Series, Paris

Hayek, F. (1932); Prices and production. George Routledge and Sons, London

via ZeroHedge News https://ift.tt/2C14dA0 Tyler Durden

JPMorgan Spots A Big Problem For Stocks

Tyler Durden

Wed, 07/01/2020 – 16:45

In the latest FOMC Minutes released earlier today, the Fed made it clear that contrary to near-consensus expectations that Powell would usher in some form of Yield Curve Control around the September meeting (if not sooner), such a move is unlikely to take place in the near future as Fed officials had “many questions” about the benefits of yield-curve control when they discussed its pros and cons at the latest Fed meeting, even as the Fed reiterated that it would keep rates at zero and continue to buy bonds “for many years.”

And while stocks barely reacted to the Fed’s surprising talk back of YCC, perhaps because algo subroutines weren’t sufficiently clear in what 23-year-old math PhDs expected from the Fed today, the fact that the Fed may be content with leaving things as is indefinitely, is a very worrisome development to none other than the most important bank in the world, JPMorgan.

As the bank’s quant Nick Panigirtzoglou writes in his latest Flows and Liquidity report, looking ahead at the second half, it is neither the second virus wave, nor the outcome of the president election that is keeping him at night, but rather a policy mistake that “worries us the most”, to wit:

One of the main topics of discussion with clients in recent weeks has been about the downside risks to the equity and risky market outlook into the second half of the year. Of the three main risks mentioned by clients, a second virus wave, a Democratic sweep in the US presidential election; and a policy mistake, it is the third one that worries us the most.

As Panigirtzoglou explains, “the risk of policy mistake is related to the idea that there is a need for additional stimulus going forward and if policy makers fail to deliver it, they would effectively slip behind the curve rather than staying ahead of the curve, risking a negative market response.”

In other words, having injected over $3 trillion in liquidity in the past three months, JPM argues that this is nowhere near enough, and incidentally, the House of Morgan is not alone: after all this is precisely the same argument that Goldman made in mid-May when the bank “spotted a huge problem for the Fed“, namely that the Fed will need to monetize much more debt – about $1.6 trillion more – than it currently envisions in order to avoid a disorderly surge in Treasury yields.

In not so many words, JPMorgan agrees, and implicitly argues that soon the Fed will have to find a way to appease the market once again or risk a major market hit in the coming months.

Which brings us to the next question: “How should we monitor this risk of policy mistake?”

In his answer, Panigirtzoglou writes that “the lesson from the past and in particular from the Fed’s policy mistake of 2018, is that rate markets are likely to be more sensitive and more prompt in signalling any risk of policy mistake. The slope of the yield curve is an important metric to watch in this respect to gauge whether the risk of a policy mistake is re-emerging.”

Here we take a slight detour to the first time the JPM quant made a similar warning, which was back in early April 2018 (as extensively discussed here), and around the time the Fed was overtightening and would continue to hike rates into December of that year, sparking the first bear market of the post-crisis era as markets turmoiled in response to the Fed, which had repeated the error of 1937 and nearly tightened right into a recession. While few warned this would happen at the time, Panigirtzoglou was one of them, highlighting that the curve between the 2-year and 3-year forward points of the 1-month OIS had inverted…

… with “such inversion generally perceived as a bad omen for risky markets.”

So if we fast forward to today, what is the yield curve signaling at the moment?

There’s some good and some bad news: while the 10y UST-Fed funds yield curve slope remains firmly into positive territory (Figure 1), this is not true with the slope at the front end of the US curve (Figure 2), which to the JPM quant “is a better signal of policy expectations” and is precisely the curve that JPM was focused on back in 2018 when the inversion accurately predicted the upcoming Fed policy error.

This, according to JPM, “is because the information content of the 10y UST-Fed funds yield curve slope might be blunted by investor flows and imbalances between bond supply and demand rather than expectations about policy”, which is a polite way of saying the yield curve is losing its signaling powers and is turning into pure noise as everyone scrambles to frontrun the Fed. Meanwhile, such frontrunning flows “should affect the front end of the curve by much less. For example, pension funds, insurance companies and banks, which together comprise the majority of foreign flows into USTs, tend to focus at either the long or the intermediate 2y-10y part of the UST curve.”

