Authored by Jim Quinn via The Burning Platform blog,

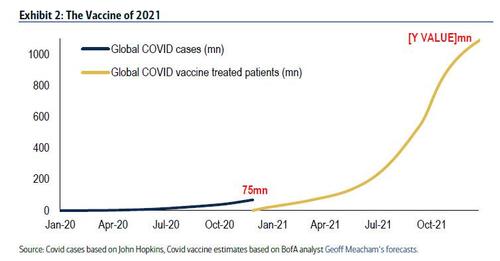

In Part 1 of this article I laid out the case the “dark winter” narrative and how an experimental vaccine marketed like a tech product by Big Pharma and their cronies are part of a globalist scheme to reset the world and force us into subservience.

In Part 2 of the article I revealed how the “build back better” narrative is part of Klaus Schwab’s Great Reset plan to implement a one world command and control dystopia, managed by billionaire oligarchs and their dark forces.

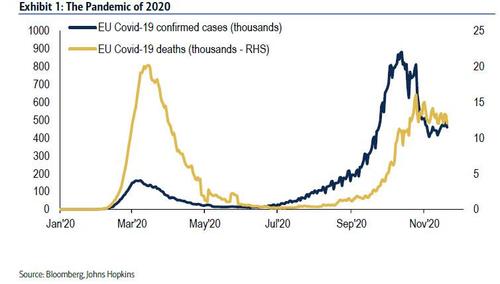

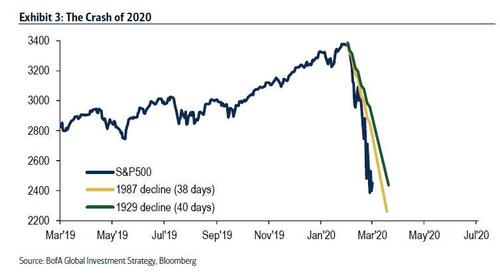

Their “new normal” tripe is built on a foundation of falsity. The Spanish flu pandemic of 1918 killed 50 million people when the population of earth was 1.8 billion, or 2.8% of the world population. This China flu has contributed to the deaths of 1.8 million people with a worldwide population of 7.8 billion, or .023%. The world was not locked down by totalitarians, no vaccine was created, the flu dissipated over time (probably due to natural herd immunity), people continued to live their lives, and the world returned to normal without global elites dictating how we had to live.

There is no such thing as a new normal. There is normal and abnormal. What we are experiencing today is a warped stage-managed abnormality being jammed down our throats by men who will benefit greatly if we let them take over the world, with no downside risk for themselves when their hair brained ideas tragically fail.

Allowing all businesses to open, allowing all workers to work, ending the masking farce, opening schools, guaranteeing freedom of speech on social media platforms, restoring the freedoms and liberties of citizens, not forcing a DNA changing vaccine upon those who do not want it, protecting the old and infirm, and letting the virus run its course, will allow us to go back to normal. These wealthy powerful tyrants will not allow this to happen without a fight to the finish.

“In this hour, I do not believe that any darkness will endure.” ― J.R.R. Tolkien, The Return of the King

“You can only come to the morning through the shadows.” ― J.R.R. Tolkien

I find the words of Tolkien inspiring and hopeful in this time of danger and deceit. To those of us who still believe the founding principles of our country, as documented in the Constitution, need to be upheld and honored by those we have chosen to represent us, a darkness has descended upon our world endangering our way of life and threatening to turn the world into a communist nightmare of impoverishment, retribution and one world government run by billionaire oligarchs and their worthless bureaucratic state cronies.

The carefree bright days of the shire are long gone, and the eye of Sauron has set its glaze upon the deplorable hobbits trying to regain their way of life by embarking on a journey to confront the forces of evil arrayed against them. The primary themes of Tolkien’s masterpiece are the corrupting influence of power and the inevitability of decline in all civilizations.

