By the mid-1990s, the economy of Zimbabwe was in serious trouble.

The national government under its dictator Robert Mugabe had spent years confiscating private property– real estate, businesses, factories, bank deposits, etc.

And unsurprisingly, this had a disastrous effect on the economy.

Productive citizens and talented entrepreneurs left Zimbabwe in droves– after all, who would want to keep operating under such awful conditions?

So within a few years, everything from food production to mining output to manufacturing had plummeted.

The banking sector collapsed. Unemployment soared. Tax revenue dried up.

So Mugabe did what most politicians would do in that position: he started printing money.

This is an old trick that governments have relied on for thousands of years.

The ‘denarius’ coin of ancient Rome, for example, contained 93.5% silver in the early 100s AD under Emperor Trajan. By the time Aurelian became emperor the following century, the coin contained only 5% silver.

And as the denarius became less and less valuable, prices across the empire soared. Merchants had to keep increasing their prices in order to receive the same amount of silver that they used to… so inflation was rampant.

This is precisely what happened in Zimbabwe.

The government conjured absurd quantities of money out of thin air in order to make ends meet… but the new money had no value.

It’s not like the central bank was able to create new mining production or agricultural output. They just created a bunch of paper.

And with trillions upon trillions of new Zimbabwe dollars flooding into an economy that was suffering an extreme depression, prices started to skyrocket.

By 2000, Zimbabwe’s annual inflation rate was a whopping 55%.

The following year more than 110%. By 2003 inflation was nearly 600%… and nearly 1300% by 2006.

But the government continued printing money.

By 2008 the inflation rate in Zimbabwe was so extreme that no one could even calculate it anymore. Economists estimated that it was as high as 800 TRILLION percent.

In April 2009, the government finally threw in the towel… and the country’s economic planning minister announced that the Zimbabwe dollar would be taken out of circulation “because there is nothing to support and hold its value.”

Duh.

Frankly, this is the case whenever any country simply conjures new money out of thin air: there’s nothing to support or hold its value.

So for the next ten years, Zimbabwe did not have its own currency; people used dollars, euros, renminbi, South African rand… any other currency they could get their hands on.

I’ve been several times to Zimbabwe– and the only Zim dollars I ever saw were in souvenir shops or wallpaper in people’s bathrooms.