As a result, the right curve to keep an eye on is that of the very front end of the US curve as shown in Figure 2, and which as JPM lament “is unfortunately more negative than the message from Figure 1″, and here is the same punchline to what was observed back in 2018:

While the spread between the 1- and 2-year forward points of the US OIS curve in Figure 2 had improved rapidly and turned significantly positive after the dramatic policy response to the virus crisis last March, it has been slipping over the past couple of months and turned negative last week. It printed -3bp negative on Monday, June 29th.

For those who missed the prior two explanations (here and here) why this is significant and why this is important for risky markets, JPM had argued before – correctly – that the inversion at the front end of the yield curve had been one of the most important market indicators over the previous two years.

During 2018, JPM cautioned that the inversion at the front end of the US yield curve, since it first emerged in April 2018 between the 2- and 3- year forward points of the 1m OIS rate, had been an important market signal, suggesting markets were concerned over the risk of a policy mistake (Fed overtightening at the time) and thus downside risk for equity and risky markets.

JPM proved to be absolutely accurate as the events in Q4 2018 would demonstrate: indeed, this indicator had been worsening during 2018 not only by turning progressively more negative, but also by shifting forward to between the 1- and 2-year forward points since November 2018. And this negativity persisted during the course of 2019 up until last October, keeping the bank with a cautious stance until then, when none other than JPM conveniently sparked “NOT QE”, by inciting a crisis in the repo market and forcing the Fed to launch massive repo operations coupled with Bill monetizations, dramatically easing conditions.

The re-steepening seen after October 2019 was a positive development but it lasted only three months; that’s when a far more aggressive catalyst was needed. In January this year, the indicator of Figure 2 had turned significantly negative again, pointing to downside risk for risky markets at the time. Enter Coronavirus, the economic shutdown and the biggest liquidity injection of all time.

Questions about JPM’s – or the coronavirus’ – role in triggering massive QE episodes in the recent past aside, the lesson we learned from the past two years as well as from the previous cycles is that as long as the inversion at the front-end of the US yield curve persists, it may act to limit the upside to equity and risky markets and signals vulnerability to further negative shocks.

So, as Panigirtzoglouo warns, the re-emergence of that inversion last week is a warning sign. That said, the spread between the 1- and 2-year forward points of the US OIS curve in Figure 2 is not yet negative enough to be worried about a coming correction, but what it does is suggest that many market participants believe the combination of fiscal and monetary accommodation already in train is not yet sufficient given the size of the shock! If it was, the 1-to 2-year or 2- to 3-year forward spreads should be into positive territory.

You read that right: trillions and trillions in QE, corporate bond purchases, repos, FX swaps, debt backstops and so on, is no longer enough, which makes sense for a market that habituates to whatever the Fed’s latest liquidity injection is quickly… and then even quicker demand more.

Meanwhile, JPM notes that markets signaling that further policy accommodation may be required is not only confined to the US. As shown by Figure 3 the inversion at the front end is prevalent across most DM yield curves. In some cases, e.g. with the BoE and RBNZ, the central banks have already signaled an openness to consider negative rates, while in others, e.g. with the Fed, markets price in a possibility of negative rates even where they have been more dismissive of the prospect.

To JPM, this suggests that rate markets are signaling the need for further monetary and/or fiscal policy stimulus across DM economies. And, logically, if the Fed turns a deaf ear to this latest extortion attempt by market, and additional stimulus is not delivered, then the inversion at the front end could worsen, “eventually becoming a more problematic signal for equity and risky markets going forward.“

In short: unless the Fed wants another market meltdown on its hands, it better pre-emptively stimulate and do so to the tune of trillions.

That said, the Fed still has time: JPM’s best guess is that this downside risk signaled by the re-emergence of money market curve inversion would not manifest itself into a substantial correction, as policy makers are likely to eventually respond to signs of deterioration, unless of course they do nothing like in 2018, and perhaps in 2020, with YCC now apparently on the back burner. Still, JPM is confident that “further monetary support, particularly in the form of QE, would likely provide support for risky assets either directly, in the case of corporate bond purchases by central banks, or indirectly by liquidity injections that boost holdings of cash by non-bank investors.”

Bottom line: we live in a world where everything is disconnected from reality, from fundamentals and certainly from cash flows, and in order to keep suspending the disbelief the Fed has to inject a fresh trillion (or more) every quarter, if not every month. And with the Fed’s balance sheet now shrinking for 2 consecutive weeks, having resulted in a plateau of sorts in the S&P500…

… the only thing that can push stocks higher according to JPMorgan, is another dramatic liquidity injection.