A dark winter will entomb the nation if basement Biden assumes power on January 20, 2021. This will mean the corrupt powerful forces of tyranny will have successfully pulled off their election coup. The corrupting influence of power is clearly seen in the likes of Gates, Bezos, Bloomberg, Zuckerberg and Dorsey, as their success in creating businesses and reaping massive riches makes them believe their political beliefs should hold sway over the masses, while they use their extreme wealth to influence elections and control the administration of the world.

This corruption of power turns these men into perverted arrogant creatures, seeking further wealth, power, and control. Soros represents the wretched, demented Gollum-like creature in our current day battle for middle earth, consumed by desire for the power of the ring (new world order). Biden, Schwab, Soros and their ANTIFA and BLM Orcs are already at war, and it is time for us to defend what is dear.

“War must be, while we defend our lives against a destroyer who would devour all; but I do not love the bright sword for its sharpness, nor the arrow for its swiftness, nor the warrior for his glory. I love only that which they defend.” ― J.R.R. Tolkien, The Two Towers

“The treacherous are ever distrustful.” ― J.R.R. Tolkien, The Two Towers

The inevitability of decline is true for humans, as well as civilizations, empires, and ages. The Great Reset/Davos crowd wants to transform our world into a green utopia, ruled by those who fervently believe they are more intelligent than those they rule, because they equate ill-gotten wealth with intellectual superiority. The truth is, these narcissistic psychopath lords are going to die, just like the serfs they want to entrap in servitude to their one world government.

Gates, Soros, Bloomberg, Bezos, Zuckerberg and the rest of Great Reset mob do not deserve our admiration, but our scorn and contempt. They are consumed by their self-importance and avarice for complete control over those they see as nothing more than cattle. Coercion, impoverishment, and fear are their tools, and domination is their goal. They appear to have the upper hand, as people around the globe cower in fear as the Eye of Sauron (Covid-19) is turned in their direction. Despair fills the air.

“It is not despair, for despair is only for those who see the end beyond all doubt. We do not.” ― J.R.R. Tolkien, The Fellowship of the Ring

It isn’t a coincidence Tolkien wrote his epic battle between good and evil during the last Fourth Turning. The existing order is always swept away during a Fourth Turning and replaced by something – better or worse. That is why I find its themes so prevalent, as we confront our own epic battle with the forces of evil.

Many are praying their Grey Champion – Trump – will arrive with the forces of good at the climactic battle of the DC Swamp before January 20, just as Gandalf the Grey arrived, just in time, at the Battle of Helm’s Deep to turn the tide and defeat the forces of evil. I’m not counting on such a glorious outcome, as there will be many battles to be fought on many fronts before victory can be secured, with future generations honoring glorious heroes long deceased. But it is also not time to be forlorn.

“Oft hope is born when all is forlorn.” ― J.R.R. Tolkien, The Return of the King

Waiting to be saved from the Great Reset by a white hat brigade is not a feasible strategy for victory. Every person whose eyes have been opened to the plans of these tyrants has a part to play. The key ingredients to defeating these malevolent forces are courage and truth. You may consider yourself an insignificant cog in the machine, without the capacity to fight billionaire despots and autocratic government officials. But you are not insignificant.

This war may ultimately require those three hundred million firearms be put to use, but direct confrontation against a heavily armed government force is a losing proposition. Winning will require guile, guerrilla tactics, turning their technology into a liability, and the courage to say no to their mandates and un-Constitutional decrees. Frodo and his fellowship of the ring did not directly confront the powerful forces of Sauron. They outsmarted him. Each of us can do our part, based upon our talents, resources, judgement, daring, and cleverness.

“Courage is found in unlikely places.” ― J.R.R. Tolkien

There are numerous ways to fight this dehumanization campaign being waged by these godless opportunists. Choose not to participate in their masking charade. Do not let them jab you with their DNA altering poison. Use facts and reason to convince others masks are worthless and the vaccine is nothing but an enrichment scheme for Gates, Fauci and Big Pharma. Support small businesses and restaurants that flaunt tyrannical lockdown mandates. Reduce your tax footprint by opting out of this materialistic paradigm. Get healthier by exercising, eating unprocessed food, and taking supplements (Vitamin B, D, C).

