One year ago, when looking at the 20 most popular stories of 2019, we pointed to a certain undertone of artificial stability permeating capital markets and society, with the economy firing on all cylinders (thanks to the massive dual deficits and debt that had exploded under the current administration), with the market surging 30% last year and at all time highs (despite flat earnings and entirely thanks to the Fed’s resumption of “NOT QE” last September in order to bail out JPMorgan and a handful of hedge funds’ treasury basis trades), and with Trump cruising to re-election victory in what we thought one year ago would be the most important even of 2020: the US presidential election. It’s also why we said that “with the Fed fully behind Trump and helping the S&P return nearly 30% in 2019, 4 more years of Trump is now virtually assured (barring some unexpected calamity in 2020).”

Oh how prudent that disclaimer proved to be, as well as this next caveat we casually mentioned in our last year review, warning that “with the 2020 elections looming, it is certainly true that anything can still happen, only as with all true “black swans”, it won’t be what anyone had expected.”

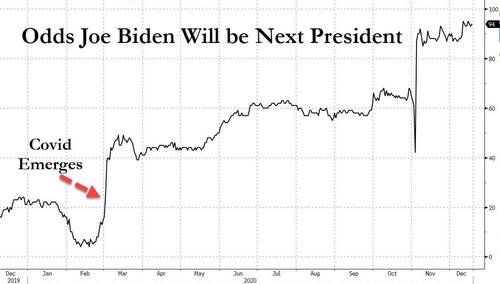

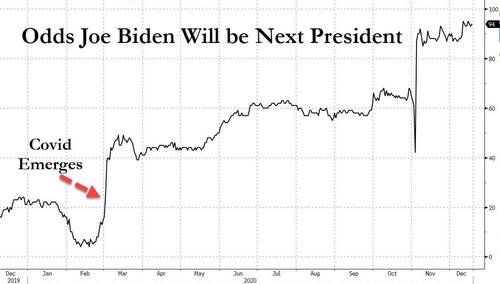

It certainly wasn’t because around the time we were penning our year-end wrap post exactly one year ago, a highly contagious coronavirus strain had escaped the Wuhan Institute of Virology (China’s first and only biosafety 4 lab) whether purposefully or intentionally, and was set to spread around the globe, unleashing the biggest global black swan in the past 100 years, triggering personal and economic hell for hundreds of millions around the world who lost their jobs or loved ones as a result of the China virus, markets nirvana for millions of 16-year-old Robinhood and hedge funds traders who benefited from the greatest stock market rally in history, and ultimately helped Joe Biden emerge from complete obscurity and with virtually no chances of defeating Trump, to eventually winning the Nov 3 presidential election, Trump’s ongoing challenges to the outcome notwithstanding.

The arrival of the virus that would eventually be called Covid-19 by the global scientific community (to remove any links to China) – and which would lead to a historic pandemic the likes of which nobody expected one year ago – shook the world, and would lead to a slew of historic events taking place in just a few months, including a staggering lockdown of the global economy, the official arrival of global Helicopter Money, tens of trillions in fiscal and monetary stimulus, an overhaul of the global economy punctuated by an unprecedented explosion in world debt, an Orwellian crackdown on civil liberties by governments everywhere, and ultimately set the scene for what even the World Economic Forum called simply “The Great Reset.”

Needless to say, it would be impossible to describe everything that happened in 2020, or all the black swans that the pandemic and its associated lockdowns let loose upon the world, in one article: those looking for a detailed breakdown of all the major events this year are urged to read the latest magnum opus “Year in Review” by David Collum (part 1 here and part 2 here), but a quick recap of some of the most prominent and bizarre events that shook the world in the past 365 days, what Mark Orsley called “the year of years“, is as follows:

- WW3 fears run rampant on social media as the US strikes Iranian army general Soleimani

- Black swan health event that leads to a historic equity market crash, and funding strains

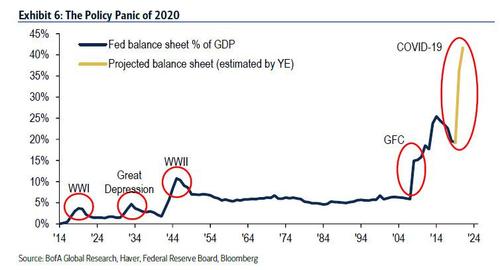

- Fed takes US policy rates to near 0% and institutes QE at a magnitude that puts the post GFC period to shame

- Treasury institutes trillions of dollars of fiscal stimulus

- Unprecedented lockdowns lead to Tiger King craze

- The world learns how to school and work remotely, changing the office space landscape forever

- WTI front month contract trades with a negative price

- Subsequent epic equity bull market recovery rally that pierces March highs

- Australia burns

- Kobe Bryant tragically dies

- We begin to watch sports with no fans

- Pentagon releases UFO footage

- Quantas offers flight to nowhere

- California wildfires burn uncontrollably and wipe out parts of Napa

- US social unrest turns violent

- Murder hornets

- Ruth Bader Ginsberg dies

- Overhyped US election event that leads to a volatility collapse, year-end rally

- A middle-aged skateboarder, drinking Cranberry juice to a 70s rock hit brings calm to the world

That list could have gone on forever. The point is, there could not have been more regime shifts, volatility moments, and memes than 2020 (we hope).