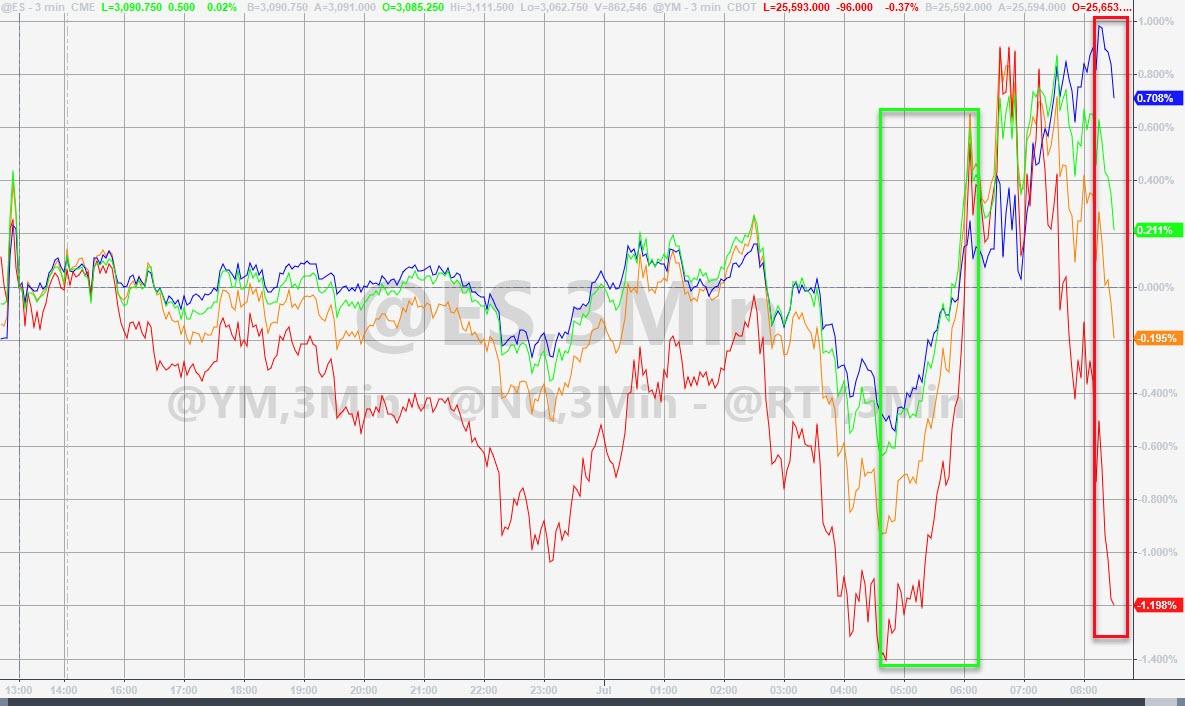

Then last year the government of Zimbabwe decided to give it another try… and they launched a new Zimbabwe dollar (technically called the RTGS dollar).

Go figure, they’re once again in hyperinflation, with the most recent statistics estimating an annual inflation rate of 785%, and climbing.

This time, in addition to printing more money, the government has imposed strict capital controls. They suspended the stock exchange and have prohibited investors from pulling their money out.

They also shut down large parts of the local financial system a few days ago (which is dominated by mobile payment platforms) in order to prevent capital flight.

What’s truly remarkable, though, is that nearly every country around the world is following Zimbabwe’s example.

Central banks everywhere, across Asia, Latin America, Europe, and North America, have conjured trillions upon trillions of currency units out of thin air since the pandemic started.

In the United States alone, the Federal Reserve has expanded its balance sheet by $3 trillion since March… and they’re barely getting started.

Meanwhile the federal government’s debt has increased by the same amount– roughly $3 trillion since March– in its quest to bail out every last person across America.

$3 trillion. Just think about that.

I remember in the late 1990s when $1 billion was still considered a lot of money. If the government was found having wasted a few billion dollars, it was a really big deal.

Then over the next decade came 9/11, endless wars, and the Global Financial Crisis. Suddenly banks were being bailed out to the tune of $800 billion.

That was a shocking figure at first. But eventually people got used to it.

Today these politicians and central bankers are throwing around TRILLIONS of dollars, like it’s nothing.

The US runs trillion dollar deficits each year. The federal debt increased by half a trillion dollars in the last month alone, soaring past $26 trillion, and it doesn’t even make headlines anymore.

In the span of 20 years, $1 billion went from being a lot of money, to a rounding error… and now $1 trillion doesn’t even make the news.

Honestly this pandemic is a politician’s dream come true– they have a free pass to create limitless quantities of money to pay for whatever pet project they want.

Universal basic income? Print money. Free healthcare? Print money. New roads? Print money.

Economists call this “Modern Monetary Theory”, and the idea is that prosperity is created by printing money, not by hard work and value creation.

It’s extraordinary that very intelligent people believe in this nonsense.

But if MMT were true, then Zimbabwe should be the most prosperous nation on earth.

Yet this is literally the second time in the past 20 years that Zimbabwe has gone down this road of printing money, and then hyperinflation.

You’d think Zimbabwe would have learned its lesson. Or at a minimum, you’d think the rest of the world would look at the experiences in Zimbabwe and think, “Let’s never do that… ever.”

But that’s clearly not the case.

Policymakers around the world, including in the US and Europe, are racing to become Zimbabwe as quickly as they can.

But they’re crazy enough to expect a different outcome.

from Sovereign Man https://ift.tt/2YQ53sD

via IFTTT