And since we have no doubt that JPM’s observation is accurate, it means that Powell faces a two-fold problem: since the Fed chair has taken negative rates off the table (for the time being) and since the Fed today announced that Yield Curve Control isn’t coming any time soon, Powell has no choice but to boost unleash another firehose of debt monetizing liquidity in the financial system via even more QE. However, any such reversal to the Fed’s current posture of flat/shrinking QE (the Fed is now buying “only $80BN in TSYs per month, down sharply from the $1 trillion or so in March) will be met with howls of rage, especially among what’s left of the conservative political establishment. Which means that, just like in March when the Fed used the first pandemic-induced market crash to unleash unlimited QE, the Fed will soon have to go for round 2 and spark either a new market crash or await for another covid-linked market selloff, one which it then uses as a convenient pretext for the next massive liquidity injection.

Failing to do that, watch as the dollar takes off as markets sniff out that another major dollar squeeze is imminent as the front-end inverts. And since this will accelerate the liquidity crunch, one way or another, the coming $1.6 trillion in Treasury issuance – which has already been generously greenlighted by Congress – will serve as a trigger for the next market shock, one which the Fed will quickly reverse by expanding the already unlimited QE by trillions on very short notice.

The one question we have is whether this will be the market crash that the Fed uses to unveil it will also buy equity ETFs (and individual stocks) or if Powell will save this final bullet in its ammo for whatever comes next.

Yet while the Fed’s QE expansion is just a matter of time, whether catalyzed by another market crash or not, the bigger question is what happens after that?

“Can governments continue to borrow at such record levels? No,” George Boubouras, head of research at hedge fund K2 Asset Management asked in May. “Central-bank support is key in the massive bond buying we’ve seen for now. But if they blink then at some point, in the medium term, it will all likely unravel – with unforgiving consequences for some countries.”

Ironically, this also means that an end to the coronavirus crisis is the worst possible thing that could happen to a world that is now habituated to helicopter money and virtually unlimited handouts, which however need a state of perpetual crisis.

“Once there is an end to the crisis in sight, they will be less and less willing to provide support and it will fall more on the street to absorb paper,” said Mediolanum money manager Charles Diebel, who’s adding bond steepeners in anticipation of a coming inflationary supernova.

Translation: expect a major crisis in the coming months, one which gives the Fed a green light to do whatever it needs to avoid another market crash.

That, incidentally, would also be the beginning of the end for the current monetary regime, which is why anyone hoping that officials, policymakers and the establishment in general will allow the coronavirus crisis to simply fade away, is in for the shock of a lifetime.

via ZeroHedge News https://ift.tt/38jkFHY Tyler Durden

The New Normal: Extremes Of Neofeudalism, Incompetence, Authoritarianism, & Relocalization

Tyler Durden

Wed, 07/01/2020 – 16:25

Authored by Charles Hugh Smith via OfTwoMinds blog,

The pendulum swung to an extreme of globalization, financialization, centralization and monopoly, all of which created extreme systemic fragility.

Here’s what to expect in the rapidly evolving New Normal: extremes become even more extreme as the status quo attempts to force compliance with its last-ditch schemes to preserve what was always unsustainable while painting a happy face on the stock market, the one thing they can push higher as the global economy unravels.

Mark, Jesse and I discuss this dynamic in Salon #10: Remember when Maximum Pessimism and Irrational Exuberance were mutually exclusive? (54 minutes): realistic pessimism is lashed to the mast with the irrational exuberance of stock market soothsayers, central bank cheerleaders and the organs of propaganda (Wall Street) and control of the narratives (social media and search monopolies).

Cognitive dissonance? Yes. Schizophrenia? Sure. Crazy-making? Undoubtedly. So the default “solution” is petty Authoritarianism to ensure we only see approved narratives, that we focus on the happy-happy signal of the glorious stock market (best rally ever!), that we pay higher taxes without complaint, and so on.

And of course, buy, buy, buy and borrow, borrow, borrow, lest the flimsy house of cards collapse.

As I explain in my book Why Our Status Quo Failed and Is Beyond Reform, the only possible output of central bank monetary stimulus is financialization, and the only possible output of financialization is unprecedented wealth and income inequality.