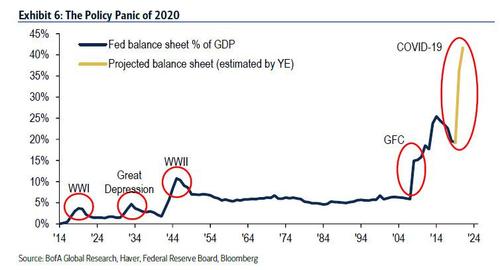

Yet for all the chaos and panic unleashed by covid, a certain undertone of pre-determination and almost tangible order was felt just below the surface: after all, the virus, crash, lockdown and recession provoked an unprecedented monetary and fiscal policy panic which sparked a record $22 trillion of stimulus in just the past 9 months around the world. As a result, central banks spent over $1 trillion a month on financial assets via QE, crushing yields, volatility, and spreads, and pushing stocks to all time highs at the end of 2020 even as earnings continue to slide.

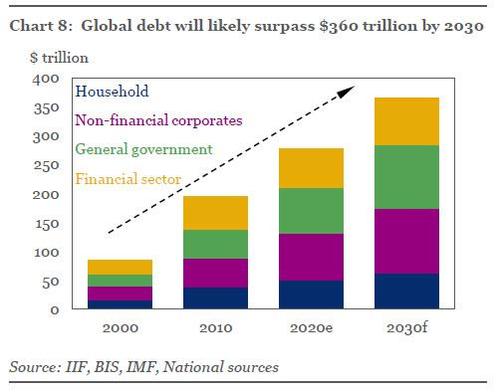

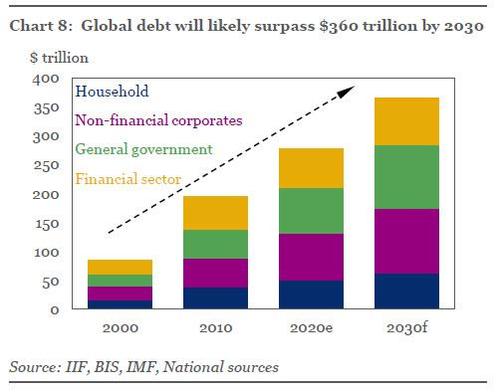

It’s almost as if the world’s richest asset owners requested the covid pandemic. It wasn’t just them however: politicians the world over would benefit from the transition from QE to outright helicopter money and MMT which made the over monetization of deficits widely accepted in the blink of an eye. And in the span of just a few months, $14 trillion in fiscal stimulus was announced, with central banks monetizing most of it, and pushing the quantity of global debt to a record $277 trillion, a number which the Institute For International Finance expects to hit a record $360 trillion by 2030…

… while thanks to central bank intervention, the price of world debt dropped to a record 5,000 year low, with global negative yielding debt now at an all time high $18tn.

The common theme here was simple: no matter what happens, capital markets can never again be allowed to drop, regardless of the cost or how much more debt has to be incurred. Indeed, as we look back at the news barrage over the past year, and past decade for that matter, the one thing that becomes especially clear amid the constant din of markets, of politics, of social upheaval and geopolitical strife – and now pandemics – in fact a world that is so flooded with constant conflicting newsflow and changing storylines that some say it has become virtually impossible to even try to predict the future, is that despite the people’s desire for change, for something original and untried, the world’s established forces will not allow it and will fight to preserve the broken status quo at any price – even global coordinated shutdowns – which is perhaps why it always boils down to one thing – capital markets, that bedrock of Western capitalism and the “modern way of life”, where control, even if it means central planning the likes of which have not been seen since the days of the USSR, and an upward trajectory must be preserved at all costs, as the alternative is a global, socio-economic collapse.

And since it is the daily gyrations of stocks that sway popular moods – and why none other than the US president was tweeting almost daily ahead of the November election at what level the S&P closed on any given day to boost his approval rating and bolster his credibility – the interplay between capital markets and politics has never been more profound or more consequential. Indeed, in a historic moment when the president was impeached by the House (if not the Senate), Trump’s natural response was to point to the record high hit that very day in the S&P500.