Barter with local farmers or pay in cash to deny Caesar his cut. Plant as big a garden as possible based on your circumstances. Make sure you have guns, ammo, and training. Join protests against this oppression. Build resiliency into your daily life. Think for yourself. Never watch or read anything in the mainstream media. Do not believe anything the government tells you, without verifying the facts. If the social media titans ban someone, seek out their writings because they must be telling the truth. If Google takes down a youtube video, seek it out on bitchute or other platform.

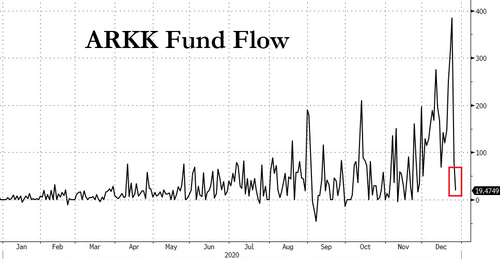

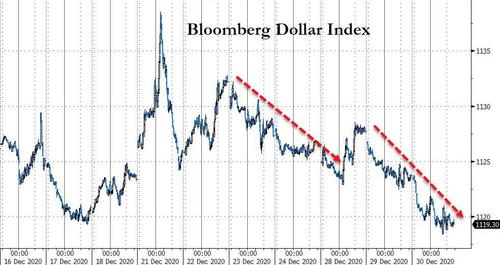

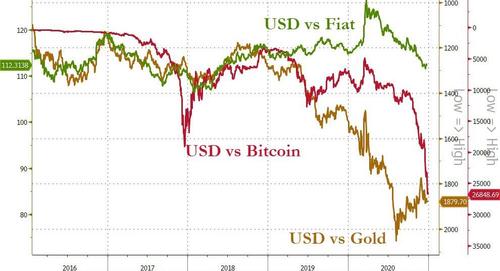

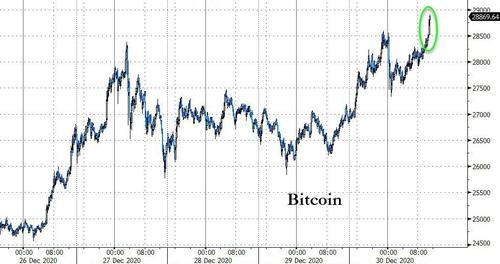

For those with a particular talent in IT, electrical, or mechanical, be prepared to utilize those skills in confronting the oligarchy. If possible, use encryption messaging to defeat the surveillance state. Protect your loved ones. Make sure you know who you can trust. Find neighbors of like mind. Make yourself anti-fragile by having alternative means of power and alternative medicines in supply. Attempt to open the eyes of those blinded by decades of propaganda exposure. Remove any funds from Wall Street banks. Diversify your financial holdings (land, cash, metals, crypto?).

Stay as far away from urban ghettos as possible. Speak truth to power. Don’t lose faith. The truth is on our side. We can win this war for the soul of our country. We have a limited amount of time on this earth. We must use what time is left to protect the world from these degenerates and provide future generations with a humanistic world where they have choices, liberty and freedom. I wish we weren’t confronted with such a herculean task, but it has happened in our time.

“I wish it need not have happened in my time,” said Frodo. “So do I,” said Gandalf, “and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the time that is given us.” – J.R.R. Tolkien

We cannot let the “new normal” or “great reset” take hold. If it is up to Klaus and his crew, you will be permanently masked, mandatorily vaccinated, eternally locked down, perpetually impoverished and forever dependent upon a central authority to provide minimal sustenance and maximum punishment for disobedience.

Even as the dark clouds fill the distant sky and the future appears bleak, our roots are strong and will not wither under the approaching tempest. The fight is before us and the outcome uncertain, but there is some good in this world and it is worth fighting for. The sun will surely come out again when this dark shadow passes.

* * *

The corrupt establishment will do anything to suppress sites like the Burning Platform from revealing the truth. The corporate media does this by demonetizing sites like mine by blackballing the site from advertising revenue. If you get value from this site, please keep it running with a donation.