As Max Keiser, Stacy Herbert and I discuss in Fractals of Incompetence (15:30), the problem with pushing extremes is the system is incompetent at every level, from school boards to the Federal Reserve. Rather than solve problems, our institutions have devolved into mechanisms to protect clerisy / insiders from transparency and accountability.

In the New Normal, systemic incompetence isn’t going to magically transform into competence, it’s going to reach new extremes of incompetence and self-serving hubris.

My term for servitude via debt and taxes is neofeudalism, and neofeudalism is the default setting of the New Normal as the super-wealthy can buy even more of the nation’s assets thanks to the Federal Reserve’s free money for financiers, leaving the peasantry the owners of debt rather than assets.

The only way to escape neofeudal servitude is to figure out some way to live on a fraction of what the conventional lifestyle requires, i.e. radical frugality. Radical frugality will also be a permanent part of the New Normal, either voluntary or imposed by circumstances.

The silver lining in all this is the potential to relocalize essential elements of our economy, a subject Richard and I discuss in The New Normal (37 minutes). The pendulum swung to an extreme of globalization, financialization, centralization and monopoly, all of which created extreme systemic fragility.

In the New Normal, the pendulum will finally start moving away from globalization, financialization, centralization and monopoly to decentralized, relocalized economic activity, which is the core dynamic in doing more with less and regaining agency.

The New Normal has yet to fully impact the global financial system, which is still in the eye of the hurricane, magnificently confident that the Federal Reserve’s money-printing is the most powerful force in the Universe. The stock market’s hubris is begging the gods for retribution, and we may not have to wait too long for the karmic hammer to crush the hubris and the irrational exuberance, as Adam, Mike, John and I discuss in Three major risks the markets are not pricing in yet (39 minutes).

The winds are picking up, and the flimsy shacks of the Fed and Wall Street are no match for the real world.

* * *

My recent books:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via ZeroHedge News https://ift.tt/31wMnQp Tyler Durden

Vaccine Hype Redux Sparks Another Big-Tech Buying-Panic, Gold Dumped

Tyler Durden

Wed, 07/01/2020 – 16:00

Ok, so this is what happened today…

0742ET PFIZER CSO SAYS COVID VACCINE IS `VERY PROMISING’

0815ET ADP Job growth slows (massive revisions)

1000ET ISM jumps into expansion (biggest jump ever)

1110ET ARIZONA REPORTS RECORD ONE-DAY INCREASE IN VIRUS CASES

1240ET U.S. READIES GLOBAL SANCTIONS ON CHINA OVER XINJIANG ABUSES

1310ET HOUSTON-AREA ICUS REACH 102% OF CAPACITY: TEXAS MEDICAL CENTER

1400ET FOMC MINUTES – No YCC, More QE (But it may not work), Stocks only up on hope

1420ET GOV NEWSOM ORDERS LA COUNTY RESTAURANTS CLOSED FOR 3 WKS: EATER

1425ET APPLE RE-CLOSING 30 MORE STORES THURSDAY: CNBC

1510ET CALIFORNIA CLOSES INDOOR DINING IN 19 COUNTIES, INCLUDING L.A.

And the result of all that… Nasdaq soared to new record highs, Small Caps were dumped and the Dow unch…until the last 10 minutes…

As every RH’er desperately searches for the next dip to buy…

FANG stocks soared on this first day of Q3…

Source: Bloomberg

TSLA topped $200bn and became the world’s largest carmaker by market cap…

Source: Bloomberg

Bank stocks underperformed despite a modest steepening of the yield curve…

Source: Bloomberg

Notable reversal in value/momentum today…

Source: Bloomberg

Despite stocks gains, credit ain’t buying it…

Source: Bloomberg

Treasury yields were marginally higher on the day (up around 2bps across the curve) but on the week 2Y remins flat while the long-end is up 6bps…

Source: Bloomberg

The 10Y topped 70bps briefly but did not hold it…

Source: Bloomberg

The USDollar was lower today, extending yesterday’s losses…

Source: Bloomberg

Bitcoin and Ethereum pushed higher on the day, back in the green on the week…

Source: Bloomberg

Gold was slammed lower on the vaccine news, running stops back below $1800…

WTI ended higher on the day, after last night’s API inventory draw but chopped around after the DOE inventory data (but ended back below $40)…

Finally, as we start H2 of 2020, the question is – will this divergence recouple? And if so, will it be stocks or bonds that are sold?

Source: Bloomberg

via ZeroHedge News https://ift.tt/3dQgSmP Tyler Durden