The more powerful message here is the implicit realization and admission by politicians, not just Trump but also his peers and challengers, that the stock market is now seen as the consummate barometer of one’s political achievements and approval. Which is also why capital markets are now, more than ever, a political tool whose purpose is no longer to distribute capital efficiently and discount the future, but to manipulate voter sentiments far more efficiently than any Russian election interference attempt ever could.

Which brings us back to 2020 and the past decade, which was best summarized by a recent Bill Blain article who said that “the last 10-years has been a story of massive central banking distortion to address the 2008 crisis. Now central banks face the consequences and are trapped. The distortion can’t go uncorrected indefinitely.“

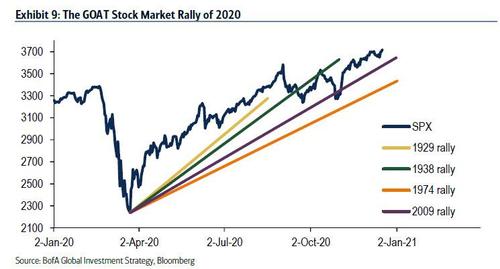

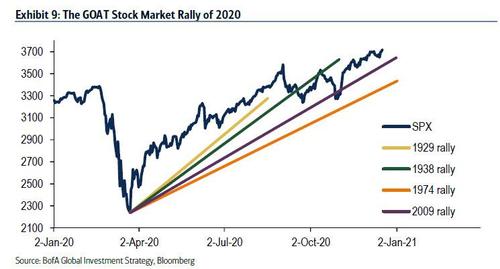

He is right: the distortion will eventually collapse, but so far the establishment and the “top 1%” have been successful – perhaps the correct word is lucky – in preserving the value of risk assets: on the back of the Fed’s firehose of liquidity the S&P500 returned an impressive 15.5% following the 28.50% return in 2019. It did so by staging the greatest rally off all time from the March lows, surpassing all of the 4 greatest rallies off the lows of the past century (1929,1938, 1974, and 2009).

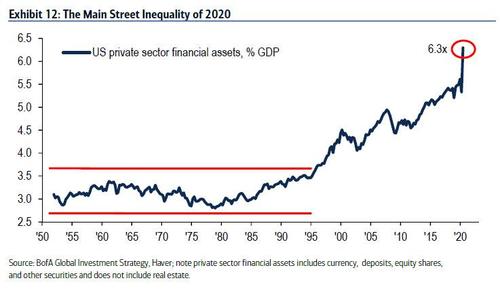

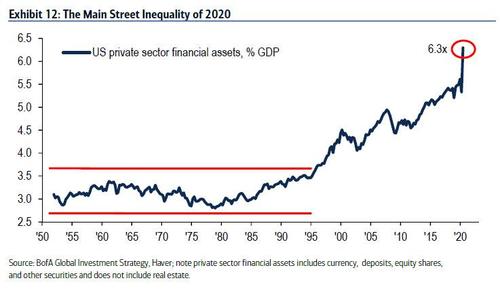

Yet this continued can-kicking by the establishment – all of which was made possible by the covid pandemic and lockdowns which served as an all too convenient scapegoat for the unprecedented response that served to propel risk assets (and fiat alternatives such as gold and bitcoin) to all time highs – has come with a price… and an increasingly higher price in fact. As even Bank of America CIO Michael Hartnett admits, Fed’s response to the the pandemic “worsened inequality in 2020” as the value of financial assets – Wall Street – relative to economy – Main Street – hit all-time high of 6.3x.

And as we said previously, with the system now caught in a vice operated by a handful of people, there is no longer any chance that the status quo will change without a revolution, a revolution which is increasingly unlikely in a world where “generous” governments hand out $600 “stimulus checks” to a population that has no other means of providing for itself besides relying on the same government that is pillaging and plundering the middle class.

In other words, going back to what we said above, 2020 helped further crystalize the realization that politics is now markets, and markets have become political weapons, and why the past decade was, as Bill Blain put it, “a story of massive central banking distortion to address the 2008 crisis.” The problem is that this distortion has only made the mess even greater, and the only hope central banks have – in their own words – is if government fiscal stimulus takes over where monetary stimulus ends, and this is where covid came in: almost overnight it ushered in MMT – the fusion of fiscal and monetary policy, the fusion of the Fed and the Treasury. In other words, 12 years after we predicted it would come, helicopter money finally arrived.

Only there is just one problem, or rather 277 trillion problems as shown above, because whereas one could argue that fiscal stimulus is a credible option if the world’s wasn’t drowning in debt, when global debt to GDP is 330%, it is tantamount to saying that only more debt can fix a debt crisis. Which is effectively what the world’s smartest people are saying.

Meanwhile, the trends observed in recent years will continue: coming years will be marked by even bigger government (because only more government can “fix” problems created by government), higher stock prices and dollar debasement (because only more Fed intervention can “fix” the problems created by the Fed), and a policy flip from monetary and QE to fiscal & MMT, all of which will attempt to spark an unprecedented inflationary wave. As Hartnett writes, “if 2020 was year of COVID-19 pandemic; it will, according to Hartnett, “also be remembered as the secular low point for both inflation & interest rates.”

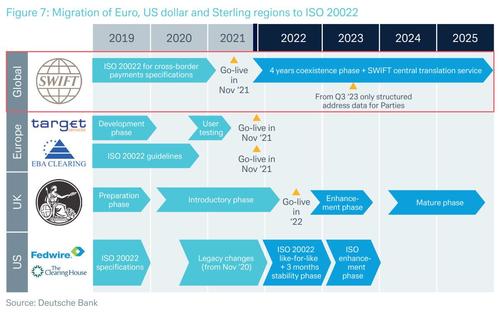

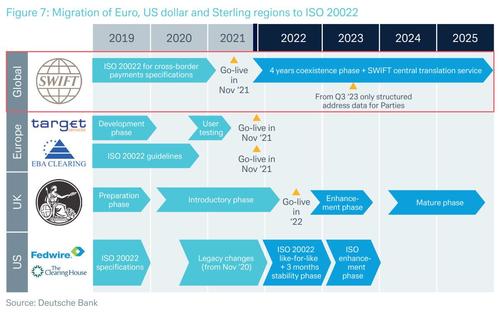

He is, of course, right because once all other conventional methods to spark reflation fail, central banks will activate Plan B which is also the core pillar of the coming Great Reset: the roll out of digital currencies which can be deposited by central banks directly into digital wallets, bypassing the entire commercial banking fractional banking infrastructure, in a last ditch effort to spark the inflation that will be needed to inflate away the $300+ trillion in debt suffocating world growth. For those wondering when this will happen, tentative schedules show this historic transfer to an all digital payments infrastructure taking place as early as the second half of 2021…

… so it is very likely that while 2020 was an insane year, it may prove to be just an appetizer to the shockwaves that will be unleashed in 2021 when we see the first stage of the most historic overhaul of the fiat payment system in history.

Here we should note one thing: in a world undergoing historic transformations, any free press must be throttled and controlled, and over the past year we have seen unprecedented efforts by legacy media and its corporate owners, as well as the new “social media” overlords do everything in their power to stifle independent thought. For us it was especially “personal” on not one but two occasions. In January, Twitter suspended our account because we dared to challenge the conventional narrative about the source of the Wuhan virus. It was only six months later that Twitter apologized, and set us free, admitting it had made a mistake.

Yet barely had twitter readmitted us, when something even more unprecedented happened: for the first time ever (to our knowledge) Google – the world’s largest online ad provider and monopoly – demonetized our website not because of any complaints about our writing but because of the contents of our comment section. It then held us hostage until we agreed to implement some prerequisite screening and moderation of the comments section. This was a stark lesson in how quickly an ad-funded business can disintegrate in this world which resembles the dystopia of 1984 more and more each day, and we have since taken measures. In December for the first time in our 12 year history, we launched a paid version of our website, which is entirely ad and moderation free, and offers readers a variety of premium content. It wasn’t our intention to make this transformation but unfortunately we know which way the wind is blowing and it is only a matter of time before the gatekeepers of online ad spending block us again. As such, if we are to have any hope in continuing it will come directly from you, our readers. We will keep the free website running for as long as possible, but we are certain that it is only a matter of time before the hammer falls as the censorship bandwagon rolls out much more aggressively in the coming year.

That said, whether the story of 2021, and the next decade for that matter, is one of helicopter or digital money, of (hyper)inflation or deflation: what is key, and what we learned in the past decade, is that the status quo will throw anything at the problem to kick the can, it will certainly not let any crisis go to waste… even the deadliest pandemic in over a century. And while many already knew that, the events of 2020 made it clear to a fault that not even a modest market correction can be tolerated going forward. That in turn may explain why the last quarters of 2020 were a mirror image of events from the first quarter when stocks tanked. After all, if central banks aim to punish all selling, then the logical outcome is to buy everything, and investors, traders and speculators did just that armed with the clearest backstop guarantee from the Fed, which in March crossed the Rubicon when it formally nationalized the bond market as it started buying both investment grade bonds and junk bond ETFs in the open market. As such it is no longer even a debatable issue if the Fed will buy stocks after the next crash – the only question is when.

Meanwhile, for all those lamenting the relentless coverage of politics in a financial blog, why finance appears to have taken a secondary role, and why the political “narrative” has taken a dominant role for financial analysts, the past year showed vividly why that is the case.

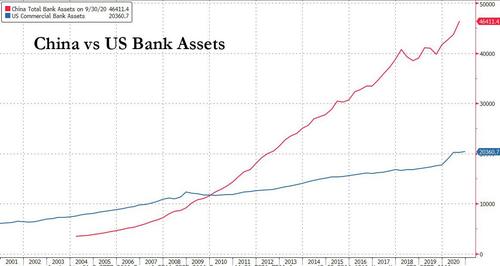

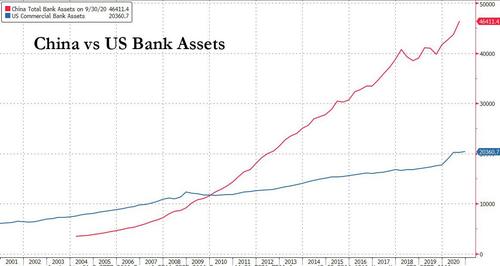

As for predictions about the future, as 2020 so vividly showed when it comes to true surprises and all true “black swans”, it won’t be what anyone had expected. And so while many themes, both in the political and financial realm, did get some accelerated closure courtesy of China’s covid pandemic, dramatic changes in 2020 persisted, and will continue to manifest themselves in often violent and unexpected ways – from the ongoing record polarization in the US political arena, to “populist” upheavals around the developed world, to the gradual transition to a global Universal Basic (i.e., socialized) Income regime, to China’s ongoing fight with preserving stability in its gargantuan financial system which is now more than double the size of the US.

As always, we thank all of our readers for making this website – which has never seen one dollar of outside funding (and despite amusing recurring allegations, has certainly never seen a ruble from the KGB either, although now that the entire Russian hysteria episode is over, those allegations have finally quieted down), and has never spent one dollar on marketing – a small (or not so small) part of your daily routine.

Which also brings us to another critical topic: that of fake news, and something we – and others who do not comply with the established narrative – have been accused of. While we find the narrative of fake news laughable, after all every single article in this website is backed by facts and links to outside sources, we find it a dangerous development, and a very slippery slope that the entire developed world – is pushing for what is, when stripped of fancy jargon, internet censorship under the guise of protecting the average person from “dangerous, fake information.” It’s also why we are preparing for the next onslaught against independent thought and why we had no choice but to roll out a premium version of this website.

In addition to the other themes noted above, we expect the crackdown on free speech to accelerate in the coming year, especially as the following list of Top 20 articles for 2020 reveals, many of the most popular articles in the past year were precisely those which the conventional media would not touch out of fear of repercussions, which in turn allowed the alternative media to continue to flourish in an orchestrated information vacuum and take significant market share from the established outlets by covering topics which the public relations arm of established media outlets refused to do, in the process earning itself the derogatory “fake news” condemnation.

We are grateful that our readers – who hit a new record high in 2020 – have realized it is incumbent upon them to decide what is, and isn’t “fake news.”

* * *

And so, before we get into the details of what has now become an annual tradition for the last day of the year, those who wish to jog down memory lane, can refresh our most popular articles for every year during our no longer that brief, almost 11-year existence, starting with 2009 and continuing with 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018 and 2019.

So without further ado, here are the articles that you, our readers, found to be the most engaging, interesting and popular based on the number of hits, during the past year.

- In 20th spot with 690,000 readers, was an article that touched on one of the most sensitive topics of 2020 – the origins of the Covid virus. As readers are all too aware, the great debate here has been whether the virus emerged due to something as innocuous as a Chinese citizen eating a bat soup, a narrative espoused by the China-controlled media, or if it escaped from a Wuhan biolab. And as AP journalists are now discovering, all signs increasingly point to the latter, something which Luc Montagnier the man who discovered the HIV virus back in 1983 first said back in April, shocking the world with his claim that the virus was man made as we explained in “COVID-19 Is A Man-Made Virus: HIV-Discoverer Says “Could Only Have Been Created In A Lab“.” Eventually he will be proven correct, confirming once again that the biggest “fake news” is whatever the mainsteam media pushes as the narrative du jour.

- In 19th spot of the year’s most popular articles, we received another reminder that not all is as it seems when it comes to stoking tensions within US society, as 718,000 readers clicked on a story pointing out that “More Bricks Appear In Advance Of Monday Demonstrations In Baltimore, Texas.” While a wave of protests and violent riots swept across the nation, ostensibly as a grassroot movement condemning police violence against blacks, it had dramatic consequences across the country, leading to the defunding of countless police forces across mostly liberal cities and yet many wondered about who the puppetmaster behind this wave of violence was, because as even Jeff Gundlach mused recently, “It’s Interesting How The Violent Riots Of 2020 Ended Right After The Election.” Hopefully, one day someone will get to the bottom of who and how organized the protest deadly movement of the summer of 2020.

- In 18th spot, addressing what may be the most critical topic of the next four years, nearly 720,000 readers were presented with a “Blockbuster Report” which in impressive detail “Revealed How THE Biden Family Was Compromised By China.” As a reminder, when news reports of Hunter Biden’s relationship with China first emerged, the social networks were quick to censor any mention of the original report. However, just a few weeks later (and certainly after the election) we learned that Hunter was indeed being probed by tax evasion stemming from his shady Chinese deals which sought just one thing: to buy favor with the family of Joe Biden. Of course, it won’t be the first time foreign powers have sought such undue influence on US politicians – after all that’s what the whole point behind the existence of the Clinton foundation, which did nothing for starving African children or Haiti earthquake survivors, but sure made Bill and Hillary filthy rich.

- Pivoting from China’s attempts to influence the White House, we once again find ourselves in the middle of the social unrest which defined much of the summer of 2020. Only this time there was a twist: 726,000 readers were fascinated how an “Antifa Attempt To Riot In California Suburb Goes Awry” when a group of Antifa ‘protesters’ were met with instant justice at the hands of angry residents in the suburban town of Yucaipa, California. Unfortunately, we expect this violent left-right split across the heart of America to only get worse in 2021 as none of the fundamental reasons for the growing anger and resentment across US society has been addressed yet, and if anything, it has become the media’s duty to stoke even more anger and hatred.

- Confirming the scientists at best can only make(un)educated guesses about the future (especially if they have paid conflicts of interest) was an analysis from the early spring when the covid pandemic was first sweeping across the country, and which “found” that “All Hospital Beds In The US Will Be Filled With Patients ‘By About May 8th’ Due To Coronavirus.” This article, which was based on official research and was the 16th most read of 2020, with some 764,000 views, merely showcased something that never happened, and in fact the virus rapidly faded away as soon as various containment measures were rolled out. But not before it demonstrated how the media successfully instills a sense of panic amid the population, which continues to this day even as the most apocalyptic predictions postulated by “scientists” never actually came true.

- By now a clear pattern is emerging: 2020 was without doubt the year of Covid, and it also served as the foundation of the 15th most popular article of 2020, which discussed a “Chilling Documentary Mapping Out Likely Origin Of COVID-19.” Some 767,000 readers got their first glimpse of covid not as a virus that emerged by accident in nature but one that was created in a Chinese lab; more troubling was the hint that China released the virus on purpose in hopes of overturning the socio-economic status quo. While the jury of “scientists” is still out on the real origins of covid (even if the broader public knows all too well where it came from), one thing is certain: the unprecedented transformations sparked by covid left China as one of the biggest geopolitical winners. If nothing else, this should at least prompt some more questions about who stood to benefit from the release of the virus.

- Covid continued to dominate the most popular list, and the 14th most read article of 2020 with 820,000 views was the report that triggered the worst economic collapse since the Great Depression when on March 12, Trump finally bent under pressure and announced a ban on all travel from Europe, in the process triggering both widespread and targeted shutdowns that have lasted to this day, resulting in millions of job losses and countless small and medium business failing in response to the shotgun approach to deal with the pandemic which while crippling most of the population, made a handful of ultra rich investors and mega corporations extremely rich.

- The 13th most popular article of 2020 touched on the year’s other biggest event, the US presidential election, and whose outcome Trump contests to this day as a result of countless allegedly fraudulent votes being cast on Nov 3. Some 830,000 readers were interested to learn how and why Trump’s then lawyer Sidney Powell intended to “Overturn Election Results In Multiple States.” So far, that has not happened, and in fact it is unlikely that it will after the Supreme Court refused to hear to Trump’s challenge last month. That said, with 3 weeks to go until the inauguration, Trump still refuses to concede although it remains unclear on what grounds he hopes to launch any upcoming legal challenges, even as Joe Biden has already hired his movers in preparation for his transition to the White House.

- For the 12th most popular article of the past year, we once again shift back to Covid and specifically China’s massive obfuscation campaign, according to which the country which sparked the global covid pandemic has had less than 100,000 cases, even as the rest of world has arounf 500,000 new cases daily. Beijing’s facade of lies almost cracked in February when as asked whether “China’s Tencent Accidentally Leaked The True Terrifying Coronavirus Statistics.” It did, but since the truth in China has a halflife that is shorter than a virus in the wild, everyone quickly moved on and to this day the world continues to drink some bizarre Kool Aid according to which China has just a handful of new cases daily.

- The 11th most popular article of the year was something different: it had to do with what may well have been the most underreported story of 2020 (and 2019) – the crimes of Jeffrey Epstein and his powerful, rich pedophile friends. Of course, most of Epstein’s secrets died with him when he “committed suicide” in the summer of 2019, although some hope for justice remains and it is tied to the ongoing incarceration of Epstein’s madame and girlfriend, Ghislaine Maxwell, who knew everything and everyone in Jeffrey’s circle. It’s also why 835,000 read the article laying out “The Top Highlights From Ghislaine Maxwell’s Unsealed Court Records.” Unfortunately, so far Ghislain has refused to shine a light into the true scandal surrounding Epstein and his “friends”, and we are confident that if that were to ever change then the daughter of Robert Maxwell – who died in mysterious circumstances back in 1991 – will face a similar fate.

- With 864,000 page views, the 10th most popular story of 2020 was neither Covid, nor Trump, nor Epstein-related, but instead exposed China’s giant gold counterfeiting underworld as we explained in “83 Tons Of Fake Gold Bars: Gold Market Rocked By Massive China Counterfeiting Scandal.” Over the years there has been much speculation about just how much of the $11 trillion notional in above-ground gold is legitimate, and how much gold-plated tungsten, and the shocking news that emerged out of China in June underscored that one should always check the authenticity of one’s gold holdings, especially if there is any link to China, the country that has taken counterfeiting to an art.

- Having entered the top 10 most popular stories of 2020, we find that covid makes another appearance in 9th spot with 915,000 reads, this time with the claim made by a top pathologist, Dr. Roger Hodkinson, who made the shocking allegation that the coronavirus Is “The Greatest Hoax Ever Perpetrated On An Unsuspecting Public” and claimed that “There is utterly unfounded public hysteria driven by the media and politicians, it’s outrageous, this is the greatest hoax ever perpetrated on an unsuspecting public.” One can easily see why any reference to the story or the doctor was promptly scrubbed by the world’s social media censors who have taken it upon themselves to also be “fact-checkers” on any claim related to covid, even if as we reported previously, most of those ‘fact-checkers’ are deeply conflicted individuals who have a vested interest in perpetuating the far more lucrative, fake narrative about covid.

- In 8th spot, with just a few hundred more page views, was our report about the scientific analysis conducted on voting patterns in the Nov 3 election. In “It Defies Logic”: Scientist Finds Telltale Signs Of Election Fraud After Analyzing Mail-In Ballot Data” we showed a statistical anslysis “which strongly suggested that fraud occurred” on election night, when several swing states inexplicably stopped reporting vote counts while President Trump maintained a healthy lead over Joe Biden. To this date, this remains a deeply polarizing issue, and even though the courts – including SCOTUS – have refused to investigate further, millions of Americans believe that there are telltale signs that Biden’s victory on Nov 3 was not proper and is why so many Americans refuse to accept Joe Biden as their president.

- With just over 1.1 million page views and in 7th spot, was the article that got us suspended (for 6 months) from Twitter: in “Is This The Man Behind The Global Coronavirus Pandemic?” we asked if Wuhan Institute of Virology scientist Peng Zhou (whose data was available publicly to anyone), was the person responsible for unleashing the pandemic. While Twitter unceremoniuosly banned our account for merely asking this question, a few months later the joke was on Jack Dorsey after we reported that “Western Spy Agencies Investigating Wuhan Scientist Highlighted By Zero Hedge In January.” Of course, since the question of China’s involvement in the creation and spread of the covid virus has tremendous political consequences, so far there has been no official finding or conclusion either way.

- The 6th most popular article of 2020 was another notable question probing the validity of the November election, namely: “Why Does Biden Have So Many More Votes Than Democrat Senators In Swing States?” Another way of asking the same question – which 1,113,129 readers also wanted answered – was “what’s going on here? If it were “never-Trumpers” pairing Biden with their GOP Congressional picks, wouldn’t one expect fewer votes for Trump than GOP Senators?” So far we have not received an answer.

- Questions about the credibility of the presidential election continued into the Top 5 posts as well, and with 1,245,000 was out post covering the rollercoaster event which was the Nov 3 election, which had Biden winning at first, then odds overwhelmingly shifted in Trump’s favor after he won Florida and Ohio, only to see Biden be declared winner after mail in votes in most swing states came overwhelmingly in Biden’s favor. Not surprisingly, “Trump Blasts Vote-Count Delays As “Fraud On The American Public” and yet it was precisely those same vote counts, as well as various documented reports of mystery ballot boxes emerging in the deep of the night, that ultimately handed Biden the election. Trump is still contesting the outcome.

- The devastating consequences from the covid pandemic may have been more limited than many expected, largely thanks to an unprecedented fiscal and monetary stimulus, which made life especially easy for companies that had access to capital markets, however it was quite the opposite for millions of small and medium businesses for whom the PPP loans handed out at the peak of the covid crisis provided at best a brief respite. As a result, and as we reported in “Bankruptcy Tsunami Begins: Thousands Of Default Notices Are “Flying Out The Door“,” well over 1.2 million readers were shocked to learn just how bad the economy was for all those “mom and pop” small business operators who had no choice but to fold as the lockdowns resulting from the covid pandemic crippled the service economy and led to a historic bankruptcy filing spree.

- The 3rd most popular article of 2020, read over 1.3 million times, had to do with another topic which the mainstream media would not come within 10 feet of, namely whether or not the highly popular Black Lives Matter movement was credible, or if it was just another way of sabotaging the popular narrative in hopes of benefiting a certain social class. One person who took the other side of the argument was an Anonymous Berkeley Professor who “Shredded the BLM Injustice Narrative” only to be met with a furious rebuke from Berkeley, which ironically validated one of the letter’s core claims that dissent outside “a tightly policed, narrow discourse” is not welcome. Sadly, to this day any truly open discourse on the topic of whether BLM’s claims are valid remains taboo, and is the surest and quickest way to ending one’s career.

- The year’s second most popular article with just over 1.5 million reads, was also an example of conventional media cracking down on anything it found disagreeable to the popular narrative. Shortly after the first reports of covid’s spread, we published our take on a research report which found that “Coronavirus Contains “HIV Insertions”, Stoking Fears Over Artificially Created Bioweapon.” This prompted an immediate panic among the “factcheckers” whose job was to perpetuate the mainstream narrative, and they promptly conceded that while HIV insertions are present, such insertions can also be found in other viruses. Unfortunately, their attempts to discredit the theory that covid was a manmade bioweapon have so far failed to be scientifically validated, while covid’s surprising ability to mutate and force the immune system to attack the host body itself, which are now widely accepted even by the so-called “scientists” have failed to ease concerns that covid is, in many ways, an airborne version of HIV.

- Finally, in the top #1 spot, and cementing 2020’s status as the year of covid, was an article from March that tried to take on the mass hysteria spread by everyone from (conflicted) politicians to (conflicted) mainsteadm media to (conflicted) pharma companies, all of which had a vested interest in creating the biggest ever crisis possible. With 1.7 million page views, in “COVID-19 – Evidence Over Hysteria” we laid out one take why the widespread panic resulting from covid may be ultimately self-defeating especially when juxtaposed side by the side with the far greater (and far wider reaching) economic damage sparked by lockdowns. Alas, to this day, the hysteria dominates confirming the old saying to let no crisis go to waste, especially when the crisis in question is the biggest one in generations and allows the establishment to rollout socially and economically transformational changes that would never be possible without the scapegoat that is covid.

With all that behind us, and as we wave goodbye to another bizarre, exciting, surreal year, what lies in store for 2021, and the next decade?

We don’t know: as frequent and not so frequent readers are aware, we do not pretend to be able to predict the future and we don’t try despite endless allegations that we constantly predict the collapse of civilization: we leave the predicting to the “smartest people in the room” who year after year have been consistently wrong about everything, and never more so than in 2020, which destroyed the reputation of central banks, of economists, of conventional media and the professional “polling” and “strategist” class forever. We merely observe, try to find what is unexpected, entertaining, amusing, surprising or grotesque in an increasingly bizarre, sad, and increasingly crazy world, and then just write about it.

We do know, however, that after a record $22 trillion in stimulus was been conjured out of thin air by the world’s central banks and politicians in just the past 9 months, as helicopter money makes a triumphal arrival in both the US and Eurozone, and as interest rates are on the cusp of breaking out, the entire world is floating on an ocean of excess money, which in 2020 once again succeeded in masking just how ugly the truth beneath the calm surface is.

We are confident, however, that in the end it will be the very final backstoppers of the status quo regime, the central banking emperors of the New Normal, who will eventually be revealed as fully naked. When that happens and what happens after is anyone’s guess. But, as we have promised – and delivered – every year for the past 12, we will be there to document every aspect of it.

Finally, and as always, we wish all our readers the best of luck in 2021, with much success in trading and every other avenue of life. We bid farewell to 2020 with our traditional and unwavering year-end promise: Zero Hedge will be there each and every day – usually with a cynical smile – helping readers expose, unravel and comprehend the fallacy, fiction, fraud and farce that the system is reduced to (ab)using each and every day just to keep this grand tragicomedy going for at least one more year.

(@disclosetv)

(@disclosetv)